Everything you need to know about strategy formulation. Strategy formulation is the process of offering proper direction to a firm.

Strategy Formulation seeks to set the long-term goals that help a firm exploit its strengths fully and encash the opportunities that are present in the environment.

There is a conscious and deliberate attempt to focus attention on what the firm can do better than its rivals. To achieve this, a firm seeks to find out what it can do best. Once the strengths are known, opportunities to be exploited are identified; a long-term plan is chalked out for concentrating resources and effort.

Henry Mintzberg, after much research found that strategy formulation is typically not a regular, continuous process.

ADVERTISEMENTS:

“It is small often an irregular, discontinuous process, proceeding in fits and starts. There are periods of stability in strategy development, but also there are periods of flux, of grouping of piecemeal changes and of global change.”

Strategy formulation is as much an art as it is a science. In fact, it is the art of strategy formulation that drives fast growth and catapults a firm into newer horizons. Leaders should develop skills and capabilities to sense early opportunities and be quick in making strategic moves.

In this article we will discuss about strategy formulation. Learn about:-

1. Meaning and Modes of Strategy Formulation 2. Subjective Aspects in Strategic Formulation 3. Framework 4. Process 5. Approaches 6. Tools and Techniques and 7. Challenges Faced.

Strategy Formulation: Meaning, Process, Framework, Approaches and Challenges

ADVERTISEMENTS:

Contents:

- Meaning and Modes of Strategy Formulation

- Subjective Aspects in Strategic Formulation

- Framework of Strategy Formulation

- Strategy Formulation Process

- Approaches to Strategy Formulation

- Tools and Techniques of Strategy Formulation

- Challenges Faced during Strategy Formulation.

Strategy Formulation – Meaning and Modes

Strategy formulation is the process of offering proper direction to a firm. It seeks to set the long-term goals that help a firm exploit its strengths fully and encash the opportunities that are present in the environment. There is a conscious and deliberate attempt to focus attention on what the firm can do better than its rivals. To achieve this, a firm seeks to find out what it can do best. Once the strengths are known, opportunities to be exploited are identified; a long-term plan is chalked out for concentrating resources and effort.

Since strategies consume time, energy and resources, they must be formulated carefully. Strategies, once formulated, must ensure a best fit between goals, resources and effort put in by people. The ultimate goal of every strategy that is being formulated should be to deliver outstanding value to customers at all times.

Henry Mintzberg, after much research found that strategy formulation is typically not a regular, continuous process. “It is small often an irregular, discontinuous process, proceeding in fits and starts. There are periods of stability in strategy development, but also there are periods of flux, of grouping of piecemeal changes and of global change.”

ADVERTISEMENTS:

Performance results are generally periodic measurements of developments that occur during a given time period like return on investment, profits after taxes, earnings per share and market share. Current performance results are compared with the current objectives and with that of the previous year’s performance results. If the results are equal to or greater than the current objectives and past year’s results, the company will mostly continue with the current strategy otherwise, the strategy formulation process begins in earnest.

The strategic managers must evaluate the mission, objectives and policies. In fact, the strategic managers are evaluated in terms of management style, values and skills by the top management. Henry Mintzberg has pointed out that a corporation’s objectives and strategies are strongly affected by top management’s view of the world. This view determines the mode to be used in strategy formulation.

These modes include:

1. Entrepreneurial Mode:

Strategy is formulated by one powerful individual. The focus is on opportunities rather than on problems. Strategy is guided by the founder’s own visions of direction.

2. Adaptive Mode:

This strategy formulation mode is characterised by reactive solutions to existing problems rather than a proactive search for new opportunities.

3. Planning Mode:

Analysts assume main responsibility for strategy formulation. Strategic planning includes both the proactive search for new opportunities and the reactive solution of existing problems.

ADVERTISEMENTS:

Strategic planning is a systemic and disciplined exercise to formulate strategies. It relates to the enterprise as a whole or to particular business units (identified as strategic business units – SBUs) of a divisionalised organisation. It consists of making risk- taking decisions -entrepreneurial decisions – for the future with the best possible knowledge of their probable outcome and effects.

In short, strategic planning concerns itself with the formulation of strategic alternatives to obtain sanctions for one of the alternatives which is to be ultimately interpreted and communicated in operational terms. Thus, strategic planning is a forward-looking exercise which determines the future posture of the enterprise with special reference to its products-market posture, profitability, size, rate of innovation and external institutions.

Strategic planning differs from project planning tactical, planning and operational planning. Strategic planning is more comprehensive, for strategy is dealt with at corporate level and is concerned mainly with the long-term aspects of business. It deals with what business the company wants to be in.

Project planning involves looking for new markets for existing products, developing new products, creating demand for the same, and utilising the existing facilities if they have the capacity to meet the marketing and selling requirements of the new product. Tactical planning is done at the functional level. It is concerned more with the present than the future. It implies an ad hoc approach based on expediency with a time schedule.

ADVERTISEMENTS:

Operational planning, on the other hand, is essentially concerned with the existing product-market operations – the ‘bread and butter lines’ of the business. The scope of operational planning is restricted to the operations in the market with which the company has built up a rapport with the existing range of products through the facilities which are already in harness.

Choice activity consists of selecting the most appropriate strategy from among the alternatives. This framework is helpful in understanding the essential elements involved in strategy formulation. But the sequence of intelligence, design and choice activity may not be practiced in the same order. It is possible for a strategic planner to first choose a preferred strategy, then develop other options (alternatives) to analyse for rationalising the choice.

The degree of uncertainty in tactical planning and operational planning is of a low order. It is of a higher order in project planning, while in strategic planning risk and uncertainty involved are much greater. The time span of discretion is relatively shorter in tactical and operational planning than in project planning. It is much longer in strategic planning as compared with that of project planning. Thus the value of judgment is of much greater significance in strategic planning than in project planning or operational planning.

Strategic Formulation – 4 Important Subjective Aspects: Culture, Politics, Leadership, and Managerial Bias

Strategy formulation is as much an art as it is a science. In fact, it is the art of strategy formulation that drives fast growth and catapults a firm into newer horizons. Leaders should develop skills and capabilities to sense early opportunities and be quick in making strategic moves.

ADVERTISEMENTS:

The successes of Airtel and Bharti Enterprises in India, and Google and Southwest airlines abroad, are some examples. Cavin Kare, the Chennai- based FMCG company has moved from a personal care product company into a major FMCG over the years because of the bold strategic initiatives that it undertook. Similarly, snacks maker Haldirams has established its brand in the food segment with a range of ready-to-eat food items from ethnic India.

