Monetary policy refers to the policy of the central bank of a country to regulate and control the volume, cost and allocation of money and credit with the aim of achieving the objectives of optimum levels of output and employment, price stability, balance of payment equilibrium, or any other goal set by the government.

Monetary and fiscal policies are closely interrelated and therefore should be pursued in coordination with each other. Fiscal policy generally brings about changes in money supply through the budget deficit. An excessive budget deficit, for example, shifts the burden of control of inflation to monetary policy. This requires a restrictive credit policy.

On the contrary, a fiscal policy, which keeps the budget deficit at a very low level, frees the monetary authority from the burden of adopting an anti-inflationary monetary policy. The monetary policy can then play a positive role in promoting economic growth by extending credit facilities to development programmes.

In a developing economy like India, appropriate monetary policy can play a positive role in creating conditions necessary full rapid economic growth. Moreover, since these economies are highly sensitive to inflationary pressures, the monetary policy should also serve to control inflationary tendencies by increasing savings by the people, checking credit expansion by the banking system and discouraging deficit financing by the government.

ADVERTISEMENTS:

In India, during the planning period, the aim of the monetary policy of the Reserve Bank has been to meet the needs of the planned development of the economy.

With this broad aim, the monetary policy has been pursued to achieve the twin objectives of the economic policy of the government:

(a) To accelerate the process of economic growth with a view to raise national income, and

(b) To control and reduce the inflationary pressures in the economy.

ADVERTISEMENTS:

Thus, the monetary policy of the Reserve Bank during the course of planning has been appropriately termed as that of ‘controlled expansion’. It aims at adequately financing of economic growth and, at the same time, ensuring reasonable price stability in the country.

Policy of Credit Expansion:

The overall trend in the economy during the planning period has been that of continuous expansion of currency and credit with an objective of meeting the developmental needs of the economy.

This expansion has been achieved by adopting the following measures:

i. Revision of Open Market Operations:

ADVERTISEMENTS:

The Reserve Bank revised its open operations policy in October 1956, according to which it started giving discriminatory support to the sale and purchase of government securities. Between 1948-51 the Bank made large purchases of government securities.

In the subsequent period, the Bank’s sales of the government securities to the public exceeded its purchases. This excess sales method was discontinued between 1964 and 1969 with a purpose of expanding currency and credit in the economy.

ii. Liberalisation of the Bill Market Scheme:

Through the bill market scheme, the commercial banks receive additional funds from the Reserve Bank to meet the increasing credit requirements of their borrowers. Since 1957, the Reserve Bank has extended the bill market scheme to include export bills in order to help the commercial banks to provide credit to exporters liberally

iii. Facilities to Priority Sectors:

The Reserve Bank continues to provide credit facilities to priority sectors such as small-scale industries and cooperatives, even though the general policy of the Bank is to control credit expansion.

For instance, in October 1962, the banks were allowed to borrow additional funds from the Reserve Bank in order to provide finance to small scale industries and cooperatives. The Reserve Bank has also been providing short-term finance to the rural cooperatives.

iv. Refinance and Rediscounting Facilities:

In recent years, the Reserve Bank has been following a policy of providing selective refinance and rediscounting facilities. At present, the banks are permitted to refinance equal to one per cent of the demand and time liabilities at the rate of 10 per cent per annum. Refinance facilities are also available for food procurement credit and export credit.

ADVERTISEMENTS:

v. Credit Facilities through Financial Institutions:

The Reserve Bank has also been instrumental in the establishment of various financial institutions like Industrial Development Bank of India (IDBI), Industrial Finance Corporation of India (IFCI), Industrial Reconstruction Corporation of India (IRCI), Industrial Credit and Investment Corporation of India (ICICI), State Finance Corporations (SFCs).

Agricultural Refinance and Development Corporation (ARDC) and National Bank for Agriculture and Rural Development (NABARD). Through these institutions, the Reserve Bank provides medium-term and long-term credit facilities for development.

vi. Deficit Financing:

ADVERTISEMENTS:

Continuous increase in money supply in the country has been caused by adopting the method of deficit financing to finance the budgetary deficit of the government. This has been made possible through changes in the reserve requirements of the Reserve Bank.

