When a small country imposes tariff on import of the product that competes with the product of the small domestic industry, the tariff can neither affect the international prices (as the country is small) nor can it affect the rest of the economy (as the industry is small). In such conditions, the partial equilibrium analysis that concerns the market for a particular product becomes the most appropriate.

Assumptions:

The effects of tariffs under a partial equilibrium system can be analysed on the basis of the following set of assumptions:

(i) The demand and supply curves of the given commodity are concerned with home country that imposes import tariff.

ADVERTISEMENTS:

(ii) The given demand and supply curves remain constant.

(iii) There is no change in consumers’ tastes, prices of other commodities and money income of the consumers.

(iv) There is an absence of technological improvements, externalities and other factors that result in changes in cost conditions.

(v) No tariff is imposed by the home country on the import of materials that are required for producing the given commodity.

ADVERTISEMENTS:

(vi) Imported product and home-produced product are perfect substitutes.

(vii) There is no change in the foreign price of the commodity.

(viii) There is an absence of transport costs.

(ix) The foreign supply curve of commodity is perfectly elastic.

ADVERTISEMENTS:

(x) Domestic production of commodity takes place at increasing costs.

Kindelberger has mentioned eight effects of tariff in a partial equilibrium approach.

These include: 1. Protective or Production Effect 2. Consumption Effect 3. Revenue Effect 4. Redistribution Effect 5. Terms of Trade Effect 6. Competitive Effect 7. Income Effect 8. Balance of Payments Effect.

These effects are explained below:

1. Protective or Production Effect:

The imposition of tariff may be intended to protect the home industry from the foreign competition. As tariffs restrict the flow of foreign products, the home producers find an opportunity to increase the domestic production of import substitutes. That is why Ellsworth termed the protective or production effect of tariff as the import-substitution effect.

In order to analyse the production and other effects diagrammatically, it is assumed that the world supply of the given commodity is perfectly elastic so that it is available at the constant price and the world supply curve is perfectly elastic. The domestic production of the commodity is possible, it is assumed, at an increasing cost. Therefore, the domestic supply curve is positively sloping. The domestic demand curve of the commodity, as usual, slopes negatively.

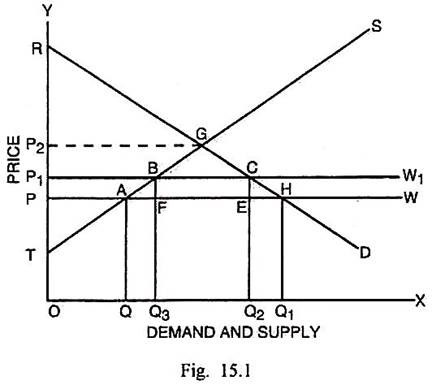

In Fig. 15.1, demand and supply are measured along the horizontal scale and price along the vertical scale. D and S are the domestic demand and supply curves of the given commodity respectively. Originally PW is the world supply curve of the commodity and the pre-tariff price is OP. At the price OP, the domestic supply is OQ and demand is OQ1.

The gap QQ1 between demand and supply is met through import of the commodity from abroad. If PP1 per unit tariff is imposed on import, the price rises to OP1 and world supply curve shifts to P1W1. At this higher price, the demand is reduced from OQ1 to OQ2 whereas the domestic supply expands from OQ to OQ3.

Thus the domestic production of import substitutes rises by the extent of QQ3. This is the protective, production or import substitution effect. The increased domestic production reduces the demand for foreign product from QQ1 to Q2Q3.

In case the per unit tariff were PP2 causing the price to rise to OP2, the domestic production would have expanded large enough to meet fully the domestic demand. In such a situation, imports would have been reduced to zero.

2. Consumption Effect:

The imposition of import duty on a particular commodity has the effect of reducing consumption and also the net satisfaction of the consumers. According to Fig. 15.1 at the free trade price OP, the total consumption was OQ1. It was constituted by OQ as the consumption of home produced good and QQ1 as the consumption of foreign produced good. After the imposition of tariff, when price rises to OP1, the consumption is reduced from OQ1 to OQ2.

Out of it, OQ3 is the consumption of home-produced good and Q2Q3 is the consumption of foreign produced good. Thus there is a reduction in consumption by OQ1 – OQ2 = Q1Q2. There is net loss in consumer satisfaction amounting to the area PHCP1. Kindelberger has called the combined protective and consumption effects as the trade effect. Subsequent to the imposition of tariff, the volume of international trade gets reduced from QQ1 to Q2Q3.

