For the determination of the par values of different currencies, alternative theoretical explanations have been given.

Some of the prominent explanations or theories include: 1. Mint Parity Theory 2. The Purchasing Power Parity Theory 3. The Balance of Payments Theory 4. The Monetary Approach to Foreign Exchange 5. Portfolio Balance Approach.

1. The Mint Parity Theory:

The earliest theory of foreign exchange has been the mint parity theory. This theory was applicable for those countries which had the same metallic standard (gold or silver). Under the gold standard, countries had their standard currency unit either of gold or it was freely convertible into gold of a given purity.

The value of currency unit under gold standard was defined in terms of weight of gold of a specified purity contained in it. The central bank of the country was always willing to buy and sell gold upto an unlimited extent at the given price. The price at which the standard currency unit of the country was convertible into gold was called as the mint price.

ADVERTISEMENTS:

Suppose the official price of gold in Britain was £ 20 per ounce and in the United States it was $ 80 per ounce, these were the mint prices of gold in the two countries. The rate of exchange between these two currencies would be determined as £ 20 = $ 80 or £ 1 = $ 4.

This rate of exchange determined on weight-to-weight basis of the metallic contents of currencies of the two countries was called mint par of exchange or the mint parity. So the mint par values of the two currencies determined the basic rate of exchange between them.

Under the gold standard, the balance of payments adjustments were made through the free international flows of gold. The export and import of gold involved costs of packing, freight, insurance, interest etc. Consequently, the actual rate of exchange between two currencies could vary above and below the mint parity by the extent of cost of gold export.

In order to illustrate it, the supposition is taken that the U.S. has a BOP deficit with Britain. It is adjusted through the export of gold to Britain. The mint parity between pound and dollar is £ 1 = $ 4. The cost of exporting gold including freight, insurance, packing, interest etc. of gold worth $ 4 is 0.04 dollar. So the U.S. importers have to pay 4.04 dollars (4+.04) for each pound.

ADVERTISEMENTS:

No U.S. importer will pay more than 4.04 dollars for one British pound because he can buy 4 dollar worth of gold from the U.S. treasury and transport it to Britain and obtain 1 pound in exchange of that.

Therefore, the exchange rate between dollar and pound at the maximum can be £ 1 = $ 4.04. This exchange rate signifies U.S. gold export point or upper specie point. Similarly, the exchange rate of pound could not fall below $ 3.96 dollars, in case the United States had a BOP surplus resulting in flow of gold from Britain to that country.

If the rate of exchange were lower than £ 1 = $ 3.96, the exporter would have preferred to import gold from Britain. This rate of exchange (£ 1 = $ 3.96) is the U.S. gold import point or lower specie point. The upper and lower specie points prescribe the limits within which the fluctuation can take place in the market rate of exchange.

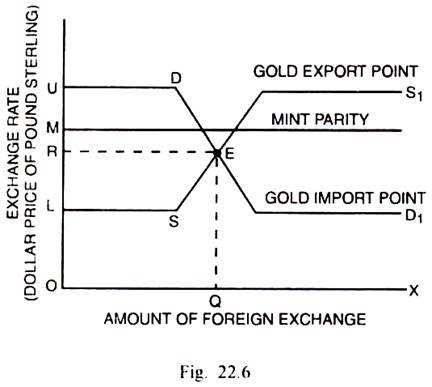

The determination of the rate of exchange, according to mint parity theory, can be explained through Fig. 22.6.

In Fig. 22.6, the amount of foreign exchange is measured along the horizontal scale and the exchange rate is measured along the vertical scale. DD1 and SS1 are the demand and supply curves of foreign exchange. The equilibrium market rate of exchange between dollar and pound sterling is determined by the intersection of DD1 and SS1 curves at E.

The equilibrium rate of exchange is OR at which the quantity of foreign exchange demanded and supplied is OQ. The horizontal line drawn at M denotes mint-parity (£ 1 = $ 4). The mint parity and market rate of exchange do not necessarily coincide.

The horizontal lines drawn at U and L denote the gold export point or upper specie point and gold import point or lower specie point respectively. The horizontal portion S1 of the supply curve SS1 corresponds with the upper specie point.

It indicates that no American would pay more than $ 4.04 for each pound. He can get any quantity of pounds at the price of $ 4.04 by exporting gold so that the supply function becomes horizontal or perfectly elastic at the upper specie point. D1 part of the demand function DD1 is again horizontal and it corresponds with the lower specie point L.

