The theory of revealed preference allows us to use information about consumer choices to inter how the consumer must rank bundles if he is maximizing utility with budget constraints. Alternatively, the revealed preference model explains that how the consumer spends his income with given prices of different commodities. The change in price allows consumer to buy of more or less commodities. But increase in income also helps to buy of more one commodity or buy more of other commodity. Such model is based on certain assumptions.

Assumptions:

Revealed preference theory is based on following assumptions:

1. Consumer spends his entire income on two commodities only.

ADVERTISEMENTS:

2. The consumer chooses one commodity for each price vector p and income situation.

3. There is one and only one price p and income combination at which bundle x is chosen by consumer.

4. The consumer choices are consistent. The X0 with price p0 and if different bundle x1 is chosen then x0 will be no longer feasible alternative.

Model:

ADVERTISEMENTS:

Let us assume that P0 will be the price vector at which x0 can be purchased. The consumer chooses x1 when X0 was chosen. The cost for consumer of consumption bundle is p0x1 > p0x0. The consumer chooses x0 when p0x0 = M0. Now the price changes then it increases from p0 to p1. In the economy, such rise in prices is always observed of commodities. At new price level, p1x0 consumer is not happy because he/has to pay more in terms of money.

But his choices are changing and he prefer P1x0 > p1x1 then consumer is still better off. Similarly P1x0 ≥ p0x1 implies p1x1< p1x0. At new adjustment, the previous bundle of consumption gives more satisfaction to consumer. It also means that P0x0 ≥ p0x1 → P1x1≤ P1x0.

The Weak Axiom of Revealed Preference (WARP):

In the Weak Axiom of Revealed Preference (WARP), we have assumed two commodities. Now x0 is chosen at p0, M0 where B0 is at equilibrium. Now, X1 is chosen at p1m1. The price effect shows a choice structure, it satisfies the weak axiom of revealed preference. There may be a rational preference relation consistent with these choices.

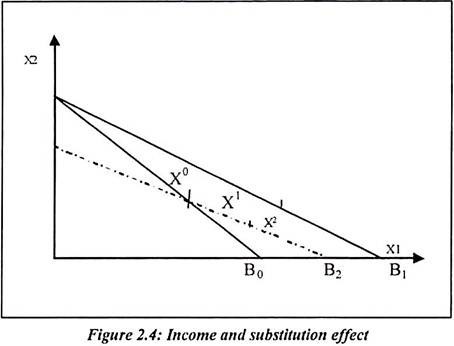

In figure 2.4:

B0 = It is a consumers’ budget line defined by P0 and M0

X0 = The initial bundle chosen by consumer on B0

B1 = It is a budget line after the fall in p1 with

X1 = The new bundle chosen on B1

In the figure, the line B1 shifts to B2. The bundle x2 is just right to x0. Therefore x0 and x2 is the substitution effect. Both goods are alternatively purchased. The x0 and x1 is income effect which is shown in diagram. It is because of fall in price p1. The P0x0 is the price vector and consumption vector. The P1x1 is the new price vector and consumption vector. The consumer’s income is adjusted until at m2x0. It can be purchased at the new prices p1, so that p1x0 = M2. The price vector p1 and the compensated money income is M2. The consumer chooses x2, it is because all income is spent. We have

The compensating change in M ensures that:

Now x2 is chosen because x0 is still available to consumers. In routine life, consumer expects to buy new commodities when old commodities exist. It means likeness and preferences changes.

ADVERTISEMENTS:

From the equation (10), we have

Here, X2 is not purchased by consumer but x0 is purchased. It may be because new choice of commodity is not suitable to him.

ADVERTISEMENTS:

Now we consider equation (11)

Now, equation (12) can be written as

ADVERTISEMENTS:

Subtracting equation (14) from (13) gives the following equation,

And multiplying above equation by (-1) we will have following equation,

This prediction applies irrespective of the number and direction of price changes. In case of a change in the jth price, only p1 and p0 differ in pj.

ADVERTISEMENTS:

Therefore equation (15) can be written as:

We can also derive Slutsky equation from the behavioral assumption. Therefore M2 = p1x0 and M0 = p0x0 the compensating reduction in M is

The case of Δ in Pi only we have:

Above equation explains that the change in price is equivalent to the change in money income. Government offset the effect of price rise with dearness allowance to public sector workers. Such dearness allowance increases the money income up to the new rise in price level.

The price effect of pi on Xj is and this can be partitioned into substitution effect (x2j -xj) and income effect (x1j -xj). We divide price substitution and income effect by D Pi.

ADVERTISEMENTS:

It is as follows:

But from equation (18) we have ΔM = ⎯ Δpix0j

... Δpi = ⎯ ΔM/X0i substituting this into second term of equation (19), we have on the right hand side

Above equation helps us to show the utility maximizing theory of the consumer. The revealed preference theory and utility maximization are equal in their nature.