3. Revenue Effect:

The imposition of import duty provides revenues to the government. The revenue receipts due to tariff signify a revenue effect. In Fig. 15.1 the original price OP does not include any tariff and no revenue receipts become available to the government.

ADVERTISEMENTS:

Subsequently when PP1 per unit tariff is imposed, the revenue receipts of the government can be determined by multiplying per unit tariff PP1 (or BF) with the quantity imported Q3Q2 or (EF). Thus the revenue receipts due to tariff amount to PP1 × Q3Q2 = BF × EF = BCEF. This is revenue effect of tariff.

4. Redistribution Effect:

The imposition of tariff, on the one hand, causes a reduction in consumer’s satisfaction and, on the other hand, provides a larger producer’s surplus or economic rent to domestic producers and revenues to the government. Thus tariff leads to redistributive effect in the tariff-imposing country. The redistributive effect can be shown with the help of Fig. 15.1.

Loss in Consumer’s Surplus = RHP – RCP1 = PHCP1

Gain in Producer’s Surplus = TBP1 – TAP = PABP1

ADVERTISEMENTS:

Gain in Revenues to the Government = BCEF

Net Loss = PHCP1 – (PABP1 + BCEF)

= ΔBAF + ACEH

Kindelberger calls this net loss as the “deadweight loss” due to tariff. It signifies the cost of tariff. It is clear that tariff causes a redistribution of income or satisfaction in the given country. Consumers suffer a loss while producers and government make a gain.

5. Terms of Trade Effect:

The traditional theorists believed that tariff led to an improvement in the terms of trade of the tariff-imposing countries. The modern theorists, however, do not hold such a simplistic view. In their opinion, the terms of trade, consequent upon the imposition of tariff, depend upon the elasticities of demand and supply of products of the two trading countries.

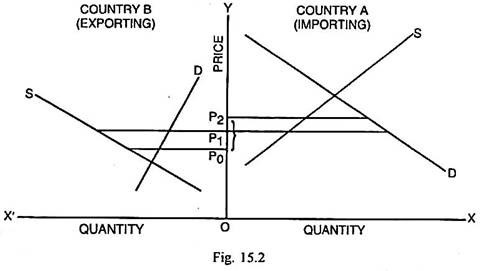

If the foreign supply of a good is perfectly elastic or if the foreign suppliers are ready to supply the product at a constant price, the imposition of tariff is not likely to improve the terms of trade for the tariff-imposing country. In case the foreign supply of a good is not perfectly elastic, the imposition of tariff can have varying effects upon the terms of trade of the tariff-imposing country depending upon the elasticities of demand and supply in the two trading countries. It has been explained through Fig. 15.2.

ADVERTISEMENTS:

In Fig. 15.2, country A is an importing and country B is an exporting country. The domestic demand and supply curves of the exporting country B are less elastic. Country B imposes per unit tariff of P0P2 amount for reducing import of the commodity. Since the domestic demand is inelastic, the surplus product of country B can be disposed of in the other country A. Therefore, the exporters lower the price of the commodity by P1P0. So P0P1 part of tariff is borne by exporters and P1P2 part of it by the importers.

If the tariff burden borne by importers in country A is less than the burden borne by the exporters i.e., P1P2 < P1P0, the rise in price of the commodity in country A is less than the fall in the export price of the commodity in country B. In such a situation, the terms of trade become favourable to the tariff-imposing country A.

In case, P1P2 is more than P1P0, the rise in price of the commodity in country A being larger than the fall in export price of the commodity in country B, the terms of trade get worsened for country A. It can happen when the elasticities of demand and supply for the commodity in country B are relatively more than in country A.

6. Competitive Effect:

The imposition of tariff, can facilitate the growth of an infant industry which otherwise is not in a position to face the foreign competition. As tariff makes the foreign product relatively more costly, the domestic infant industry finds opportunity to grow behind the protective shield.

Thus tariff increases the competitive power of the industries of tariff-imposing country. After the infant industry becomes mature enough to face the foreign competition, tariff may be removed.

ADVERTISEMENTS:

The increase in the competitive power of the domestic industries through tariff is called as the competitive effect. The fears are, however, expressed that protection breeds inefficiency and promotes the growth of monopolies.

It was because of such considerations that Kindelberger commented, “…if foreign competition is kept out by tariff the domestic industry tends to become sluggish, fat and lazy.” He pointed out that tariff was actually anti-competitive. In his words, “…The competitive effect of a tariff is really an anti-competitive effect; competition is stimulated by tariff removal.”

