The following three points highlight the three major macroeconomic issues. That are: 1. Employment and Unemployment 2. Inflation 3. Economic Growth.

Issue # 1. Employment and Unemployment:

Unemployment refers to involuntary idleness of resources including manpower. If this problem exists society’s actual output (or GNP) will be less than its potential output.

So one of the objectives of government policy is to ensure full employment which implies absence of involuntary unemployment of any type.

Issue # 2. Inflation:

It refers to a situation of constantly rising prices of commodities and factors of production. The opposite situation is known as deflation. During inflation some people gain and most people lose. So there is a change in the pattern of income distribution. Therefore, one of the objectives of government policy is to ensure price level stability which implies the absence of inflation and deflation.

Issue # 3. Economic Growth:

ADVERTISEMENTS:

The macroeconomic goal of full production is achieved when an economy is producing as much as it possibly can with its available resources, or producing at its maximum capacity. Although the problem of scarcity always exists, full production permits an economy to minimise its impact.

The further an economy moves away from full production, the greater the scarcity problem becomes. Production is closely interwoven with employment because factors of production are used to produce goods and services. When an economy reaches full employment, it also reaches its peak productive capacity; when it moves away from full employment, it operates below its peak capacity.

In addition to full production, the third macro- economic goal calls for economic growth, which is an increase in the economy’s full production- full employment level of output over time. In other words, to achieve the third goal, not only must the economy operate at maximum capacity, but that capacity must grow over time.

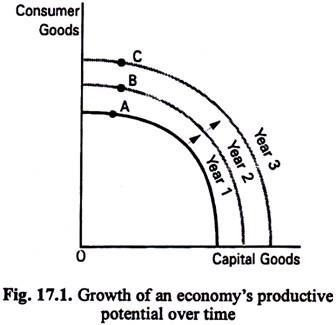

The production possibilities curve for capital and consumer goods in Figure 17.1 illustrates the meaning of economic growth. Full production would be reached in the first year by producing at any point, such as A, on the production possibilities curve for year 1. Economic growth occurs when the production possibilities curve shifts to the right, as is done for the second and third years. This economy would achieve the third macroeconomic goal of full production and economic growth if it were to produce at a point such as B along the curve for year 2 and C for year 3.

The process of growth is best understood as a series of small, cumulative advances in full employment output, perhaps in the neighbourhood of 2% to 5% per year, rather than a few large, dramatic leaps from time to time. Economic growth is a long-term objective that is accomplished over a number of years.

Although economic growth is defined as an increase in full production output over time, a more precise definition is an increase in full production output per capita over time. If output increased, but population grew at a fast rate, output per person would decrease. Even with more goods and services available, the average person would be worse off.

Achieving Economic Growth:

Economic growth occurs because the quantity of resources available to the economy increases, existing resources are used more efficiently or new resources are introduced into production. The quantities of a country’s resources can be increased in several ways a labour force can be expanded by encouraging the immigration of foreign workers; farmable land can be claimed from the sea and desert; and policies that encourage entrepreneurship, such as risk sharing by government, can be adopted.

ADVERTISEMENTS:

There are limits, however, on the speed and size of an increase in labour, natural resources, or entrepreneurship. Capital, on the other hand, can be expanded more readily. As a result, economic growth can be promoted by directing attention towards increasing the amount of machines, factories, and other capital equipment in the economy.

Governments have encouraged business to invest in capital by changing tax laws to allow investments to be depreciated over a shorter period of time, by following policies to keep interest rates low to facilitate borrowing for capital, and by participating in the production or financing of capital itself.

Probably the most important factor leading to improved resource efficiency and quality is technological change, or an increase in knowledge about production and its processes. Technological change influences productivity in many ways and affects all sectors of the economy. It has resulted in information superhighways that combine communication and cable technologies, and in new medical procedures that have come from breakthroughs in biochemistry or biomedical engineering. Technological change is widely regarded as the single most important cause of economic growth.

Technological change takes many forms — from rearranging existing processes and equipment to designing and developing new and different inputs and processes. It is not limited, however, to investments in buildings, machines, and equipment. Important technological change results from investments in people through formal education, training, and other ways.

Human capital investments increase productivity in the same way that investments in machines increase productivity. Human capital investments strengthen the quality of the workforce, and increase individual productivity and the overall stock of knowledge in the economy. This knowledge base ensures that technological change will continue.

If economic growth is to be realised, attention must be paid to maintaining a strong demand for the output from the economy’s additional and/or improved resources. If the growth in an economy’s productive capability results in the unemployment or under-utilisation of resources because of insufficient demand for the economy’s output, the benefits of the growth effort will be largely nullified.

Two major policies influence spending to accomplish the objectives for the macro- economy. In terms of the circular flow model, these policies are designed to regulate the leakages and injections that travel through the government sector and through financial institutions. One policy focuses on increasing or decreasing the size of the spending stream by changing government taxes and/or expenditures (transfer payments and purchases of goods and services).

To increase the level of economic activity, spending is enlarged by lowering taxes and/or increasing government expenditures. The economy is slowed (to counteract demand- pull inflation) by withdrawing spending through increasing taxes and/or reducing government expenditures. This strategy for influencing the economy through government-induced spending changes is called fiscal policy.

A second policy focuses on changing the levels of saving and, especially, borrowing through the economy’s financial institutions. The amount of loans that financial institutions can make and the interest rates that are charged on these loans are influenced by actions of the central bank. The central bank can create conditions that encourage borrowing and spending by households and businesses, or tighten credit and discourage borrowing and spending.

ADVERTISEMENTS:

These changes in borrowing are related to changes in the interest rate and the money supply. Changing the level of spending by influencing the interest rate, borrowing, and the supply of money in the economy is called monetary policy.