In fact, there was no separate discipline known as macroeconomics before the publication of Keynes’ revolutionary title- The General Theory of Employment, Interest and Money in 1936. Although it was the first title on macroeconomics, the term macroeconomics was coined by the first Nobel Laureate economist Ragnar Frisch in 1933.

Moreover, there is no such thing as the classical model because there were so many classical economists such as Adam Smith, David Ricardo, T.R. Malthus, J.B. Say and David Hume. So classical view refers to the main views and major beliefs of these economists who influenced economic theorising and policy-making. The classical view does not refer to the ideas of any particular economist who can be singled out as a representative of his time.

In fact, the term classical economics refers to the broad views of a typical capitalist economy like that of England at the time of Industrial Revolution (1760). And all pre-Keynesian economists were classical economists.

It may be noted at the outset that there is no such thing as classical theory of employment the first theory of employment was presented by Keynes. In contrast, the classical theory was one of the price level. Since the classicists believed in automatic full employment, they were mainly concerned with determining the general price level and identifying the main cause of rise in the price level. The two main blocks of classical theory are the Say’s Law of Markets and the Quantity Theory of Money, originally presented by David Hume and refined and modified by Irving Fisher in 1911.

ADVERTISEMENTS:

The classical economists believed in the Say’s Law of Markets, which states that supply creates its own demand. They also believed in wage-price flexibility. These two assumptions, viz., the operation of Say’s Law and flexibility of wages and prices would ensure automatic full employment. This was the basic postulate of the classical economists. So the classical economists ruled out the possibility of unemployment in free-market capitalist economies.

If there were any unemployment in the classical model, it would be of a temporary nature. The cause of such unemployment would be too high a real wage. But this could not persist for long. Unemployment implies excess supply of labour, which would cause the money wage rate to fall. This, in its turn, would lead to a fall in the cost of production and the price level.

As a result, the real wage, which is the ratio of money wage and the price level (W/P), would also fall, the demand for labour would increase and the labour market would be cleared. This was the belief of the classical economists. So the classical economists considered only price adjustment, aggregate output remaining fixed at full employment (whether the general price level was high or low).

The classical economists also believed in the Quantity Theory of Money which is essentially a hypothesis relating to the relation between M and the general price level (P). The theory suggests an exact proportional relation between M and P. So the Quantity Theory of Money contains the seeds of inflation.

ADVERTISEMENTS:

In contrast, the Keynesian theory of income and expenditure considers only output adjustment, assuming rigidity of wages and prices. But Keynes’ General Theory contains no theory of inflation because true inflation, according to him, occurs only at full employment. Keynes’ theory contains, at best, a theory of the general price level.

Say’s Law:

Say’s Law (named after J.B. Say, the French economist, 1736-1832) states that supply creates its own demand. We can easily imagine the application of the law in a barter economy. It can also be applied in a money-using economy. We may now describe the application of the law.

People work not because they like to work. Instead, the converse is true. Work is unpleasant to them. People work by sacrificing leisure in order to obtain goods and services that yield satisfaction. In an economy based on DOL, specialisation and exchange, an individual obtains most of these goods and services not directly through his own effort (as did Robinson Crusoe who used to live on an isolated economy).

ADVERTISEMENTS:

Rather, he produces goods in which he has comparative advantage (in which his relative efficiency is maximum) and exchanges the surplus above his own use for the products of others.

The very act of production (supply) creates demand for other goods: a demand equivalent to the surplus output each person is able to generate. Since each person’s excess supply of anything is always matched by excess demand for other goods, the aggregate demand must, in some sense, equal the aggregate supply. So, there cannot be any such thing as overproduction or underproduction in a market-based economy guided by Adam Smith’s invisible (hidden) hand.

Thus, there is no possibility of any unemployment in the wonderful world of classical economists. If there is any unemployment in such an economy, it will be of a voluntary nature. Such unemployment is likely to occur if output does not increase beyond a point at which, for each individual, the satisfaction of a little more leisure outweighs the sacrifice of a little more of goods that might have been obtained.

This theory behind Say’s Law is different from the definitional identity among national product, national income and total expenditure. This identity exists at any level of national product, national income and total final expenditure.

The equilibrium real wage defines full employment of the labour force, and full employment of the labour force (with a given production function) defines the full employment level of output. Classical theory found no obstacle to the attainment of these positions as long as the money wage was flexible—that is, as long as it would fall in the face of unemployment.

