The upcoming discussion will update you about the difference between functional distribution and personal distribution.

In the theory of distribution we are concerned with the functional distribution of income (i.e., how national income is divided among workers, landowners, capitalists) and not with the size distribution of income (i.e., whether the rich are getting richer and the poor poorer).

The functional and the size distribution of income:

The functional distribution of income refers to the amounts of income paid to various individuals or households. A single individual may receive income from more than one factor of production or from one source. A man may get income by offering his labour service, from renting his property (land or building) and from his holdings of company shares or government bonds.

ADVERTISEMENTS:

When income is classified according to the size of income received by each households irrespective of the sources of that income, we are dealing with the size distribution of income. Progressive income taxes are imposed and subsidies are paid to reduce income inequality.

According to neo-classical theory, the income of any factor of production (and hence the amount of the national product that it is able to command) depends on the price that is paid for the factor and the amount that is purchased or hired.

For instance, total wage income = the wage rate x the number of workers employed. Thus factor pricing and income distribution are interrelated. If the wage rate rises and more workers are employed at a higher wage, the share of labour in national income will also rise and workers will now be able to buy those things which they could not previously afford.

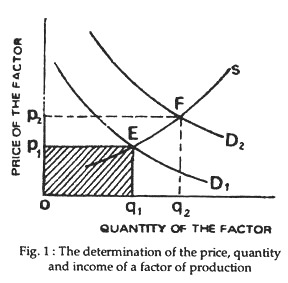

The market price of any commodity like carrots is determined by the impersonal forces of demand and supply. In Fig. 1 the demand and supply curves for some factor of production are D1 and S. The equilibrium price and quantity are p1 and q1, respectively. The total income earned by the factor is indicated by the area Op1Eq1 (which is op1 x oq1).

Our analysis of factor-pricing and income distribution is based on the assumption that the prices of all other factors of production the prices of all goods, and the level of national income are given constants’ Fluctuations in the equilibrium price and quantity may cause fluctuations in the return to the factor, in its relative earnings (compared to other factors) and in the share of national income going to the factor.

Suppose, for instance that the demand curve for the factor in question shifts from D1 to D2. Now the price of the factor rises from P1 to p2 and the relative price rises from p1/f to p2/f where f is the given average price of all other factors.

The total earnings rise from p1q2 to p2q2 and if the total income in the whole economy remains constant at a then the share of income going to this factor rises from P1q1/a to p2q2/a. This is the essence of the free-market determination of a factor’s price and its share of national income.

Thus to quote Lipsey:

ADVERTISEMENTS:

“According to neo-classical theory the problem of distribution in a free-market society can be reduced to the question of the determinants of the demand and supply of factors of production, plus the problem of determining the effect of the departures from a free market caused by such forces as monopolistic organisations, government action and unions.”