The debate concerning the fixed versus flexible exchange rates is not complete unless the arguments that the economists have advanced in support of and against the system of flexible or fluctuating rates of exchange are considered.

Arguments for Flexible Exchange Rates:

The main arguments in favour of the flexible exchange rates are as below:

(i) Simple Mechanism:

The system of flexible exchange rates operates in an easy, quick and efficient manner in clearing the foreign exchange market. It ensures an automatic adjustment between the forces of demand and supply. The mechanism is simple because it can work efficiently without involving any intervention of the monetary or fiscal authorities in the foreign exchange market.

ADVERTISEMENTS:

(ii) Continuous Adjustments:

Under a fixed exchange system, there are periodic crisis and aggravation of balance of payments pressures. It is essential that the corrective actions are taken. The success of these corrective measures is never definite. In contrast, under a system of flexible exchange rates, there are smooth and continuous adjustments in the foreign exchange market through appropriate changes in the rates of exchange.

(iii) No Need of Accommodating Gold or Capital Movements:

Unlike the fixed, exchange system where the achievement of BOP equilibrium requires the accommodating gold or capital movements, there is no such necessity under flexible exchange rates. The automatic exchange rate adjustments ensure the maintenance of BOP equilibrium even without the accommodating transactions.

ADVERTISEMENTS:

(iv) No Necessity of Adjustments through Price and Income Changes:

In the fixed exchange system the BOP equilibrium may necessitate deliberate resort to deflationary or inflationary policies. The objective may be achieved sometimes also through the income and expenditure policies. The effects of such policies may be quite widespread in the economy. In contrast, the flexible exchange system can ensure the automatic BOP adjustment through the simple mechanism of freely flexible exchange rates rather than price and income variations.

(v) Removal of the Problem of International Liquidity:

In a system of flexible exchange rates, a deficit country is simply to allow its currency to depreciate and adjust the BOP equilibrium. On the other hand, the pegging of exchange rate and the removal of payments deficit under the fixed exchange rates requires large inflows of foreign currencies.

ADVERTISEMENTS:

Therefore, the countries under the latter system remain faced with the problem of shortage of international liquidity. There is no such problem under flexible exchange rates. The activities of speculators will ensure the additional supply of liquid resources or withdrawal of surplus liquidity from the exchange market.

(vi) Economical:

The flexible exchange system is very economical. There is no idle holding of international currency reserves that is so essential under the system of fixed exchange rates. The countries having flexible exchange system can make an optimum use of their entire available exchange reserves.

(vii) Beneficial for International Trade:

There is a wrong impression that the instability of exchange rates will have an adverse effect on the expansion of international trade. On that logic, the fixed exchange rates were supported. In this connection, it is argued that the flexibility of exchange rates maintains the rates of exchange at their natural level. Sometimes the problems in international trade under the fixed exchange system arise because there are objections that the currency of a particular country is over-valued or under-valued compared with what should have been its natural rate of exchange.

In such situations the trade is seriously hampered. No such problems, however, can arise in the case of a flexible exchange system because exchange rates are likely to remain at the natural level due to continuous market adjustments. Therefore, the latter can ensure sustained expansion of trade and steady growth of the economy.

(viii) No Need of International Institutional Arrangements:

In a system of stable exchange rates, there is the necessity of international monetary institutions for borrowing and lending of short- term funds for maintaining exchange rate parities and for settling BOP problems. The job done by the institutions like IMF can be handled quite efficiently by the freely fluctuating system of exchange rates. Thus the flexible exchange system can dispense with complex international institutional arrangements.

(ix) Autonomy in Domestic Policies:

ADVERTISEMENTS:

Under a stable exchange system, conflict may arise between the objectives of internal price stability and full employment on the one hand and exchange stability on the other. A country, faced with BOP deficit and possible depreciation in exchange rate, will have to resort to contractionary monetary and fiscal policies. Thus domestic economic policies become subordinated to the state of external trade and payments. The internal stability is likely to be sacrificed for the achievement of external stability.

In case of flexible exchange system, the continuous automatic adjustments in external disequilibria can be possible without resort to deliberate deflationary or inflationary policies. In this regard, Johnson comments, “The fundamental argument for flexible exchange rates is that they allow countries autonomy with respect to their use of monetary, fiscal and other policy instruments, by automatically ensuring the preservation of external equilibrium.”