The possibility that this level of output once produced wouldn’t find a market was dismissed; Say’s Law ruled out any deficiency of aggregate demand. What Say’s Law implies is that any output increase will generate (be matched by) an equivalent increase in income and spending. This implies that output and income can always be at a full-employment level.

If output and income are at a lower level, with some resources remaining involuntarily idle, additional production will generate an equivalent amount of additional income, which will all be spent to purchase the extra output that is produced.

If there is any temporary maladjustment of demand and supplies of different commodities (i.e., emergence of shortages of certain things and excess supplies of others), the market will promptly correct the imbalance. This is known as the self-adjusting mechanism of the market. And since there is no lack of demand or purchasing power in the economy, all that producers are required to do is to produce as much as they can. This process will continue until the full-employment level is reached.

Application in a Money Economy:

ADVERTISEMENTS:

The Say’s Law was originally framed in terms of a barter economy. But the law holds true for a money-using economy, too. In general, people do not desire money for its own sake. Money is a temporary abode of purchasing power. If people sell their output or service for money, the money will immediately be spent against other goods. The money is just like any commodity, which cannot be consumed directly, but by being used as a medium of exchange, money avoids the disadvantages of barter, but nothing beyond that.

The Quantity Theory of Money:

People do not desire money for its own sake. So they do not hold idle balances. This is the essence of the classical Quantity Theory of Money, which is also an important component of classical economics. The theory is based on the assumption that a money economy behaves in the same way as a barter economy, because rational individuals do not hold idle money. Since rational people make no use of idle cash, they do not hoard it.

People normally pass along all the cash they receive and price level fluctuations arise primarily from changes in the quantity of money (cash) in circulation. If money supply increases, the additional cash will be spent on existing goods and services. Since the economy is always at full employment (where its actual output is equal to its potential output) as soon as this additional money is spent on goods and services, all money prices will rise, leaving real prices unchanged. Thus, if the central bank prints more money, the general price level will rise in proportion to the increase in money supply. Thus, prices are proportional to the supply of money.

ADVERTISEMENTS:

The Essence of the Quantity Theory of Money:

If we assume given payment habits and a given structure of production, that prices are perfectly flexible in either direction, that people have no desire for idle balances, then the price level will be proportional to the quantity of money in circulation.

More formally, we can state the proposition in terms of the following formulation:

MV = PtT, where

ADVERTISEMENTS:

M = Quantity of money in circulation;

V = transaction velocity of money expressed in number of times per year or other period;

Pt = the average price level of transactions;

T = the physical value of transactions occurring during the year or other period (as for V).

Let us assume that people never hold idle balances, i.e., money balance is held only long enough to make necessary payments. We also assume that the institutional factors which determine this minimum period are given. This means that V is constant, and MV is proportional to M.

If prices are perfectly flexible, T can always be at the maximum level permitted by the technology and people’s desire to work. At any given time, this level can be taken as constant. Hence, P is proportional to M. An increase or decrease in M would lead to a proportional increase or decrease in prices.

ADVERTISEMENTS:

An alternative version of the Quantity Theory is known as Cambridge version, which is presented as:

M = kPY, where, M = Quantity of money and kPY= transaction velocity of money.

The Cambridge economists thought that people hold money only for transaction purposes.

Comparing Say’s Law with Quantity Theory of Money: Absolute versus Relative Prices:

The notion that people of a money-using economy do not hold idle cash balances, as suggested by the Quantity Theory of Money, was primarily used to suggest an explanation for the absolute level of prices. In a barter economy, there are only relative prices.

In a money economy— where people hold money not only for its own sake but for using as a medium of exchange—all prices (in terms of this common medium of exchange, or what Walras called numeraric commodity) rise or fall together with changes in the stock of money. This means that we have an absolute level of prices, which depends on the quantity of money.

ADVERTISEMENTS:

Say’s Law, on the other hand, hints at involuntary unemployment arising from a deficiency of aggregate demand for goods. No doubt, Say’s proposition (that such deficiency cannot occur) is obvious for a barter economy, which has no absolute price level. But for a money-using economy, Say’s Law does not always operate or is not always valid.

As G. Ackley has opined- Say’s Law describes a result which depends on several specific behavioural assumptions that may or may not be true and upon a fairly complicated theory of markets. In short, Say’s Law always holds in a barter economy where there are only absolute prices. But the Quantity Theory of Money holds in a money economy where the relevant variable is the absolute level of prices.