Some of the important subjective aspects of strategy formulation are culture, politics, leadership, and managerial bias. All these aspects are capable of being skewed by personal experience, individual understanding, and prejudice. Although these might not necessarily be ill-motivated or falsified they digress from purely scientific decision-making and could be risky to that extent.

i. Cultural Aspects:

Culture defines the way of life or decision making in the firm. Culture includes values, beliefs, norms, and attitudes and could be positive, neutral, or negative. Culture evolves and changes according to the changing circumstances or if a need is felt among organizational members. We will see here how it can influence strategy formulation.

Culture could be passive and submissive. In such cultural situations, there is an inability to speak up to senior management. There have been traditional companies that are promoted by extraordinary entrepreneurs, who have meticulously grown the business. There are a number of family-owned businesses that have grown big, but have not become entirely professional.

Cultural features also relate to societal involvement and orientation towards strategy. In India, dairy cooperatives are highly successful in Gujarat because such a style involves more democracy and has no gender bias. However, the same amount of success could not be achieved in dairy cooperatives in Uttar Pradesh and Maharashtra. Ironically, these states are not against cooperatives.

For instance, sugar cooperatives are highly successful in both the states, especially in Maharashtra. One of the reasons could be that animal husbandry and dairy farming is usually led by women and needs more social and economic freedom, whereas sugar cooperatives are led by leaders with links to the political system. Thus, cultural traits could be critical for strategy formulation.

ADVERTISEMENTS:

We have seen in the case of start-ups how cultural factors influence strategy formulation. Some of the strategic focus areas include the hiring of key resources, fund raising through equity, and approach towards product and market reach. If the promoters of a start-up are professional they may be open to some of these factors and be culturally oriented.

They may also have some issues with respect to controlling the interest and submitting to funding bodies or agents. If the start-up is promoted by those who are popular, it is difficult for such personalities to keep subjective factors away from strategy formulation. Such personalities fail to understand the scientific side of strategy formulation and sooner or later dwarf the growth of the start-up.

Normally cultural differences surface when inorganic growth strategies such as joint ventures, alliances and mergers and acquisitions are initiated.

The inability of the promoters to involve professional management in the decision process, and inadequate orientation could lead to such passive cultures. This may lead to a serious hindrance in upward communication of ground level realities. The authors are aware of companies, which have an asset valuation and business of nearly $200 million but are driven by first generation promoters acting as chairman and/or managing directors.

Though the entrepreneur is a thorough professional encouraging risk taking and leadership among the next tier of management, in reality, the next tier is unable to be truly professional in formulating a strategy. This is because there is a hesitancy due to the perceptions about the likes and dislikes of the promoter in business.

This results in a loss of a number of opportunities to promote business and a few bad decisions, which have a negative strategic impact on the company. This is a cultural trait when a promoter builds a business with close friends, or early starters who he has groomed, but is willing to come out and be independent of his friends or the early starters. Such cultural traits undermine the scientific effort in strategy formulation.

ADVERTISEMENTS:

On the positive side, when there are shared values and beliefs, it may be easier to create a shared vision. Such situations help in formulating strategies that lead to excellence. For example, the TVS group of companies has a culture of providing value to customers by deploying superior technology and processes.

This practice is well-appreciated in the southern states of India. Most of the group’s companies are among the leaders in their chosen businesses. Sundaram Clayton supplies its products globally because of its excellent quality standards. Some other companies have also achieved a similar status. Cultural fit for achieving excellence is natural in formulating strategy, where the vision is shared across all levels of employees.

Shared values create trust and togetherness in an organization. Shared values contribute to the social identity of an organization, for example, the Tata group stands for socially-responsible business behaviour. These values must be stated as both corporate objectives and individual values. Every organization and every leader has a different set of values that are appropriate to the organization’s business situation. However, a company must encourage its employees to create shared values and respect the synchronization of individual and corporate values.

General Electric (GE) is known for its customer value, Wal Mart for best pricing, Toyota for quality, and Sony and Nokia for innovativeness. In India, we have companies that have gained shared to improve the effectiveness of strategy formulation. For example, the Tata group seeks excellence and scale in whatever it does. Any such focus on culture is generally cherished by external stakeholders as well.

Cultural perspectives in strategic formulation arise largely from ethnicity, region, and level of education. For example, we find in some ethnic societies in India, that doing business in financial services is encouraged whereas in some places it is taboo. Entrepreneurial traits are imbibed from birth in certain geographies and communities. Such a cultural milieu fosters the mushrooming of self-driven small businesses as a strategic orientation in certain geographies such Gujarat and Punjab.

It is rare in such cultures to build large companies on the basis of scientific analysis and scale because of their cultural need to control. For example, there are some successful fast-food brands in South India such as Saravana Bhavan and Hot Chips which have grown into large firms, and are still following the measured steps that they had been carrying out earlier to succeed in their business.

ADVERTISEMENTS:

We can find such cultures in the services business as well. We observe that in India, education is offered predominantly by trusts of large corporates or personalities well known in their region. In these cases, scalability and cultural orientation are limited.

ii. Political Characteristics in Strategy Formulation:

The term ‘political’ here refers to taking sides or being influenced in decision making. It could be because of leadership and managerial team.

Leadership bias, predominantly, refers to owners, capital providers, or the CEO. We have cited a few instances where promoters have led to a controlled or guarded strategy formulation. There are cases where the leader’s initial success drives the spirit of entrepreneurism and strategy formulation. For example, there have been cases where after a success, the leader has heavily bet on the same business. In the case of sugar and retail, we have quite a few examples in India such as Thiru Aaroon Sugars, Rajashree Sugars, Shree Renuka Sugars, EID Parry and in the retail sector, south Indian consumer goods chains Vivek’s and Vasanth & Co.

In a way, this has been a welcome approach as they have a focus on horizontal integration. However, at times, such approach leads to inadequate application of science in strategy formulation. In addition, the people lower in the hierarchy lack the orientation to think critically on strategic perspectives. It has also been seen that after a stage inertia sets in, investments and returns mature, and take an inverted ‘U’ turn after reaching a peak. This happens because of leadership bias.

Leadership bias could also be present because of the persuasive approach of the leader on a chosen plan, pushing it through a strategy formulation stage. In ex-post facto analysis, one can look at a number of such decisions taken both in the case of listed and unlisted companies. Ideally, some stakeholders should apply pressure against such bias and insist on withdrawing support. When this fails to happen, it leads to business failure as the leader’s obsession may not turn into market success.