(x) No Necessity of Controls:

The BOP adjustments under a system of fixed exchange rate can be effected only if there is an elaborate regime of controls on imports, exports and capital movements. These controls cause distortion in the efficient production and distribution of goods. The efficiency of the system of controls is highly doubtful on account of bureaucratic red-tapism, corruption and a tendency to screw up the whole system more and more tightly.

ADVERTISEMENTS:

In contrast, the flexible exchange system can maintain the exchange values of the currencies at their natural level through market adjustments. The regime, of controls can be dismantled, if reliance is placed upon the flexible exchange rates.

(xi) No Retaliation:

In the past, under the system of fixed exchange rates, the world was witness to competitive and retaliatory devaluation. Such developments and tariff warfare are not likely to exist, atleast to some extent, under a system of freely flexible exchange rates.

(xii) Reinforces Monetary Policy:

ADVERTISEMENTS:

If a country is faced with inflationary conditions along with a BOP deficit, a restrictive monetary policy of higher discount and interest rates may be adopted. Such a policy is likely to restrict spending which will have a disinflationary effect. It may also bring about some reduction in imports. As a consequence, the BOP deficit is likely to be reduced. Sohmen pointed out that the flexible exchange rates will reinforce the anti-inflationary monetary policy and contribute also in removing the BOP deficit.

The higher interest rate policy will induce inflow of capital from abroad. It will bridge up whatever external deficit is left. The rise in the exchange rate of the home currency will stimulate imports and lower exports. These developments have a further disinflationary effect. Similarly expansionary monetary policy, involving lower interest rates to tackle internal recession and unemployment, will be strengthened by depreciation of the home currency caused by the outflow of capital.

The exchange depreciation will encourage domestic exports and restrict imports. These factors will have the off-setting effect on recessionary tendencies. Thus the free movements of exchange rates can reinforce the domestic monetary policy to make it more effective both during the periods of inflation and recession.

Arguments against Flexible Exchange Rates:

The main objections which are raised against the system of flexible exchange rates are as follows:

(i) Possibility of Disequilibrium:

In case of flexible exchange system, it is believed that the free working of the market forces results in the establishment of rate of exchange that corresponds with the BOP equilibrium. There is a possibility that the demand and supply forces in the foreign exchange market operate in such a way that the exchange rate diverges farther and farther from the natural level of rate of exchange and the variations in the rate of exchange fail to bring about the BOP equilibrium.

ADVERTISEMENTS:

(ii) Indirect Government Intervention:

The flexible exchange system presumes that the government does not interfere in the foreign exchange market. The government may not directly interfere through pegging or exchange controls and regulations. But there can still be indirect government intervention through the impact of monetary and fiscal policies. The imposition of additional excise duties raises costs and prices of the products and has a discouraging effect upon exports.

The subsidies, on the opposite, may facilitate an increase in exports. The changes in interest rates, essentially for dealing with internal inflation and deflation can have effect on capital flows and exchange rates. The government borrowings and investments abroad too can have effect on the rates of exchange. In view of indirect effects of government policies on the rates of exchange, there is never a freely flexible system of exchange rates.

(iii) Not Practical:

It is advocated in this system that the exchange rate should be allowed to be determined by the free working of demand and supply forces in the market. All the governments in the present day world exercise controls upon the prices of goods, services, capital and all other assets in varying degrees.

In the regime of price controls, e.g., control over commodity prices, wages, interests, rents, profits etc., there can be no justification of letting the price of foreign exchange to be determined by the market forces. Such a system of exchange rates is, therefore, not consistent with the actual realities of practical life.

ADVERTISEMENTS:

(iv) Exchange Risks and Uncertainty:

The flexible exchange system causes frequent variations in the rates of exchange which create exchange risks, breed uncertainty and impede the international trade and capital movements. If an Indian makes imports from the U.S.A. and is to make payments in terms of dollars, the exchange risk arises, when the rupee price of dollar rises above the expected levels.

There can be exchange risk to the American exporter, when the dollar price of rupee falls below the expected levels. Given the exchange risks, the importers or exporters may be disinclined to enter into transactions and international trade is likely to be impeded. These exchange risks are likely to have even more serious consequences for long-term capital movements. The borrowers and lenders may be discouraged from entering into long-term capital contracts.

Sodersten has analysed how the flexible exchange rates increase the uncertainty for traders and that has a dampening effect upon the volume of international trade. It is assumed that a country has a regime of flexible exchange rates. The price level is supposed to be stable in that country. It is further assumed that the balance of trade of the country was originally in equilibrium. A decrease in the demand for exports perhaps due to a change in tastes in foreign country results in the depreciation of home currency.