At the exchange rate £ 1 = $ 3.96, there can be an unlimited demand for pounds by the Americans so that the demand curve becomes perfectly elastic at the lower specie point. If the rate of exchange falls below the lower specie point, the U.S. will prefer to import gold from Britain. It, therefore, lies down that the rate of exchange can lie only within the limits of the upper and lower specie points or within the gold-export and gold-import points.

The mint parity theory of foreign exchange rate highlighted two important facts. Firstly, the actual rate of exchange can differ from the equilibrium rate of exchange. Secondly, under gold standard, there are specified limits beyond which the fluctuations in the rate of exchange cannot take place.

The mint parity theory was severely criticized on the various grounds. Firstly, the international gold standard has been completely abandoned since its breakdown under the weight of depression of 1930’s. It is, therefore, unrealistic to analyse the rate of exchange presently in terms of mint parities. Secondly, the theory presupposed the free international gold movements.

The modern governments do not permit the free buying and selling of gold internationally. In these circumstances, the mint parity theory of exchange rate has little relevance. Thirdly, most of the countries at present are having inconvertible paper currencies. In such a system, the mint parity theory cannot at all determine the rate of exchange.

In view of the above shortcomings, the traditional mint-parity theory does not have any practical significance in the field of determination of foreign exchange rate. It is absolutely not more than an academic exercise in the modern times.

2. The Purchasing Power Parity Theory:

ADVERTISEMENTS:

The purchasing power parity theory enunciates the determination of the rate of exchange between two inconvertible paper currencies. Although this theory can be traced back to Wheatley and Ricardo, yet the credit for developing it in a systematic way has gone to the Swedish economist Gustav Cassel.

This theory states that the equilibrium rate of exchange is determined by the equality of the purchasing power of two inconvertible paper currencies. It implies that the rate of exchange between two inconvertible paper currencies is determined by the internal price levels in two countries.

There are two versions of the purchasing power parity theory:

(i) The Absolute Version and

ADVERTISEMENTS:

(ii) The Relative Version.

(i) The Absolute Version:

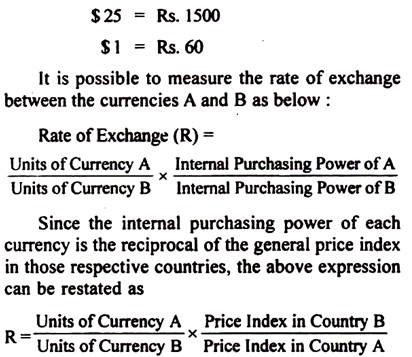

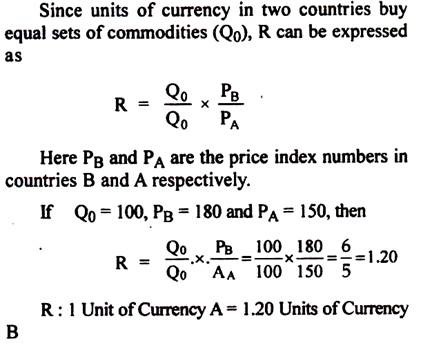

According to this version of the purchasing power parity theory, the rate of exchange should normally reflect the relation between the internal purchasing power of the different national currency units. In other words, the rate of exchange equals the ratio of outlay required to buy a particular set of goods at home as compared with what it would buy in a foreign country. It may be illustrated with an example.

Suppose 10 units of commodity X, 12 units of commodity Y and 15 units of commodity Z can be bought through spending Rs. 1500 and the same quantities of X, Y and Z commodities can be bought in the United States at an outlay of 25 dollars. It signifies that the purchasing power of 25 dollars is equivalent to that of Rs. 1500 in their respective countries. That can form the basis for determining the rate of exchange between rupee and dollar.

ADVERTISEMENTS:

The exchange rate between them can be expressed as:

The absolute version of the purchasing power parity theory is, no doubt, quite simple and elegant, yet it has certain shortcomings. Firstly, this version of determining exchange rate is of little use as it attempts to measure the value of money (or purchasing power) in absolute terms. In fact, the purchasing power is measured in relative terms. Secondly, there are differences in the kinds and qualities of products in the two countries.

These diversities create serious problem in the equalisation of product prices in different countries. Thirdly, apart from the differences in quality and kind of goods there are also differences in the pattern of demand, technology, transport costs, tariff structures, tax policies, extent of state intervention and control and several other factors. These differences prohibit the measurement of exchange rate in two or more currencies in strict absolute terms.

