In this article we will discuss about the process of price determination in a perfectly competitive market.

In a perfectly competitive market, the number of buyers and sellers is large. The buyers and sellers are in competition to buy and sell a homogeneous product. The number of buyers and sellers in such a market is so large that each of them buys or sells a negligible fraction of the total quantity bought and sold in the market. As a consequence, none of them has any individual influence on the process of price determination.

In a perfectly competitive market, equilibrium price of the product is determined through a process of interaction between the aggregate or market demand and the aggregate or market supply. Equilibrium price is the price at which the market demand becomes equal to market supply.

If, at any particular price, demand and supply are equal, the buyers and sellers both remain satisfied, for at the said price the sellers supply what the buyers demand, and the buyers demand what the sellers supply.

ADVERTISEMENTS:

Therefore, the buyers and sellers accept this price, and buy and sell accordingly. None of them is dissatisfied, and so, none of them would want a change in the price. That is why this price is called the equilibrium price.

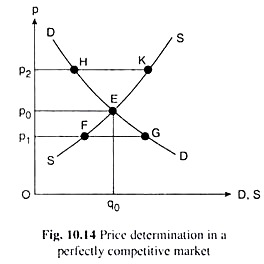

We may explain the process of price determination as a matter of interaction between demand and supply with the help of Fig. 10.14. The DD curve in this figure is the aggregate or market demand curve for the product. This curve tells us what is the aggregate demand of the buyers for the good at any particular price, and, as such, this curve is the horizontal summation of the individual demand curves of all the buyers.

For example, from the DD curve of Fig. 10.14 we come to know that at the price p = p,, the market demand for the good is P1G. Again, at p = p2, the market demand amounts to p2H.

Owing to the law of demand, the individual demand curves are downward sloping towards right. That is why the market demand curve as a horizontal summation of the individual demand curves would also be downward sloping towards right (or negatively sloped).

On the other hand, the SS curve in Fig. 10.14 is the aggregate or market supply curve for the good. We may know from this curve the market supply of the good at any particular price, and so, this curve is the horizontal summation of the individual supply curves of the sellers. For example, from the supply curve, SS, we can know that at p = p1, the market supply of the good is p1F, or at p = p2, the market supply is p2K.

Since the supply curves of individual sellers are sloping upwards towards right owing to the law of supply, the aggregate supply curve as the horizontal summation of the individual supply curves would also be sloping upwards towards right or positively sloped, like the SS curve in Fig. 10.14.

The price, p0, of the good that would be obtained at the point of intersection, E, of the aggregate demand curve, DD, and the aggregate supply curve, SS, would itself be the equilibrium price of the good. At p = p0, the market demand and market supply of the good are equal, both being equal to q = q0 in Fig. 10.14. That is why, here p = p0 is the equilibrium price and q = q0 is the equilibrium quantity demanded and supplied.

If we assume:

ADVERTISEMENTS:

(i) That if, at any particular price, the market demand for the good is larger than the market supply, then the dissatisfied buyers (who cannot buy all they want to buy) would be willing to pay a higher price for the good and

(ii) That if, at any particular price, the market supply of the good is greater than the market demand, then the dissatisfied sellers (who cannot sell all they want to sell) would be willing to accept a lower price for the good, then the equilibrium that would be obtained at the point E in Fig. 10.14 would be a stable equilibrium.

For, here, if for any reason, the price of the good be more or less than the equilibrium price, then the behaviour pattern of buyers and sellers mentioned above ensures that the price would again come back to the level of equilibrium price, i.e., the market equilibrium will be restored. The two assumptions mentioned above are known as the behavioural assumptions.

We may illustrate the matter with the help of Fig. 10.14. Here, if the price of the good be less than p0, if it is p1 < p0, then the quantity demanded would be more than the equilibrium quantity, q0, and the quantity supplied would be less than q0. We shall get this because of the laws of demand and supply.

