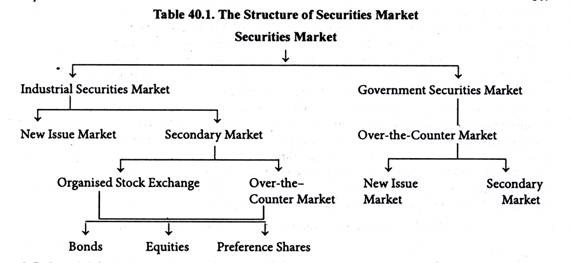

Let us make in-depth study of the structure of securities market in India.

Industrial Securities Market:

The Industrial securities market refers to the market for shares and bonds of the existing companies, as well as those of new companies.

This market is further divided into New Issue Market (NIM) and Old Issue Market. The New Issue Market is also called Primary Market. Likewise, the Old Issue Market is also called Secondary Market or Stock Exchange.

However, it is important to emphasize that the New Issue Market and Stock Exchange are inter-linked and work in conjunction with each other. Although they differ from each other in the sense that the New Issue Market deals with ‘new securities’ issued for the first time to the public and Stock Exchange deals with those securities which have already been issued once to the public.

However, it is important to emphasize that the New Issue Market and Stock Exchange are inter-linked and work in conjunction with each other. Although they differ from each other in the sense that the New Issue Market deals with ‘new securities’ issued for the first time to the public and Stock Exchange deals with those securities which have already been issued once to the public.

(i) Primary Market:

The primary market is concerned with the floatation of new issues of shares or bonds. The firms floating new issues to raise funds may be new companies or existing companies planning expansions. The Merchant Banking Division of a commercial bank is asked by the company to advise on the viability Of floatation of an issue before an issue is actually floated in the market.

ADVERTISEMENTS:

The stock issuing company also approaches the institutional underwriters like LIC, UTI, ICICI and IDBI, to ensure the marketability of an issue. The underwriters like LIC and UTI purchase securities from the New Issue Market to hold these in their own asset portfolio.

In Indian capital market, there are two main ways of floating new issues:

(a) Public issues, and

ADVERTISEMENTS:

(b) Rights issues.

(a) Public Issues:

The most popular method for floating securities in the New Issue Market is through a legal document called the “Prospectus”. It is an open invitation to the public to subscribe to the issue at par or at premium.

(b) Right Issues:

ADVERTISEMENTS:

This method of the sale of stock is normally used by existing companies whose shares are already listed in the Stock Exchange. Right issue represents an invitation to the existing shareholders to subscribe to a part or the whole of the new issue in a fixed proportion to their shareholding.

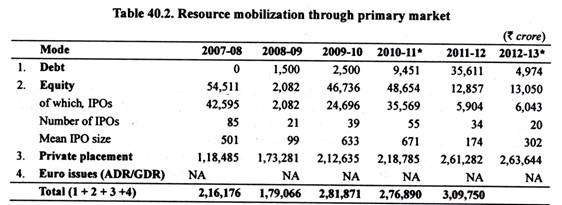

Resource mobilisation through primary market by Indian corporate companies is shown in Table 40.2 for the years 2007-08 to 2010-11. The primary capital market progressed significantly in 2009-10 and 2010 -11 after the setback in 2008-09. The amounts of funds raised and the number of new issues which entered the primary market increased in 2009-10 and 2010-11.

The total amount of capital raised through equity issues in 2009-10 was Rs. 46,736 crore as against Rs. 2082 crore in 2008-09. Due to global financial crisis in 2008, the primary capital market received a setback in 2008-09. The number of new issues declined sharply in 2008-09.

Total amount of capital raised through equity issues during 2010-11 was Rs. 48,654 crore. The total number of initial public offerings (IPOs) in 2010-11 was only 55 as against 85 in 2007-08 and 39 in 2009-10. The amount mobilized by IPOs in 2010-11 was Rs. 35,569 as against Rs. 24,696 crore in the whole year 2009-10.

The mean IPO size increased from Rs. 033 crore in 2009-10 to Rs. 671 crore in 2010-11. There was debt issue (i.e. issue of corporate bonds and debentures) to the tune of Rs. 2,500 crore in 2009-10 and Rs. 9,451 crore in 2010-11. There was no debt issue in 2007-2008. As will be seen from Table 40.2 the amount of capital mobilized through private placement in 2010-11 was Rs. 2,18,785 crore as compared to Rs. 2,12,635 crore in 2009-10.

