The below mentioned article provides notes on corporate bond market in India.

In pursuance of the guidelines of the High Level Expert Committee on Corporate Bonds and Securitisation (December 2005) and the subsequent announcement made in the Union Budget 2006- 07.

SEBI authorized BSE (January 2007), NSE (March 2007) and Fixed Income Money Market and Derivatives Association of India (FIMMDA) (August 2007) to set up and maintain corporate bond reporting platforms for capturing all information related to trading in corporate bonds as accurately as possible.

In the second phase of development, BSE and NSE put in place corporate bonds trading platforms in July 2007 to enable efficient price discovery in the market. Reflecting these developments, trading in corporate bonds increased significantly in terms of number of issues and amount raised through them.

ADVERTISEMENTS:

Economy vibrancy coupled with sophisticated state-of-the-art financial infrastructure has contributed to rapid growth in the equity markets in India. In terms of market features and depth the Indian equity market ranks among the best in the world. In parallel, the Government securities market has also evolved over the years and expanded given the increasing borrowing requirements of the Government. In contrast, the corporate bond market has languished both in terms of market participation and structure. Non-bank finance companies are the main issuers and very small amounts of finance are raised by these companies directly.

There are several reasons for this:

(i) Predominance of bank loans;

(ii) FII’s participation is limited;

ADVERTISEMENTS:

(iii) Pensions and insurance companies and households are limited participants because of lack of investor confidence; and

(iv) Crowding out by Government bonds.

The corporate bond market as a result is only about 14 per cent of the total bond market; and market liquidity and infrastructure remain constrained. With the implementation of the Patil Committee recommendations, the corporate bond market is slowly evolving. With bank finance drying up for long-term infrastructure projects in view of asset liability problems faced by banking system, the need for further development of a deep and vibrant corporate bond market can hardly be overemphasized.

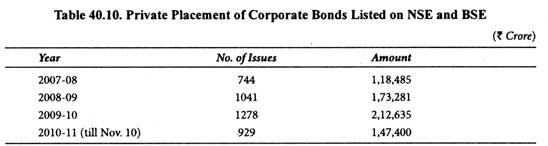

The following table shows the status of corporate bond market in India:

Earlier initiatives taken for development of corporate bond market in India:

1. Regulatory jurisdiction over corporate bond market has been clearly defined and placed under SEBI. SEBI (Issue and Listing of Debt Securities) Regulations, 2008 simplified disclosures and listing requirements. A minimum market lot criterion has been reduced from Rs. 10 lakhs to Rs. 1 lakh to encourage retail investors.

2. The limit of FIIs investment in corporate bonds has been increased to US$ 20 billion from the existing limit of US$ 15 billion and the incremental limit of US$ 5 billion has to be invested in corporate bonds with residual maturity of over five years.

3. BSE, NSE and FIMMDA have set up reporting platforms. Aggregate data reported on these platforms is disseminated to the public. Summary data is available on SEBI website. Repos in corporate bonds have been permitted, following RBI guidelines, since March 2010. Exchange traded interest rates futures were introduced in August 2009.

4. Draft Credit Default Swap, (CDS) guidelines have been released by RBI h. July. 2010.

5. The Finance Act, 2008 (with effect from 01.06.2008) mandated that no TDS (tax deduction at source) would be deducted from any interest payable on any security issued by a company, where such security is issued in dematerialized form and is listed on a recognized stock exchange in India. The stamp duty on items in Central List (debentures and bonds in the nature of promissory note) have been brought down and made uniform.

6. Clearing and Settlement through clearing corporations have been mandated for trades between specified entities, namely, mutual funds, foresight institutional investors, venture capital funds etc. Clearing and Settlement is on DvPI basis.

Suggested initiatives to be taken for further development of corporate bond market (Agency responsible is indicated in bracket):

1. Clearing and settlement on DvP (Delivery versus Payment) III basis. Market making with primary dealers. Enabling credit default Swap. Allowing banks to do credit enhancement- Guaranteeing of corporate bonds by banks. Relaxing norms on short-selling of Government bonds. (RBI)

ADVERTISEMENTS:

2. Relaxing norms for use of shelf prospectus requires amendment to Section 60 of Companies Act (MCA).

3. Empowering bond holder under SARFAESI (Department of Financial Services, RBI).

4. Creating of a comprehensive bond data base (RBI, SEBI, FIMMDA).

5. Amendment to Section 9 of the Stamp Act to lower stamp duties across states and make them uniform (Department of Revenue).

ADVERTISEMENTS:

The yield on corporate debt paper (with AAA rating) for five-year maturity ranged between 8.13 per cent and 11.64 per cent during 2008-09.The spread between yield on five-year Gol bonds and Indian corporate debt paper (AAA rating) with five-year maturity, which had moved in a range of 133-223 basis points between April-August 2008, widened thereafter to reach as high as 416 basis points in November 2008, which reflected tight liquidity conditions in the market. However, it narrowed down from December 2008 and was around 200 basis points by the end of March 2009.