7. Income Effect:

The imposition of tariff reduces the demand for foreign products. The amount of money not spent on imported goods may either be spent on the home-produced goods or saved. If there is the existence of surplus productive capacity in the home country, switch of expenditure from foreign to home-produced goods will lead to a rise in production, employment and income.

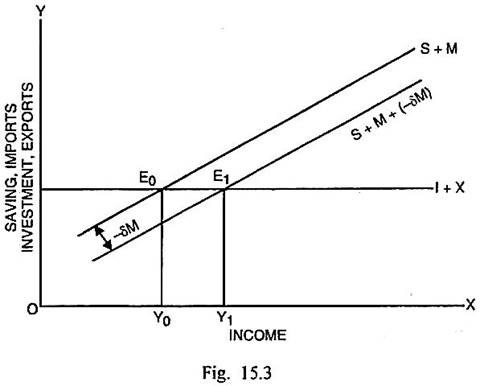

Alternatively, if the money not spent on foreign products is saved, that result in greater accumulation of capital. The financing of investment through additional saving can again enlarge the productive capacity and income in the tariff-imposing country. The expansionary effect of reduction in imports upon domestic income can be shown through Fig. 15.3.

In Fig. 15.3, income is measured along the horizontal scale and saving (S), imports (M), investment (I) and exports (X) are measured along the vertical scale. If investment and export are assumed to be autonomous, the investment plus export function (I + X) can be drawn. Assuming saving and import to be positively related with income, saving plus import function (S + M) can be drawn.

ADVERTISEMENTS:

The intersection between 1+X and S + M results in the original equilibrium at E0 and the original equilibrium income is Y0. If tariff causes a reduction in imports by δM, the S+M function shifts down to S+M+(-δM). The intersection between 1+X and S+M+ (-δM) function at E1 determines the equilibrium income at a higher level Y1. The expansion in income Y0Y1 is much more than the change in imports measured by the vertical distance between S+M and S+M+(-δM) curves on account of the reverse operation of import multiplier.

It is sometimes argued that the income effect due to tariff may not actually take place even under a less than full employment situation for two reasons.

Firstly, the imposition of tariff by the home country hits the exports of the foreign country. Such a policy, if raises income, has such an effect at the cost of the foreign country, the exports of which decline resulting in a contraction in its output, employment and income. Joan Robinson and many other economists have called such a trade policy as a ‘beggar-my-neighbour’ policy.

In due course of time, such policies can have adverse repercussion even upon the tariff-imposing country. The reduced exports of a foreign country will lower its income. The foreigners will be able to buy less products from the tariff-imposing country. Thus even the latter will also experience a decline in the demand for its products and consequent decline in its income. Secondly, the foreign countries may adopt retaliatory tariff and other counterveiling measures and neutralise any advantage obtained by the home country and the desired income effect may fall to materialise.

If the home country is in a state of full employment, the tariff causing a reduction in imports and switch of expenditure to the home-produced goods, will not contribute in raising the output. Consequently, the inflationary pressures alone will be felt. There may be an increase only in money income and the real income, output or employment will remain unaffected.

8. Balance of Payments Effect:

When tariff is imposed by a country upon foreign products, the home-produced goods become relatively cheaper than the imported goods. The price effect caused by tariff, on the one hand, reduces imports from other countries and on the other hand, causes increased production and purchase of home- produced goods. That leads to a reduction in the balance of payments deficit of the home country. It may be illustrated also through Fig. 15.1.

ADVERTISEMENTS:

Before the imposition of tariff, the quantity imported was QQ1. The price being OP or AQ, the value of import or payment for import was AQ × QQ1 = QAHQ1. After the imposition of tariff, the price is OP1 or BQ3 and quantity imported is reduced to Q2Q3.

The value of import is Q3BCQ2 out of which BFEC is the revenue receipts of the government of the tariff- imposing country so that the net payment to foreigners for import is Q3FEQ2, which is less than the payment for imports before tariff. Needless to say that tariff can cause a reduction in the balance of payments deficit of the tariff-imposing country.

In the regard, some doubts are raised that tariff may fail to improve the balance of payments deficit. Firstly, if the demand for imports in the tariff- imposing country is inelastic, tariff may not reduce the volume of imports despite the rise in the prices of imported goods consequent upon the imposition of tariff.

Secondly, if the balance of payments disequilibrium is caused by the export surplus, the imposition of tariff will further aggravate rather than adjust the balance of payments disequilibrium. Thirdly, tariff can, at the maximum, bring about some adjustment in temporary disequilibrium of international payments. There is no possibility of adjusting the fundamental disequilibrium in the balance of payments through tariff restrictions.