In this article we will discuss about the effects of excess burden of indirect taxes, explained with the help of suitable diagrams.

While a sales tax is imposed on the sale of a product, an excise duty may be imposed on either on sale or the manufacture of a product. However, as far economic effects are concerned, they are the same. As a general rule the government will collect less tax if demand is price-elastic than if it is price-inelastic, other things being equal.

Therefore, the government will prefer to impose sales tax and excise duty on goods and services for which demand is price-inelastic. Taxes on essential items of consumption such as cigarettes or liquor, for example, are very productive from the revenue point of view. Since these taxes do relatively little to reduce quantities produced and consumed they do more to raise revenue than they do to reduce consumption.

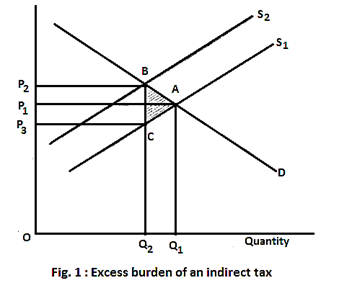

In general, excise duties are levied by the central government and sales tax by the state governments. In most cases consumers end up paying higher prices for products that are subject to sales tax or excise duty. That is, a portion of the burden of such taxes is shifted to consumers. However, a portion of the tax may be passed back to workers as well as the owners of other factors which produce the taxed commodity. This pointed is illustrated in Fig. 1.

Fig. 1 shows the demand curve for a product and two supply curves. Here S1 is the supply curve before the imposition of the tax and S2 is the supply curve after the imposition of the tax. In the absence of the tax, the market reaches equilibrium at point A.

The equilibrium quantity is Q1 and the equilibrium price is P1. Since the excise duty is an added cost of supplying the product it has the effect of shifting the supply curve upward exactly by the amount of the tax. The new supply curve is S2. It runs parallel to the original supply curve because a specific (or fixed tax) has been imposed.

The new equilibrium occurs at point B, with quantity Q2 and price P2. Since consumers are forced to pay higher price (P2 instead of P1), they bear some of the burden of the tax. But price does not rise fully by the amount of the tax per unit.

This is shown by the vertical distance from B to C. The suppliers receive a price of P3 per unit which is less what they received before the imposition of the tax. Therefore, part of the burden of the tax falls on producers. In other words, the entire tax burden is not borne by consumers of the product.

ADVERTISEMENTS:

Due to the imposition of the tax the quantity of the product supplied falls. This, in its turn, leads to a fall in demand for factors of production used to produce the taxed commodity. Consequently, some labourers and other factors will be made redundant or accept lower wages and payments or change jobs (or both). Similarly, some firms will be forced to go out of business.

Therefore, those workers, owners of business and other factor-owners bear a portion of the burden of the tax if they cannot find new avenues of employment that pay as well as the ones lost because of the tax.

Excess Burden:

A major defect of an indirect tax like excise duty that it is highly regressive in nature. It is largely paid by the poor people who spend a major portion of their income on consumption goods. Since most consumption goods attract excise duties and sales tax, the tax liability of the poor people is higher than that of the rich people.

ADVERTISEMENTS:

But this is not the whole truth. There is also an excess burden from this type of tax. This means that the total burden of such taxes is greater in value than the amount collected by the triangle P3P2BC. The vertical dimension of the triangle (BC) is the tax revenue per unit of the commodity and the horizontal dimension shows the number of units on which the tax is collected.

The triangle ABC measures the excess burden. The excess burden refers to the net gains from units of the product that were produced when there was no tax, but which are not produced now because of the tax. Net gains existed because there was a gap between the demand price and supply price of the commodity before the imposition of the tax.

This means that the amounts that consumers were willing and able to pay (shown by the demand curve) were greater than the amount that suppliers needed to receive to offer the product for sale (shown by the supply curve).

A sales tax will have the same effect as that of an excise duty. The tax burden will be shifted partly to consumers and partly to owners of resources used to produce the taxed goods and services.

If however, the demand for a commodity (on which tax is imposed) is highly elastic consumers will spend less for the good or service after the tax than they did before and most of the burden will fall on factor owners rather than on consumers. Therefore, like the government the factor-owners would prefer to have sales taxes or excise duties placed on goods and services for which demand is price-inelastic.