In this article we will discuss about the introduction and types of market failure.

Introduction to Market Failure:

The supporters of economic reforms who argued for diluting the role of public sector or government as it does not ensure efficiency in production laid great stress on ‘Government failures’ in promoting economic growth. They however turned a blind eye to the market failures. To quote an eminent American economist, Dr. Joseph Stiglitz, who won Nobel Prize in economics in recent years, “Market failures are a fact of life, as are government failures. New liberal ideologies assume perfect markets, perfect information, and a host of other things which even the best performing market economies cannot satisfy.” He therefore forcefully argues for a balanced approach to government and markets recognising that both are important and complementary.

This means both public sector and private sector should play complementary roles in bringing about economic growth. Due to market failures we cannot rely on private sector alone to bring about sustained economic growth and adequate expansion in employment opportunities.

ADVERTISEMENTS:

We are not arguing here that we should go back to ‘license-permit Raf’. What we are stating is that (1) markets need to be regulated effectively by the government if the objective of growth with equity is to be realised. Stock market scam of 1992 prompted by Harshad Mehta and the recent stock market scam of 2001 engineered by Ketan Parikh and recent (2008) the Indian stock market crash triggered by financial crisis in the US caused by defaults of sub-prime housing loans there and collapse of the American banking system are shining examples of the absence of effective regulation of the market by the government which is playing havoc with the economy.

Again UTI fiasco of July 2001 suspending the sale and repurchase of US 64 units has showed that activities of mutual funds be effectively regulated and not left to the free working of markets. The recent financial crisis in the US which has spilled over to the European and Asian countries (including India) has clearly shown that free markets economy is not self-correcting. It is due to the failure of market system to correct itself that even in the capitalist America President Bush had planned 700 billion dollars to bail out the US economy.

The US government announced buying of CDO securities and also equity shares of the banks and other financial institutions to solve their liquidity problem. This implies a part ownership by the government of banks and other financial institutions. This means free market or capitalist system cannot be relied upon for smooth functioning of an economy and the government has to play an important role to avoid and overcome recession in the economy.

Further, apart from regulation of markets and private sector, what is needed in the context of the Indian economy is the paramount role of government in stepping up public sector investment in infrastructure if sustained rate of higher growth rate is to be achieved. Government role is also crucial for adequate investment in social sectors such as education, healthcare and poverty alleviation programmes which are generally neglected by the private sector.

ADVERTISEMENTS:

For the purpose of poverty alleviation, undertaking of rural public works to utilise not only accumulated food stocks but also to generate employment opportunities for the poor and unemployed is of paramount importance for which the government should increase its expenditure. For the purpose of investment in infrastructure and social sectors (education and healthcare) and expenditure on employment schemes for the poor it should not hesitate to incur fiscal deficit. In this way, if fiscal deficit increases, it should do so and does not follow unthinkingly IMF inspired policy of reducing fiscal deficit under all circumstances.

In our view reduction in fiscal deficit should not be elevated to a dogma. What is relevant is that government should spend its borrowing for investment purposes, especially infrastructure, and on development of human capital, education and healthcare. What is needed is that government should not borrow for consumption purposes. Prof. Amartya Sen rightly writes that the success of liberalisation and closer integration with the world economy may be severely impaired by India’s backwardness in basic education, elementary healthcare, gender inequality and limitations of land reforms.

While Manmohan Singh did initiate the correction of governmental over-activity in some fields, the need to correct the governmental under-activity in other areas has not really been addressed. Further, referring to the higher growth rate in some East Asian countries which have received high growth rate with considerable equality, he writes, “These countries all share some conditions that are particularly favourable to widespread participation of the population in economic change. The relevant features include high rates of literacy, a fair degree of female empowerment, and quite radical land reforms. Can we expect in India results similar to those that the more socially egalitarian countries have achieved, given that half the Indian population (and two-thirds of the women) are still illiterate, that female empowerment is very little achieved in most parts of India, that credit is very hard to secure by the rural poor, and that land reforms remain only partially and unevenly expected? Should we not have expected more in the direction of breaking the terrible neglect of these concerns, on which the basic capabilities of the Indian masses depend?”