In the financial year 2011-12 resource mobilisation through the primary market was still greater. Rs. 35,611 crore was raised through sale of bonds by the corporate sector (i.e., through debt mode) and Rs. 12,857 crore was raised through issue of equity and Rs. 2,61,282 crore were raised through primary primate placement. In this way the total of Rs. 3,09, 750 crore were raised during financial year 2011-12. During the financial year (up to December 2012-13) resource mobilisation through primary market witnessed an upward movement and a total of Rs. 2, 81,667 crores were raised in the first three quarters of 2012-13 (See Table 40.2).

Initial Public Offer (IPO):

As is seen from Table 40.2, the equity capital may be raised through IPO. IPO or Initial public offer is the first issue of shares by a corporate company to the general public to raise capital for expansion of its business. IPO is followed by a listing of its shares in the stock market. The issue of IPO by the Indian companies and the price of share that is fixed is regulated by SEBI. IPOs may be issued through the “Fixed Price Method” or through the book Building Procedure. In 2007-08 there were 85 IPOs but the number of IPOs declined to 39 only in 2009-10. In 2008-09, when global financial crisis hit the Indian economy, the number of IPOs had declined to only 21.

ADVERTISEMENTS:

Private Placement:

It will be seen from Table 40.2 that a lot of capital is raised through the private placement. An unlisted company which wants to raise equity funds but is not yet prepared to make an IPO may place privately its equity or equity related instruments with one or more sophisticated investors such as financial institutions, mutual funds, venture capital funds, banks etc.

The private placements can be made by a company to the investors at any agreed price and quantity as such private equity issues are not regulated by SEBI. The Securities and Exchange Board of India (SEBI) has effected several reforms in the New Issue Market. These reforms seek improved disclosure standards, prudential norms and simplification of issue procedures.

Improvements in Resource Mobilisation from the Primary Market:

ADVERTISEMENTS:

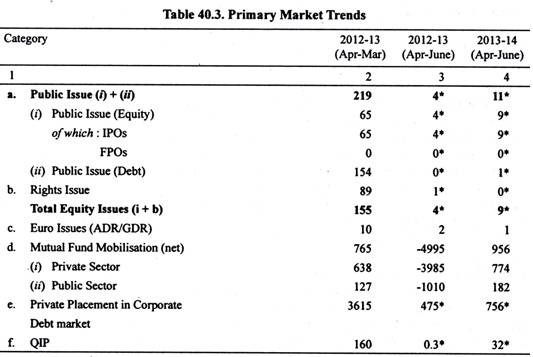

During April-May 2013, the total resource mobilisation from the primary equity market more than doubled to Rs. 9.3 billion compared with Rs. 3.9 billion mobilized during April-May 2012 (Table 40.3). The higher resource mobilisation in equity was due to a recovery in the secondary market and the floatation of a mega issue in May 2013. Resource mobilisation via the private placement route continued its growth momentum.

During April-May 2013, mobilisation through private placements increased by nearly 59 per cent to Rs. 756 billion as compared to Rs. 475 billion in the corresponding period last year. Led by private sector mutual funds, resources mobilized by mutual funds during April-June 2013 also registered an increase to Rs. 956 billion as against net sales of Rs. 4,995 billion during April-June 2012.

(ii) Secondary Market:

The Secondary Market deals in existing securities. This market provides both liquidity and marketability to such securities. It implies that it is a market where a security can be bought or sold at small transaction cost. Although the Secondary Market deals with the purchase and sale of old securities, the firms issuing new securities get themselves registered on a Stock Exchange by applying for listing of shares. Listing offers the investor a ‘market’ for the sale of his stock.

ADVERTISEMENTS:

The Secondary Market of Securities in India functions through its following two segments:

(a) Stock Exchange;

(b) Over-the-Counter Market.

Stock Exchange:

Stock Exchange is an organised market for the purchase and sale of second hand listed industrials and financial {i.e., shares and debentures of corporate companies). Listed securities are those securities which appear on the approved list of a Stock Exchange. Only listed securities are traded on the floor of the Stock Exchange. It is to be noted that an organised Stock Exchange is an ‘auction’ type of market, where the prices of traded securities are settled by open bids and offers on the floor of the exchange.

In a Stock Exchange, the transactions in stocks can be classified into two types:

ADVERTISEMENTS:

(a) Investment transactions; and

(b) Speculative transactions.

Investment Transactions:

An investment transaction in securities is that transaction which is concerned with the purchase of securities, with a view to investing funds to get an income as annual dividends from these securities and gain from the sale of these securities. The basic feature of an investment transaction is that it involves the actual delivery of the security and payment of its full price. An investment transaction is motivated by the considerations of safety of investment and security of income.