The Classical Full Employment Equilibrium:

According to classical price (as opposed to monetary) theory, the volume of employment and output is determined not by the level but by the internal structure of prices.

1. Employment as a Function of Real Wage:

The first basic proposition of the classical theory is that output (or input) is carried to the point where the marginal product of labour equals the real wage, the money wage deflated by the price level:

ADVERTISEMENTS:

MPL = W/P.

It is the relationship of wages to-prices that determines employment decisions and output, not the absolute level of either one. Thus, if both wages and prices rise or fall in the same proportion, there would be no incentive for any profit-maximising firm to hire fewer or more workers or to produce a different level of output.

2. The Law of Diminishing Returns:

The second proposition of classical theory is that the Law of Diminishing Returns applies for any given enterprise (with given capital and natural resources); marginal physical product declines (marginal costs rise) as output increases. This statement is true of the economy as a whole. Since total output is the sum of output in all firms, as more workers are hired in the economy, aggregate output increases, but in continually smaller proportions than the increase in output.

3. The Supply of Labour:

The aggregate supply curve of labour is upward sloping. The more labour will be supplied at a higher than at a lower real wage.

ADVERTISEMENTS:

Price Flexibility and Full Employment:

The basic point made by the classical economists is that the operation of Say’s Law and flexibility of wages and prices would ensure automatic full employment. We may now describe the adjustment mechanism in the classical model, i.e., how a deviation from full-employment gets corrected automatically in a capitalist economy where perfect competition prevails in all markets and the government follows the policy of laissez faire.

Let us suppose that, at existing levels of money wage and price level, employers find it profitable to employ fewer workers than those who wish to work at that real wage. In a competitive market the unemployed workers will offer their labour services at a lower money wage rate, rather than remain idle.

The extent, to which this results in additional employment and output, if at all, depends on what happens to prices. If prices fall in the same proportion as money wages there would be no incentive for the employers to increase employment and output. If they do not fall at all, or fall in smaller proportion than did wages, employers would find it profitable to expand output to some extent and, thus, absorb some of the unemployed.

If the initial fall in money wages (with accompanying smaller reduction in prices) were insufficient to eliminate all unemployment, money wages would fall further, prices in turn falling again—but by less than wages. The process would continue until full employment and maximum output was reached, at which point wages, prices, employment and output would stabilise.

Thus, in the classical model, the volume of employment and output depend directly on the structure and not upon the level of prices, they depend on the real wage, which is the ratio of wages to prices. But in order to widen the gap between wages and prices, i.e., to lower the real wage rate (i.e., the ratio of W to P) it is necessary to reduce the absolute level of money wage. This leads to a fall in both the real wage and (W/P) and the price level.

There are two central factors of the classical macroeconomic system (model):

i. Dichotomy:

First, central feature of the system is the dichotomy between the factors determining the real and nominal variables. In this system, real (supply) side-factors determine real variables. Aggregate output and level of employment depend primarily on population, technology, and capital formation. The interest rate depends on productivity and thrift. Money is a veil determining the nominal values in which quantities are measured, but monetary factors do not play any role in determining these real quantities.

In other words, classical economists stressed the role of real as opposed to monetary factors in determining real variables such as output and employment. Money had a role in the economy only as a medium of exchange. Money was held only for the sake of the goods it could purchase, Closely connected with the issue of classical dichotomy is the question of whether the stock of money is neutral in its real effects on the economy.

Given a classical model ensuring automatic full employment, an increase in the nominal stock of money (M) creates an excess demand for goods and services through appositive real balance effect.

By degrees the individual prices of various commodities must rise, and, accordingly, so must the general price level (P). The increase in the price level decreases the volume of real money balances (M/P), which, in turn, generates a decrease in demand for goods and services (a negative balance effect).

Ultimately, the price level rises in proportion to initial increase in nominal money balances, and people have the same level of real money holdings with which they started. Thus, money has been neutral, the final behaviour of people unchanged, and the price level is higher.

Classical economists stressed the self-adjustment tendencies of the economy. Government policies to ensure an adequate demand for output were considered by the classical economists to be unnecessary and generally harmful (recommended non-interventionist policy).

ii. Automatic Full Employment:

Second, a crucial feature of the classical model is the supply- determined nature of output and employment. To classical economists, the equilibrium level of income at any time was a point of full-employment or a point where actual output was equal to potential output. Classical economists stressed the self-adjusting tendencies of the economy.