Neoclassical economists think that the market system works efficiently in the allocation of resources and thus achieves maximum social welfare. However, in regard to the use of environmental resources, market system does not function efficiently and this requires intervention by the government to correct market failures and ensure efficient use of environmental resources of the society. Markets fail when private individuals working in unregulated market economy fail to achieve efficiency in the use and allocation of resources. It is worth mentioning that market failures occur when there are no definite property rights over resources or goods by the private individuals or firms.

ADVERTISEMENTS:

In the absence of well-defined property rights over the environmental resources free market cannot work to achieve efficient allocation of resources. Market failures occur in case of the existence of externalities, in which case the productive activity by an individual affects other individuals whose welfare is not considered by the individuals while doing the productive activity. In case of public goods also market fails to achieve efficiency.

A public good is that from which all get benefits but no one can be excluded from enjoying benefits from it if he does not pay for it. Thus, market failure comes about when people cannot define property rights clearly. Markets fail when we cannot transfer rights freely, we cannot exclude others from using the good. Under these conditions, free market does not lead to socially desirable outcome. We either produce too much of bad good like pollution or too few of goods things like open space. Since everyone ‘owns’ the right to clean air and good climate and biodiversity, nobody owns the right and therefore it is impossible for a market to exist so that people can trade freely.

Types of Market Failure:

There are three types of market failure- externalities, public goods and common property.

i. Externalities:

Externality is the most important case of market failure and one most directly relevant to the use of environmental resources. Externalities refer to the beneficial and detrimental effects of the economic activity of an agent (a firm or a consumer or industry) on others. To be more precise, when an economic agent through his activity benefits others for which he does not receive any payment, there exist beneficial or positive externalities. On the other hand, detrimental or negative externalities occur when the activity of an economic agent harms others for which it is not required to pay.

It is important, to note that when there are y be made to the owner. However, when externalities occur and there are no individual property rights on goods, services or factors, market will not ensure optimum or socially desirable output due to the non-payment for the benefits or harms created for others. In case of positive externalities less will be Production (Causing pollution) produced and in case of negative (i.e., Fig. 57.1, in the presence negative externalities more detrimental) externalities more of a good output is produced than is socially desirable is produced than is socially desirable.

Let us give an example of how negative externalities lead to more than socially desirable output. The chief example the negative externalities occurs in case of electricity producing firm which pollutes air which harm others but they are not paid for this by the firm. Note that no one has individual property rights over the air which is provided by the environment.

Therefore, the firm can extend its production to the level which maximises its profits or benefits for the industry – In the case of a firm, which pollutes air and does not pay those who suffer as a result of pollution, marginal private cost (MPC) will be smaller than the social marginal cost (SMC) as the latter will also include negative externalities of pollution. How, in this case, more of output of good will be produced than is socially desirable?

ADVERTISEMENTS:

This is illustrated in Fig. 57.1 where MB is marginal benefit curve of the firm whose production pollutes the air and is sloping downward. This is because this marginal benefit curve depends on the demand curve of the product of the firm. As the firm produces and sells more of its product, its price falls. This price is the benefit for the firm.

Therefore, as it produces more, its marginal benefit (MB) declines. On the other hand, as more is produced by the firm its private marginal cost (PMC) will rise in accordance with the principle of diminishing returns of traditional microeconomic theory, and rising private marginal cost (PMC) of the firm will cause the private marginal cost curve of the firm to slope upward as shown in Fig. 57.1 by PMC.

The firm does not take into account the harms done to others especially those living in the surrounding areas of air pollution generated by it. The question is how it is allowed to pollute the air to extend its production to the level beyond what is socially desirable? This is because, no one has the ownership rights over the air which is supplied by the environment (i.e., air is environmental good). It will be seen from Fig. 57.1 that considering only its private marginal cost the firm will equate private marginal cost (PMC) with its marginal benefit (MB) and produce output OQ2 to maximize its profits.

