In this article we will discuss about:- 1. Statement of the Theory 2. Radcliffe Report 3. Gurley-Shaw Thesis 4. Evaluation.

Statement of the Theory:

During the 1950’s, the publication of Radcliffe Committee’s Report in England and the work by Gurley and Shaw in the United States questioned the adequacy of existing monetary theory to serve as a guide for monetary policy and led to the development of a new theory, called liquidity theory of money.

According to the new approach, the causal relation between money and the volume of economic activity or the general price level cannot be explained under the modern conditions either by the classical quantity theory or by the Keynesian income theory, but by the role played by the whole structure of liquid assets which can serve as a substitute for money to satisfy the liquidity desire of the public.

In view of the easy substitutability between money and wide range of financial assets, also called near- moneys (such as time deposits, various money market instruments like bills of exchange, treasury bills, gilt- edged securities, cash surrender values of life insurance policies, saving bonds, deposits of building societies, deposits of saving and other banks, postal saving deposits, and all credit instruments of the financial sector of the economy), in modern times, the quantity of money gets a secondary role and the liquidity of the economy assumes more significant position in the monetary analysis.

ADVERTISEMENTS:

Besides the banking sector, a good deal of liquidity is created by the non-bank financial intermediaries, such as insurance companies, saving banks, building societies, etc., which provide liquid assets in exchange for short-term and long-term claims on the private and public sector of the economy. These financial intermediaries, by increasing the liquidity in the economy cause the velocity of money and, in turn, expand general business activity.

Thus, the traditional monetary policy which influences only the total volume of money supply and not the total volume of liquidity in the economy (which is much more than the money supply) is inadequate and ineffective because aggregate spending is influenced not only by the currency and the bank deposits but also by the near-money assets as created by the non-bank financial institutions. Since the new theory holds that non-bank financial institutions can frustrate the conventional monetary policy by altering the velocity (liquidity) of money, an appropriate definition of money must include the liabilities of non-bank financial institutions.

Gurley and Shaw suggest a liquidity definition of money in which money is regarded as “a weighted sum of currency and demand deposits and substitutes with weights assigned on the basis of the degree of substitutability ranging from one to zero”. The more imperfect substitute, the less the weight.

Radcliffe Report:

Radcliffe Committee was appointed by British Chancellor of Exchequer in 1957 to inquire into the working of monetary and credit system and to make recommendations. The Report of the Committee was published in August 1959.

ADVERTISEMENTS:

Various findings and recommendations of the Radcliffe Report are as follows:

I. Classical Direct Mechanism Criticised:

While investigating the way in which money influences the economic activity, the Report criticised the direct mechanism (as embodied in the Equation of Exchange, MV = PT) of the classical quantity theory of money on the following grounds:

(a) No tight relationship was found between the supply of money (as defined in the classical theory) and the level of economic activity (national income),

ADVERTISEMENTS:

(b) In a highly developed financial system with many financial intermediaries, grave theoretical difficulties were faced to identify or label some quantity as ‘the supply of money’,

(c) The Committee could not find any reason or historical evidence for believing the velocity of money to be stable or constant. The Committee considered the velocity of money as a numerical constant devoid of any behavioural content and as a variable whose value changes as the definition of money was altered.

II. Velocity of Money Indeterminate:

The Committee also observed that in a system of highly developed financial intermediaries providing substitutes for narrowly defined money, the velocity of circulation was indeterminate. If the central bank wanted to restrict the growth of aggregate demand (MV) by restricting the growth of money supply (M), the non-bank financial intermediaries were able to activate demand deposits and currency, thus raising velocity (V) sufficiently to offset the restrictions on the money supply and, thereby, leaving the aggregate demand (MV) largely unaltered.

III. Keynesian Indirect Mechanism Criticised:

The Committee also found no empirical evidence for the Keynesian indirect mechanism. According to the Committee, (a) it found no evidence that higher interest rates reduced consumption; (b) there was no indication that interest rates were important to large firms with respect to investment in either inventories or fixed capital; (c) Expenditures of the nationalised industries and of local authorities were also largely impervious to changes in interest rate; (d) the smaller firms treated the interest rate effect with skepticism. Thus, in the words of Radcliffe Report, “as the system works at present, changes in the rates of interest only very occasionally have direct effects on the level of demand.”

IV. Definition of Liquidity:

The Radcliffe Report considered the impact of money supply on economic activity through its influence on the overall level of liquidity. Liquidity is not limited by the amount of money in existence. It consists of the amount of money people think they can get hold of, whether by receipt of income, by disposal of capital asserts, or by borrowing.

The report distinguished between the old liquidity and the new liquidity. Old liquidity refers to the amount of money people think they can get hold of from their own resources, while new liquidity relates to the amount of money people think they can get hold of from unused borrowing power.