The reserve system was made more flexible by making two changes:

(a) By dropping proportional reserve system which required keeping of 40 per cent of reserves in gold (coins and bullion) and foreign securities, with the provision that the value of gold would not be less than Rs. 40 crore.

(b) Modifying the minimum reserve system so that the Reserve Bank need keep only gold worth Rs. 115 crore with the provision that the minimum requirement of keeping foreign securities of the value of Rs. 85 crore can be waived during extreme contingency.

ADVERTISEMENTS:

vii. Anti-Inflationary Fiscal Policy:

The Seventh Five Year Plan prefers an anti-inflationary fiscal policy to an anti- inflationary monetary policy and emphasises a positive, promotional and expository role for monetary policy. It is believed that “a fiscal policy that keeps the budget deficit down would give greater autonomy to monetary policy.”

In the seventh plan, the amount of deficit financing (i.e., net Reserve Bank Credit to the government) has been fixed at a level considered just sufficient to generate the additional money supply needed to meet expected increase in the demand for money, such an anti-inflationary fiscal policy will liberate the Reserve Bank for its anti-inflationary responsibilities and will enable it to extend sufficient credit facilities for the development of industry and trade.

viii. Allocation of Credit:

The pattern of allocation of credit is in accordance with the plan priorities. The major part of the total credit available goes to the public sector through statutory requirements and other means. A certain minimum of credit at concessional rates of interest is ensured for the priority sectors through selective credit control and the differential rate of interest scheme. Private industries can secure funds for investment purposes through public financial institutions.

Policy of Credit Control:

Apart from meeting developmental and expansionary requirements of the economy, the Reserve Bank has also been assigned the task of controlling the inflationary pressures in the economy. During the planning period, the large and continuous increase in the deficit financing and government expenditure has been expanding the monetary demand for goods and services.

ADVERTISEMENTS:

But, on the other hand, the factors like shortfalls in production, hoardings, etc., have been creating inelasticity’s in the supply of commodities. As a result the country has been experiencing an inflationary rise in prices ever since 1955-56 and particularly after 1973-74.

The Reserve Bank has adopted a number of credit control measures to check the inflationary tendencies in the country:

I. Bank Rate:

The bank rate is the rate at which the Reserve Bank advances to the member banks against approved securities or rediscounts the eligible bills of exchange and other papers. Bank rate is considered as a pace-setter in the money market. Changes in the bank rate influence the entire interest rate structure, i.e., short- term as well as long term interest rates.

A rise in the bank rate leads to a rise in the other market interest rates, which implies a dear money policy increasing the cost of borrowing. Similarly, a fall in the bank rate results in a fall in the other market rates, which implies a cheap money policy reducing the cost of borrowing.

The Reserve Bank has changed the bank rate from time of time to meet the changing conditions of the economy. The bank rate was raised from 3% to 3.5% in November 1951 and was further raised to 4% in January 1963, to 5% in September 1964, to 6% in February 1965.

ADVERTISEMENTS:

In March 1968, the bank rate was reduced to 5% in view of the recessionary conditions. Subsequently, it was further raised to 7% in May to 9% in July 1974 and to 10% in July 1981. The bank rate was again raised to 11% in July 1991. It was 12% w.e.f October 8, 1991.

The increases in the bank rate were adopted to reduce bank credit and control inflationary pressures. At present the bank rate is 9%.

The situation, however, has changed since the introduction of economic reforms in early 1990s. As a part of financial sector reforms, the Reserve Bank of India (RBI) has decided to consider the Bank Rate as a policy instrument for transmitting signals of monetary and credit policy. Bank rate now serves as a reference rate for other rates in the financial markets.

With this new role assigned to the Bank Rate and to meet the growing demand for credits from all sectors of the economy under the liberalised economic conditions, the Bank Rate has been reduced in phases in subsequent years. It was reduced to 10% in June 1997, to 9% in October 1997, to 8% in March 1999, to 7% in April 2000, to 6.5% in October 2001, to 6.25% in October 2002, to 6.00% in April 2003.