(ii) The Relative Version:

ADVERTISEMENTS:

The relative version of Cassel’s purchasing power parity theory attempts to explain the changes in the equilibrium rate of exchange between two currencies. It relates the changes in the equilibrium rate of exchange to changes in the purchasing power parities of currencies. In other words, the relative changes in the price levels in two countries between some base period and current period have vital bearing upon the exchange rates of currencies in the two periods.

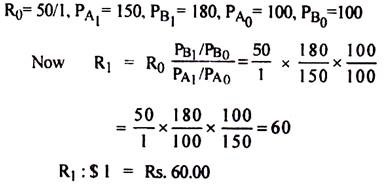

According to this version, the equilibrium rate of exchange in the current period (R1) is determined by the equilibrium rate of exchange in the base period (R1) and the ratio of price indices of current and base period in one country to the ratio of price indices of current and base periods in the other country.

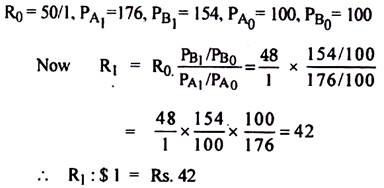

In the above expression, R1 is the rate of exchange in the current period and R0 is the rate of exchange in the base period or the original rate of exchange. PB1 and PB0 are the price indices in country B in the current and base periods respectively. PA1 and PA0 are the price indices in the current and base periods respectively in the country A.

To illustrate, it is supposed that the original or base period rate of exchange between rupee and dollar was $ 1 = Rs. 50. The price index in India (country B) in the current period (PB1) is 180 and the price index in the U.S.A. (country A) in the current period is 150. The price indices of two countries in the base period were 100.

It shows that rupee has depreciated while dollar has appreciated between the two periods.

ADVERTISEMENTS:

If the price level in India (B) has risen between the two periods at a relatively lesser rate than in the U.S.A., the exchange rate of rupee with dollar will appreciate. The dollar on the opposite will show some depreciation.

It is illustrated through the following hypothetical example:

Thus rupee has appreciated while the dollar has depreciated between the two time periods.

It is, of course, true that the purchasing power parity between the two currencies is determined by the quotient of their respective purchasing power. This parity is modified by the cost of transportation including freights, insurance and other charges. These costs lay down the limits within which the rate of exchange will fluctuate.

ADVERTISEMENTS:

The upper limit is called as the commodity export point whereas the lower limit is termed as the commodity import point. These limits are not fixed as the gold specie points. Since the purchasing power parity itself is a moving parity on account of the price variations in the two countries, the limits within which it fluctuates are also of a moving character.

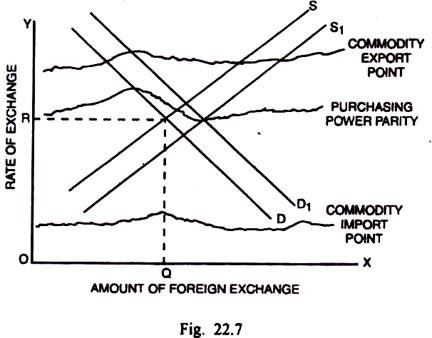

The purchasing power parity theory is explained through Fig. 22.7.

In Fig. 22.7, the purchasing power parity curve is of a fluctuating character. It signifies a moving parity. Along with it, the curves indicating commodity export and commodity import points also fluctuate. The market rate of exchange is determined by the intersection of demand curve DD and supply curve SS of foreign exchange.

The market rate of exchange is OR and the quantity of foreign exchange demanded and supplied is OQ. When the demand for and supply of foreign exchange change, the demand and supply curves can undergo shifts as shown by D1 and S1 curves.

Accordingly, there will be variations in the market rate of exchange around the normal rate of exchange determined by the purchasing power parity. The market rate of exchange, however, will invariably lie between the limits specified by the commodity export and commodity import points.

ADVERTISEMENTS:

Criticism:

The purchasing power parity theory has met with severe criticism from the economists on the following main grounds:

(i) Direct Functional Relation between Exchange Rate and Purchasing Powers:

This theory assumes a direct functional relation between the purchasing powers of two currencies and the exchange rate. In practice, there is no such precise link between the purchasing power of the currency and the rate of exchange. Apart from the purchasing power, the rate of exchange is influenced by several other factors such as capital flows, BOP situation, speculation, tariff structures etc. The purchasing power parity theory overlooks all these influences.