The large regional retailer Subhiksha which became defunct in 2008-09 could be an example here. If leadership had avoided bias by broadening its forum of decision makers, the company could have seen different times.

ADVERTISEMENTS:

There are cases of successful persuasive leadership bias as well. The classic Indian examples are of Reliance Industries, many Tata group companies, and the Aditya Birla group. In the case of these examples, leadership bias has been validated through scientific analysis and support systems.

There have also been some cases where inadequate application of right leadership perspective led to a crisis. For example, there was a distillery company that adopted unproven venture funded technology for handling effluent, which led to the failure of the distillery and finally forced its promoters to sell the business.

Here, the case was of a clear lack of perception and inadequate time spent on analysis and choice while formulating the strategy. If it had been done, there could have been some fall-back option and adverse situations could have been avoided. Though it is not the mistake of any one in the system, an analysis based on scenario building using multi-dimensional ‘failure scenarios’ and their impact on cash flow and overall viability could have helped to protect the company from this investment.

Managerial bias can also influence strategy formulation. It is highly subjective in nature. Managers’ success and rise to stardom lead, at times, to strong bias. In addition, there have been cases of ‘agency theory’ at work, where manager’s agents or trustees of investors, are, after a point, driven by their own personal motives. This makes them drive the strategic decisions that are convenient to them instead of being scientific in strategy formulation. This has been well articulated by Oliver E. Williamson (1970).

This is applicable even today, especially in large corporates and MNCs. It could be difficult to be conclusive for us to comment on whether it is advisable. However, such biases must be validated through systematic analysis and choice process. During contemporary business conditions, we see that boards are effective in handling this bias. Even then, the bias and organizational politics are subjective in nature and influence strategy formulation.

iii. Role of Directors and CEOs:

The board of directors is elected as representatives of the shareholders. Its role is to oversee the function of the company and ensure that the company continues to operate in the best interests of all stakeholders. However, in contemporary business, this is not an easy task. In addition, the board’s effectiveness is the key performance driver in Indian companies. This is true from the perspective of the individuals and the intangible value they bring to the business and its stakeholders.

The board could be passive, active or aggressive. There were times when the board was considered the rubber stamp of the promoters. With an increased orientation towards responsible corporate governance prevalent in the business landscape today, the perception and effectiveness of a board of directors has now changed to that of a strategic asset for the company.

A good board needs to set a tone that will promote a transparent culture, and effective dialogue among directors, senior management, and various functional and risk managers. The composition and role of the independent directors are also now examined closely. Independent directors should significantly contribute to the functioning of the board through requisite understanding of the company and business. Boards must be involved in their own performance evaluation and enable continuous feedback and communication across stakeholders.

Effective boards build capabilities within themselves and their organizations that allow them to jointly protect existing assets (compliance role), as well as, manage threats to future growth (strategy oversight role).

It is important to note that there are some key functions that should be fulfilled by the board, such as the following:

1. Strategy formulation, budgets, business plans, etc.

2. Monitoring the effectiveness of the company’s governance practices.

3. Selecting, compensating, and monitoring key executives, and overseeing succession planning.

4. Deciding executive and board remuneration

5. Ensuring a formal and transparent board nomination and election process.

6. Monitoring and managing potential conflicts of interest of management, board members, and shareholders, including misuse of corporate assets and abuse in related party transactions.

7. Ensuring the integrity of the corporation’s accounting and financial reporting systems, including the independent audit.

8. Ensuring control systems for risk management, financial and operational control, and compliance.

9. Overseeing the process of disclosure and communications.

If you study these key functions, you will realize that all are important from the strategic management process perspective. In fact, strategy formulation is one of the most important functions that the directors spend a lot of time on.

Indian companies understand the importance of board composition and large business houses vie to maintain illustrious people among their board of directors. Clayton M Christensen, the Robert and Jane Cizik Professor of Business Administration at the Harvard Business School, is on the board of TCS as a non-executive director and along with him there are other business leaders who serve on the board. His research and teaching interests center on managing innovation and creating new growth markets. Christensen has founded three successful companies.

Similarly, Dr. Marti G. Subrahmanyam, the Charles E. Merrill Professor of Finance, Economics, and International Business at the Stern School of Business at New York University is on the board of Infosys Technologies as an independent director. Subrahmanyam has published several articles and books in corporate finance, capital markets, and international finance. Similarly, many of the leading companies have well-known personalities as independent directors who can bring high value to strategy formulation, and direction to the company based on their intellect and experience.

iv. Role of Chief Executive Officer/Managing Director:

A Managing Director (MD) is the director of a company who is given special powers by its constitution. In most companies, this is the senior-most manager of the company, heading the organization, and so may have a title, such as Chief Executive Officer (CEO). In some companies, there are Chief Operating Officers (COO) who are responsible for the routine operation of the company, leaving the CEOs free to plan and direct the company’s strategy. We now commonly come across such job profiles in many IT firms in India and elsewhere.

A managing director is in a leadership role for an organization and he may have to work towards fulfilling a motivational role for the stakeholders. A managing director has responsibility for the overall management of a company, including the staff, the customers, the budget, the company’s assets, and all other company resources to make the best use of them and increase the company’s profitability. The CEO and the board must work on ideas for the improvement of the company. It is the CEO/MD’s responsibility to implement, improve upon, or ignore these ideas.

The responsibility of the CEO is to align the company, internally and externally, with its strategic vision. A CEO must balance internal and external initiatives to build a sustainable company. This clearly brings out the role of the CEO in strategy formulation. In some companies, the CEO primarily coordinates external initiatives, as functional level executives (i.e., marketing, information, technical, and financial) are oriented towards internal initiatives.

On the other hand, in emerging entities, promoters act as CEO on a very different platform than that of the corporate level. At times, when other top level executives are not incorporated in small operations, it is the duty of the CEO (and sometimes founder) to assume those positions. In these companies, both formulation and execution responsibilities lie with the CEO. Some CEOs reach celebrity status with their performance and achievement.

You may note the impact these leaders have on strategy formulation through setting a vision, ensuring that it becomes the shared vision, and orchestrating strategy for high performance. Corporate history has seen many such leaders and their role in strategy formulation. Mid-sized companies, start-ups, not-for-profit organizations and governments have such leaders. Key skill sets include the ability to set vision and drive the strategy team to proceed on the same.

Strategy Formulation – Stages & Framework: External Input, Internal Input, Matching and Decision

Strategists try to run their organizations based on a systematic and objective method of strategy formulation, strategy-implementation and strategy-evaluation. This approach of managing the firm is dependent on long term and short-term objectives of the firm and is known as managing by objectives. Unfortunately, importance of strategy on the chief executive officer’s agenda is mostly very low. M. de Kare Silver (1997) has referred to a survey work done by Kalchas group in August 1996 on ranking of strategy by CEOs of top 100 companies based in USA and UK.