II. Net Liquidity Ratio:

In order to check excessive borrowings from the Reserve Bank by the commercial banks, the Reserve Bank introduced the system of net liquidity ratio in September 1964. According to this system, a commercial bank can borrow from the Reserve Bank at the bank rate only if it maintains a minimum net liquidity ratio to its total demand and time liabilities, and it will have to pay a penal rate of interest to the Reserve Bank, if the net liquidity ratio falls below the minimum ratio fixed by the Reserve Bank.

ADVERTISEMENTS:

Net liquidity of a borrowing bank comprises- (a) cash in hand and balances with the Reserve Bank plus (b) balances in currency account with other banks, plus (c) investments in government and other approved securities, minus (d) borrowing from the Reserve Bank, the State Bank of India and the Industrial Development Bank of India.

In 1964, when the system was introduced, the net liquidity ratio was fixed at 28%, and for every point drop in the ratio, the interest rate was to go up by 0.5%. In 1973, the net liquidity ratio was raised to 40% and the rate of interest was to go up by 1% above the bank rate for every 1% drop in the net liquidity ratio. In 1975, however the system was abandoned.

III. Open Market Operations:

Through the technique of open market operations, the central bank seeks to influence the excess reserves position of the banks by purchasing and selling of government securities, commercial papers, etc.

When the central bank purchases securities from the banks, it increases their cash reserve position, and hence their credit creation capacity. On the other hand, when the central bank sells securities to the banks, it reduces their cash reserves and the credit creation capacity.

Sections (178) and 17(2)(a) of Reserve Bank of India Act authorise the Reserve Bank to purchase and sell the government securities, treasury bills and other approved securities. However, due to underdeveloped security market, the open market operations of the Reserve Bank are restricted to government securities. These operations have also been used as a tool of public debt management.

ADVERTISEMENTS:

They assist the Indian government in raising borrowings. Generally the Reserve Bank’s annual sales of securities have exceeded the annual purchases because of the reason that the financial institutions are required to invest some portion of their funds in government and approved securities.

In India, the open market operations policy of the Reserve Bank has not been so effective because of the following reasons- (a) Open market operations are restricted to government securities. (b) Gilt-edged market is narrow, (c) Most of the open market operations are in the nature of switch operations, i.e., purchasing one loan against the other.

IV. Cash-Reserve Requirement (CRR):

The central bank of a country can change the cash-reserve requirement of the bank in order to affect their credit creation capacity. An increase in the cash- reserve ratio reduces the excess reserve of the bank and a decrease in the cash-reserve ratio increases their excess reserves.

Originally, the Reserve Bank of India Act of 1934 required the commercial banks to keep with the Reserve Bank a minimum cash reserve of 5% of their demand liabilities and 2% of time liabilities. The amendment of the Act in 1956 empowered the Reserve Banks to use the cash reserve ratio as an instrument of credit control by varying them between 2 and 20% on the demand liabilities and between 2 and 8% on the time liabilities- Further, amendment of the Act in 1962 removes the distinction between demand and time deposits and authorises the Reserve Bank to change cash-reserve ratio between 3 and 15%.

The Reserve Bank used the technique of variable cash-reserve ratio for the first time in June 1973 when it raised the ratio from 3% to 5% and further to 7% in September 1973. Since then, the Reserve Bank has raised or reduced the cash-reserve ratio many times.

Recently, it was raised to 9% on February 4, 1984, to 9.5% on February 28, 1987, to 10% with effect from October 24, 1987, to 10.5% effective from July 2, 1988 and further to 11% effective from July 30, 1988.

The CRR was raised to its existing maximum limit of 15 % with effect from July, 1989. The present CRR ratio is 11% w.e.f. August 29, 1998. This reduction is due to the new liberalised policy of the government.

The Narsimham Committee in its report submitted in November 1991, was of the view that a high Cash Reserve Ratio (CRR) adversely affects the bank profitability and thus puts pressure on banks to charge high interest rates on their commercial sector advances. The government therefore decided to reduce the CRR over a four year period to a level below 10%.

As a first step in the pursuit of this objective, CRR was reduced in two phases from 15% to 14.5% in April 1993 and further to 14% in May 1993. It was reduced to 13% in April 1996. Again in line with the monetary policy aimed at facilitating adequate availability of credit to support industrial recovery, the CRR was further reduced to 8% in April 2000, to 7.5% in May 2001, to 5.5% in October 2001, to 4.75% in November 2002, to 4.50% in June 2003.