(ii) General Price Level:

The PPP theory determines the rate of exchange through the indices of general price levels in the two countries. Since the general price level is inclusive of prices of domestically and internationally traded goods, the theory rests upon the implicit assumption that the prices of these two categories of goods vary equi-proportionately and in the same direction in both the countries. But it is often found that the prices of internally and internationally traded goods move disproportionately and sometimes even in opposite directions.

Therefore, critics suggested that the rate of exchange should be related to the price indices based upon the internationally traded goods. According to them, the prices of commodities produced and used only in the home country can have no impact on the foreign exchange rate. Keynes has, however, objected to such thinking. According to him, “Confined to internationally traded commodities, the purchasing power parity theory becomes an empty truism.”

(iii) Problems in the Construction of Price Index Numbers:

The major objection against the PPP theory is concerned with the use of price- indices as the basis for measuring the purchasing power of currencies in different countries. The price index numbers are of different kinds that raises the preliminary problem of the choice of the most appropriate price index.

Another problem is that the price index numbers of two countries may not be comparable on account of difference in base period, choice of commodities and their varieties, averages and weights assigned to different items. Given such diverse problems in the construction of price index numbers in two countries, it seems difficult to have a true measure of the purchasing power parity.

(iv) Relationship between Price Level and Exchange Rate:

The PPP theory suggests that the change in price level is the cause and the change in exchange rate is an effect. The changes in prices induce the changes in exchange rates. The theory repudiates that changes in exchange rates can cause changes in price level. In fact the chain of causation in the PPP theory is faulty and misleading. Depreciation in exchange rate can stimulate exports and restrict imports. The reduced supplies for domestic market are likely to push up prices in the home country.

In foreign country the prices are likely to fall. Thus the exchange rate changes may induce the changes in price level. In this context, Halm pointed out that domestic prices follow rather than precede the movement of exchange rate. In his words, “A process of equalisation through arbitrage takes place so automatically that the national prices of commodities seem to follow rather than to determine the movement of the exchange rate.”

(v) Neglect of Capital Account:

This theory can be applicable to only those countries in case of which the BOP is constituted only by the merchandise trade account. It overlooks completely, the capital transactions and hence is not relevant for those countries in case of which the capital account is of prime significance. In this context, Kindelberger remarked that the PPP theory was designed for trader nations and gives little guidance to a country which is both a trader and a banker.

(vi) Presumption of BOP Equilibrium:

In its relative version, the PPP theory presumes that the BOP in the base period was in equilibrium. Given this assumption, the theory proceeds to determine new rate of exchange. Such an assumption may not be true. It may be difficult to locate such a base period because the given country might have been faced with a permanent BOP disequilibrium.

(vii) No Structural Changes:

This theory assumes that there are no structural changes in the factors which underlie the equilibrium in the base period. Such factors include changes in tastes or preferences, productive resources, technology etc. The assumption related to constancy of structural factors is clearly unrealistic and the exchange rate is bound to be affected by the changes in these factors.

(viii) Absence of Capital Movements:

The PPP theory related exchange rate exclusively to the internal price changes in the two countries. It, thereby, assumed implicitly that there were zero capital movements. Such an assumption is completely invalid. The changes in capital flow have significant bearing upon the exchange rate, through their effects upon the demand for and supply of domestic and foreign currencies. The impact of capital movements upon the rate of exchange had been neglected by this theory.

(ix) Neglect of Elasticity of Reciprocal Demand:

Another defect in the PPP theory, exposed by Keynes, was its failure to consider the elasticity of reciprocal demand. The rate of exchange between currencies of two countries is determined not only by changes in relative prices but also by elasticities of reciprocal demand.

(x) No Change in Barter Terms of Trade:

The PPP theory relies upon still another assumption that there is no change in barter terms of trade between two countries. Even this assumption is not valid as there are frequent changes in the barter terms of trade on account of several factors such as supply of exported goods, demand for foreign goods, external loans etc.

(xi) Neglect of Demand and Supply Forces:

The rate of exchange is not influenced only by the relative price changes in two countries. The demand for and supply of foreign exchange are the fundamental forces to determine the equilibrium rate of exchange. These forces are influenced, apart from transactions of goods, also by such factors as capital flow, cost of transport, insurance, banking etc. But the PPP theory gives little importance to the forces of demand for and supply of foreign exchange.