It has been observed therein that, on an average, strategy formulation ranks sixth in importance in the ten-key agenda items of the top executives. Only 14 per cent of the executives put future strategy at the top of their list. And out of those 14 per cent, only a few executives depend on systematic and objective approach for strategy-formulation.

Those who assign less priority on strategy formulation try to manage their organizations either by extrapolation of the past plans, works and achievements or by reacting under crisis and allowing external events to dictate the what’s and when’s of business decisions or by creating the hope that failures are the pillars of success or by not doing any unified planning and directing all to do their best.

Even in today’s competitive world, these executives are trying to survive without any objective framework and sometimes without any planned strategy. They refuse to realize that the future will not be an extrapolation of the past. Obviously, they are failing in their endeavor. And all these failures indicate the need for strategy- formulation framework.

Generally, strategy-formulation framework is a four-stage integrated process of decision-making. In the first stage strategists are concerned with analysis and diagnosis of the external environment. In this process, strategists develop Competitive Profile Matrix, or External Factor Evaluation Matrix, or External Factor Index Matrix, or Environmental Threat and Opportunity Profile.

This stage is also known as external input stage. The Second stage is internal input stage where the strategists are concerned with internal capabilities and limitations. They develop Internal Factor Evaluation matrix, or Internal Factor Index matrix, or Strategic Advantage Profile.

The third stage focuses on generating alternative strategies by matching the basic external factors with the basic internal factors. In view of the same the third stage is termed as matching stage. Matching stage techniques include Strengths-Weaknesses- Opportunities-Threats (SWOT) analysis, Threat-Opportunities-Weaknesses-Strength (TOWS) analysis, Strategic Position and Action Evaluation (SPACE) matrix. Internal- External (IE) matrix, the Indexed Internal-External (HE) matrix and the Grand Strategy (GS) matrix.

The fourth stage is the decision stage involving Quantitative Strategic Planning Matrix (QSPM). QSPM reveals the relative attractiveness of different alternative strategies generated in the earlier stage and provides with the objective basis for final selection of the corporate strategy.

Lenz (1987) has however, emphasized that this number-oriented planning process might give rise to a false sense of certainty and reduce discussions, arguments and opinion based analysis. He is in favor of words-oriented planning, but, according to David (1989) biases, groupism and halo error (i.e., error due to assigning extra weightage on a single factor) creep in when objective information is lacking. Thus, strategists must make a balance between number oriented planning and word oriented planning tools by opting for analytical tools and facilitating communication.

Strategy Formulation – 5 Step Process: Developing Strategic Vision, Setting Objectives, Crafting a Strategy to Achieve the Objectives & Vision, and a Few More

The strategy formulation involves the following steps:

Step # 1. Developing Strategic Vision:

i. Vision specifies what direction or path to follow.

ii. Specify what products, markets, technologies and customer policies to follows

iii. Vision communicate management aspirations to stack holders of company.

iv. Helps to boost morale of organization and engages them for a common direction.

v. Clear vision helps to provide a motivated and stimulated environment in the organization.

vi. Vision specify management aspiration for the business in long-term.

Step # 2. Setting Objectives:

Corporate objectives are outcome of “Mission and Vision” of organization. Objectives define specific performance targets, results and growth that organization wants to achieve.

To determine the objectives an approach known as Balance Score Card is used.

Balance Score Card Approach:

Overall a company should set both strategic and financial objectives. However, organization can use Balance Score Card approach for setting objectives. This approach states that “Organization should focus more on achieving strategic objectives – like “performance”, “customer satisfaction”, “innovation” and “profitability” – than financial objectives (i.e., profit and profit growth) only.

Balance Score Card also provides a basis to measure company performance against set objectives.

Company strategic and financial objectives should be set both as, short-term and long-term objectives.

Long-Term and Short-Term Objectives:

Long-Term Objectives:

i. Profitability.

ii. Productivity.

iii. Competitive Position.

iv. Employee Development.

v. Employee Relations.

vi. Technological Leadership.

vii. Public Responsibility.

Long-term objectives represent the results expected from pursuing certain strategies, usually from two to five years.

Qualities of Long-Term Objectives:

i. Acceptable

ii. Flexible

iii. Measurable

iv. Motivating

v. Suitable

vi. Understandable

vii. Achievable.

Objectives are commonly stated in the following terms; growth in assets, growth in sales, profitability, market share, degree and nature of diversification, degree and nature of vertical integration, earnings per share, and social responsibility.

Short-range objectives can be identical to long-range objectives for example, if a company has long- term objective of 15 percent profit growth every year, then the company’s short-term objective would also be 15% profit growth for current year.

Here intent refers to intension. A company exhibits strategic intent when it relentlessly (aggressively) pursues an ambitious strategic objective and concentrates its full resources and competitive actions on achieving that objective.

A company’s strategic intent can helps in many ways to the company, like –

i. In becoming the dominant company in the industry;

ii. Unseating the existing industry leader;

iii. Delivering the best customer service in the industry (or the world);

iv. Turning new technology into products which capable of changing the way people work and live.

Sometime ambitious companies begin with strategic intents that are out of proportion to their immediate capabilities and market positions. But they continuously work hard— even achievement of objective may take a sustained effort of 10 years or more. Moreover, on reaching one target they stretch the set objectives and again pursue them relentlessly, sometimes even obsessively.

The Need for Objectives at all Organizational Levels:

Objective setting should not stop with top management’s setting the companywide performance targets. Company objectives need to be broken down into performance targets for each separate business, product line, functional department, and individual work unit.

Company performance can’t reach full potential unless each area of the organization does its part and contributes directly to the desired companywide outcomes and results. This means that objectives should be given to each and every business units and those should be combined with overall company objectives.

Step # 3. Crafting a Strategy to Achieve the Objectives and Vision:

A company can achieve its mission and objectives when all the components of a company work together. A company’s strategy is at full power only when its many pieces are united. Achieving unity in strategy planning and formulation is partly a function of communicating the company’s basic strategy themes effectively across the whole organization.

A company’s strategic plan lays out its future direction, performance targets, and strategy.

“Developing a strategic vision, setting objectives, and crafting a strategy are basic direction-setting tasks”.

Vision, Objectives and crafting a strategy set the both short-term and long-term performance targets for organization. Together, they constitute a strategic plan to deal with industry and competitive conditions.