Now, if negative externalities represented by creation of air pollution, which inflicts costs on others, are taken the account, we will add to private marginal cost, these negative externalities to get social marginal cost (SMC) curve which lies above the private marginal cost (PMC) curve. The socially desirable output which represents optimum allocation of resources is equal to OQ1 at which social marginal cost (SMC) equals marginal benefits (MB). Thus, by producing OQ2 output, the firm in case of the existence of negative externalities produces more than what is socially optimum output level OQ1.

ADVERTISEMENTS:

Another important example of negative external economies is found in case of a firm discharging its toxic effluent into the water of a lake which is used by the fishermen to catch fishes to make their living. The toxic effluent in the lake kills many fishes which reduces the number of fishes captured by the fishermen and thus harms them. The harms done to the fishermen by the firm dumping its toxic product into lake do not enter into the calculations of the polluting firm. As no one has ownership right over water of lake, the firm produces more product than is socially desirable. In this case also social marginal cost (SMC) curve will be above the private marginal cost (PMC).

ii. Public Goods:

Market failure also arises in the supply of goods known as public goods. Public good is one from which everybody benefits from it even when he does not pay for it. There are two features of a public good. First, it is non-rival in consumption. Second, in case of a public good even those who have not paid for it, cannot be excluded from enjoying its consumption.

A non-rival in consumption implies that consumption of a public good by one individual does not exclude its consumption by others. Public street lighting, television signals, parks, flood control project, pollution control project, lighthouse in the sea are some examples of public goods. Thus, when public street lighting is provided in a colony everyone living will benefit from it, even those who have not paid for it. Similarly, all persons of a city can benefit from the television signals and enjoy the programme telecast.

ADVERTISEMENTS:

The enjoyment provided by a park, if there is free access to it, can be obtained by all who visit it. Public street lighting, parks, television signals and such other goods are non-rival goods as their consumption by one individual does not exclude its consumption by others. That is, the consumption of a non-rival good by an individual does not reduce its amount available for others to consume.

Non-Excludability:

The other essential characteristic of a public good is non-excludability in distribution of their consumption benefits. This non-exclusive nature of a public good implies that it is difficult if not impossible to exclude those from consuming them who are not willing to pay for them. In case of private rival goods such as shirts, cars, Pepsi Cola, apples those who do not pay for them can be easily prevented from consuming them or receiving benefits from them because the producer or seller simply does not provide them these goods, if they do not pay price for them. On the contrary, in case of public goods, either it is not possible or it is very costly to prevent those people from consuming them who do not pay for these goods. It is due to the feature of non-excludability of public goods that accounts for the failure of market in case of these goods to ensure economic efficiency.

For example, national defence is a public good and is provided to all members of a society and its benefits are available to all equally irrespective of whether some people pay for it or not. It is difficult if not impossible to exclude those people from receiving benefits of security provided by national defence system who do not pay for it.

Likewise, if a lighthouse is constructed in a sea, it provides light for all the ships whether any one of them pays for it or not and it is not possible to prevent those who do not pay from receiving light from the lighthouse. This inability to exclude those who do not pay from receiving benefits also applies in case of other public goods such as television signals, pollution control project to provide clear air, flood control projects, parks etc.

Free-Rider’s Problem in Case of Public Goods and Market Failure:

ADVERTISEMENTS:

It is easy to show how non-excludability of a public good can lead to the market failure, that is, failure of market to achieve Pareto efficiency. As explained above, non-excludability of public goods arises because producers are not able to prevent those from consuming these or enjoying benefits from these who do not pay their share of cost. There is a problem called a free-rider’s problem which states that because people cannot be excluded from consuming public goods or enjoying benefits from them, there is incentive for persons in these situations to free ride and try to enjoy benefits from reduced pollution, parks, television signals, lighthouse without paying for them. These persons want to get something for nothing and rely on others to make payment for public goods whose benefits they will also automatically get.