ADVERTISEMENTS:

V. Transmission Mechanism:

The Radcliffe report outlined a new transmission mechanism explaining the influence of the money supply on the pace of economic activity. Liquidity plays an important role in this transmission mechanism.

There are two elements in the transmission mechanism:

(i) The first element relates to the relation between liquidity and expenditures. If liquidity is reduced, expenditure (to the extent they exceed current income) ought to decline and vice versa.

ADVERTISEMENTS:

(ii) The second element relates to the way the money supply can influence the level of liquidity and hence the level of expenditures.

Conventional monetary contraction, for example, raises interest rates, which, in turn produces two effects:

(a) Rising interest rates reduce the old liquidity of the spenders because the capital value of these assets is reduced,

(b) Rising interest rates-also reduce the new liquidity.

ADVERTISEMENTS:

The capital value of assets held by the financial institutions is reduced as a result of rising interest rates. This reduces their ability to lend, thus making it more difficult for the individuals to acquire new liquidity.

According to the Radcliffe Report, it is the increasing difficulty of acquiring new liquidity that is the major effect of the monetary policy and this difficulty has its impact on the ability of the lenders to lend and not on the ability of borrowers to borrow.

Thus, while the tight monetary policy and the resultant rising interest rates have little effect on the demand for loanable funds, they reduce the supply of loanable funds. And since the individuals cannot acquire funds (or new liquidity), they tend to reduce their expenditures.

VI. Policy Implications:

The new transmission mechanism, as suggested in the Radcliff Report, indicates that the structure of interest rates is the centre piece of monetary action and the money supply is an important means to influence the structure of interest rates. Banks occupy a special position because they are the most convenient institutional sources of borrowing funds. But, according to the Radcliffe Report, all this does not mean that the monetary measures are the most effective measures and should alone be relied upon.

As regards the stabilisation policy, the committee has the following recommendations:

ADVERTISEMENTS:

(a) Greater reliance should be on the fiscal policy, and the monetary policy should play a subordinate part in guiding the development of the economy.

(b) In extraordinary times, direct measures to influence liquidity, such as control of capital issues, bank advances, consumer credit should be taken.

(c) The Committee rejects the controls over the lending capacity of non-bank financial intermediaries because of additional administrative burdens.

Gurley-Shaw Thesis:

Gurley-Shaw thesis was based on the implications of the rapid growth of financial intermediaries in the post-War II period. Gurley and Shaw were particularly inspired by the work of Raymond Goldsmith which showed that while all financial intermediaries grew rapidly during the first half of the 20th century, the claims of non-bank intermediaries increased much more than the demand deposit claims of the commercial banks, thus causing the commercial banks to diminish in importance among all intermediaries.

On the basis of this growth of non-bank intermediaries, Gurley and Shaw drew three conclusions:

(a) The relative decline of commercial banks weaken the ability of the central bank to control economic activity,

ADVERTISEMENTS:

(b) Direct control of non-bank intermediaries is necessary,

(c) Non-bank financial intermediaries are to be treated in exactly the same way as commercial banks if the amount of lending in the economy is to be controlled.

Policy Implications of Non-Bank Financial Intermediaries:

All financial intermediaries except banks are non-bank financial intermediaries. The basic difference between commercial banks and non-bank financial intermediaries is that the former possess, while the latter do not possess, the demand deposits or credit creating ability.

According to Gurley and Shaw, currency and demand deposits are not unique assets (except as means of payment); they are just two among many claims against financial intermediaries. The claims against all types of financial intermediaries are close, though not perfect, substitutes as alternative liquid stores of value or as temporary abodes of purchasing power.

In other words the saving deposits of different types of non-bank financial intermediaries are more or less the same as the demand deposits of commercial banks because saving deposits can be easily converted into cash or demand deposits.

ADVERTISEMENTS:

i. Secular Monetary Policy:

The long run monetary policy must maintain some optimum rate of interest over time to be consistent, say, with full employment. Gurley and Shaw believe that in a monetary model with a variety of money substitutes, no simple rule can be adopted for ascertaining the growth in the conventionally defined money supply necessary for keeping interest rate on an optimum full-employment trend.

The determination of a long-run monetary policy (i.e., determination of the necessary increase in the money supply) is not a simple function of trends in income but of a host of other factors, like the share of spending that is externally financed (specially by long-term securities), the growth in demand by spending units for direct, relative to indirect financial assets (the liabilities of non-bank intermediaries are called indirect financial assets), and on the development of financial intermediaries whose indirect debt issues are; competitive with money.

ii. Cyclical Monetary Policy:

The presence of non-bank intermediaries also frustrates a successful operation of the short-run or countercyclical monetary policy. The central bank has control over commercial banks and not over non-bank financial intermediaries. If the central bank wants to adopt a tight money policy to reduce money apply, it can do so only by restricting the credit creating activities of the commercial banks.