The imports get reduced and the marginal importers will be unable to compete on account of higher import prices and they go bankrupt. The exporters may gain because of higher prices abroad but that gain is offset on account of reduction in the volume of exports. The net result will be determined by the elasticities of demand and supply functions. Sodersten holds that the flexible exchange system involves an extra risk compared with the system of fixed exchange rates.

In the latter case, the import prices remain stable and there is no change in the volume of imports. Under the flexible exchange system, the importers are hurt by exchange rate variations for no fault of their own. Thus there is greater exchange risk in case of flexible exchange rates.

ADVERTISEMENTS:

In this regard, Sodersten remarks, “Under flexible exchange, import and export prices will show greater variation. An increased risk will be connected with foreign trade, and resources will be reallocated to a greater degree than under fixed exchange rates. Marginally profitable exports and imports will be out-competed and the volume of foreign trade will be smaller than it would be under a system of fixed exchange rates.”

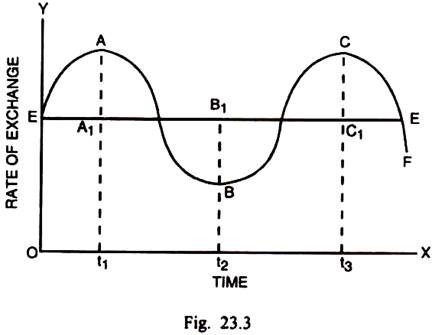

This may be illustrated with the help of Fig. 23.3. In this Fig., time is measured along the horizontal scale and rate of exchange is measured along the vertical scale. The horizontal line EE shows the exchange rate under a fixed exchange system and EF is the curve representing the flexible exchange rate. The exchange rate, to begin with, is exactly the same regardless of the system. At the time t1, the home currency has depreciated relative to foreign currency.

Given the depreciated exchange rate at point A, compared with fixed exchange rate at point A, the imports will be discouraged while the exports will get encouraged. At time t2, there is an appreciation of exchange rate under the flexible exchange system at B. In this situation, the exports will be adversely affected whereas imports will be stimulated.

At the time t3, the home currency has again depreciated relative to foreign currency. Thus the fluctuation of exchange rate around a trend value will cause an increased risk for exporters and importers. It will have a dampening effect upon the foreign trade. It is, of course, true that the exchange risk can be averted through hedging. But all risks associated with flexible exchange rates cannot be off-set. Therefore, this system of exchange rates is likely to have considerable adverse effect on the external trade.

(v) Destabilizing Speculation:

ADVERTISEMENTS:

A very strong objection against the flexible exchange system is that continuous variations in exchange rate greatly stimulate the activities of speculators in the foreign exchange market. The speculators take the decline in the exchange rate as a signal for a further decline and will thus tend to make the movements in the exchange rate sharper than they would be in the absence of speculation.

There is strong opinion that the speculation under flexible exchange system is highly destabilizing, i.e., it tends to widen the fluctuation in exchange rate.

The evidence in support of such a contention was provided by the exchange rate instability during 1920’s, 1930’sand after 1973 periods. Although Milton Friedman pointed out that speculation is stabilising, the writers like R.Nurkse and S.C. Tsiang held that speculation was destabilizing. Since 1973, many of the leading currencies have been floating against one another, either independently or in groups and the fluctuations in the rates have been quite substantial. There are instances when currencies fluctuated up and down by 20 percent or more within a few months.

It is difficult to disentangle the speculative motive from other factors influencing the exchange rate variations. The large changes in exchange rates that took place in post-1973 period could not be ascribed to other economic forces. In the words of Salvatore, “The amplified fluctuations in exchange rates with destabilizing speculation increase the uncertainty and risks of international transactions and reduce the international flow of trade and investments.”

(vi) Inflationary Impact of Flexible Exchange Rates:

Critics of flexible exchange rates put forward a forceful argument that this system has a strong inflationary bias. If there is exchange depreciation, there can be a rise in the domestic price level. Depreciation of exchange rate makes imports more expensive. As the import prices rise, the use of imported inputs raises the cost of production in a number of home industries. This leads to cost-push inflation in the home country.

The appreciation of the exchange rate, on the opposite, is not likely to cause a fall in internal prices because it is not likely to be passed on further by the importers. Any extra profits accruing from lower import prices are cornered by them. In this connection, a counterargument is given that the exchange depreciation can encourage import-substitution.

If that happens, the transmission effect of import prices will not take place. But there is very limited possibility of import-substitution. Consequently, the exchange variation is likely to strengthen the inflationary pressures.

