Get the answer of: What is the Business Cycle?

Business (trade) cycles refer to regular oscillations in the level of business activity over a period of years, which occurs when economic activity speeds up or slows down. In fact, business cycles and unemployment reflect unavoidable features of a market economy.

The term ‘Business Cycle or Trade Cycle’ is used to denote the fluctuation in economic activity which occur in a more or less regular time-sequence in capitalist societies. The volume of economic activity in a community is shown by various indicators, viz., the volume of employment, price level, output and income.

When these indicators are plotted on a chart, the graph looks like a wave. This shows that economic activity rises and falls in a regular manner. Each movement, the rise and fall taken together, is called a Trade Cycle or a Business Cycle.

ADVERTISEMENTS:

In the language of J.M. Keynes “A trade cycle is composed of periods of good trade characterised by rising prices and low unemployment percentages altering with periods of bad trade characterised by falling prices and high unemployment percentages”.

More specifically, Paul Samuelson defines a business cycle as follows:

“A business cycle is a swing in total national output, income and employment, usually lasting for a period of 2 to 10 years, marked by widespread expansion or contraction in many sectors of the economy.”

Types of Business Cycle:

There are three distinct types of business cycles:

ADVERTISEMENTS:

1. The Long Waves or the Kondratieff Cycles:

These are long period cycles of 50 to 60 years. So far, only two full waves, 1789-1814 and 1814-1896, and the first half of the third wave 1896-1920 have discovered and examined. Statistical evidence collected by Kondratieff and others show that there was a long period of rise and then of fall of prices, interest and employment during these periods.

The regularity of the movements seems to show that they were not due to random causes. Schumpeter ascribes the upward movement of the first cycle (1789-1814) to the industrial revolution, of the second cycle (1814-1896) to the use of steam and steel, and the third cycle (1896-1920) to the discovery of electricity, the development of chemistry, and the use of motors.

2. Short Waves of 9 to 10 years:

ADVERTISEMENTS:

These are short cycles last for 9 to 10 years on an average. Jugler cycles occur with great regularity and have been studied in detail by economists. Most of the theories evolved by economists regarding business cycles relate to this type.

3. Shorter Waves:

It has been found that Juglar is convertible into three shorter cycles of 40 months each.

Phases of Business Cycle:

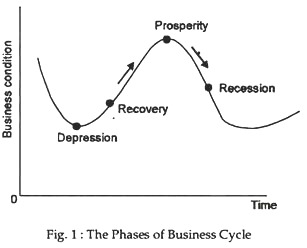

There are different types of business cycles. But, they have one major characteristic. These have four common phases. In fact, a business cycle like a year has its own seasons. A typical short cycle B has four more or less distinct phases—Depression, Recovery, Prosperity and Recession. These phases can be shown in a diagram as in Fig.1. Different writers use different terms for these phases but all are agreed on the fact that there are four phases.

The four phases constitute one cycle. They repeat themselves in the order shown.

The characteristic features of each phase are described below:

1. Depression:

During depression economic activity in the community is at a low level. Unemployment is high. Incomes are low. Consumption expenditure is much reduced. Investment is low and there is little demand for producer’s goods. Price tends to go downwards. Enterprise is discouraged. Income, employment and output decline cumulatively owing to the multiplier effect.

ADVERTISEMENTS:

After depression has continued for a time, certain structural changes occur. Weak enterprises are liquidated or reorganised. Old debts are paid off and banks again become strong. The economy comes back into equilibrium on the basis of a lower volume of employment and income. Now, the process of recovery starts.

2. Recovery:

During a depression, households and business concerns keep their purchase low. So, manufacturers do not get sufficient orders to produce. But, after depression has lasted for some time the semi-durable

goods wear out and have to be replaced.

Buying gradually increases and as the sellers’ stocks are gradually reduced more order are placed on the manufacturers. Industry begins to revive. Once begun, the recovery grows cumulatively. An increase in the business of a trader makes him readier to renew his equipment and order fresh goods from the manufacturer.

ADVERTISEMENTS:

Employment in the factories increases and more income is generated which leads to further consumer purchases. The improving state of trade produces a more cheerful state of the mind among businessmen.

In the language of Keynes, “the marginal efficiency of capital” increases and gives a fresh impetus to the improvement in trade. The phase of the cycle when these things happen is called Recovery. Recovery is sometimes accelerated by non-business factors like a war or a good harvest.

3. Prosperity:

As the forces producing recovery gather strength, profits tend to rise. The reason is that, while prices of raw materials and the rate of interest often rise faster than selling prices, the prices of labour (i.e., wages) usually lag far behind and overhead costs remain fixed by old contracts regarding salaries, leases etc.

