Here is a compilation of essays on ‘Financial Economics’ for class 10, 11 and 12. Find paragraphs, long and short essays on ‘Financial Economics’ especially written for school and college students.

Essay on Financial Economics

Essay Contents:

- Essay on the Meaning of Financial Economics

- Essay on the Importance of Finance in Economics

- Essay on the Genesis and Growth of Financial Economics

- Essay on the Theories of Financial Economics

- Essay on the Changing Scenario of Finance in the Economy of India

Essay # 1. Meaning of Financial Economics:

ADVERTISEMENTS:

Financial Economics is a generic term applicable to a vast array of topics relating Finance with Economics. It is well-known that, finance is a lubricating mechanism to the Economic Activity. Finance, under the head of capital is becoming a Factor of Production. Finance under the head of inputs is becoming a factor in input-output matrix.

Finance under head of money is becoming a measure of value, medium of exchange and a store of value. In its function as a medium of exchange and measure of value, its use is for transaction and precautionary purposes, wherein cash is needed for all and by all. Cash is a financial asset and current asset. In its store of Value Function, money is an asset — a Financial asset and one of the facets of wealth. Wealth is a basket of assets both physical and financial in one’s possession. Finance and wealth are also inter-related.

Finance is a scarce input and particularly in developing economies like India, it is scarce, compared with their inputs, like labour, land and enterprise. All these factors are factors of production in the productive process, called the economic activity. Economics is a science dealing with scarce means and unlimited ends. Finance being scarce, the relation of finance with Economics is quite important.

Economic activity is the circularity of relations between production, distribution and consumption. The end use of all activity is the consumption-demand backed by purchasing power. Production is a type of economic activity which combines all the factors of production as inputs and brings an output called production. The relationship between inputs and outputs is a function of technology, which in modern economic jargon leads to input-output matrix. The intermediary between Production and Consumption is Distribution which is a vital link in the circularity of economic activity.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 2. Importance of Finance in Economics:

The importance of Finance in Economics can hardly be over-emphasised in view of the above facts. In the classical Writings of Adam Smith and others, Economics is considered a handmaid of Ethics, but in the modern technology Economics is a handmaid of Finance.

Economic activity relates to the real world of physical goods, and services while Finance relates to the money world. The distinction between real values and money values will be clear if one keeps in mind the functions of money. Since we are used to denominate everything in terms of money, the distinction between them is blurred.

If we know the distinction between the barter economy and money economy, the role money and the distinction between money economy and real economy becomes clear. In barter economy goods and services are exchanged for goods and services and the value of each is set by the relative scarcity and abundance in relation to demand for it. This brings us to the demand and supply factors in the money economy.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 3. Genesis and Growth of Financial Economics:

In classical writings money is neutral. But the Genesis of the Financial Economics goes back to the Fisher’s writings. Money was introduced then as a variable influencing the value of transactions in the Fisher’s equation of Exchange, namely-

MV = PT

Where,

‘M’ is quantity of Money

‘V’ is velocity or the number of times that one unit of money changes hands in a year

P is price level

T is the volume of transactions.

This equation sets up an identity between the total Money in demand (MV) and the total value of transactions (PT). While PT is a function of real variables, MV is a function of money variables. Given the quantity of money, velocity will change as per the total value of real transactions. If ‘V’ is also set constant ‘M’ will change as per the requirements of real transactions. This equation emphasises the role of money in transactions.

ADVERTISEMENTS:

The next stage of development of the concept of Money as a functional variable in the real economy is given by the Cambridge Equation of Exchange as expounded by Marshall and Pigou. Here money demand is based on the peoples’ preferences, choices and behaviour. People prefer to hold only a proportion (K) of the level of income or output represented by PT. Here the equation boils down to- Md (Money demand) is equal to K (PT)

Md = K (PT)

Md/K = PT

Therefore 1/K here is equal to V in the equation of exchange of Fisher.

ADVERTISEMENTS:

Cambridge equation is an improvement in that it brings in the peoples’ preferences and habits of how much cash balances they would like to hold among other alternative assets out of their total income. The other improvement is the introduction of the concept of choice and the alternatives foregone in holding cash balances as the income in the form of interest foregone on the alternatives. So money is considered desirable to hold, but this desire is influenced by the opportunities, lost through holding idle cash balances out of the total income PT.

But the role of interest rate, which determines the liquidity preference of the people and as a determinant of the demand for money is not brought out clearly by the Cambridge school of thought. It was left to Keynes in his book (The General Theory of Employment, Interest and Money) to bring out the real integration of Money (or Finance) with the real economy.