For crafting or developing a strategy many assessments are performed.

However, three assessments are very important:

i. The first determine organizational strengths and weaknesses.

ii. The second evaluates competitor strengths, weaknesses, and strategies, because an organization’s strength is of less value if it is neutralized by a competitor’s strength or strategy.

iii. The third assesses the competitive environment, the customers and their needs, the market, and the market environment.

These assessments, based on the strategy selected, focus on finding how attractive the selected market will be. The goal is to develop or formulate a strategy that exploits business strengths and competitor weaknesses and neutralizes business weaknesses and competitor strength.

Step # 4. Implementing & Executing the Strategy:

Strategy implementation and execution is an operations-oriented activity. This stage is the most demanding and time-consuming part of the strategy-management process.

Till now, in the above stages everything was planning only. In this stage above plans are given actions. In this stage, based on company and competitor’s strength and weaknesses various activities are implemented.

This stage is like management process and includes followings:

i. Staffing the organization with the needed skills and expertise.

ii. Developing budgets and organizing resources to carry out those activities which are critical to strategic success.

iii. Using the best-known practices to perform business activities and pushing for continuous improvement.

iv. Motivating people to pursue the target objectives energetically.

v. Tying rewards and incentives directly to the achievement of performance objectives and good strategy execution.

vi. Creating a company good culture and work climate for successful strategy implementation and execution.

vii. Keep on improving strategy execution and when the organization encounters stumbling blocks or weaknesses, management has to see that they are addressed and rectified quickly.

Good Strategy Execution Involves Creating Strong “Fits”:

i. Between strategy and organizational capabilities.

ii. Between strategy and the reward structure

iii. Between strategy and internal organization working systems, and

iv. Between strategy and the organization’s work climate and culture.

Step # 5. Monitoring Implemented Strategy and Making Corrective Adjustments:

A company’s vision, objectives, crafting strategy, and implementing and execution of strategy are not final thing in strategic management – managing strategy is an ongoing process.

There is one more stage in the corporate strategy management and that stage is—monitoring and evaluating the company’s progress. As long as the company’s strategy is going well, executives may remain stick to implemented strategy except more changes are required with time.

But whenever a company encounters disruptive changes or downturn in its market positions then company managers are required to search out whether the reasons of downturn are due to poor strategy, poor execution, or both to take timely corrective action.

A company’s direction, objectives, and strategy have to be revisited anytime external or internal conditions warrant. It is to be expected that a company will modify its strategic vision, direction, objectives, and strategy over time, if required.

Strategy Formulation – Top 11 Approaches: Strategic Hierarchy, Generic Strategies, Strategic Intent, Strategic Posture, Logical Instrumentalism and a Few More

There are as many approaches to formulating strategy as there are academicians researching on business policy or strategic management.

The following are some of the well-known approaches:

1. Strategic hierarchy

2. Shotgun strategies vs. rifle strategies

3. Street-smart planning vs. formal planning

4. Intuitive planning vs. analytical planning

5. Generic strategies

6. Strategic intent

7. Strategic posture

8. Logical instrumentalism

9. Proactive strategies vs. creative strategies

10. Random walk

11. Strategy as revolution.

Approach # 1. Strategic Hierarchy:

Strategic hierarchy is a very popular approach among academicians. Every company should have a clear mission statement which is usually reflective of the value system of the founder(s). Johnson & Johnson’s credo goes thus – ‘We believe our first responsibility is to the doctors, nurses and patients, to mothers and all others who use our products and services. In meeting their needs, everything we do must be of high quality. We must constantly strive to reduce our costs in order to maintain reasonable prices…’

Some of the major points from the business philosophy of Matsushita, the founder of the Matsushita Electric Industrial Company Ltd, are:

i. The purpose of an enterprise is to contribute to society by supplying goods of high quality at low prices in ample quantity.

ii. Profit comes in compensation for contribution to society.

iii. Always direct your effort for ‘mutual prosperity and existence’.

iv. Human unity and harmony are indispensable for job achievement.

A mission statement should lead to objectives and goals. The objectives of an organization are generally towards achieving leadership in a particular field (market share, new product introduction or profits). Goals set specific targets such as attaining 50 per cent market share or introduction of a certain number of new products.

A SWOT (strengths, weaknesses, opportunities and threats) analysis can help a firm develop strategies to attain its goals. Strategy should decide the organizational structure to carry out activities for the same. Management Control and Information Systems (MCIS) help managers to control and review the performance of their organizations with regard to mission, objectives and goals.

Approach # 2. Shotgun Strategies vs. Rifle Strategies:

When a company faces the problem of starting a new business, it has two options – (i) It can either define the target market, understand its needs and develop products according to its tastes, or (ii) develop good products as defined by the technologists of the company and make them available in, the market so that whoever likes them can buy them.

The first option is referred to as rifle strategy as one knows the exact target and the company aims and shoots accordingly. The second approach is called shotgun approach as one fires in all directions and hopes that some of the shots may hit the target.

Approach # 3. Street-Smart Planning vs. Formal Planning:

Formal planning is often criticized by street-smart entrepreneurs as slow and impractical. Consider, for example, a case for offering a 1 per cent discount for a slightly damaged product to clear the stock. An MBA, because of his training, would subject this problem to such an analysis that by the time he came to a decision, the competitor would have given a 1 per cent discount on his fresh stock and clinched the deal.

Parle’s chief, Ramesh Chauhan, is often described as street-smart. The following case illustrates the ordeal Double-Cola, a potential competitor for Parle’s Thums Up brand at that time, went through in Mumbai with regard to distribution.

‘The unique industrial relations problems which sabotaged the launch of Double-Cola in Bombay in mid-June provides ample testimony of the domination of the indigenous bottled soft drinks market by the tough Ramesh Chauhan, Chief Executive of the Bombay- based Parle Beverages Pvt. Ltd., which has a 65% share of the national bottled soft drinks market….The Bharatiya Kamghar Sena, the trade union arm of the Shiv Sena, suddenly insisted that distributors’ contractors, who have traditionally worked on a commission basis for all soft drink manufacturing companies, should be absorbed by Double-Cola Manufacturing Company as full-time employees. Curiously, the Bharatiya Kamghar Sena is the recognised union in Parle Beverages as well, where it has made no such demand’.

Double-Cola’s problems could have been further compounded by the fact that having spent large sums of money on advertising, and thus stimulating demand for the product, the company would have been unable to make the product available at the retail outlets.