Due to this free-rider problem or inability of the producers of public goods to prevent those who do not pay from receiving benefits from them, that a profit-maximising firm will either not produce a public good or produce too little of it. This creates economic inefficiency or Pareto non-optimality. Let us take an example of this free-rider’s problem in case of public goods leading to economic inefficiency. Suppose the construction of a dam to check floods which cause a lot of damage in a city is required. This dam when built will protect equally all people of the city from the damages due to floods.

However, some people of the city would not like to pay for the dam with the hope that others would pay for it and they because of non-excludability would also enjoy its benefits. But in view of this incentive to free ride, adequate revenue to cover costs of building the dam cannot be provided, and therefore, no private entrepreneur would consider it worthwhile to construct the dam to control floods. Similarly, the production of other public goods such as lighthouse, television signals, and pollution abatement projects would not be extended to the socially desirable level in view of the non-excludability and incentive to free ride.

iii. Common Property Resources:

Common property resources are the resources to which everyone has free access, that is, anyone can use the property without making any payment. Parks, rivers, ocean, fisheries, public roads and highways are examples of common property resources. For example, anyone can have a free entry into the India Gate parks in Delhi and enjoy there. However, each person’s use of common property reduces its value to others and thus creates negative externality.

Since people do not have to pay for the use of common property resources, they tend to be overused or overexploited. For example, parks with free entry often become overcrowded which results in lowering of enjoyment of parks by everybody. Further, the use of rivers Ganga and Yamuna in India is quite free and has become so much polluted because factories dump their waste products into them without paying any cost.

ADVERTISEMENTS:

Even people in general throw all sorts of their wastes (even dead bodies, and their remains) into these rivers. Similarly, costless use of public common land for grazing of cattle or hunting, results in overuse of these common property resources. This overuse of common property resources where there is free access to them is often referred to as the tragedy of commons. This is also called the common problem.

An important common property resource is fisheries in which no fee is charged for catching fishes from them. Each fisherman wants to catch fish before others do the fishing. This results in overfishing which may ultimately lead to the destruction of stock of fish in the fisheries for use in future years.

It is worth noting that lack of property rights over the common resources leads to their overuse. Fishermen when they have costless access to the use of common property resources have incentive to catch more fish than they would if the fisheries were private property, whose owner would charge fee or price for catching fishes by fishermen.

Suppose, now each fishery has been given exclusive private property right to a lake where fishes are caught by fishermen. Now, since there exist well-defined property rights, there are no externalities. Therefore, each owner of lake would not allow overfishing in any year so as to maintain the stock (i.e., the number) of fish for the future years.

On the other hand, most ocean fisheries are common property to which fishermen have free access. As in case of private manufacturers who create external diseconomy by polluting air or water, fishermen operating in ocean fisheries take into account only their private costs. Thus in calculating their costs they include in them the cost of boats, other complementary equipment, a crew etc. They do not take into account the costs they impose on future generation as their fishing in the present leads to the decrease in the stock of fish in the ocean in the future years.

Thus Professor Perloff writes, “The fewer fish there are, the harder it is to catch any, so reducing the population offish today raises the cost of catching fish in the future. As a result, fishers do not forego fishing now to leave fish for the future. The social cost is the private cost plus the externality cost from reduced future population of fish.” It may be emphasised again that it is the lack of clearly defined property rights of fisheries that leads to overfishing. Fishermen have an incentive to catch more fish than they would if the fishery was private property.

ADVERTISEMENTS:

Roads and Highways:

Let us take another case of common property resources- roads and highways. Everyone has access to them for driving their cars and other vehicles. Since owner of a car has no exclusive right to use the highway on which he drives, he cannot exclude others from driving on the same highway and must share it with others. This leads to the too many drivers using the highway for driving their vehicles which leads to congestion and often jams (i.e., a negative externality). This slows down driving on the highway. Thus this is another example of overuse of the common property resource.

