The below mentioned article provides a close view on the role of foreign trade in economic growth.

Subject-Matter:

International trade refers to exchange of goods and services between one country and another (bilateral trade) or between one country and the rest of the world (multilateral trade).

The basis of international trade, from the supply side, is the Ricardian theory of comparative cost (advantage).

According to Ricardo the source of comparative advantage is difference in labour cost between two countries. Modern economists have extended Ricardo’s theory and identified various other sources of comparative advantage, such as differences in factor endowments, tastes and preferences, technological gaps and product cycles. Ricardo’s theory is static in nature.

ADVERTISEMENTS:

The same is true of the modern theory of comparative advantage, viz., the Heckscher-Ohlin theory. Given a nation’s factor endowments, technology and taste, Heckscher-Ohlin theory proceeded to determine a nation’s comparative advantage and the gains from trade. However, factor endowments change over time; technological improvement occurs in the long run; and tastes may also change. Consequently the nation’s comparative advantage also changes over time.

Over time a nation’s population grows and with it the size of its labour force. Similarly, a nation increases its capital stock in the long run. Moreover, natural resources (such as minerals) can be depleted or new ones found through discoveries or new applications.

All these changes lead to faster economic growth and changing pattern of comparative advantage over time. Technical change also leads to faster growth of real per capita income and is thus an important source of growth of nations and also a determinant of comparative advantage.

The growth of resources (such as land, labour, capital) and technological progress cause a nation’s production possibilities curve (frontier) to shift outward.

ADVERTISEMENTS:

There are the two main sources of growth:

1. Increase in the supplies of resources and

2. Technological progress. The effect of growth on the volume of trade depends on the rates at which the output of the nation’s exportable and importable commodities grow and with the consumption pattern of the nation as its real per capita income increases through growth and trade.

The Effect of Growth on Trade: The Small-Country Case:

If the output of the nation’s exportable goods increases proportionately faster than that of its importable commodities at constant relative prices (or terms of trade), then growth tends to led to greater than proportionate expansion of trade. Economic growth has natural effect of leading to the same rate of expansion of trade.

ADVERTISEMENTS:

On the other hand, if the nation’s consumption of its importable commodity increases proportionately more than the nation’s consumption of its exportable commodity, at constant prices, then the consumption effect tends to lead to a greater than proportionate expansion of trade. What in fact happens to the volume of trade in the process of growth depends on the net result of these production and consumption effects. This prediction is relevant for a small country which cannot influence world prices of tradable goods.

Growth and Trade: The Large-Country Case:

Economic growth is more relevant for one development of LDCs. If economic growth, what-ever its source may be, expands the nation’s volume of trade at constant prices, then the nation’s terms of trade (which is the ratio of the price index of exports to that of imports) tend to deteriorate. On the other hand, if growth reduces the nation’s volume of trade at constant prices, the nation’s terms of trade will improve. This is known as the terms-of-trade effect of growth.

The effect of economic growth on the nation’s welfare depends on the net result of terms-of-trade effect and a wealth effect. The wealth effect refers to the change in output per capita as a result of growth. A favourable wealth effect, by itself, tends to increase the nation’s welfare.

Otherwise, the nation’s welfare tends to decline or remain unchanged. If the wealth effect is positive and the nation’s terms of trade improve as a result of growth and trade, the nation’s welfare will surely improve. If they are both unfavourable, there is a loss of social welfare. If the wealth effect and the terms-of-trade effect move in opposite directions, the nation’s welfare may deteriorate, improve or remain unchanged depending on the relative strength of these two opposing forces.

Immeserising Growth:

Even if the wealth effect, by itself, tends to increase the nation’s welfare, the terms of trade may deteriorate so much that there a net loss of social welfare. This is termed as immeserising growth by Jagdish Bhagwati. The term refers to a situation in which a developing country’s attempt to increase its growth potential through exports actually results in a retardation of that potential.

This is very much an exceptional situation confined only in theory to a country where export speciality (some mineral or agricultural crop) accounts for a major share of world trade in the product. The country needs to export more to earn the foreign exchange to finance the capital imports which it requires to accelerate its rate of economic growth.

If all its export effort is concentrated on its speciality, this could lead to an ‘oversupply’ of its product resulting in a deteriorating of the country’s terms of trade. As a result, the country’s foreign exchange earnings will now buy fewer imports and domestic growth potential will be impaired.

So long we briefly explained the effects of economic growth on a country’s foreign trade but not the other side of the coin, the effects of trade on growth. Those effects are much more important for developing countries, at least, from the policy point of view. It is to this issue that we may turn now.

Trade Theory and Economic Development:

The clasical (Ricardian)-trade theory predicts that if each nation specialises in the production of the commodity of its comparative advantage, world output will be greater, and, through trade, each nation will share in the gains from specialisation and exchange.

ADVERTISEMENTS:

According to the modern theory of comparative advantage (known as the factor endowments or Heckscher-Ohlin theory) developing countries should specialise primarily in the production and export of raw materials, fuels, minerals and food to developed nations in exchange for manufactured products.

It is now believed that this pattern of specialisation and trade relegates developing countries to a subordinate position vis-a-vis developed nations and keeps them from deriving the dynamic benefits of industrialising and maximising their welfare in the long run.

The dynamic benefits include a more trained labour force, more innovations, higher and more stable prices for the nation’s exports, and higher per capita income. With developing countries specialising in primary commodities and developed nations in manufactured goods, most, if not all, of these dynamic benefits of industry and trade accrue to developed nations, leaving developing countries poor, backward and dependent.

Another reason for this is that all developed nations are primarily industrial, while most developing nations are largely agricultural or engaged in extractive activities such as construction and mining. For these reasons the traditional theory of comparative advantage is static and irrelevant to the process of economic development.