In the classical model, full-employment would always be achieved. The first of this self-stabilising mechanism is the interest rate, which adjusts to keep shocks to sectoral demands from affecting AD. The second set of stabilisers consists of freely flexible prices and money wages which keep changes in AD from affecting output.

Flexibility of prices and wages is crucial for ensuring automatic full employment in the classical model. These two assumptions—essential for the nature of the classical equilibrium theory of output and employment— are the elements of the classical theory that Keynes attacked.

In the classical model, the levels of output and employment are determined solely by supply factors. In this model, output is not a function of price. As price changes, money wage changes proportionately. The real wage does not change. This is why the classical AS curve is vertical when plotted with price on the vertical axis and output on the horizontal axis.

In short, automatic full-employment is the only logical possibility in the classical model due to the operation of Say’s Law and wage-price flexibility. Classical economists felt that the free market mechanism would work to provide markets for any goods that were produced.

The classical doctrine was that in the aggregate production of a given quantity of output would ‘generate sufficient demand for that output; there would be a want of buyers for all commodities. Consequently, classical economists gave little explicit attention to factors that determine the overall demand for commodities, termed aggregate demand, or to policies that regulate aggregate demand.

Conclusion:

According to the classical dichotomy, the monetary sector of the economy determines the general price level whereas the demand for and supply of goods and services determine relative prices. Hence, the price level has no effect on demand for and supply of individual goods and services.

The real balance effect denies the existence of this dichotomy, since any change in real balance will affect the demand for and supply of goods and services. This dichotomization of the real and monetary sectors was settled by Don Patinkin’s refinement of the real balance effect.

The real balance effect refers to the direct effect of changes in real money holdings upon the demand for goods and services. Changes in real cash balances take place when changes in quantity of money and/or in the price level occur.

An increase (decrease) in real money holdings is presumed to increase (decrease) aggregate demand, A decrease in the price level (P), at any given nominal stock of money (M), will increase the real stock of money (M/P) and will lead to an increase in real aggregate demand.

The Classical Model in a Nutshell:

The classical model is presented in the following four equations:

1. Y = f (L), i.e., output or income is a function of the level of employment L (with dY/dL > 0, but declining as L increases).

2. dY/dL = W/P, i.e., MPL = real wage.

3. L = f (W/P), i.e., employment is a function of real wage [with dL/d (W/P) > 0].

4. M = kPY, i.e., quantity of money is equal to the transactions demand for money (which is a fraction of national income at current price).

Graphical Representation of the Classical Theory of Price Level:

The classical theory of aggregate demand and aggregate supply is a complete explanation of the factors that determine the level of employment and the level of GDP, the relative price of labour and commodities in terms of money (the nominal wage, W, and the price level, P).

We now proceed to explain the role of price level in the aggregate supply theory using three diagrams- the labour demand and supply diagram, the production function diagram, and the aggregate supply diagram.

The classical economists simplified the aggregate supply theory by assuming that labour demand and supply decisions of households in a dynamic monetary economy are similar to those of households in a barter economy; the assumption being valid under certain strong simplifications about the way people make choices.

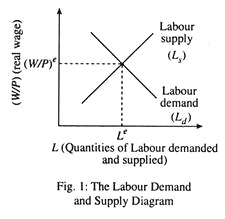

In Fig. 1, the labour demand and supply curves (Ld and Ls, respectively) indicate the choices of household and the firm. The labour market being in equilibrium in the classical model, equilibrium real wage (W/P)e and employment level (Le) are determined by the intersection of Ld and Ls.

The classical analysis considers only the real wage, because W/P indicates how many units of a good the household will get for a given labour effort. Le and (W/P)e, in practice, depend on the nature of the technology and preference of households, which determine the position, and slopes of Ld and Ls.

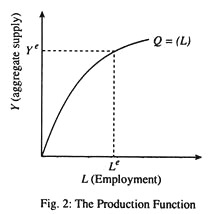

Next, the classical aggregate supply theory has to determine the supply of output. Given level of employment, this is determined by the production function. The higher the level of employment, greater is the supply of output. Fig. 2 shows the production function. The equilibrium supply of output, Ye is the amount of output produced when labour demand equals labour supply (i.e., labour input = Le). Ye is dependent on the characteristics of the production function and preferences of households.