(xii) Neglect of Aggregate Income and Expenditure:

This theory has been found to be deficient by Ragnar Nurkse on the ground that it considers only the price movement as the determinant of exchange rate. The variations in aggregate income and expenditure that can have effect upon the foreign exchange rate through their effect upon the volume of foreign trade were completely overlooked by this theory.

According to him, the PPP theory “treats demand simply as a function of price, leaving out of account the wide shifts in the aggregate income and expenditure which occur in the business cycle (as a result of market forces or government policies), and which lead to wide fluctuations in the volume and hence the value of foreign trade even if prices or price relationships remain the same.”

(xiii) Static Theory:

The PPP theory attempts to determine equilibrium rate of exchange under static conditions such as constancy of tastes and preferences, absence of capital movements, absence of transport costs, no changes in tariff, constant technology, absence of speculation etc. It is highly unrealistic to determine exchange rate with all these over-simplifying assumptions. In the actual dynamic realities, this theory fails altogether.

(xiv) Assumptions of Free Trade and Laissez Faire:

This theory rests on the assumptions of free international trade and laissez faire. It means the government does not resort to tariff or non-tariff restrictions upon trade. Even these assumptions do not hold valid in actual reality. There is frequent use of tariffs, quotas and other controls by the governments in both advanced and poor countries. The restrictions on trade do have a definite impact upon the rate of exchange. It signifies that the PPP theory is completely incapable of determining the rate of exchange in actual life.

(xv) Inexact Theory:

Vanek held the belief that the PPP theory at best could serve as a crude approximation of the equilibrium rate of exchange. With its over-simplifying assumptions, it can neither exactly measure the rate of exchange nor can make a precise forecast of it over future period. In this context Halm commented, “Purchasing power parities cannot be used to compute equilibrium rates or to gauge with precision deviations from international payments equilibrium.”

(xvi) Change in International Economic Relations:

This theory fails to take cognizance of change in international economic relations. If originally trade was taking place between two countries, the appearance of a third country either as a purchaser or as a buyer of a particular commodity can have a significant effect on the volume and direction of trade as well as on demand and supply conditions pertaining to the foreign exchange.

Therefore, this theory is not capable of providing a proper measure of rate of exchange in the more realistic conditions of multi-country trade.

(xvii) Relevant for Long Period:

The PPP theory can be considered relevant only in the long period when the disturbances are of purely monetary character. During 1980’s, the exchange rates were found to deviate from those suggested by the purchasing power parities.

No doubt, there are serious theoretical and practical deficiencies in the PPP theory, yet it is indisputably a highly sensible explanation of rate of exchange in such countries where the price movements have a major impact on the exchange rate.

This theory can explain the determination of rate of exchange not only under inconvertible paper standard but under every possible monetary system. The long term tendency of exchange rate can be stated more appropriately through relative price movements and that underlines the practical importance of this theory.

Empirical Tests of the PPP Hypothesis:

Despite weaknesses of both the absolute and relative versions of the PPP theory, the assumptions of this theory are central to many a model. The empirical studies have been made to assess the validity of the PPP hypothesis. These studies have attempted to deal with three issues.

First, whether the Law of One Price holds and whether it is possible to construct price indices that would follow that law. The studies made in this regard attempted by Isard (1977) and Kravis and Lipsey (1978) have given the conclusion that the Law of One Price does not hold true. They also indicate that changes in exchange rate result in variations in relative prices that make it apparently impossible to construct price indices for which the Law of One Price will hold.

Second, the empirical studies attempt to estimate the generalised form of equation and test whether the parameters differ significantly or not from those predicted by PPP. In this connection, the regression-based studies tend to suggest that the PPP hypothesis is not acceptable in the short term. It may, however, do better in the long run.

Third, the issue is whether or not PPP provides efficient forecasts of exchange rate movements over time. In this regard, the time series are based on more sophisticated models involving interest rates, rational expectations and price levels. They proceed to examine the markets. The evidence, in this context, is conflicting. While Mac Donald (1985) concluded that the market was efficient, Frankel and Froot (1985) arrived at the opposite conclusion.

According to Sodersten and Reed, the empirical evidence related to the PPP, is rather mixed. The evidence on balance is against this theory except in the long run. In their words, “We may therefore feel that we must look at models that embody one or other of the PPP hypothesis with some skepticism.”