V. Statutory Liquidity Ratio (SLR):

Under the original Banking Regulation Act 1949, banks were required to maintain liquid assets in the form of cash, gold and unencumbered approved securities equal to not less than 25% of their total demand and time deposits liabilities. This minimum statutory liquidity ratio is in addition to the statutory cash-reserve ratio. The Reserve Bank has been empowered to change the minimum liquidity ratio.

Accordingly, the liquidity ratio was raised from 25% to 30% in November 1972, to 32% in 1973, to 35% in October 1981, to 36% in September 1984, to 38% to in January 1988, and to 38.5% effective from September 1990.

There are two reasons for raising statutory liquidity requirements by the Reserve Bank of India:

(a) It reduces commercial banks’ capacity to create credit and thus helps to check inflationary pressures.

(b) It makes larger resources available to the government. In view of the Narsimham Committee report, the government decided to reduce SLR in stages from 38.5% to 25%. The effective SLR on total outstanding net demand and time liabilities of the scheduled commercial banks come down to 27% by the end of December 1996.

VI. Selective Credit Controls:

Selective credit controls are qualitative credit control measures undertaken by the central bank to divert the flow of credit from speculative and unproductive activities to productive and more urgent activities. Section 21 of the Banking Regulation Act 1949 empowers the Reserve Bank to issue directives to the banks regarding their advances.

These directives may relate to- (a) the purpose for which advances may or may not be made; (b) the margins to be maintained on the secured loans; (c) the maximum amount of advances to any borrower; (d) the maximum amount upto which guarantees may be given by the banking company; and (e) the rate of interest to be charged.

The Reserve Bank of India has undertaken the following selective credit controls to check speculative activities and inflationary pressures and extend credit in developmental lines:

(i) Directives:

Since 1956, the Reserve Bank has been making extensive use of the selective controls and has issued many directives to the banks:

(a) The first directive was issued on May 17, 1956 to restrict advances against paddy and rice. Later on other commodities of common use were also included. At present, advances against the following categories of commodity are subject to selective credit control- (i) Foodgrains; (ii) pulses; (iii) oilseeds; (iv) vegetable oils; (v) sugar; and (vi) gur and Khandsari.

(b) The Reserve Bank has fixed minimum margins to be maintained by the banks regarding their advances against the commodities subject to selective controls.

(c) The Reserve Bank fixes higher minimum lending rate for advances against commodities subject to selective controls,

(d) State agencies such as the Food Corporation of India and State Trading Corporation, have, however, been exempted from the use of selective credit controls.

(ii) Credit Authorisation Scheme (CAS):

Credit Authorisation Scheme is a type of selective credit control introduction by the Reserve Bank of India in November 1965. Under this scheme, the commercial banks had to obtain Reserve Bank’s authorisation before granting any fresh credit of Rs. 1 crore or more to any single party. The limit was later raised gradually to Rs. 4 crore in November 1983, in respect of borrowers in private as well as public sector.

The limit was farther raised to Rs. 6 crore with effect from April 1986. Under this scheme, the Reserve Bank requires the commercial banks to collect, examine and supply detailed information regarding the borrowing concerns.

They are also required to ascertain the working of the borrowing concerns on matters such as inter-corporate lending and investment, excessive inventory build- up diversion of short-term funds for acquiring fixed assets, etc.

The main purpose of this scheme is to keep a close watch on the flow of credit to the borrowers. It requires that the banks should lend to the large borrowing concerns on the basis of credit appraisal and actual requirements of the borrowers.

Since July 1987, the CAS has been liberalised to allow for greater access to credit to meet genuine demands in production sectors without the prior sanction of the RBI.

(iii) Moral Suasion:

The Reserve Bank has also been using moral suasion as a selective credit control measure. It has been sending periodic letters to the commercial banks to use restraint over their credit policies in general and in respect to certain commodities and unsecured loans in particular.

Regular meetings and discussions are also held by the Reserve Bank with commercial banks to impress upon them the need for their cooperation in the effective implementation of the monetary policy.

