The Sylos-Bain-Modigliani-Bhagwati model postulates that the limit price will be higher than the LAC due to the scale-barriers to entry.

Thus the firms will be earning abnormal profits without attracting entry.

Bhagwati mentions that firms under certain conditions may adopt a mixed strategy, namely charge the monopoly price (PM > PL) over a certain period of time and subsequently reduce their price to the level that will prevent entry (PL).

The adoption of this strategy depends on the length of two time periods: the period over which entry will not occur due to various barriers, and the period that is required for the established firms to adjust their pre-entry plant to the post-entry optimum size. If the latter period is longer, then the firms maximise their profits by charging to begin with the limit price, while if the former period is longer, the existing firms will attain higher profits by adopting the above mixed strategy.

ADVERTISEMENTS:

Pashigian explored more systematically the implications of the above mixed strategy, by defining the period T at which the firms will switch from the monopoly price to the entry-preventing price (PL) or to the competitive equilibrium price (Pc), depending on the profitability of each alternative. For simplicity he starts by assuming that there is only one firm in the industry (monopoly).

The firm has to decide whether and for how long it is profitable to charge the monopoly price that maximises its short-run profits. By setting the price at the monopoly level (PM) entry will occur eventually. Thus the crucial element is the number of periods during which the price will remain above the limit price while entry is taking place. Pashigian concentrates for simplicity on two alternatives open to the firm.

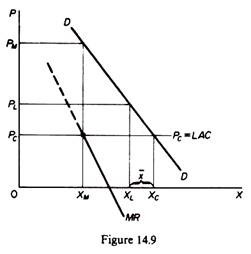

He assumes that over a period T the firms will charge the monopoly price and allow entry to occur. The entrants are assumed to collude with the existing firms and sell at the pre-entry price. Thus over the period T the price will be PM and the quantity supplied XM (figure 14.9), but it will be produced by a gradually increasing number of firms.

The share of the ex-monopolist (to the market and to the monopoly profit) will be decreasing over this period as he will be ‘accommodating’ the entrants. After period T the originally established firms (the ex-monopolist in Pashigian’s model) must choose one of the following two policies: either to charge the limit price (PL) and enjoy thereafter the excess profits that this price allows, or to continue over an additional period, TT, to charge the monopoly price and allow further entry to take place until price has eventually fallen to the competitive level Pc, which yields only normal profits.

ADVERTISEMENTS:

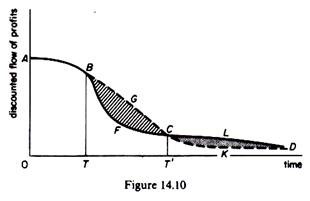

The choice between these two alternatives will be based on the comparison of the discounted flows of profits resulting from these policies. If the ex-monopolist, who is assumed to set the pace in the market, adopts the former policy, his discounted profits will be the area under the thick line in figure 14.10. If he adopts the second strategy his discounted stream of profits will be the area under the dotted curve. The ex-monopolist (leader) will thus compare the shaded areas BFCG and CKDL.

The former denotes the profits which will be forgone if the firm chooses to charge the limit price during the time period TT, while the latter area (CKDL) shows the profits which will be earned beyond period T if the firm charges the limit price at period T. If BFCG > CKDL the firm leader will stick to the monopoly price for a longer period (TT) because this policy maximises his profits. Pashigian’s time-period analysis has the advantage of treating time explicitly and of attempting to justify the entry-preventing policy on grounds of maximum profitability.

ADVERTISEMENTS:

However, the model is based on several assumptions that might be questioned. For example, the model assumes that entry will not take place immediately due to barriers of various forms. Furthermore it assumes that the entrant is a small firm which will be coerced by the dominant established firm(s) to collude and charge the same price.