ADVERTISEMENTS:

The increase of profits combined with the general feeling of optimism leads to larger investments which, in turn, increases employment, income and the volume of trade. This situation is called Prosperity. The peak point of Prosperity is marked by a greatly accelerated economy activity and is called a Boom.

4. Recession:

Towards the later stages of prosperity, there occurs a gradual accumulation of factors which undermine the prosperity.

These factors are as follows:

(i) The cost of production gradually increases:

Prices of labour and of raw materials rise in response to increased demand. Labour efficiency declines because shortage of labour supply forces employers to appoint unemployables and make other labourers work overtime. Overhead costs increase when the limit of existing capacity is reached. Wastage increases owing to pressure of work.

ADVERTISEMENTS:

(ii) The money market becomes tighter:

The larger volume of trade creates greater demand for cash and the rates of interest rise, thus, putting a check on investments.

Causes of Business Cycle:

There are various causes of business cycles and various theories have been developed from time to time to explain the causes. The causes may be divided into two broad categories, viz., external and internal. The external causes refer to those forces which are outside the economic system such as wars, revolutions, political upheavals, earthquakes, population, explosion and migration, discovering of new land, oil, gold, technological progress (or scientific breakthroughs) or even sunspots (or the weather).

The internal factors originate from mechanisms within the economic system itself that will give rise to self-generating business cycles. The internal factors explain an important point: the fact that every expansion breeds recession and contraction, and every contraction breeds revival and expansion.

In this context, W.C. Mitchell comments that, “the frequent recurrence of economic crisis and depressions is evidence that the automatic functioning of our business system is defective”. However, in order to suggest the complete explanation of business cycles, it is necessary to combine both types of forces.

Economics have developed various theories of business cycles. These can be divided into two broad categories — monetary and real. Monetary theories, developed by R. Hawtrey and Milton Friedman, attribute the business cycle to the expansions and contractions of money and credit, which must, therefore, be controlled by regulating credit to wholesalers and retailers via the bank rate and not by regulating public expenditure. And Friedman made the banking monetary policies of the US Central Bank (the FRB) responsible for the depression of 1930s.

ADVERTISEMENTS:

Real theories developed to Keynes, Hansen and others attribute business cycle to investment fluctuations. According to A. Aflalion, the chief responsibility for cyclical fluctuations should be assigned to one of the characteristics of modern industrial techniques; namely, the long period required for production of fixed capital.

Most explanations of the existence and the nature of the cycle are based on the determinants of business investment and its effects, through the multiplier process, on the level of national income. Paul Samuelson has shown that the accelerator theory of investment, in conjunction with the multipliers can be used to show that the adjustment of the level of investment to the rate of change of sales gives rise to cyclical fluctuations in national income. One prominent factor is the volatility of fixed investment and inventory investment expenditures (the investment cycle).

At the top of the cycle, national income begins to level-off and investment in new investment made to increase production capacity finally catches up with demand. (This is the essence of the acceleration principle or the accelerating theory of investment.)

This causes a reduction in induced investment and, viz., reverse multiplier effects, leads to a fall in national income which reduces investment even further. At the bottom of the depression, investment may rise ecogenous (due, for example, to the introduction of new technologies) or through the revival of replacement investment.

In this case, the increase in investment spending will, via expansionary multiplier effects, lead to an increase in national income and a greater volume of induced investment. In short, Samuelson’s multiplier accelerator interaction model proposes that “external shocks are propagated by the multiplier along with an investment theory known as the accelerator, thereby generating regular, cyclical fluctuations in output”.

Characteristics of Business Cycles:

The rather regular ups and downs of output, employment and prices were named the business cycle in the nineteenth century. The pattern of a hypothetical business cycle is shown in Fig. 1.

ADVERTISEMENTS:

This typical business cycle shows fluctuations in the level of economic activity over time. In this hypothetical business cycle, the peak and trough are equal in magnitude and the upturn and downturn take the same length of time. Actual cycles may be less symmetric, with upturns greater or smaller than downturns in size or duration. The cycle is measured from peak to peak. The trend line is the underlying growth rate of GNP.

In the expansionary phase of the cycle (from upturn through peak), output rises, prices rise rapidly, and unemployment falls. Productivity tends to increase as the economy emerges from the trough of a recession primarily because firms have kept some workers on but have not fully used them. As sales increase, firms employ these workers more fully and productivity rises. As expansion continues, new and less experienced workers are hired, and the increase in productivity starts to slow rate.

Recessions, Troughs, Expansions and Peaks:

As the cycle turn down, output falls and prices tend to fall also, or at least rise at a slower rate. The economy is entering a recession when real GNP declines for two or more successive quarters. Unemployment increases and income and output fall until the lower turning point or trough, when the process starts over again.

The lower turning point, when output reaches its lowest level, is called the trough. From trough to peak (highest output level) is an expansion. The downturn is called a recession. A complete cycle goes from peak to peak.