ADVERTISEMENTS:

But, on the other hand, the non-bank intermediaries tend to offset the decline in money supply by increasing the velocity of money in two ways:

(a) By selling government securities to holders of idle demand deposits in the commercial banks, the non-bank intermediaries can activate the deposits and raise velocity.

(b) By raising the rate of interest to be paid on deposits, the non-bank intermediaries can attract hitherto idle demand deposits away from commercial banks and by relending them the velocity of money can be raised.

In other words, the tight money policy during inflationary situation can reduce the money supply through its influence on commercial banks, but the reduction in money supply will not automatically reduce the liquidity in the economy which has been increased by the operation of non-bank intermediaries.

Since both long run and short-run monetary policy operates only through commercial banks and exerts no influence on non-bank intermediaries, Gurley and Shaw called for direct control of velocity through the regulation of the lending policies of non-bank intermediaries. Financial control must supplant monetary control.

In the words of Gurley and Shaw, “Financial control as the successor of monetary control, would regulate creation of financial assets in all forms that are competitive with direct securities in spending units” portfolios. ‘Tight Finance’ and ‘Cheap finance’ are the sequels to ‘tight money’ and ‘cheap money.’

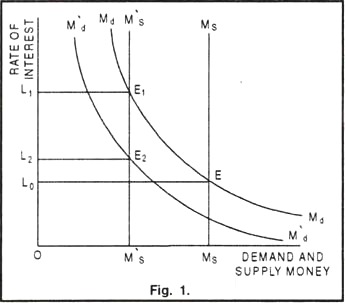

Fig. 1 illustrates the weakening effect of non-bank intermediaries on the operation of monetary policy. Initially, the demand for money curve (MdMd) intersects the supply of money curve (MS,MS) at point E and the equilibrium rate of interest is Oi0. The central bank, by following the tight money policy, reduces the money supply from Ms Ms to M’s M’s. The new point of equilibrium now will be E1 and the rate of interest increases to Oi1. This rise in the rate of interest enables the non-bank intermediaries to raise their deposit rates which lead to a reduction in the demand for money from MdMd to M’d M’d.

The new equilibrium this time will be E2, representing the rate of interest Oi2 which is less than Oi1. Thus the stringent effect of a rise in the rate of interest (i.e., from Oi0 to Oi1) due to the adoption of tight money policy has been largely offset because of the activities of non-bank financial intermediaries.

Evaluation of the Theory:

Broad Conclusions of the Theory:

The broad conclusions and implications of the liquidity theory of money are summarised below:

(i) According to the liquidity theory of money, the relation between money and the volume of economic activity (or the general price level) cannot be explained either by the classical quantity theory or by the Keynesian income theory, but by the role played by the whole structure of liquid assets which can serve as a substitute for money.

(ii) It is not the quantity of money in the economy; but the liquidity of the economy, that is more significant in the monetary analysis.

(iii) The definition of liquidity is not limited to the amount of money in existence. Liquidity consists of the amount of money people think they can get hold of whether by receipt of income, by disposal of capital assets, or by borrowing.

(iv) Aggregate spending in the economy is influenced not by the currency and the bank deposits, but also by the near-money assets as created by the non-bank financial institutions.

(v) The non-bank financial institutions through their near-money assets increase the liquidity in the economy. Increase in liquidity causes a rise in the velocity of money which, in turn, expands general business activity.

(vi) The traditional monetary policy which influences only the total volume of money supply and not the total volume of liquidity in economy is inadequate and ineffective.

(vii) Non-bank intermediaries are to be treated in exactly the same way as commercial banks if the amount of lending in the economy (and thereby the liquidity and economic activity) is to be controlled; the monetary authority must have direct control over the non-bank intermediaries.

Radcliffe-Gurley-Shaw view that the growth of non-bank financial intermediaries weakens the monetary policy remained popular during the late 1950s and early 1960s in the U.S.A. and U.K.

(i) During periods of tight money, interest rates rose. In order to take advantage of this rise in the interest rates, the public tended to withdraw their funds from the non-bank intermediaries and started lending directly to investors by buying primary securities.

(ii) The financial Reserve System imposed ceiling on the deposit rates of the financial intermediaries. The rationale behind this ceiling was to make tight money policy effective. A ceiling on the deposit rates would induce individuals to withdraw their funds from financial intermediaries and invest directly in primary securities. This would reduce the bank reserves and curtail their ability to create credit. Financial disintermediation thus undermined the significance of Radcliffe- Gurley-Shaw approach.