Approach # 4. Intuitive Planning vs. Analytical Planning:

Generally, professional managers, by virtue of their education and training, believe in the strength of logic and are reluctant to give up their implicit faith in logic even when they reach senior levels where strategic and entrepreneurial decisions are required. In many such cases data is scanty and the ultimate decision has to be arrived at by largely using intuition.

Approach # 5. Generic Strategies:

Porter (1980) developed a thesis which stated that a firm’s profitability was determined by the characteristics of the industry it was in and the firm’s position within it. Using his own framework to analyze industry structure, Porter developed three generic strategies for firms.

i. Overall cost leadership

ii. Differentiation

iii. Focus.

Any other strategy followed by firms could be classified as ‘getting stuck in the middle’.

Approach # 6. Strategic Intent:

Hamel and Prahalad (1989) turn much recent thinking upside down by asserting that the real function of a company’s strategy is not to match its resources with its opportunities but to set goals which ‘stretch’ a company beyond what most managers believe is possible. The examples cited are Toyota vs. General Motors, CNN vs. CBS, British Airways vs. Pan Am and Sony vs. RCA. In all these cases the overwhelming ambition and determination may well have been a vital ingredient in their success story.

Of course, the ambitious strategic intent should be backed by an active Management process that includes focusing the organization’s attention on the essence of winning; motivating people by communicating the value of the target; leaving room for individual and team contributions; sustaining enthusiasm by providing new operational definitions as circumstances change; and using intent consistently to guide resource allocations.

While strategic intent is clear about the end, it is flexible with regard to the means and leaves room for improvisation. Achieving strategic intent requires enormous creativity with regard to the means. It also creates an extreme misfit between resources and ambitions. The top management then challenges the organization to close the gap between the two by systematically building new advantages. The essence of strategy lies in creating tomorrow’s advantage faster than competitors mimic the ones the organization possess today.

Approach # 7. Strategic Posture:

There are three basic postures that are exhibited by companies in coping with the changing environment:

i. Proactive strategy

ii. Crisis management strategy

iii. Reactive strategy.

Proactive strategy means anticipating and adapting to change. Crisis management means working out an escape route after a crisis occurs. Reactive strategy is followed by those who simply offer resistance to any change and, in the process, get wiped out.

Approach # 8. Logical Instrumentalism:

Logical incrementalism basically means formulating strategies through a one-step-at-a-time process. A company may not have a clear mission, as in the case of the strategic hierarchy method. It may have some idea about growth and targets but not about the route to be taken. Therefore, it will take into consideration its past history to guide it about what course of action to take and what to avoid. After studying its past experience, at a given point of time, the company will decide the next logical step.

All subsequent decisions too will be taken in a similar manner. Additionally, the choice of the new strategy will also depend upon the company’s current strengths, weaknesses and resources, as such a company will not think beyond its current capabilities. Logical incrementalism is probably the most commonly adopted approach by companies.

A number of companies do not have a strategic intent or a vision. They start off as small companies and as they generate sufficient profits and reserves they start looking for the next set of opportunities for growth. They focus on backward integration or forward integration which is the next logical step to be taken for growth. Similarly, entry into related areas are also logical steps.

For example, the TTK group of companies, though they were marketing Kiwi Shoe Polish, never considered entry into men’s toiletries until they tied up with the Beecham group of the U.K. to market Brylcreem in India. Now the next logical step is to look for companies for acquisition in the area of men’s toiletries to fill the product or line gap between the head and the toe.

Approach # 9. Proactive Strategies vs. Creative Strategies:

Proactive strategy means changing in accordance with the change anticipated. However, the creative approach enables the company to engineer changes to suit itself. The first approach is like wearing a sweater to protect oneself from the cold and the second approach is somewhat similar to using a heater to warm up the room. The creative approach breaks through the constraints and barriers and creates an environment that suits the company’s requirements.

The creative approach is also different from the incremental approach which is based on logic, is rooted in the past, and constrained by current firm capabilities. Conversely, the creative approach goes beyond the boundaries to develop multiple alternatives, and comes up with totally new products and develops entirely new markets.

The often quoted anecdote about two shoe salesmen who visited some underdeveloped country to explore the market potential aptly illustrates these two approaches. One salesman came back saying that there was no potential as no one wore shoes in that country, while the other felt that there was a huge potential for the same reason.

Steve Job’s personal computer and Akio Morita’s Walkman are products of the creative approach. Both go beyond trivial innovations, such as changing the shape or color of a product, practised by logical incrementalists.

Approach # 10. Random Walk:

Random walk is steps taken in random directions without much analysis or evaluation. The company or the entrepreneur grabs whatever comes their way. Survival is the primary driving force that makes the individual take a number of random steps in the hope that one of them will click someday.

Approach # 11. Strategy as Revolution:

According to Hamel (1996) the strategy-making process usually tends to be reductionist based on simple rules and heuristics. It works from the present forward, not from the future back, implicitly assuming, whatever evidence to the contrary, that the future will be more or less like the present.

The organizational pyramid is a pyramid of experience. But the experience is valuable only to the extent that the future is like the past. In industry after industry the terrain is changing so fast that experience is becoming irrelevant and even dangerous.

There are basically three types of companies:

i. The rule makers—the market leaders, who have shaped the industry, e.g. IBM and Sony

ii. The rule takers—the companies that pay homage to industrial ‘lords’ like Fujitsu and Matsushita

iii. The revolutionaries—the companies that overturn the industrial order, e.g. IKEA and Body Shop

Rule breakers, or revolutionaries, set out to redefine the industry, to invent the new by challenging the old. Anita Roddick, founder of Body Shop, once said – ‘Watch where the cosmetics industry is going and then walk in the opposite direction.’

In the same way, there are revolutionaries within every company. They are likely to be found lower down the hierarchy and not in the top management. However, their voices are muffled by layers of cautious bureaucrats who separate them from senior managers. It is difficult to challenge the combined forces of precedence, position and power.

The leaders who fail to recognize these revolutionaries are those who have lost confidence in their ability to shape the future of the organizations. They have forgotten that from Gandhi to Mandela, from the American Patriots to the Polish Shipbuilders, the creators of revolutions have not come from the top.

To help revolutionary strategies to emerge, senior managers must supplement the hierarchy of experience with a hierarchy of imagination. By this process a revolution will gather mass and momentum and overthrow the stale and obsolete industry conventions and norms and develop radically different and new strategies.

As can be seen from the various approaches, there is no single best approach, especially as situations vary. This is what makes the field of strategic management exciting, offering scope for creativity, innovation and intuition. Having understood the concept of business strategy let us turn our attention to marketing.