Essay # 4. Theories of Financial Economics:

i. Keynes General Theory of Financial Economics:

ADVERTISEMENTS:

Keynes’ treatment of the real and Money variables is more generalised as against the special case of the classical theory. It brought in the non-neutral character of Money in the real world as against classical theory which treated money as neutral to the real world. It is called general theory as it has brought out the integration of Monetary Theory and the Theory of Employment and Output.

While the former is the money factor, the latter is the real factor. Their integration is brought out by the role of interest rate. According to Keynes, the rate of interest is a reward for parting with liquidity that is cash. It is the price which equilibrates the desire to hold wealth in the form of cash and the available quantity of cash.

Liquidity Preference Theory of Keynes refers to the desire of the people to hold money as an asset because it is the most liquid form of assets and can be converted into any other form of asset later.

The demand for money has three components:

(1) Transaction demand for money.

(2) Precautionary demand for money.

ADVERTISEMENTS:

(3) Speculative demand for money.

While the first two categories of demand for money are income elastic and not interest elastic, the third category is purely interest elastic. So both income and interest rates together influence the Money demand.

The role of interest rate in both the money sector and real sector brings about the needed integration of Finance with Economics. To explain this, aggregate supply function of Keynes and Aggregate demand function interact and the equilibrium point between those two functions determines the level of employment and income for the economy. Aggregate demand function has two components, namely, consumption function and investment function. Consumption function depends on the marginal propensity to consume and the level of income. Investment function is dependent upon the expected rate of profit or marginal efficiency of capital and the interest rate.

MPC is marginal propensity to consume. While MEC is marginal efficiency of capital. MEC is the expected annual rate of profit over the life of the machine. It is rate of discount which makes the sum of prospective yields equal to the cost of machine.

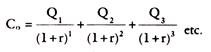

If r is that rate of discount then-

Where,

ADVERTISEMENTS:

co is the cost of machine

r = rate of discount

Q1Q2 … are the expected returns over a period of years, then-

The rate of interest should be lower than the marginal efficiency of capital. Investments take place until MEC = rate of interest.

ii. Monetarist Theory:

ADVERTISEMENTS:

Consumption is a function of income normally, according to Keynes, but according to Friedman and his followers (Monetarist Theory), propensity to consume is also a function of interest rate. At some level of income and consumption higher interest rates may reduce consumption expenditure and increase savings and investment but savings is also a function of interest rate. So consumption is negatively related to interest rate while investment is positively related to interest rates. It is this interest rate that links both Savings and Investment and the role of Savings and Investment on output and employment in the real economy which is the starting point of Financial Economics.

Concept of Multiplier:

Keynes’ income multiplier is the number of times that the final income and output will rise by an initial increase in investment-

K (multiplier) = ΔY/ΔI

Where, AY is the final increase in income and AI is the initial increase in Investment.

AI is the incremental capital employed in an enterprise. This will lead to increase in incomes of factors and consumption and savings and these savings are further invested to lead to a multiplier increase in incomes. If the multiplier is 5, an investment of Rs. 1 crore will induce an additional income and additional consumption to lead to a total final rise of income to Rs. 5 crores.

ADVERTISEMENTS:

Accelerator:

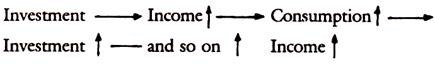

Accelerator complements the investment multiplier in promoting the real growth in the economy. An increase in consumption demand may lead to induced investment expenditure. Through the effects of changes in investment expenditure on the consumption expenditure, the accelerator principle operates to produce the effect of changes in consumption expenditure on induced investment expenditure. This will lead to further increase in income.

The Theory of Investment multiplier is attributed to J.M. Keynes, while the Theory of Accelerator is credited to many writers like J.M. Clark, J.R. Hicks, Harrod, and Samuelson etc. The combined effect of investment multiplier and accelerator on income is more than the original increase in investment.

These two attributes in the inter relations between multiplier and accelerator lead to a cycle as shown below:

These strengthen then the role of savings and investment on the economy. The starting point of action is the MEC and interest rates. It is the interaction of money attributes on the real economic variables that contributes to this growth process of the real economy, with the help of money Economy and here money stands for finance, in the wider sense.

Lastly the influence of Money and monetary variables is brought out by Milton Friedman and his followers. They have brought out a reformulation of the Liquidity Preference Theory of Keynes and Fisher’s Quantity Theory of Money. In Friedman’s formula, money demand is a function of many variables in the economy and Money supply is the major determinant of nominal GNP growth. The main economic variables such as aggregate demand, output, employment and prices are mainly driven by money.

According to Keynes, Liquidity Preference Theory on the demand for money is based on the significance of the store of value function of money. This is same as the wealth of the individual. Friedman uses it as the asset value of money and treats money as a form of wealth that everybody would like to hold for psychological satisfaction. Keynes’ motives for holding money are transactions demand, precautionary demand and speculative demand. While the first two motives of Money demand are a function of income, the third motive of the speculative demand is a function of the interest rate. Thus Money demand is now a function of both income and interest rate.

