In this article we will discuss about:- 1. Meaning of Capital Investment Projects 2. Classification of Investment Projects 3. Importance and Use of Capital Budgeting 4. The Goal of Capital Investment 5. Conditions for Maximisation of the Value of the Firm 6. Evaluation of Capital Investment Projects.

Meaning of Capital Investment Projects:

Capital investment projects are those business projects that would give the company returns for more than a year in future. Decisions regarding planning for different investment projects, collection of funds, and distribution of the money over different projects are called capital budgeting or capital investment decisions.

Establishment of new factories, purchase of machines, means of transport or computers—all these may be the objects of capital investment projects. Expenditures for research and development or those on advertisement programmes may also be called investment expenditures, if, however, returns are to be obtained from these expenditures for more than a year.

Classification of Investment Projects:

Investment projects may be divided into different classes:

ADVERTISEMENTS:

(i) Investment planning for reduction in expenditures—for example, planning for the training of the employees.

(ii) Investment projects for increasing production—for example, planning for installation of new plants or for expansion of the existing plant.

(iii) Planning for expansion through innovations of new products and/or new markets.

(iv) Planning for compliance with government regulations in respect of security, environment, etc.

Importance and Use of Capital Budgeting:

ADVERTISEMENTS:

From the definition of capital budgeting or capital investment decisions, it can be easily understood that the importance and usefulness of capital budgeting to a modern business firm cannot be overestimated.

The main reasons for this are:

(i) Usually, a huge sum of money is involved in each investment decision and, in general, the decisions are irreversible. That is why in the event of a correct decision, the firm can earn profit for a long period, but if, on the other hand, the decision proves to be wrong, it would have to suffer losses for a long time. That is, every investment decision has a long-term significance.

(ii) If the firm wants to undertake an investment project, then generally, it would have to borrow money to bear the cost of that investment. On the other hand, the firm has to get over the uncertainties of the business world to make that investment profitable. Efficient capital budgeting is one of the main instruments which can ensure the profitability of the project.

ADVERTISEMENTS:

(iii) It is clear from the above discussion that every investment decision of the firm increases the risk-bearing of the firm. Because of this also, the firm has to minimise the risk- bearing with help of a systematic capital budgeting.

The Goal of Capital Investment:

The firm intends to increase and maximise its value. By the value of the firm, we mean the present value of the net profit that the firm expects to earn in different periods in future.

Therefore, we may write:

Here Rt = revenue of the firm in the t-th period

Ct = Cost in period t

r = rate of discount used to obtain present value of profit to be earned in future (0 < r < 1).

This rate is the opportunity cost of the investible capital resources of the firm.

n (years) = Life of the firm.

Conditions for Maximisation of the Value of the Firm:

ADVERTISEMENTS:

The firm invests capital with a view to increasing its value. That is why it distributes its investment over different projects in such a way that its profits are maximised.

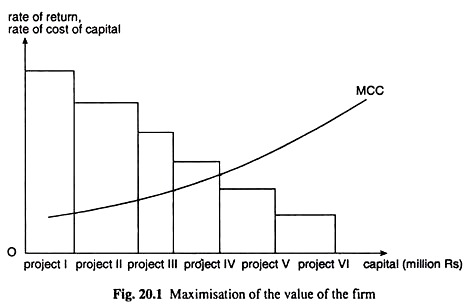

Since the goal of the firm is to maximise profit, it goes on increasing its investment so long as the marginal returns from investment are greater than marginal costs of capital. But if the latter becomes greater than the former, the firm withdraws the marginal dose of investment. We can explain the point with the help of Fig, 20.1.

In Fig 20.1, we have constructed different adjacent rectangular pillars for the different investment projects. The base of a pillar represents the costs of the corresponding investment project and the height of the pillar represents the rate of return that is obtained from the project.

ADVERTISEMENTS:

The curve MCC, on the other hand, is the curve for marginal cost of capital. In Fig. 20.1, we see that the rates of return obtained from the first four projects are greater than the marginal cost of capital (MCC). But for the projects that come after the fourth project, the rates of return are smaller than MCC.

Therefore, here the firm would decide to invest in the first four projects. Only then the firm’s profit would be maximised. That is, the firm, if it wants to maximise profit, would have to invest in those projects only for which the rate of return is greater than MCC.

Evaluation of Capital Investment Projects:

Properties of a Good Evaluation Method:

A good method of project evaluation should do the following jobs:

ADVERTISEMENTS:

(i) The flows of incomes and expenditures that are expected, should all be considered.

(ii) The opportunity cost of capital on the basis of which investment decisions are made, should be used as the discount rate to calculate the present value of all future revenue and cost estimates.

(iii) If only one among the different alternative projects has to be selected, then the most profitable one should be chosen so that the value of the firm might increase to the maximum possible extent.

(iv) Each project should be separately (i.e., independent of any alternative project) evaluated.