VII. Recent Monetary Policy (2011-12):

The RBI announced a comprehensive annual monetary policy (2011-12) on May 8, 2011.

The main features of the policy are given below:

(i) Controlling Inflation:

In this policy, controlling inflation takes precedence over growth which has been pegged at a lower level of 8% for 2011-12 against the government projection of 9%. Inflation rate has been aimed at 6%.

(ii) Key Rates:

The RBI raised the Repo Rate (short term lending rate) by 50 basic points from 6.75% to 7.25%. The Reverse Repo Rate (short term borrowing rate) was also raised by 50 basis Points from 5.75% to 6.25%. The CRR remained unchanged at 6%. This will be the ninth increase in the interest rates since March 2010.

(iii) Encouragement to Saving:

The interest rate regime is now tilting in favour of savers. In the new monetary policy, the RBI raised the Saving Bank interest rate from 3.50% to 4.00% after about two decades. This will benefit crores of saving bank account holders.

The move to increase the interest rate is being seen as an indication of eventual entry of the banking system into deregulated interest rate regime.

(iv) Marginal Standing Facility:

The RBI has opened a new borrowing facility under the Marginal Standing Facility (MSF), effective from May 7, 2011 to contain volatility in the overnight inter-bank rates. Banks can borrow up to 1% of their net demand and time Liabilities (NDTL).

The interest rate on MSF will be 100 basic points above the Repo Rate and 200 basic pints above the Reverse Repo Rate. The Repo Rate will be in the middle; the Reverse Repo Rate will be 100 basic Points below it and the MSF rate will be 100 basic points above it. At present, the MRF rate is calibrated at 8.25 %.

(v) Single Policy Rate Regime:

The RBI also moved to a single policy rate regime. There will henceforth be one independently varying policy rate and that will be Repo Rate. The transition to a single independently varying rate is expected to more accurately signal the monetary policy stance. The Reverse Repo Rate will be operative but it will be pegged at a level 100 basic points below the Repo Rate. Hence, it will not be an independent variable.

(vi) Review of the Policy:

(a) In its review of the monetary policy 2011-12, the RBI on January 24, 2012 left the Repo Rate unchanged at 8.50 % after raising it 13 times between March 2010 and October 2012.

(b) The CRR was cut by 50 basic points to 6.50% from 6.00% where it had stood since April 2010, in a move to ease liquidity in the banking system.

(c) Growth projection for 2011-12 was further lowered to 7.00%. In view of global slowdown.

(d) To sum up, the growth -inflation balance of monetary policy stance has shifted to growth, while at the same time ensuring that inflationary pressures remain under control.

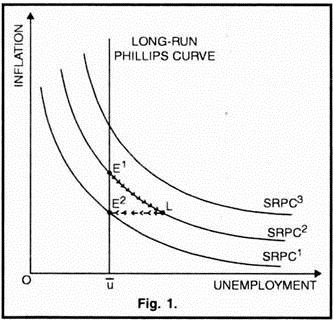

Figure-1 explains graphically the working of the current monetary policy of India along with its short-run achievements and long-run objectives. It depicts short- run and long-run Phillips Curves (SRPCs and LRPC) which highlight the trade-off involved in managing inflation. There is an inverse relationship between inflation rate and unemployment rate.

Wholesale Price Index (WPI) inflation after remaining at a higher level of over 9.00 % throughout the year has been falling since December 2011 as a result of nearly two years of tight monetary policy with adjustments of key policy rates (such as Repo Rate, Reverse Repo Rate, etc.) since March 2010. This leads to moderate inflation around 6.50 % to 7.00 % by March 2012. Inflation is expected to come down further during 2012-13.

But the anti-inflation monetary management has an adverse impact on economic growth. The Indian economy is expected to grow at the rate of 6.9% during 2011-12 after having grown at the rate of 8.50% in each of the two preceding years. This is shown by a downward movement from E1 TO L along SRPC2 (in Fig. 1), indicating falling- inflation-and increasing unemployment.

Looking ahead, efforts are now called for in getting back to low inflation /sustained high growth path in India by renewed focus on supply-side measures and improved fiscal consolidation. The objective is to make a shift from point L on SRPC2 to point E2 on SRPC1 (in Fig. 1) in order to achieve the dual goal of high growth with price stability.

