To study the effects of public debt we have to first draw a distinction between internal debt and external debt. When a government borrows money from its own citizens by selling bonds or long-term credit instruments a internal debt is created. It is owed by a nation to its own citizens. So, it may apparently seem that an internal debt does not impose any burden on society because we owe it all to ourselves. But this is a wrong position.

Public debt has both short-term and long-term implications as far as the management of the economy as also its operational efficiency are concerned Public debt creates three major problems:

(1) The difficulties of servicing a large external debt,

(2) The efficiency loss from taxation, imposed to pay interest on public debt, and

ADVERTISEMENTS:

(3) Slowing down of the rate of growth of the economy which occurs when a large debt reduces the rate of capital formation in the private sector (by diverting resources to the public sector). To throw light on these three specific issues we have to examine the pros and cons of public debt.

When a country borrows money from other countries (or foreigners) an external debt is created. It owes it all to others. When a country borrows money from others it has to pay interest on such debt along with the principal amount. This payment is to be made in foreign currencies (or in gold).

If the debtor nation does not have sufficient stock of foreign exchange (accumulated in the past) it will be forced to export its goods to the creditor nation. To be able to export goods a debtor nation has to generate sufficient export surplus by curtailing its domestic consumption.

Thus, an external debt reduces society’s consumption possibilities since it involves a net subtraction from the resources available to people in the debtor nation to meet their current consumption needs. In the 1980s, many developing countries such as Poland, Brazil and Mexico faced severe economic hardships after incurring large external debt.

ADVERTISEMENTS:

They were forced to curtail domestic consumption to be able to generate export surplus (i.e., export more than they imported) in order to service their external debts, i.e., that is, to pay the interest and principal on their past borrowings. The burden of external debt is measured by the debt-service ratio.

It refers to a country’s repayment obligations of principal and interest for a particular year on its external debt as a percentage of its exports of goods and services (i.e., its current receipts) in that year. In India it was 26.3% in 1998. An external debt imposes a burden on society because it represents a reduction in the consumption possibilities of a nation. It causes an inward shift of society’s consumption possibilities curve.

Three Problems: When we shift our attention from external to internal debt we observe that the story is different.

Internal debt creates three major problems:

ADVERTISEMENTS:

(1) Distorting effects on incentives due to extra-tax burden

(2) Diversion of society’s limited capital from the productive private sector to unproductive public sector, and

(3) Slowing the rate of growth of the economy.

These three problems may now be briefly discussed:

1. Efficiency and Welfare Losses from Taxation:

When the government borrows money from its own citizens, they have to pay more taxes simply because the government has to pay interest on debt. So there is likely to be adverse effects on incentives to work hard and to save.

It may be a happy coincidence if the same individual were a tax-payer an a bond-holder at the same time. But even in this case one cannot avoid the distorting effects on incentives that are always present in the case of any taxes. If the government imposes additional tax on Mr. X to pay him interest, he might work less and save less.

Either of the outcomes or both must be treated a distortion of efficiency and well-being. Moreover, if most bond-holders are rich people and most taxpayers are poor repayment of the debt money will redistribute income (welfare) from the poor to the rich.

2. Capital Displacement (Crowding-Out) Effect:

ADVERTISEMENTS:

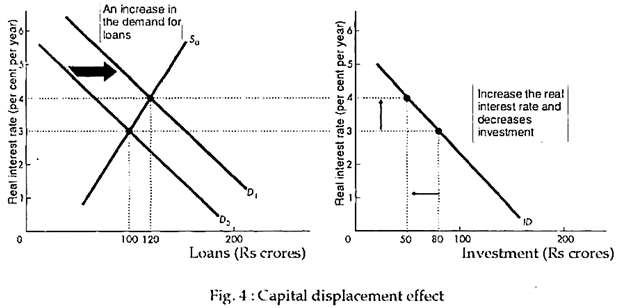

Secondly, if the government borrows money from the people by selling bonds, there is diversion of society’s limited capital from the productive private sector to unproductive public sector. The shortage of capital in the private sector will raise the rate of interest. As a result, private investment will fall.

In fact while selling bonds, the government competes for borrowed funds in financial markets, pushing up interest rates for all borrowers. With the large deficits of recent years, many economists have been concerned with competition for funds and the consequent higher interest rates which have discouraged borrowing for private investment.

This effect is known as crowding-out or capital-displacement effect. Crowding out is the tendency for an increase in government purchases of goods and services to bring about a decrease in private investment.

Full crowding out occurs when an increase in government purchases results in an equivalent decrease in private investment. If crowding out does occur, there will be a larger stock of government debt from 100 to 120 and a fall in private capital stock as shown in Fig. 4.

ADVERTISEMENTS:

Full crowding out does not occur if:

(i) Real GDP is less than potential GDP; and

(ii) The budgetary deficit arises from the government’s purchase of capital on which the return equals (or exceeds) that on privately purchased capital.

ADVERTISEMENTS:

Full crowding out does occur if:

(i) Real GDP equals or exceeds potential GDP; and

(ii) The government purchases consumption goods and services or capital on which the return is less than that on privately purchased capital.

This, in its turn, will lead to a fall in the rate of growth of the economy. So, a decline in living standards is inevitable. This seems to be the most serious consequence of a large public debt in that it displaces capital from the nation’s stock of wealth. As a result, the pace of economic growth slows and future living standards decline.

3. Public Debt and Growth:

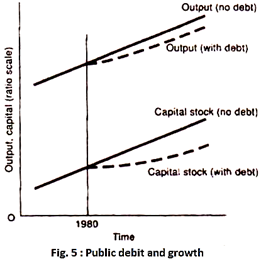

By diverting society’s limited capital from productive private to unproductive public sector public debt acts as a growth-retarding factor. Thus, an economy grows much faster without public debt than with debt.

ADVERTISEMENTS:

When we consider all the effects of government debt on the economy, we observe that a large public debt can be detrimental to long-run economic growth. Fig. 5 shows the relation between growth and debt. Let us suppose an economy were to operate overtime with no debt, in which case the capital stock and potential output would follow the hypothetical path indicated by the solid lines in the diagram.

Now, suppose the government incurs a huge deficit and debt. With the accumulation of debt over time, more and more capital is displaced, as shown by the dashed capital line in the bottom of Fig. 5. As the government imposes additional taxes on people to pay interest on debt, there are greater inefficiencies and distortions which reduce output further.

What is more serious is that an increase in external debt lowers national income and raises the proportion of GNP that has to be set aside every year for servicing the external debt. If we now consider all the effects of public debt together, we see that output and consumption will grow more slowly than. In the absence of large government debt and deficit as is shown by comparing the top lines in Fig.5.

This seems to be the most important point about the long-run impact of a huge amount of public debt on economic growth. To conclude with Paul Samuelson and W D. Nordhaus, “A large government debt tends to reduce a nation’s growth in potential output because it displaces private capital increases the inefficiency from taxation, and forces a nation to serve the external portion of the debt”.