According to Triffin, a ratchet effect is associated with the flexible exchange rates. A depreciation in exchange rate will push up wages and prices. The appreciation of exchange rate, on the other hand, will not cause a comparable fall in wages and prices because these are rigid in the downward direction. Thus there is an asymmetry which causes a sustained upward pressure upon the domestic prices.

In the case of flexible exchange rates, there can be a vicious circle of depreciation-inflation- depreciation. As there is depreciation of exchange rate, the internal price level may go up. The higher price level can discourage exports and encourage imports. Consequently, BOP deficit can appear. The excess demand for foreign currency can cause depreciation of home currency again. That can, in turn, cause inflationary again.

The inflationary strains can also arise because the flexible exchange rates bring about reallocation of resources. The larger exchange rate variations can cause frequent attempts at reallocation of resources. If some cost is connected with the reallocation of resources, the domestic prices are likely to increase. In this respect, the flexible exchange system is likely to be worse than the fixed exchange system.

The continuous and uncontrolled variations in the exchange rates can have disruptive effect on the long terra foreign investment in the home country. It can place a restraint upon the productive capacity. The slowing down of the growth of output can give rise to the inflationary trends.

The fluctuating exchange rates invariably provide opportunities to the speculators to make profits through their anticipations about the future. The speculation in rates of exchange not only affects the exchange rates and capital flows but also leads to inflationary consequences due to greater uncertainty.

Another line of reasoning in this connection is that the exchange depreciation induces an expansion in exports. There is an enlargement of incomes of the exporters. Given an inelastic supply of output, the increased income will produce a demand-pull and consequent rise, in domestic prices.

In addition, an increase in exports, consequent upon the depreciation of exchange rate, will reduce the domestic availability of goods, given the less elastic supply function. This can again lead to inflationary consequences.

Under the fixed exchange system, the monetary and fiscal authorities remain in a state of readiness to enforce the monetary, fiscal and. exchange controls to ensure the internal and external stability. Such a policy discipline is non-existent in the flexible exchange system. All adjustments are supposed to be made through free flexibility of exchange rates.

The government and monetary authority are not supposed to intervene. In the absence of anti-inflationary policies, the society is likely to face strong inflationary pressures. Inflation may be the cost of maintaining the flexible exchange system.

(vii) Fragmentation of the World Market:

One of the major shortcomings of flexible exchange system is that there is an absence of a stable medium of exchange, a stable unit of account, a stable store of value and a stable standard for deferred payments. The world commodity, capital and exchange markets get split into several small units. In such a situation, there is sub-optimal allocation of resources and lesser international specialization.

Consequently, the world trade and welfare of a community get adversely affected about BOP adjustments in the advanced countries, but it is not suited to the LDC’s.

(viii) Not Suited to the Less Developed Countries:

The flexible exchange system may efficiently bring flexible exchange rates were examined separately. In case of the latter, the necessity of maintaining a rate of investment higher than that of savings and difficulty in reducing imports, while the capacity to export is limited, there are persistent BOP deficits.

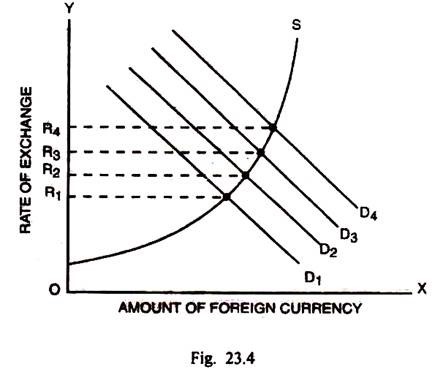

Sufficiently large flows of autonomous or accommodating capital are not available to them. In these conditions, the BOP deficits can be removed through this system only if there is continuous currency depreciation almost indefinitely. Such a situation is shown through Fig. 23.4.

In Fig. 23.4, the demand curve for foreign currency is originally D1. Given the supply curve S, the equilibrium rate of exchange, to begin with, is R1. In a LDC, there is continuous increase in the demand for foreign exchange .for financing development programmes and to offset the persistent BOP deficit. That can cause continuous shifts in the demand curve from D1 to D2, D3, D4 and so on. Since BOP deficit continues to exist, there will remain a continuous tendency for foreign currency to appreciate and for the currency of LDC to depreciate.

If there is continuous currency depreciation, there will be a serious loss of confidence in the currency of this country resulting in a grave adverse effect on its trade and overall growth.