VIII. Recent Monetary Policy (2013-16) – Tight Monetary Policy Continues (2013-15):

Though, as compared to previous years, inflation showed signs of receding during 2013-14, yet it remained above the comfort level of the Reserve Bank of India (RBI). Therefore, tight monetary policy stance was maintained during 2013-14 and 2014-15.

The depreciation of the rupee (to a record low of Rs. 68 to a dollar), following the taper indication by the Federal Open Market Committee in May 2013 also affected the inflationary situation. Consequently, the RBI hiked short-term interest rates in July 2013 and compressed the domestic money market liquidity in order to restore stability to the foreign exchange market.

On July 15, 2013, Marginal Standing Facility (MSF) rates were raised by 200 basis points (bps.) from 8.25% to 10.25%, thus increasing the width of repo-MSF corridor to 300 bps. (with repo rate remaining unchanged at 7.25%).

MSF rates were reduced to 9.50% (with repo rate rising to 7.50%) on September 20, 2013 and further to 9.00% (with repo rate remaining unchanged) on October 7, 2013. Repo rate was raised to 7.75% on October 20, 2013 and further to 8.00% on October January 28, 2014. It remained unchanged till the end of 2014.

Cut in SLR:

However, Statutory Liquidity Ratio (SLR) for banks was cut from 23% to 22.50% on June 14, 2014, to 22.00% on August 9, 2014 and further to 21.50% on February 7, 2015. This measure will release more funds by reducing the deposits the banks are required to park in government securities and enable them to lend more.

Soft Interest Rate Era Begins (2015-16):

In view of continuing easing of inflationary pressures (due to low inflation at 5% in December 2014 and sharp fall in oil prices), the RBI reduced the repo rate by 0.25% three times in five months resulting in the total fall from 8% to 7.25%. The repo rate was cut on January 15, 2015, March 4, 2015 and June 2, 2015.

However, on the third time the RBI took a cautious stand on economic recovery, while forecasting a week monsoon, rising oil prices and rupee depreciation due to rising US interest rates.

This reduction in the repo rate is possibly the beginning of the cycle of soft interest rate, depending upon inflation. Cheaper loans will encourage demand for houses, automobiles and consumer durables.

Evaluation of Monetary Policy:

The central theme of the Reserve Bank’s monetary policy has been ‘controlled monetary expansion’. The monetary policy in India during the planning period has been directed to meet the twin objectives of- (a) expansion of the economy and (b) control of inflationary pressures.

But, in practice, the performance of the monetary policy has not been quite satisfactory, particularly in respect to the objective of controlling inflationary pressures in the economy.

Various failures and limitations of the Reserve Bank’s monetary policy are discussed below:

i. Minor Role in Economic Development:

The monetary policy in India has not been given an active and crucial role in the expansion and development of the economy. So far the Reserve Bank has been assigned the minor role that the process of economic development, to the extent it depends upon the bank finance, should not be hampered because of the inadequacy of funds.

ii. Imbalance in Credit Allocation:

Unsatisfactory performance of the monetary policy is also due to the imbalance in credit allocation. Relatively less credit is diverted to the agricultural and small scale industries sectors.

In spite of the fact that some progress has been made in providing credit to these priority sectors by the commercial banks, particularly after the nationalisation of big banks, the efforts in this direction are still insufficient and these sectors continue to remain dependent mainly upon private sources for their credit needs.

iii. Limited Role of Capital Market:

Another weakness of the monetary policy lies in the limited role of capital market. So far the public financial institutions have been required to raise resources at lower than the market rate in order to finance investments in the private industries. This means that the distribution of credit in the capital market has not been based on the efficiency and profitability of the enterprises demanding funds.

There is now a strong need to enlarge the role of the capital market and for enterprises to bid for resources on the basis of their capacity and creditworthiness. Both private and public enterprises should be encouraged to seek much larger financial support from capital market.

iv. Excessive Deficit Financing:

The main reason for the failure of the monetary policy in India during the planning period is the substantial and continuous expansion of money supply in the economy which is primarily due to two factors- (a) a large increase in the net Reserve Bank credit to the government because of large scale deficit financing undertaken by the government; and (b) a large expansion in the bank credit to the private commercial sector.