Diagrammatic Illustration of Overuse of Common Property Resources:

Let us illustrate diagrammatically how in case of common property resources, there is overuse of them which is often referred to as ‘tragedy of commons’. Let us take the case of a lake which is the common property of nearby town and this lake is used for fishing. Every fisherman has free (i.e., costless) access to catch fishes from the lake and then sell it in the market. But by catching fish from the lake, fishermen reduce the population of fish in the lake and thereby raise the cost of catching fishes for others. That is, by catching fishes from the lake, fishermen create external diseconomy for other fishermen.

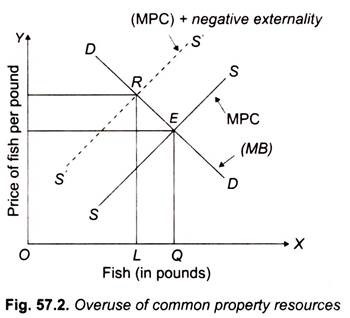

In Fig. 57.2 we have drawn a demand curve DD for fish (in pounds) in the market which reflect consumer’s marginal benefits (MB) from fish and SS is the market supply curve of fish based on marginal private cost (MPC) of fishermen. If there is free access to lake, the number of fish caught and supplied in the market is OQ pounds. Since fishermen do not take into account the negative externality they create, the fishermen’s marginal private costs (therefore the supply curve SS based on them) will be less than the marginal social cost (MSC).

Therefore, the supply curve S’S’ representing the marginal social costs intersects the market demand curve (i.e., marginal benefit curve) at point R and thus determine the OL quantity of fish caught and sold. (Note that the marginal social cost (MSC) equals marginal private cost (MPC) plus the negative externality created). Thus OL quantity of fish (in pounds) is the socially optimum output. But as fishermen do not take into account the external diseconomy or social marginal cost and operate on the basis of their marginal private cost (MPC), they catch more fish equal to OQ which thus leads to the overuse of the fishery. This is therefore called tragedy of commons.

Assigning Property Rights for Common Property Resources – Coase Theorem:

As explained above, that common property resources tend to be overused and therefore there is economically inefficient use of them. R. Coase, a Nobel Prize winner of 1991, has proposed a solution for this problem to ensure economically efficient use of common property resources. According to Coase, if costs of negotiating between the parties are quite small, the parties that create negative externality and the victims of their activity negotiate, they can arrive at a price which properly takes into account the negative external effect and thus ensures economic efficiency in the use of common property resources.

For example, if downstream water users are assigned the property right to obtain water of a particular quality, a firm that wants to pollute the stream will be prepared to give compensation to them (i.e., to downstream water users who have been given rights to obtain water of certain specified quality). Since the firm will now have to give compensation to the downstream water users, it will not find it worthwhile to pollute the stream beyond the economically efficient point. This is the gist of Coase theorem and its importance lies in its suggestion that assignment of well-defined property rights might help to promote economic efficiency.

It may be emphasised that Coase theorem assumes that transaction costs, that is, costs of negotiating and contracting by the interested parties are very small. For instance, in our above example, the downstream water users join together and then effectively negotiate with the polluting firm without much cost about the price to be charged from the latter for polluting the stream.

Besides, even if the transaction costs are small, negotiations with the polluting firm may not be practical because it is difficult to measure precisely the external cost (i.e., negative externality) of pollution imposed by the polluting firm on the downstream water users. Further, if the number of interested parties in negotiating a deal is large, it may not be possible to get unanimity required to make the negotiation effective.

To conclude in the words of Edwin Mansfield, Coase theorem suggests that “the assignment of well-defined property rights might help to promote economic efficiency. For example, to get around the difficulties caused by external diseconomies arising from waste disposal, society might find it useful to try to establish more unambiguous property rights for individuals and firms with respect to environment quality. Then, assuming that the relevant negotiations are feasible, the interested parties in a particular area might try to negotiate to determine how much-, pollution will occur.”