As a result, there would be excess demand—demand in excess of supply— in the market. At p = p1, the quantity of excess demand would be FG. In this case, the buyers are not able to buy what they want to buy, and so they would be willing to pay a higher price. Consequently, the price of the good would be increasing from p1 till it becomes equal to p0.

As price increases from p1, the quantity demanded would fall and the quantity supplied would rise leading to a fall in excess demand and when p rises to the level of p0, the whole of excess demand would be wiped out and the market would be in equilibrium.

On the other hand, if the price of the good is p = p2 > p0, supply in the market would be in excess of demand, i.e., there would be a negative excess demand in the market. In this case, the sellers would not be able to sell what they want to sell.

As a result, they would be willing to accept a lower price, and p would be falling. As p falls from p2, supply would fall and demand would rise leading to a fall in excess supply. This would go on till p falls to the level of p0 and market equilibrium is restored.

We have discussed above how the price is determined in a perfectly competitive market through the process of interaction between demand and supply for the good. We have also seen when and why the market equilibrium may be considered to be stable.

Importance of Time in Price Determination under Perfect Competition:

ADVERTISEMENTS:

As we have seen above, price is determined in a perfectly competitive market through interactions between demand and supply. That is, demand and supply have an equally important role to play in the process of price determination. According to the law of demand, as price of the good increases or decreases, the quantity demanded of it decrease or increases.

Again, because of the law of supply, as price increases or decreases, the quantity supplied also increases or decreases. We generally assume that if the price of good changes, its buyers may instantly change the quantity of its purchase. They do not require any time lag to do this.

On the other hand, if the price of a good changes, then, whether quantity produced and supplied of it would actually change, and by how much, would depend on the length of time given for adjustment. For example, if the price of a good increases, then its producer will want to supply more.

But within a short span of time he might not be able to increase supply as such as he wished. However, if he is allowed a longer span of time, he might be able to produce more. This is because, as we know, in the short run, he cannot change the quantities of the fixed inputs which he may do in the long run.

ADVERTISEMENTS:

Now, as we have seen above, the length of time obtained for necessary adjustments will determine the extent of change in quantity supplied and thereby influence the price. That is why it is said that time plays an important role in price determination in a perfectly competitive market. We may discuss the process of price determination in this market in three phases, depending on the length of time given for adjustment.

These are price determination:

(i) In the very short period,

(ii) In the short period, and

ADVERTISEMENTS:

(iii) In the long period.

(i) Price Determination in the Very Short Period:

Very short period is a short span of time during which the supply of the good, generally, cannot be changed. For example, the market for a good during the morning of a day may be called a very short period market.

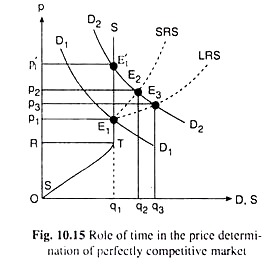

The supply curve of the good in such a market would be like the SS curve in Fig. 10.15. In this market, since the quantity supplied cannot change in response to a change in price, most of the supply curve would be a vertical straight line.

However, if the price falls below a certain low level, the sellers might think it prohibitively low and then, as price decreases further, they might attempt to reduce the quantity supplied of the good. In Fig. 10.15, this particular price is OR.

This price is known as the reservation price. If the price of the good is smaller than the reservation price (p < OR in Fig. 10.15), the very short period supply curve would be backward bending towards the origin like the segment OT of the SS curve.

ADVERTISEMENTS:

For the price of the good equal to or greater than the reservation price (for p > OR), the supply curve SS would be a vertical straight line, i.e., then the quantity supplied would be a constant w.r.t. price. In Fig. 10.15, this constant quantity of supply is q1 (or Oq1).

Now, how small or how large would be the reservation price would depend on some considerations like the perishability of the good, the sellers’ need for cash, the probability of the price of the good to change in near future, etc.

For example, the more is the perishability of the good, the more is the sellers’ need for cash and the more is the probability of the price of the good not to rise in near future, the smaller would be the reservation price of the good.