Successive peaks (and troughs) should occur at higher levels of GNP each time because the business cycle is a fluctuation around a trend cycle with a trend growth rate of GNP of 2% a year should see a final peak of real GNP that is 12 to 13% above the previous peak GNP.

ADVERTISEMENTS:

Characteristics:

Business cycles are of different types. They vary in periodicity and intensity. But, they have certain common characteristics.

The most important ones are the following:

Business cycles have certain important characteristics. First, the pattern of cycles is irregular. No two business cycles are quite the same. As Samuel- son has put, “Business cycles are no doubt members of the same family, but they are not identical twine”. As he says, “the pattern of cycles is irregular. No two business cycles are quite the same”.

In the post-war years the business cycle has been controlled to the point where absolute downward movements in the level of output have been infrequent in the Western industrial economies. The business cycle has, in consequently, been replaced by the recession, in which temporary pauses in the advance of total output (to GDP) occur and are followed by a resumption of growth.

Since economic laws are comparable to laws of tides rather than laws of gravitation, it is not possible to use an exact formula, such as might apply to the motions of the moon or of a pendulum, to predict the duration and timing of business cycles. Rather, in their irregularities, business cycles are comparable to the fluctuations of the weather.

Though business cycles are not identical twins, they have some similarities. This point will become clear if we study the characteristics of a typical business cycle in general or that of an important phase of the cycle in particular, viz., recession.

The following are the four major characteristics of a recession:

1. Demand for durables:

First, the demand for durable goods as T.V. sets, refrigerators, cars, washing machines, etc., fall faster than the demand for non-durables like food, clothing, entertainment (recreation), etc. Moreover, due to acceleration effect demand for capital goods falls much than the demand for consumption goods. As J.B. Clark commented in 1934: “Demand for new supplies of durable goods fluctuates more intensely than demand for current services these durable goods render.”

In fact, due to declining demand for consumer goods during recession business inventories of cars, air conditioners, washing machines, and other durables increase unexpectedly. So, a cutback in production is inevitable. As business firms reduce production, real GNP falls. This, in its turn, leads to a sharp fall in business investment (in plant, equipment and machinery).

2. Unemployment:

Business cycles create unemployment. This is not classical real wage unemployment but Keynesian demand-deficient unemployment.

3. Price fall:

As output falls, there is less supply of and demand for crude materials like oil or even primary commodities. Consequently, their prices fall. Since wages and manufacturing prices are institutionary determined or administered by the firms themselves in imperfectly competitive markets, they are unlikely to fall much, at least in the organised sector of industry. But they are unlikely to rise rapidly in the contractionary phase of the business cycle.

4. Profit fluctuations:

Profits usually show greater fluctuations than any other factor income. During recessions profits fall not due to falling prices but due to the fact that producers are unable to realise profits embodied in already produced stocks. This leads to a fall in share prices.

A fall in profit reduces the quantum of dividends that can be distributed. And, the price of a share largely, if not entirely, depends on the last declared dividend. If financial institutions anticipate a business downturn they will not buy shares and stocks.

This will make it difficult for companies to raise capital for real investment (purchase of machinery and equipment). Consequently, the demand for bank credit will also fall, leading to a fall in the market rate of interest.

Other Characteristics:

Certain other characteristics of business cycle are listed below:

1. A business cycle consists of alternating forces of expansion and contraction. The movement is wave-like, but not random fluctuations.

2. Details of different cycles differ though the general pattern is the same. “All the recorded cycles are members of the same family, but among them there are no twins.”

3. The time periods of the phases of short waves differ slightly, though each cycle covers approximately 9-10 years.

4. The upward and downward movements of a business cycle possess a degree of regularity in their durability and time sequence.

5. A business cycle reaches the point of prosperity (highest point of the wave) and a point of depression (the lowest point of the wave). The points are not symmetrical. The downward movement is quicker and more violent than the opposite one. The upward movement is slower and the wave has gentle slopes.

6. The phases of the cycle tend to appear in all types of business though in varying degrees, e.g., production and prices.

7. Output and employment, in durable goods and capital goods, fluctuate more than in consumption goods.

8. Changes in total output and employment are generally associated with change in currency, credit and velocity of circulation of money.

9. Profits fluctuate more than the other incomes.

10. All business cycles do not affect the macro-economy to the same extent.

11. The trade cycle is primarily an employment cycle. The volume of employment varies at different points of the cycle. It is lowest at the crisis- panic stage, grows steadily during the recovery and is largest during prosperity. Output and income naturally vary with employment.

But, there are various other things also which fluctuate during trade cycles, e.g., prices, interest rates, etc. The trade cycle may be called primarily an employment cycle because the effects on employment are serious and far reaching.