3. The Balance of Payments Theory:

The balance of payments theory of exchange rate maintains that rate of exchange of the currency of one country with the other is determined by the factors which are autonomous of internal price level and money supply. It emphasises that the rate of exchange is influenced, in a significant way, by the balance of payments position of a country.

A deficit in the balance of payments of a country signifies a situation in which the demand for foreign exchange (currency) exceeds the supply of it at a given rate of exchange. The demand for foreign exchange arises from the demand for foreign goods and services. The supply of foreign exchange, on the contrary, arises from the supply of goods and services by the home country to the foreign country.

In other words, the excess of demand for foreign exchange over the supply of foreign exchange is coincidental to the BOP deficit. The demand pressure results in an appreciation in the exchange value of foreign currency. As a consequence, the exchange rate of home currency to the foreign currency undergoes depreciation.

A balance of payments surplus signifies an excess of the supply of foreign currency over the demand for it. In such a situation, there is a depreciation of foreign currency but an appreciation of the currency of the home country.

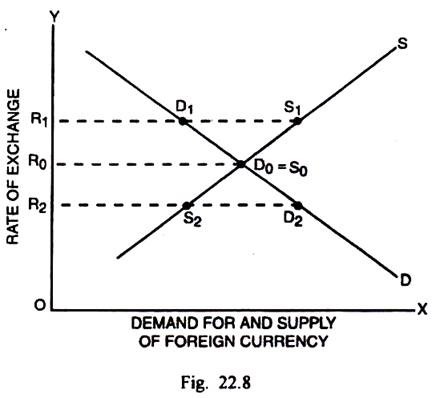

The equilibrium rate of exchange is determined, when there is neither a BOP deficit nor a surplus. In other words, the equilibrium rate of exchange corresponds with the BOP equilibrium of a country. The determination of equilibrium rate of exchange can be shown through Fig. 22.8.

In Fig. 22.8, the demand for and supply of foreign exchange are measured along the horizontal scale and rate of exchange is measured along the vertical scale. D is the negatively sloping demand function of foreign currency. S is the positively sloping supply function of foreign currency. The equilibrium rate of exchange is OR0 which is determined by the intersection between the demand and supply functions of foreign currency where D0R0 = S0R0.

The equality between the demand for and supply of foreign exchange signifies also the BOP equilibrium of the home country. If the rate of exchange is OR1 which is higher than the equilibrium rate of exchange OR0, the demand for foreign currency D1R1 falls short of the supply of foreign currency S1R1. In this situation, the home country has a BOP surplus.

The excess supply of foreign exchange lowers the exchange value of foreign currency relative to home currency. The appreciation in the exchange rate of home currency reduces exports and raises imports. In this way, the BOP surplus gets reduced and the system tends towards the BOP equilibrium and also the equilibrium rate of exchange.

If the rate of exchange is OR2 which is lower than the equilibrium rate of exchange OR0, the demand for foreign currency D2R2 exceeds the supply of foreign currency S2R2. The excess demand of foreign currency D2S2 signifies the BOP deficit. As a result of the excess demand for foreign currency, the exchange value of foreign currency appreciates while the home currency depreciates.

The depreciation of the exchange value of home currency leads to a rise in exports and a decline in imports. Thus the BOP deficit gets reduced and the exchange rate appreciates to approach finally the equilibrium rate of exchange OR0 where the BOP is also in a state of equilibrium.

If there are changes in demand or supply or both, the rate of exchange will be accordingly influenced. Apart from the changes in demand and supply, the rate of exchange is affected by the foreign elasticity of demand for exports, the domestic elasticity of demand for imports, the domestic elasticity of supply of exports and the foreign elasticity of supply of imports. The stability of the equilibrium rate of exchange requires that the demand elasticities should be high whereas the supply elasticities should be low.

Merits:

The balance of payments theory of rate of exchange has certain significant merits. Firstly, this theory attempts to determine the rate of exchange through the forces of demand and supply and thus brings exchange rate determination in purview of the general theory of value. Secondly, this theory relates the rate of exchange to the BOP situation.

It means this theory, unlike PPP theory, does not restrict the determination of rate of exchange only to merchandise trade. It involves all the forces which can have some effect on the demand for and supply of foreign currency or the BOP position.

Thirdly, this theory is superior to both the PPP theory and mint parity theory from the policy point of view. It suggests that the disequilibrium in the BOP can be adjusted through marginal variations in the exchange rate, viz., devaluation or revaluation. The PPP or mint parity theories, on the opposite, could correct BOP disequilibrium through deliberate policies to cause inflation or deflation. The price variations are likely to have more widespread destabilizing effects compared with the variations in exchange rates.