In Fig. 10.15, in the initial situation, the demand curve for the good is D1D1. Therefore, at the point of intersection, E1, of the DD1 and SS curves, the very short period market price of the good, p1, and the equilibrium quantity, q1, would be determined.

In order to see the importance of time in price determination in a competitive market, let us suppose that there has been an increase in demand due to some reason, and the demand curve for the good has shifted to the right from D1D1 to D2D2.

At any particular price, demand for the good would now increase, and the buyers would now be willing to pay a higher price. Consequently, the price of the good would be rising. Since supply cannot increase in the very short period in response to a rise in price, price would rise by a relatively large amount from p1 to p’1.

ADVERTISEMENTS:

At p = p’1, the demand curve D2D2 has intersected the supply curve SS at the point E’1(p’1, q1). Therefore, E’1 would be the new point of market equilibrium in the very short period. Since the supply curve, SS, is a vertical straight line, the shift in the demand curve would cause the equilibrium quantity bought and sold to remain constant at q1.

We have seen, therefore, that in the very short period, demand plays an active role in price determination and supply’s role here would be, at best, passive. If demand increases in the very short period, only price would change, by a rather large amount, and, supply would remain constant. The new equilibrium point E’1 would lie vertically above the initial point E1.

(ii) Price Determination in the Short Period:

Time span in the short period is larger than that in the very short period. We have already known what we understand by the short period or short run in our discussion of the theories of production and cost. We know that the firm can change the quantity of output produced and supplied in the short run by changing its use of the variable inputs.

Therefore, the firm can increase the quantity supplied of the good in the short run in response to an increase in its price. In other words, the short-run supply (SRS) curve of the firm would be sloping upward towards right like the SRS curve in Fig. 10.15.

ADVERTISEMENTS:

In Fig. 10.15, the short period market price of the good would be determined at the point of intersection E2 (p2, q2) between the demand curve D2D2 and the SRS curve. At the equilibrium point E2, price of the good would be p2 < p’1 and the quantity bought and sold would be q2 > q1.

That is, in the short period, since supply can respond to a change in price, the market price would not be as high as the very short period price, viz., p’1—it would fall to p2 in the short period. The short period equilibrium price p = p2 is called the short period normal price. As we have seen, the short-run normal price would be smaller than the very short period market price.

(iii) Price Determination in the Long Period:

The length of the long period is so long that in this period, the firm would be able to change the quantities used of the fixed factors along with those of the variable factors to produce a larger or a smaller quantity of output.

We have already seen what is meant by long run or long period in our discussion of the theories of production and cost. We have also discussed about the long-run supply (LRS) curve of a perfectly competitive industry.

ADVERTISEMENTS:

If we assume that the industry concerned is an increasing cost industry, then its LRS curve would be sloping upwards towards right like the one shown in Fig. 10.15.

In the long run, since the firm can change the quantities used of both the variable and the fixed factors, the supply of the good, in response to an increase in its price, may increase at a larger rate (w.r.t. price) in the long run than in the short run. Therefore, the LRS curve of the good (or of the industry) would be flatter than its SRS curve.

In Fig. 10.15, the long-period equilibrium price of the good will be determined at the point of intersection, E3 (p3, q3) between the demand curve D2D2 and the LRS curve of the good (or of the industry). Here this price has been p3. At this price the quantity demanded and the quantity of long-period supply, both have been equal to q3.

Here, if long period means one year, then for one year after the increase in demand, the long-period period price would be diminishing from p1 till it comes down to the level of p3 after one year, and the quantity demanded and supplied would increase from q1 to q3. The price p3 is called the long-period normal price.

Generally, this price would be considerably less than the very short period price pi, for, in the long run, along with the increase in demand, supply also increases. Again, the long-run normal price p3 would be smaller than the short-run normal price p2, because, the LRS curve of the good is flatter than the SRS curve, i.e., supply increases at a larger rate in the long run than in the short run.

This is because, in the long run adjustment, the quantities used of both fixed and variable inputs can change while, in the short run, those of variable inputs only can change.