Let us make an in-depth study of the similarities and differences between Harrod and Domar model.

Similarities between Harrod and Domar Model:

1. Both Harrod and Domar models are based on Keynesian investment equality as a condition of steady growth.

2. Both the models are designed in terms of experimental equilibrium path.

3. Both models agree to the maintenance of full-employment rise in income is much needed so that extra quality of production is utilized.

ADVERTISEMENTS:

4. Harrod and Domar have almost similar assumptions for their models as of attainment of full-employment, closed economy, no time lag, lack of government interference and marginal and average savings are equal etc.

5. Both accept income rise Y = S/Cr.

6. In both models, initial point is to achieve investment rise and the last is to attain full-employment.

7. Harrod and Domar, both feel for the introduction of dynamic element for attaining steady growth in an economy.

ADVERTISEMENTS:

8. Both, Harrod and Domar, are familiar with the Keynesian difficulties.

Differences between Harrod and Domar Model:

Though both models evolved similar conditions, yet there are few dissimilarities in both.

The points of differences are explained as under:

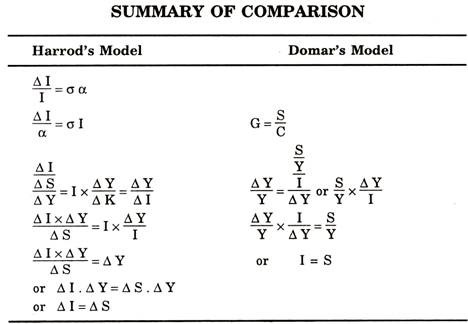

1. Harrod uses the marginal capital output ratio (MCOR) and the accelerator. But Domar uses the reciprocal of marginal capital output ratio and the multiplier.

ADVERTISEMENTS:

2. The marginal propensity to save in Domar model is represented by Greek letter Alpha (α) and in Harrod’s model, it is represented by Sigma (σ), but both represent propensities to save expressed as ratios.

3. Domar relates investment forward to the increase in income but Harrod is concerned with the way the investment is traced back to the rate of income.

4. Harrod uses three distinct rates of growth i.e. actual rate (G), warranted rate (Gw) and natural rate (Gn) while Domar uses one growth rate.

5. Harrod assumes a certain behaviour pattern for entrepreneur which induces investment but in Domar’s model, no such behaviour pattern for entrepreneurs has been mentioned.

6. Domar’s model is based on balanced technique of growth while Harrod’s growth model moves from balanced technique to balanced technique.

7. Harrod’s model is based on the principle of acceleration, while Domar’s model of growth is based on the principle of multiplier.

8. For Harrod, the business cycle is an integrated part of the path of growth and for Domar, it is not so but is accommodated in his model by allowing σ (average productivity of investment) to fluctuate.

9. Harrod and Domar have employed the same acceleration coefficients with only different symbols. Harrod’s acceleration coefficient is called psychological and that of Domar’s technological one. When income increases, the producers psychology would be to make net investment C times of that increase.

It is the producer’s psychology that determines how much investment should be made. Hence Harrod’s accelerator is psychological.