Strategy Formulation – Tools and Techniques: SWOT Analysis, TOWS Matrix, PLC, Portfolio, Market & Product Strategies, Scenarios and Gap Analysis

The various tools required for strategy formulation are:

1. SWOT Analysis and TOWS Matrix:

Analysing the external environment helps identify threats and opportunities that the company is likely to face. Further, an internal environment analysis must be carried out to identify the strengths and weaknesses of the company. These must be corroborated to identify strengths and weakness in light of the opportunities and threats faced in the external environment. This tool can be used for corporate, SBU, and functional/ operational level strategy formulation.

It is important to note here that while using the tool options must be ranked based on their net benefit to the company. The top-ranking options must be chosen, but where there are multiple strategic options, all of them must be evaluated before a choice is made.

The TOWS matrix is helpful for generating strategic options. The blend of external factors (opportunities and threats) with internal factors (strengths and weaknesses) must be analysed in light of the vision, mission and goals of the company and not independent of them. It must also be noted that the TOWS matrix as a tool is a supplementary rather than a key decision-making tool unless there is a clear conviction about these disparate external and internal factors.

Suppose the FMCG company that we have been referring to wants to drop a product line and invest in another category. In this case, SWOT analysis could be helpful. SWOT analysis can identify the product line that needs to be dropped by showing its critical weakness and serious threats. Similarly, it can also help judge the category that should be invested in by identifying its strengths and opportunities. Together, these tools would aid in making a good production portfolio decision.

The tools that could be applied include product life analysis and the ones on portfolio planning to understand the various facets of the decision, including the size of future investments, in greater detail.

2. Product Life Cycle:

The product life cycle (PLC) helps to map the stage that the product is in and understand how the strategy under pursuance would help to position the strategic unit. The company can decide whether it needs to innovate and reposition the PLC of its product by relaunching it or by any other means.

For example, Lifebuoy as a brand in India has moved from a red bar of soap to a range of specialized and generalized hygiene soaps now promoted by celebrities. This brand is a leader in the soap market of India, with an 18.4 per cent share of a consumer base of 140 million households in India, and an annual global turnover of 350 million euros worldwide, of which 200 million comes from India.

In our opinion, the repositioning of Lifebuoy in the PLC has been very successful but is still debated by many market analysts with differing views. The inference here is that the strategy formulation exercise is not as simple as using the PLC, but requires the use of a combination of tools and techniques.

3. Portfolio, Market, and Product Strategies:

These techniques include SPACE (strategic position and action evaluation) matrix, BCG matrix, GE matrix, Ansoffs matrix, McKinsey’s 7S model, and PMIS (profit impact of market share). We shall expand on their uses.

Portfolio business strategies are more relevant at the SBU-level and corporate-level strategy formulation. When a firm wants to invest in or divest a business in a portfolio, increase its market share, or utilize excess cash generated where there are inadequate opportunities to plough investments, the portfolio approach is deployed.

In these situations, either because of the market or the competition, the firm is to initiate strategic moves. This involves an in-depth analysis of the situation, and decision making at the top level of management. This has to have involvement from both the top-level and operational-level management for effectiveness. The decision could be compulsive at the SBU, product, or market level, but may have lesser priority for top management. Hence, such sensitivities must be understood by strategy analysts to initiate appropriate actions.

A good example would be that of Hindustan Unilever Limited (HUL), which has applied such strategies extremely well. The company merged its subsidiaries such as Ponds India, Lipton, and Brook Bond earlier. There were quite a few acquisitions of brands and business too such as Kissan, and Kwality Ice cream.

After these acquisitions, the company decided to foray into the food business in a big way. It also gave a big push to brands such as Annapurna, Knorr, Kissan, Kwality Walls, and some beverage brands and their product extensions such as filter coffee. This was done via advertisement, market research, and increasing the market reach of the brands by investing in more stockeeping units etc. Such initiatives would have required decisions using portfolio, market, and product analysis.

It may be interesting to note here that a single framework or technique would not be adequate. There is a need to apply a combination of tools. However, it is important to have a prime technique, along with other complementary techniques and tools while facilitating strategy formulation decisions.

Technique for Strategy Formulation:

1. Scenarios:

Scenario generation is one of the methods which strategic planners have found useful for the interpretation of a fluid, rapidly changing business environment with an uncertain future. Scenarios constitute an effective device for sensing, interpreting, organising and bringing to bear diverse information about the future in planning and strategic decision-making.

Simply stated, scenarios may be regarded as stories about the future. But more precisely speaking, these are descriptions of plausible alternative futures of the macro-environment. The primary purpose of scenario generation is to delimit the range of uncertainties in the most critical factors in an environment.

Typical scenarios include qualitative and quantitative descriptions of uncertainties in the most critical factors in an environment. Typical scenarios include qualitative and quantitative descriptions of the more important social, political, economic, demographic, technological and other conditions. They often describe the basic trends, assumptions, conditions and dynamics of the factors relating to the future period that the scenario covers. As such scenarios are not forecasts or predictions.

Probability estimates are hardly associated with the elements of the scenario. Hence scenarios are said to be fuzzy, too imprecise and hard to apply. Also scenario generation is an expensive process. There is no doubt that scenarios represent a significant departure from the traditional methods of forecasting like the single or multiple variable extrapolation and regression methods.

However, most of the environmental factors are not amenable to easy prediction on account of their complexities and the rapidity of changes. Under the circumstances scenarios are found to be an ideal complement to the various other methods of forecasting and planning.

2. Gap Analysis:

The basic question that strategic planners have to face with regard to environmental forecasting is how far ahead they will look, that is about the time horizon for forecasting. For, to respond strategically to a perceived environmental change in future, the strategic decisions have to be taken well in advance. It may be a matter of technology of production envisaged by the planners.

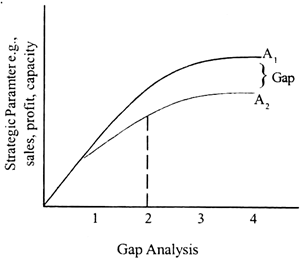

Thus, for instance, it will take a considerably longer period to create production facilities for computer hardware than for production (say) a newly designed software. A technique which has been found useful in determining the time horizon for environmental forecasting is that of ‘Gap Analysis’. Application of this technique will be clear from the following diagram which depicts a typical situation.

It will be seen in the diagram that between line A , and line A , which show the desired change in a strategic parameter like sale, profit, etc. and what will happen if there is no change in strategy, respectively, a gap has emerged by the second year. The gap widens with the passing of time. The planners should know how long it will take for current decisions to begin to-fill the gap. If it is a question of creating capacity for computer hardware, two years will be too short a period for the purpose unless it is decided to acquire an existing plant.