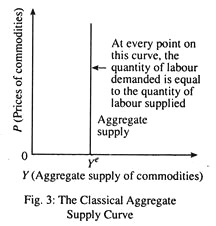

Finally, the classical theory determines the relation between the output and money price of commodities. Since real wage determines both labour demand and supply, there is no relationship between price of commodities and output supply. Whatever be their rupee price, the economy will always supply Ye output per week. Price and nominal wage both increase proportionately, leaving the real wage, supply of commodities and employment remain unchanged.

Fig. 3 illustrates the classical aggregate supply theory by plotting price of commodities on the vertical axis and their aggregate supply on the horizontal axis. The graph is a vertical line because price of output and aggregate supply of commodities are unrelated. At every point on this line, labour demand equals labour supply.

The Complete Classical Theory of Aggregate Demand and Supply:

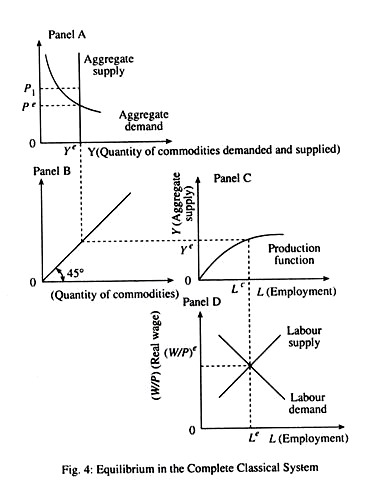

In Fig. 4 now, we combine the above three diagrams together to illustrate how the price level, output and employment are determined in a complete classical system. We use Fig. 4 to explain why the aggregate supply curve is vertical. There are four panels in Fig. 4- Panel A plots aggregate demand and supply curves in a single diagram.

Panel B has a line at 45° angle to the horizontal axis that takes vertical distances in Panel C and plots them as horizontal distance in Panel A. This Panel B is used to translate the supply of output, determined by panels C and D, to the aggregate demand and supply diagram in Panel A.

Now let us take an arbitrary value of commodity price as P1, in Panel A. To determine a point on the aggregate supply curve, we need to find the quantity corresponding to P1. For this, we turn to Panel D, the labour demand and supply diagram. In Panel D, given any price level, equilibrium in labour market will result in Le hours of labour being traded at (W/P)e real wage. Having found Le, we find the equilibrium output supply corresponding to it, using the production function in Panel C. The equilibrium level so found is Ye.

In the final step, we use the 45° line in Panel B to translate the distance Y e from vertical axis in Panel C to horizontal axis in Panel B. Thus, we get (P1, Ye) as a point on the aggregate supply curve.

Next, to find a second point on the aggregate supply curve, we start with a price level lower than P1. We repeat the same steps all over again and find that equilibrium labour hours supplied is Le and equilibrium output is Ye. The critical explanation of this argument is that quantities of labour demanded and supplied depend on the real wage and not on the nominal wage or price level.

If price doubles, labour market equilibrium will occur where nominal wage is twice as high. So, the equilibrium employment and output remain the same. Since the equilibrium employment depends only on real wage, at every price level same output level will be supplied

The Classical Theory and the Neutrality of Money:

The classical assumption that all markets are in equilibrium has important implications. The aggregate supply curve being vertical, a fall in aggregate demand will cause the price level to fall and will have no effect on real variables, A 10 per cent fall in money supply will cause price level to fall by 10 per cent, as also the nominal wage, since the demand for money is proportional to demand for commodities.

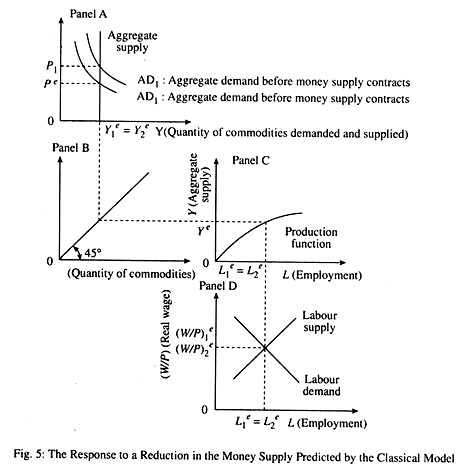

This neutral effect of money supply on real variables such as output and employment is known as neutrality of money. Through Fig. 5, we can show how a reduction in quantity of money affects output, employment, real wage and price level in the classical model.