Liquidity Preference Theory states that money is cash which is preferred by all and to make them part with it, we have to pay a return in the form of interest. Interest rate is the equilibrium rate which equates money demand with money supply. As money is the most liquid of all assets, it is preferred as an asset to be held in the portfolio of all individuals. It is in this sense that Freidman’s wealth equation contains all the assets including cash in it for any individual or firm.

Thus, Keynes’ contribution lay in attempting a general equilibrium between Aggregate demand and supply schedules, at which level, the employment and output for the nation will settle. He integrated into this equilibrium the monetary factors through the role of savings and investment and influence of interest rate on both of them. Interest rate influences both consumption and investment and is thus an important variable influencing the real factors, although interest rates itself is determined by supply and demand for liquidity or cash.

It was Friedman, who brought in Money and Monetary assets as part of the total portfolio of the economic unit along with other real variables, further integrating money with real variables. Subsequent writes have taken finance as part of the real economic system. Gurely and Shaw brought out the role of financial institutions, the velocity of many and interactions between the financial development and economic development.

It is now considered that the financial development is a sine-qua-non for economic development. A sound, healthy and well developed financial system is necessary and helps the growth of the real economy. In modern jargon thus, Financial Economics has come to be identified as an important field of study in Economics, and particularly of growth Economics.

Financial system provides the maximum financial convenience to the public. It promotes the overall savings in the economy by deepening and widening the financial structure, larger financial instruments, integrated submarkets to facilitate the flow of liquidity and the emergence of an orderly yield pattern. Secondly, financial system purveys and allocates the existing savings to be used in a more efficient manner, which increases the productivity and profitability of the capital use. Thirdly, the financial system promotes credit creation, increase in the circulation of money to facilitate trade and transactions, production and distribution in the economy.

Financial intermediation has vital role in the process of promoting savings and imparting liquidity to investments, and ultimately bad to larger economic growth. A sound financial infrastructure is sine-qua-non of the economic growth, because growth is a function of investment and capital-output ratios. Besides, the quality of assets is also to be reckoned with and it is promoted by reallocation of funds from less profitable to more profitable avenues which the banks and F.I.s are able to provide to the economic agents.

Lastly, the finance function which is performed by the financial system includes also the technological and developmental functions which modern development banks and investment banks provide to the economic enterprise. There is thus full integration of Economics and finance as seen by the brief review of the economic literature.

Essay # 5. Changing Scenario of Finance in the Economy of India:

There have been shift changes in the role of Finance in the Economy of India, after the initiation of Economic and financial Reforms since 1991-92. These reforms are going on in a continuous basis since then. The liberalization of licenses, industrial deregulation and reduction of bureaucratic control on the economic front and interest rate deregulation and reforms in gilted Market and Money and Capital Market reforms — too numerous to mention here — on the financial front are bringing out a sea-change in the role of capital and in the area of Financial Economics.

The controlled economy of a socialist era of planning and planned economy is giving place to market-oriented private sector economy. Hopefully in a few years, India will be completely market-oriented and open economy. Entry into the capital market in India is now freed to corporates registered in India and these corporates are given greater access to foreign money and capital markets and Euro-currency markets.

Foreign investments — both direct and portfolio — are now given greater freedom. Even foreign investment abroad by Indian corporates is liberalised in the form of Joint ventures, Technology sharing enterprises, construction projects, Turnkey projects, etc.

Indian corporates will now face a changing economic and financial scenario where the role of Finance assumes greater significance in the economy. Capital is being freely priced, as interest rate decontrol is taking place and entry and exit of the market gives greater liquidity to the markets and capital. Theory and practice of Financial Economics assumes greater significance in the above changing scenario. Theory will have greater relevance under free market economy where capital and labour enjoy the freedom of entry and exit.

Global players have entered the Money and capital markets in India and foreign direct and portfolio investments are assuming greater significance. Even Indian Corporates like Reliance and Jindal and many others are becoming global corporates. Globally, if factors are free to move, competition, lower costs due to operation of comparative cost advantage and widening markets and economies of scale and a host of other advantages of the free market economies will be the result.

In this changing global scenario of the Indian economy, Economics and Finance are getting closer and the significance of Financial Economies is assuming the natural role that Theory postulates. This gives added importance to any study of Financial Economics whereby the underlying principles and practices are more clearly understood and appreciated. The Theories of Finance — both Micro and Macro — are more closely integrated with the Theories of Economics — both Micro-Macro — in this changing scenario. Changes are taking place in both economic and financial fields in India, as never before, in the economic history of the past centuries.