Once the time horizon for forecasting is determined it is necessary that objective data should be processed and then analysed for making forecasts, taking into account the probabilities of occurrence and the risks involved.

One or more of the following forecasting techniques may be adopted in this context:

(1) Unstructured Inexpert Opinion techniques such as person- in-the-street interviews, brainstorming, etc.

(2) Structured Inexpert Opinion techniques include use of questionnaire, interviews and surveys.

(3) Structured Expert Opinion techniques which include ‘delphi’ technique, highly structured interviews, and on-line Computer Interaction.

(4) Multivariate Interaction Analysis which includes methods involving the use of Input-output Models, Probability Networks, Factors Analysis, and regression Analysis.

(5) Mapping which includes Relevance Trees and Morphology Analysis.

(6) Theoretical Limit Envelopes which include methods such as Worst-Case Analysis, High and Low Limits Estimation, and Sizing Calculations.

(7) Unstructured Expert Opinion techniques such as ‘What if’ Interviews, Role Playing, use of Consensus Panels, and Scenario Generation Forecasting technology change in particularly rendered easier by scenario generation.

(8) Dynamic Models which include Historical Analogues, Time- lags, and Stochastic Modelling.

(9) Single variable extrapolation – Variants of this techniques include linear extrapolation, life-cycle curves, power-series expansion, exponential smoothing, and others, Single -variable extrapolation is found useful if it is possible for the firm to identify a key environmental variable, on the assumption that the past is a guide to the future. However, a single environmental variable is generally insufficient. Thus, multiple regression techniques may have to be used.

Strategy Formulation – Challenges Faced for Effective Operation of a Business

The practice of strategy formulation is an ongoing exercise that is refined over the years. During the process, tools and techniques are validated and demonstrated by way of successful deployment in organizations. This is true for different kinds of organizations such as partnership firms, privately-held companies, corporate bodies, government businesses, and not-for-profit organizations.

Strategy formulation has to be scientific. We come across many instances wherein the strategic management process has failed to deliver the required results for competitive growth. This failure, in some cases, is attributed to a lacuna in the strategy formulation stage, leading to a failure in the subsequent strategy implementation stage. This obviously reflects the multiplicity and complexity of challenges faced at this stage.

The following points try to capture such challenges in the context of effective operation of a business:

i. Achieving Shared Vision:

This is one of the major issues in strategy formulation. There are instances where after choosing an appropriate strategy, the top management, among themselves and across organizations, fails to achieve synchronization of the vision, strategic intent and hence the strategy for way forward.

This leads to problems in implementation and in the obtainment of commitment from the stakeholders. This is a serious issue in making major decisions. For example, while venturing into inorganic moves such as mergers, acquisitions, sell offs, or divestiture, such instances are common. In this process, there could be a delay in pursuing the strategy, which may lead to value erosion.

One of the authors was involved in the selection of technology and boilers for a small power plant for co-generation of power and steam for processing. The delay in decision making made the company lose one operating season as it was a highly seasonal industry. The delay was mainly because the vision for co-generation of power was fully understood but the streamlining with operations was not clear. It required a combination of vision and operations expertise to consummate the idea, causing the delay.

To overcome such problems, creating a shared vision is critical. All successful organizations have one. Building confidence among stakeholders and communicating objectively are critical for creating a shared vision. It not only creates a shared vision but also a philosophy of oneness and growth through commitment of effort and energy for the benefit of all stakeholders.

ii. Inability of Partners to Map a Vision:

The inability of partners to map a vision and agree on strategy formulation could be another issue, especially in case of alliances and joint ventures, venture capitalists, and group companies. Though partners have well defined areas of interest, when it comes to the nitty-gritty of strategy formulation, there could be divergence of views. In addition, there could be a possibility of a dominant partner having a ‘big brother’ attitude, because of which the strategy formulation process could be jeopardized.

In case venture capitalists are active at the strategy formulation stage, they may try to overplay the role because of experience elsewhere or lack of on-ground realities. Many times, even debt fund providers drive strategic intent because of certain contractual clauses, such as the right to be present on the board. The inconvenient exposure may lead to a loss of control in making right decisions in the interest of all the stakeholders.

However, the problems among partners can be addressed by promoting healthy understanding and transparency. Key partners such as a venture capitalist can be given board responsibilities and may be involved in decision making. It may be a good idea to have an open and clear communication rather than taking problems to a breaking point and then trying to resolve them.

iii. Leadership and Managerial Bias:

Imposing leaders and self-motivated managers are often causes of dissonance at the strategy formulation stage. To overcome the same, leaders and managerial bias needs to be addressed effectively. A strong and active board is one which can balance this bias. Such an approach is possible only with large companies. Small and mid-sized companies have a problem in getting directors, who could overpower this bias, on the board of the company. In such cases, the strategy formulation team may need to involve the right advisors and experts to bring a balance.

Leaders who have a tendency to follow the success of others must be engaged in the details of operational situations and exposed to internal factors adequately so that someone’s success is not imitated. Wherever leaders have a problem with respect to assimilating the nuances of technical or functional perspectives, adequate time must be allocated during the formulation stage. Without the right perspectives, if leaders are driving or are driven by any of the stakeholders, the post-decision correction process could be time consuming. In addition, such moves may lead to strategic lapses, requiring resources and effort.

iv. Managers Over-Emphasizing Tools and Techniques:

Another issue involves managers over-emphasizing tools and techniques and losing touch with the pulse of the market or going in the wrong direction due to a herd mentality. Sometimes, they may be following the market without understanding the internal factors, leading to difficulty in strategy formulation. This is the most common issue when external agents or advisors are used to formulate a strategy.

Many times, investment bankers get enthusiastic and highly impressed with an idea, which may result in a slip at the input stage of strategy formulation. There are a number of examples especially in major strategic decisions such as sell-offs, mergers, diversification, and funding, which state that such problems of investment bankers’ overdrive have resulted in big mistakes.

It is not erroneous on the part of the advisors to commit to such situations. Many times, the internal strategists do not understand the situation in perspective or lack the ability to communicate clearly the various facets and risks of business. More importantly, the high brand value of such advisors overawes some clients, who leave the decision process to the advisors, instead of taking an active role.

The ability to manage the issue of bias towards tools and techniques, and find the right balance of experience, intellect and deployment of tools and techniques for decision making is required. This can again be achieved by involving senior board members and making a committee responsible for major strategic decisions. Such a committee can bridge the art and science of decision making for effective formulation of strategies.