Speculative Transactions:

The speculative transaction in securities is that transaction which is concerned with the purchase or sale of securities for the sake of capital appreciation. The basic feature of a speculative transaction is that the delivery of securities or the payment of the full price are rare.

ADVERTISEMENTS:

The speculator neither takes delivery of the securities sold by him; instead he only receives or pays the difference between the purchase and sale prices, as the case may be. The trading in securities, without the intention of taking delivery or making payment, is called forward trading. Under the Securities Contract (Regulation) Act. 1956 forward trading was perfectly legal till it was suspended in 1969 along with all the regulatory and penal measures.

The suspension of forward trading created a real vacuum in the stock market. The stock brokers devised the extra-legal badla system to fill up this vacuum. Under this badla system, securities contract was turned into a carry-forward instrument merely by closing the contract on the 14th day and replacing it by a new hand-delivery contract between the same buyer and seller in respect of the same securities.

Thus, only the difference between the ‘contract price’ and the ‘market price’ would change hands between the buyer and the seller. Badla transactions became the predominant form of Stock Exchange transactions. Since real transactions involving the transfer of securities became a microscopic minority, serious problem of excessive speculation developed in the stock market. In short, the badla system led to excessive speculation and short-selling often amounting to gambling. The Securities and Exchange Board of India (SEBI) banned the badla system in December 1993.

There was an increasing demand for the legitimate forward trading to give boost to the stock market. Since stock market quotations are often considered as the barometers of a country’s economy, the SEBI and the Government should stimulate stock market. The SEBI, therefore, reintroduced badla (forward trading) on July 27, 1995. Now, with the introduction of derivatives in stock market the same purpose is served by the derivatives called futures as the old badla system.

The Bombay Stock Exchange is one of the 15 recognized Stock Exchanges in India. This Stock Exchange is popularly known as Dalai Street Stock Market. It handles around three-fourth of the total trading in securities in India.

The number of companies listed on the Bombay Stock Exchange at the December-end 1993 was 3,585. Thus number of listed companies was even larger than in the developed countries stock markets of Japan, UK, Germany. Canada and France. During the last two years several reform measures have been taken with regard to the working of secondary market. The important changes are explained below.

ADVERTISEMENTS:

Rajiv Gandhi Equity Savings Scheme:

On 23rd November 2012, the government notified a new tax saving scheme called the Rajiv Gandhi Equity Savings Scheme (RGESS), exclusively for first-time retail investors in the securities market. This scheme provides 50 per cent deduction of the amount invested from taxable income for that year to new investors who invest up to Rs. 50,000 and whose annual income is below Rs. 10 lakh. The operational guidelines were issued by SEBI on 6 December 2012.

Electronic Voting Facility made mandatory for top listed companies:

As mandated in the Union Budget 2012-13 for top listed companies to offer electronic voting facility to their shareholders, SEBI has come out with the necessary amendments in this regard on 13 July 2012, to be incorporated in the equity listing agreement by stock exchanges. To make a beginning, based on market capitalization, electronic voting is now mandatory for the top 500 listed companies at the BSE and NSE, in respect of those businesses to be transacted through postal ballot.

SME Exchange/Platform:

Separate trading platforms for SMEs were launched and became functional at the BSE and NSE in March 2012 and September 2012 respectively. As on 14 January 2013, the number of equities listed on the BSE and NSE SME platforms is 12 and 2 respectively.

ADVERTISEMENTS:

Reduced Securities Transaction Tax for cash delivery transactions:

Following the announcement in Union Budget 2012-13, the rate of the securities transaction tax (STT) has been revised downwards by 20 per cent to 0.1 per cent from 0.125 per cent for delivery-based transactions in the cash market, effective 1 July 2012.

Regulatory framework for governance and ownership of stock exchanges, clearing corporations, and depositories:

Based on the recommendations of the Dr. Bimal Jalan Committee, new Securities Contracts (Regulation) (Stock Exchanges and Clearing Corporations) Regulations 2012 were notified on 20 June 2012 to regulate recognition, ownership, and governance in stock exchanges and clearing corporations, Further, the Securities and Exchange Board of India (Depositories and Participants) (Amendment) Regulations 2012 have been brought into effect from 11 September 2012 to regulate ownership and governance norms of depositories.