Criticism:

The BOP theory of exchange rate is criticized mainly on the following grounds:

(i) Assumption of Perfect Competition:

This theory rests upon the assumptions of perfect competition and free international trade. In fact there are serious imperfections in the market on account of trade and exchange restrictions imposed by the different countries. Therefore, the BOP theory is clearly unrealistic.

(ii) No Causal Connection between Rate of Exchange and Price Level:

The BOP theory assumes that no causal connection exists between the exchange rate and the internal price level. Such an assumption is false. The variations in the internal price level can certainly have their impact on the balance of payments situation which in turn can affect the rate of exchange.

(iii) Neglect of Basic Value of Currency:

Under the gold standard, the metallic content of the standard unit of money indicates the basic or optimum value of the currency. The demand and supply theory applied to the inconvertible paper currency cannot measure the optimum or basic value of the currency. In fact, it neglects this aspect.

(iv) Truism:

The BOP theory of exchange rate is just a truism. If it is recognised that the BOP must necessarily be in a state of balance, the possibility of change in the exchange rate will stand completely ruled out. The equilibrium exchange rate does not, in fact, necessarily coincide with BOP equilibrium. There may be equilibrium rates of exchange compatible with the BOP deficit or surplus.

(v) Indeterminate Theory:

This theory holds that the rate of exchange is a function of balance of payments. The variations in the rate of exchange, at the same time, are supposed to bring about adjustment in the BOP deficit or surplus. It implies that the BOP itself is a function of the rate of exchange.

From this, it follows that the BOP theory of rate of exchange is indeterminate. It pre-supposes some given rate of exchange and cannot explain how that pre-existing rate of exchange was determined.

4. The Monetary Approach to Rate of Exchange:

In contrast with the BOP theory of foreign exchange, in which the rate of exchange is determined by the flow of funds in the foreign exchange market, the monetary approach postulates that the rates of exchange are determined through the balancing of the total demand and supply of the national currency in each country.

According to this approach, the demand for money depends upon the level of real income, the general price level and the rate of interest. The demand for money is the direct function of the real income and the level of prices. On the other hand, it is an inverse function of the rate of interest. As regards, the supply of money, it is determined autonomously by the monetary authorities of different countries.

It is assumed that initially the foreign exchange market is in equilibrium or at interest parity. It is further supposed that the monetary authority in the home country increases the supply of money. This will lead to a proportionate increase in price level in the home country in the long run. It will also cause depreciation in the home currency as explained by the PPP theory.

For instance, if the Reserve Bank of India increases the supply of money by 20 percent, it may cause a 20 percent rise in price level and 20 percent depreciation of rupee relative to, say dollar, over the long period. The rate of interest, given the demand for money, is however likely to fall.

The expansion in money supply and consequent fall in the rate of interest will affect the financial markets and exchange rates immediately in the home country India. The decline in the rate of interest in India can result in increased Indian financial investments in the U.S.A. This is likely to cause an immediate depreciation of rupee by, say 15 percent, which exceeds or overshoots the 10 percent depreciation of rupee expected in the long run according to PPP theory.

Subsequently, as prices in the United States rise relative to India over time, there will be an appreciation of rupee by an extent (say 8 percent) such that overshooting or excessive depreciation that occurred soon after the increase in money supply and consequent fall in rate of interest in India gets neutralized.

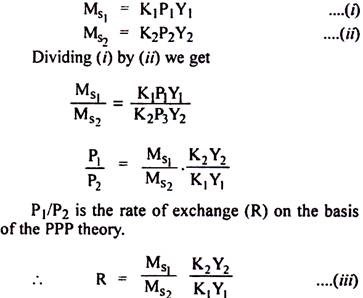

The determination of rate of exchange through monetary approach can be derived as below:

There are two countries India and the U.S.A. denoted as countries 1 and 2 respectively. The monetary equilibrium in each of them is determined when the demand for money (Md) gets balanced with the supply of money (Ms).

Md1 = MS1

Md2 = MS2

The subscripts 1 and 2 denote the two countries.

MS1 = K1P1Y1

Md2 = K2P2Y2

Here K1 and K2 are the desired rates of nominal money balances to nominal national income in two countries. P1 and P2 are the price levels in two countries and Y1 and Y2 are the real national incomes or outputs in the two countries.