In Fig. 5, we consider a fall in money supply. Reduction in household spending is shown by the leftward shift of the aggregate demand (AD) curve-in Panel A. Initially, the AD curve for money was given by AD, and equilibrium price of commodities was P1e.

After the fall in money stock, AD1 curve falls to AD2, and equilibrium price is P2e. As the demand for money is proportional to GDP, to restore equality between price and quantity of the commodity, price level must fall in the same proportion. With the fall in price level, households hold lower quantity of nominal balances.

The real wage, employment and quantity of output, being determined by technology, endowment and preferences, are not affected by a fall in money stock.

A Criticism of the Classical Theory:

In the Classical model there are three factors which affect the changes in aggregate demand or aggregate supply. These are technology, endowment, and individual preferences.

Introduction of new technology may improve productivity. If new technology makes labour more productive, the firms will be willing to pay a higher real wage because they can now produce more output per unit of labour. Similarly, increase in endowments, such as the discovery of a new deposit of natural resource, would increase productivity of labour as each labour unit will have more capital to work with.

So there is a favourable shock to labour demand. Finally, the household preferences shift the aggregate supply. If households prefer to supply more labour, the equilibrium wage rate would fall and would increase equilibrium employment and GDP.

These three factors are the cause of some of the business fluctuations that we observe from one year to another. However, it is unlikely that all such fluctuations can be explained in this way. This is evident from the history of prices and output during the Great Depression (1929-33). The classical model predicts that the price level should be countercyclical. But, during the Great Depression, it was largely procyclical. So, we can say that the classical model cannot correctly explain depressions.

The classical model also pays no attention to unemployment. It states that fluctuations in employment arise as the result of voluntary household decisions to vary the quantity of labour hours supplied to the market. This model does not take into account people who are unable to find a job. Since the real wage, employment and quantity of output are determined by technology, endowments and preferences, money supply has neutral effect on these.

Keynes’s Comments on the Classical Adjustment Mechanism:

In the classical model, the volumes of employment and output depend directly on the structure and not upon the level of prices; they depend on the real wage, which is a ratio of wages to prices. But, in order to widen the gap between wages and prices, i.e., to lower the real wage rate, it is necessary to reduce the absolute level of money wages. Competition among unemployed in the instance reduces the money wage. This leads to a reduction of both of the real wage and the price level.

In 1936, Keynes contended that classical theory provided no satisfactory explanation of what would happen to the level of selling prices in the face of a general wage reduction. Some classical economists wrongly assumed that there was no relation between wage rate paid and money demand for the product, so that prices would be assumed to remain constant as wages fell. This may be true for a firm or an industry, but not for the economy as whole, as some classical writers have wrongly believed.

Instead, Keynes thought that the logic of the classical position should require prices to fall in the same proportion as wages. Thus, if there were unemployment and wage flexibility, a general deflation of wages and prices could be expected. This would continue indefinitely, since there would be no expansion of employment opportunities and the unemployed would push the money wage level down.

Keynes’ view also ignores another major hypothesis of classical economists, viz., the Quantity Theory of Money. As Ackley has put it, “For if prices were to fall as fast as wages, with no increase in output, idle balances would automatically be created in the hands of business or consumers, or both. Since rational people are not willing to accumulate idle balances, this could not happen. Real spending would necessarily increase as prices fall, thus preventing as large a decline in prices as in wages.”

Alternatively stated, with a fixed quantity and velocity of money, prices must fall if an expanded output is to be sold. But in order to provide incentive for output expansion, wages must fall relative to prices—i.e., they must fall proportionately more than prices. If wage rates are flexible, money wages will fall exactly by the amount required to provide the necessary profit margin below that price level at which the maximum output can be sold.

The whole sequence of events can be summed up thus:

Unemployment causes a reduction of the money wage. Prices remaining fixed, this gives producers an incentive to increase employment and output. But larger output can be sold only at lower prices, with money supply remaining fixed and velocity of circulation (or, the rate of money turnover) constant. So, prices are pulled down, too, but by less than the fall in wages; in which case there will be both an incentive to increase output, and a wider market for the larger output.

If the initial fall in nominal wages (supported by smaller reduction in prices) were insufficient to eliminate all unemployment, money wages would fall further as prices, in turn, would also fall again (but by less than wages). The process will continue until full-employment and maximum output was reached, at which point wages, prices, employment, and output would stabilise.