Expansion of Qualified Foreign Investors (QFIs) Scheme:

In Budget 2011-12, the government, for the first time, permitted qualified foreign investors (QFIs), who meet the know-your-customer (KYC) norms, to invest directly in Indian MFs. In January 2012, the government expanded this scheme to allow QFIs to directly invest in Indian equity markets.

Taking the scheme forward, as announced in Budget 2012-13, QFIs have also been permitted to invest in corporate debt securities and MF debt schemes subject to a total overall ceiling of US $ 1 billion. In May 2012, QFIs were allowed to open individual non-interest-bearing rupee bank accounts with authorized dealer banks in India for receiving funds and making payment for transactions in securities they are eligible to invest in. In June 2012, the definition of QFI was expanded to include residents of the member countries of the Gulf Cooperation Council (GCC) and European Commission (EC) as the GCC and EC are the members of the Financial Action Task Force (FATF).

Initiatives to attract FII Investment:

As regards FII investment in debt securities, there has been progressive enhancement in the quantitative limits for investments in various debt categories. In June 2012, the FII limit for investment in G-Secs (government securities) was enhanced by US $ 5 billion, raising the cap to US $ 20 billion. The scheme for FII investment in long-term infra bonds has been made attractive by gradual reduction in lock-in and residual maturity periods criteria.

In November 2012, the limits for FII investment in G- Sees and corporate bonds (non-infira category) have been further enhanced by $ 5 billion each, taking the total limit prescribed for FII investment to US $ 25 billion in G-Secs and US $ 51 billion for corporate bonds (infra + non-infra). FII debt allocation process has also been reviewed for bringing greater certainty among foreign investors and helping them periodically re-balance their portfolios in sync with international portfolio management practices.

Establishment of National Stock Exchange:

An important step to provide efficient and transparent stock market culminated into the establishment of National Stock Exchange of India (NSEI) in July 1994. The NSEI opened membership to 13 cities, including Bombay, the commercial capital of India. The NSEI operates in its two segments: (i) Wholesale Debt Market (WDM) and (ii) Capital Market (CM): In the Wholesale Debt Market. Government Securities, Treasury Bills, Public Sector Undertaking (PSU) bonds, Certificates of Deposits, Commercial Papers and Corporate Debentures are traded in.

The main participants in this market are banks., financial institutions and large corporate firms. The RBI has directed banks to use only the NSEI for all transactions in debt securities instead of using the services of brokers so as to ensure transparent and regulated deals.

In the capital market, segment of NSEI, equities are traded in. In the capital market segment of NSEI, the number of securities admitted to trading has expanded from 200 to start with to 525 by December 1994. Thus, the National Stock Exchange of India (NSEI), with its scrip-less trading system, can be regarded as a milestone in the development of stock market in India.

In short, stock exchanges, as secondary market in industrial securities, furnish an important mechanism of imparting liquidity in Indian capital market. Of late, SEBI has evolved certain guidelines of rules and regulations to make stock exchanges to function in accordance with the principle of safety of the market, transparency and investor protection. The liberalisation, privatization and globalisation (LPG) of Indian economy has led to the increase in volume of business in industrial securities in both the New Issue Market and Secondary Market (stock exchange) of Indian capital market.

Government Securities Market:

The term ‘gilt edged’ means the ‘best quality’. Since Government Securities are of best quality in the sense of liquidity and zero degree of the risk of default, so these are called gilt-edged securities. In the Gilt-edged Market, the securities of the Government of India and of the State Governments are traded in. The securities guaranteed (as to both principal and interest) by the Government are also traded in this market.

The importance of Government Securities Market, that is, Gilt-edged Market, as a segment of the capital market, emanates from the fact that this market provides a mechanism for the management of public debt and open market operations to the Reserve Bank of India (RBI). It is, therefore, imperative to emphasize that this market has a strong bearing on the formulation of the fiscal policy of the Government of India and the monetary policy of RBI. The Gilt-edged Market has two segments: Treasury Bill Market and Government Bond Market.

The Treasury Bill Market is a source of short term funds for the Government. A Treasury Bill is a promissory note, that is, a liability of the Government of India. The Treasury Bills are of the maturity period of 91 days, 182 days and 364 days. The RBI sells Treasury Bills on behalf of the Government of India. It is important to point out that RBI is the chief holder of these bills. Outside it, commercial banks hold these bills. Thus, the Treasury Bills Market is a captive market.

The Indian Treasury Bills Market is underdeveloped as compared to U.S.A. and U.K. However, recently RBI has initiated certain reforms in the Treasury Bill Market to transform its captivity character to broad-based market character. The RBI reduces its holdings of Treasury Bills by converting them into dated-Government Securities at market-related interest rates.