The conditions for monetary equilibrium in two countries are written as:

If K2 and Y2 in the U.S.A. and K1 and Y1 in India remain unchanged, R will remain unchanged so long as MS1 and Ms2 remain constant. The changes in R is directly proportional to change in MS1and inversely proportional to changes in MS2.

Certain important things related to the monetary approach and equation (iii) need to be noted. First, this approach depends upon the PPP theory. Second, the above derivation assumes that interest rates in two countries are identical initially. The increase in money supply in India lowers the rate of interest and its effect on the exchange rate is reflected through change in real income.

Third, the rate of exchange adjusts to clear the money markets in each country without any flow or change in reserves. Finally, the rate of exchange is affected by the expected rate of inflation in each country.

The monetary approach to exchange rate determination has certain shortcomings which are discussed below:

Firstly, this approach has generally failed to explain the movements in the exchange rates of major currencies during the period of currency floatation since 1973. Secondly, the monetary approach has laid an excessive emphasis upon the role of money and has given very little importance to trade as the determinant of foreign exchange rate. Thirdly, this approach holds that domestic and foreign financial assets such as bonds are perfect substitutes.

In fact, this is not true. Fourthly, the monetary approach to the determination of exchange rate has not performed well empirically. The estimated parameters have been found either insignificant or they have the wrong signs. The monetary exchange rate models have not fared well also in respect of their forecasting ability. The tests on market efficiency have tended to reject this approach.

5. The Portfolio Balance Approach:

In view of the deficiencies in the monetary approach, some writers have attempted to explain the determination of exchange rate through the portfolio balance approach which is more realistic than the monetary approach.

The portfolio balance approach brings trade explicitly into the analysis for determining the rate of exchange. It considers the domestic and foreign financial assets such as bonds to be imperfect substitutes. The essence of this approach is that the exchange rate is determined in the process of equilibrating or balancing the demand for and supply of financial assets out of which money is only one form of asset.

To start with, this approach postulates that an increase in the supply of money by the home country causes an immediate fall in the rate of interest. It leads to a shift in the asset portfolio from domestic bonds to home currency and foreign bonds. The substitution of foreign bonds for domestic bonds results in an immediate depreciation of home currency. This depreciation, over time, causes an expansion in exports and reduction in imports.

It leads to the appearance of a trade surplus and consequent appreciation of home currency, which offsets part of the original depreciation. Thus the portfolio balance approach explains also exchange over-shooting. This explanation, in contrast to the monetary approach, brings in trade explicitly into the adjustment process in the long run.

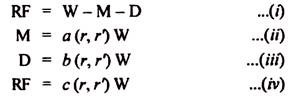

The portfolio balance approach can be given with the help of the following equations:

W = M + D + RF

Where, W is wealth, M is the quantity of nominal money balances demanded by domestic residents; D is the demand for domestic bonds. R is the exchange rate and RF is the demand for foreign bonds in terms of domestic currency.

The above equation can be written also as:

The co-efficient a relates M to W, b relates D to W and c relates RF to W. The co-efficient a, b and c are all the functions of interest rate at home (r) and interest rate abroad (r’). The sum of coefficients a, b and c is assumed to be unity. M is related inversely to r and r’, D is related directly to r and inversely to r’. RF is related inversely to r and directly to r’. An increase in r raises D but reduces M and RF. An increase in r’ raises RF but reduces M and D. W increases over time through savings. An increase in W causes an increase in M, D and RF.

According to this approach, equilibrium in each financial market occurs only when the quantity demanded of each financial asset equals its supply.

Assuming equilibrium in each financial market, the rate of exchange (R) is derived below:

By substituting equation (ii), (iii) and (iv) in (i), we get-

Since the co-efficient a and b are the functions of r and r’, it can be concluded that the rate of exchange (R) is related directly to r’ and W and inversely related to r and F.

There are some shortcomings in the portfolio balance approach. Firstly, it ignores the real income as a determinant of exchange rate. Secondly, this approach does not deal with trade flows. Thirdly, it assigns no role to expectations. Fourthly, the empirical studies concerning it have yielded only mixed results.

Fifthly, in its present form this approach does not provide a complete and unified theory of exchange rate determination that fully and consistently integrates financial and commodity markets in the short run and long run.

No doubt, this approach suffers from some deficiencies but it has become the focus for the analysis of exchange rate determination.