Read this article to learn about the effectiveness of fiscal policy in general.

Since the great depression of the 1930s, fiscal policy is being used for economic growth and removing unemployment.

As the monetary policy collapsed during depression, public authorities had to depend upon fiscal measures, which proved very effective in taking unemployment and depression.

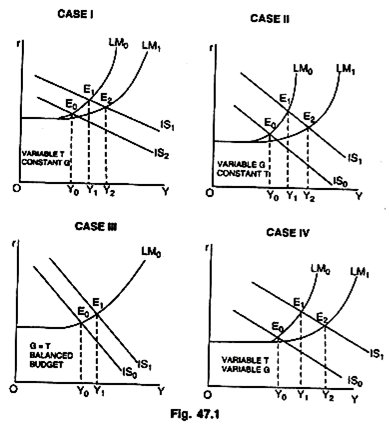

The efficacy of fiscal measures in removing unemployment of resources and manpower due to deficiency of effective demand is shown in Fig. 47.1.

ADVERTISEMENTS:

In case I of the diagram, T is variable and can be lowered, whereas G is unchanged. As a result of lowering of tax rates, consumption spending will increase which, in turn, will increase aggregate demand and the IS function will shift to the right from IS0 to IS1.

Since G (government spending) is unchanged, the authorities will have to borrow to cover the gap between lower tax receipts and the government expenditure. If the funds are borrowed from non-bank public the LM function will remain unaffected though there will be a rise in money incomes.

But if the funds are borrowed from the banking system, the LM schedule will shift to the right resulting in a much larger increase in income than when funds are borrowed from the public. In case I, the equilibrium income is Y0 at the intersection of IS0 and LM0.

ADVERTISEMENTS:

A reduction in taxes shifts the IS function from IS0 to IS1 and because borrowings have come from general public, LM curve remains unchanged at LM0 and income increases from Y0 to Y1, but if the borrowings are obtained from banks, LM function shifts from LM0 to LM1 and the intersection of LM1 and IS1 determines the new equilibrium level of income, at Y2. In this case, the expansion of income Y0 Y2 is greater than the earlier income expansion Y0 Y1.

In case II of the diagram, T is unchanged whereas G (government spending) increases. This will shift IS function to the right from IS0 to IS1 as in case I. The difference is that the shift brought about by an increase in government expenditure will be more than that caused by a reduction in taxes while a tax cut will shift the IS function only by the MPC times the tax cut; the shift on account of increase in G will be equal to the full amount of additional expenditure.

The borrowings from non-bank public have no effect on LM function as in case I, whereas the borrowings from banks shift the LM function from LM0 to LM1. The equilibrium level of income is at Y0 and when an increase in G shifts IS function from IS0 to IS1, income increases from Y0 to Y1 and when borrowings are obtained (for increased expenditure) from the banking system, a shift takes place from LM0 to LM1 and the income rises from Y0 to Y2. This case is, no doubt, similar to case I but the expansion in income as a result of fiscal programme (increase in G) is greater than the earlier case.

In case III, we have a balanced budget because an increase in G is offset by an increase in T (i.e., G = T). Since the budget is more or less balanced, it produces on deficit and therefore, there is no effect on LM function. An increase in G matched by an increase in T will cause a moderate shift in the IS function to the right from IS0 to IS1.

ADVERTISEMENTS:

In this case, there will be a small increase in income from Y0 to Y1 which is quite inadequate to cope with the problem of large scale unemployment and depression. Hence, a policy of balanced budget is not likely to be very effective to meet the serious challenges depression and unemployment, and therefore, much more effective and positive fiscal policy (say like deficit budgets) is required to remedy the situation.

In case IV, there is lower T (due to cut in taxes) and higher G (due to increase in public spending). Since the deficit is very large in this case, borrowings from the banking system are also large which, in turn, shift the LM function by a larger amount than in earlier cases. The total effect of these fiscal measures on income is more than in earlier cases.

The expansion in income is from Y0 to Y1 when the deficit is financed by borrowings from non-public and it is more from Y0 to Y2 when the deficit is financed by borrowings from banking system (because it will change the LM function by a large amount from LM0 to LM1 and also the IS function by a greater amount from IS0 to IS1). It clearly shows that a fiscal policy of combining increased public expenditure, lower taxes and borrowing from banks can provide an adequate answer to the problem of unemployment and depression due to deficiency of aggregate demand.