The main reason for undertaking large-scale deficit financing has been the desire to maintain high levels of planned outlays and to promote investment in the economy. But the reality is to the contrary.

The high levels of deficit financing have not only created excess monetary demands rather than increasing investment and output, but also have adversely affected the ability of the monetary authority to control overall monetary expansion.

v. Excessive Credit Expansion:

Excessive increase in bank credit to the private commercial sector is another cause of large expansion of money supply leading to the failure of monetary policy.

The main reasons for increase in bank credit have been:

(a) The flexible approach adopted by the Reserve Bank to provide adequate credit for promoting the interests of growth and investment in the economy, particularly in the priority sector;

(b) The deliberate policy of the Reserve Bank to provide liberal and concessional credit to priority sector and weaker sections such as agriculture, small scale industry, the retail trade, the self-employed and exports;

(c) Preferential treatment given to the government agencies and private sector in the extension of bank credit after the nationalisation of banks.

vi. Lack of Integration of Monetary and Fiscal Policies:

Fundamental weakness in the operation of monetary policy has been the lack of integration between the fiscal policy, particularly relating to deficit financing, and the credit policy relating to the private commercial sector.

Recognising the inflationary potential of excessive growth of money due to excessive deficit financing or undue expansion in bank credit to the private commercial sector, the successive five year plans repeatedly emphasised the need for a proper integration between fiscal and credit policies.

Such an integration requires- (a) limiting deficit financing to a reasonable limit, and (b) the credit policy cooperating with the policy of deficit financing so as to maintain a reasonable balance between aggregate demand and aggregate supply.

But, no serious efforts were made to bring about the necessary integration of monetary and fiscal policies to meet the genuine needs of the investment and growth requirements of price stability.

vii. Ineffectiveness of Monetary Policy:

The successful operation of monetary policy in India also suffers from the limitations related to the inadequate instruments and powers of the Reserve Bank as well as the financial conditions of the country.

Major limitations are given below:

(a) Ineffective Control of Inflationary Trend:

The Reserve Bank is not fully equipped with tools and powers to control effectively the inflationary trends in the economy. Its general and selective controls are effective only to the extend to which inflationary pressures are the result of bank finance. But, the Reserve Bank’s credit control measures may not prove effective in case the inflationary pressures are caused by deficit financing and shortage of goods.

(b) Increase in Liquidity of Banks:

Efficacy of credit control measures adopted by the Reserve Bank has been reduced by the increase in the liquidity of the commercial banks. Rapid growth of banking industry after the nationalisation of major banks has not only increased mobilisation of savings through banks but also resulted in an accelerated growth of deposits, particularly time deposits. This has largely improved the liquidity position of banks and hence their ability to grant loans without resorting to the Reserve Bank.

(c) Growth of Non-Banking Financial Institutions:

The Reserve Bank has no control over the activities of non-banking financial institutions as well as indigenous bankers. These institutions and bankers play a significant role in financing trade and industry in Indian economy.

(d) Preponderance of Currency:

Another limitation of the monetary policy in India arises from the preponderance of currency in the total money supply. This factor reduces the credit creation capacity of the banks. Since the Reserve Bank operates on the money supply through credit loans to the public, the effectiveness of its monetary policy also reduces accordingly.

(e) Existence of Black Money:

Existence of large quantity of money in the black market also poses a serious limitation to the monetary policy of the Reserve Bank. The monetary control measures have no influence on the circulation of black money because the borrowers and lenders of this money keep their transactions secret and outside the orbit of monetary policy.

Conclusion:

Rangarajan has summed up the performance of monetary policy of the Reserve Bank over the years in the following manner:

(i) The monetary measures of the Reserve Bank have generally been a response to fiscal policy.

(ii) While monetary policy has been primarily acting through availability of credit, the cost of credit has also been adjusted upward, sometimes very sharply to meet effectively the inflationary situations.

(iii) The areas of operation of monetary policy did not remain confined to those related to the regulation of monetary supply and keeping prices in check.

(iv) A more direct involvement of the monetary authority in the allocation of credit to the nongovernment sector has become an important element of national economic policy, especially after the nationalisation of major banks in July 1969.