The 364 days Treasury Bills are entirely held by the market. The Government of India’s borrowings from RBI through Treasury Bills to cover budget deficit is called monetisation of deficit. In order to contain direct and automatic monetisation of budget deficit, the Finance Secretary, Government of India and the Governor, Reserve Bank of India signed an agreement on September 9, 1994 to limit borrowing through ad hoc Treasury Bills to Rs. 6000 crore in 1994-95. It is an important step to strengthen the efficacy of monetary management by RBI. It would also help to control inflation in the economy.

‘The Government Bond Market is a source of long-term funds to the Government of India and State Governments. The Government bonds are dated securities which are floated to raise medium and long-term loans in the open market. It is significant to note that it is generally the institutions, instead of individuals, that are the buyers of Government bonds.

It is due to relatively lower interest rate, long maturity period and face value in high denominations that the individuals are found to be reluctant to invest their funds in Government bonds. The institutions like commercial banks, LIC and G1C buy the Government bonds to build up their asset portfolio.

These institutions invest in Government bonds as they are required by law to invest a certain minimum proportion of their total funds in these bonds. Left to themselves, they would not like to buy these bonds owing to low interest rate on them. The RBI, as a manager of public debt, operates on the supply side of the Government bond market. At the end of the subscription period, RBI holds the stock of unsold Government bonds and keeps them selling on its own account.

The Government bond market is a captive market. The RBI is launching a system of primary dealers for deepening and expanding the Government bond market. The Securities Trading Corporation of India was set up in 1993-94 to develop the secondary market in Government securities.

Growth of Central Government’s Securities:

The growth of Securities Market is an integral part of the process of economic growth in a free market economy. Of late, the RBI and the Government of India have pursued certain measures to reform the Securities market. These reforms have been introduced in both the New Issue Market and the Secondary Market of industrial securities and Government securities.

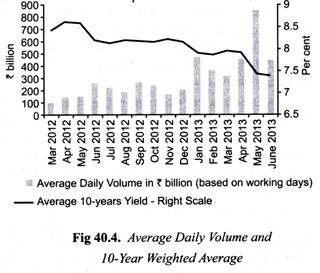

The average daily trading volume of central government securities in the secondary market increased to around Rs.570 billion during Q1 of 2013-14 from Rs. 376 billion during Q4 of 2012-13. The traded volume in G-secs generally varied inversely with G-sec yields.

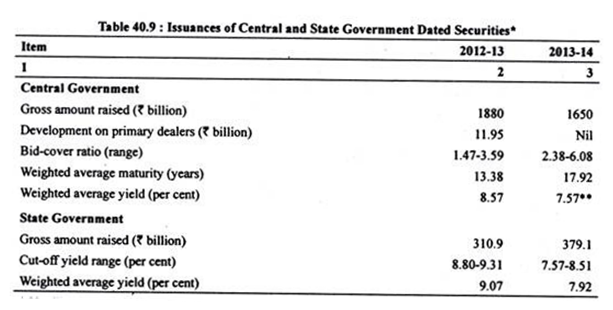

The gross market borrowings of the central government through dated securities during 2013-14 were to the tune of Rs.2,100 billion (net borrowings of Rs. 1,972 billion) up to July 26, 2013 compared with Rs. 2,340 billion (net borrowings of Rs.1, 594 billion) during the corresponding period of the previous year.

The weighted average maturity of the dated securities increased to 14.96 years from 13.62 years during the corresponding period of the previous year. The weighted average yield during the primary auctions eased to 7.64 per cent from 8.52 per cent during the corresponding period of the previous year.

The weighted average yield during the primary auctions eased to 7.64 per cent from 8.52 per cent during the corresponding period of the previous year (Table 40.9). The bid-cover ratio stood in the range of 1.41-6.09 as against 1.47-3.59 during the corresponding period of the previous year. The government availed of ways and means advances (WMA) on three occasions up to end-June 2013. As on July 16, 2013 the outstanding WMA position of the government was Rs. 3.06 billion.

During 2013-2014 (up to July 16, 2013), 18 states have raised Rs. 401.2 billion on a gross basis (net amount of Rs. 252.3 billion) compared with Rs. 419.8 billion (net amount of Rs. 369.6 billion) raised by 20 states during the corresponding period of the previous year. The weighted average yield eased to 7.98 per cent up to July 16, 2013 from 9.01 per cent during the corresponding period of the previous year.