ADVERTISEMENTS:

Critics comment that as a developing nation accumulates capital and improves its technology, its comparative advantage shift away from primary products to simple manufactured goods first and then to more sophisticated items. This has recently occurred in Brazil, Korea, Mexico and other developing countries.

Trade as an Engine of Growth:

During the 19th century, the export sector of resource-poor developing countries, mainly Great Britain (where most of the world’s modern industrial production was concentrated), was the leading sector that propelled these economies into rapid growth and development.

Thus international trade acted as an engine of growth for these nations. The expansion of exports stimulated the rest of the economy. For other countries, including the USA foreign trade shaped their factor endowments and furnished investment opportune ties for foreign as well as domestic capital.

According to Ragnar Nurkse the industrial revolution happened to originate on a small island with a limited range of natural resources, at a time when synthetic materials were yet unknown. In these circumstances, economic expansion was transmitted to less developed areas by a steep and steady demand for primary commodities which those area were well suited to produce.

ADVERTISEMENTS:

Local factors of production overseas, whose growth may in part have been induced by trade, were thus largely absorbed in the expansion of profitable primary production for export. On top of this, the centre’s increasing demand for raw materials and foodstuffs created incentives -for capital and labour to move from the centre to outlying areas, accelerating the process of growth transmission from the former to the latter.

Nurkse has argued that the young economies of the 19th century, viz., the USA, Canada and Australia had temperate climates and unusual factor endowments — vast quantities of land and small amounts of labour. They could therefore supply coffee, wheat and other staples needed at the centre of the world economy. Furthermore, the new countries of the 19th century (often called areas of recent settlement) were peopled by recent immigrants from Europe, who brought with them institutions and traditions conductive to the growth of a modern economy.

However, some economists, notably Kravis, hold a different view on the relation between trade and growth. According to them, rapid growth of such nations as Canada, Argentina and Australia during the 19th century was primarily due to very favourable internal conditions (such as an abundant supply of natural resources), with international trade playing only an important supportive role.

Modem economists generally believe that today’s developing nations can rely much less on trade for their growth and development. This is due to less favourable demand and supply conditions.

Prima facie, the demand for food and raw materials is growing much more slowly today than was the case during the 19th century.

There are at least five reasons for this:

ADVERTISEMENTS:

1. Low income elasticity of demand:

The income elasticity of demand in developed nations for many of the food and agricultural raw materials exports of developing countries is low (the coefficient is often less than 1). This means that as income rises in developed countries, their demand for the agricultural exports of developing nation’s increases proportionately less than the increase in income.

2. Development of synthetics:

The development of synthetics has reduced the demand for natural raw materials. For example, synthetic rubber has reduced the demand for natural rubber, nylon the demand for cotton and plastics the demand for hides and skins. The demand for Indian jute goods has also fallen for the same reason, i.e., use of plastic materials instead of jute bags for packing purposes.

3. Technological progress:

Technological advances have reduced the raw material content of many products, such as tin-plated cans and micro circuits.

ADVERTISEMENTS:

4. Growth of service output:

The output of services (with lower raw material requirements than commodities) has grown faster than the output of commodities in developed nations.

5. Trade restrictions:

Developed countries have imposed trade restrictions on many agricultural exports (such as wheat, vegetables, sugar, oils and other products) of developing nations.

On the supply side the following four factors have been identified:

1. Factor endowments:

ADVERTISEMENTS:

Most of today’s developing countries are much less endowed with natural resources (except for petroleum- exporting countries) than were the western countries during the 19th century.

2. Population growth:

Most of today’s developing countries are overpopulated. This means that the major portion of any increase in their output of food and raw materials is absorbed domestically, leaving, very little, if any, export surplus.

3. Factor mobility:

There is much less flow of capital in developing countries today than was observed in the 19th century. At the same time there is outflow of skilled labour from such countries on a fairly large scale.

4. Neglect of agriculture:

ADVERTISEMENTS:

Finally, until recently, developing nations have somewhat neglected their agriculture in favour of more rapid industrialisation. This has hampered their export growth in particular and development prospects in general.

The Contributions of Trade to Development:

Today international trade cannot be expected to act as an ‘engine of growth’. Yet there are many ways in which it can contribute to the economic growth of today’s developing nations.

According to G. Haberler international trade can have the following beneficial effects on economic development:

1. Full utilisation of resources:

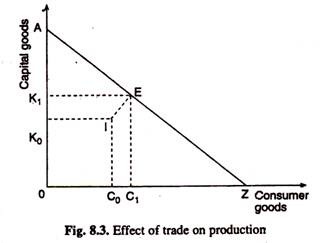

Trade can lead to full utilisation of a country’s idle and under-employed resources as Fig. 8.3 shows. In the absence of trade a developing country is operating at point I (an inefficient point). International trade enables it to operate at point E (an efficient point) and thus produce more of both consumption and capital goods.

This is the essence of the vent for surplus theory, developed by Hla Myint. According to this theory, international trade represents an outlet for its potential surplus of agricultural commodities and raw materials. This has really happened in many developing countries, particularly those in South-east Asia and West Africa.

2. Division of labour and specialisation:

There is not much scope for division of labour and specialisation if production of a commodity takes place for the narrow domestic market. If, instead, production is for the wider and unlimited export market there is much greater scope for specialisation. This has actually occurred in the production of light manufacturers in small economies such as Taiwan, Hong Kong and Singapore.

3. Transmission of knowledge:

International trade often acts as a vehicle for the transmission of new ideas, new technology and new managerial and organisational skills. And knowledge is the only factor of production which is not subject to diminishing returns.

4. Capital inflow:

International trade also stimulates and facilitates the flow of financial capital from developed to developing countries. In case of foreign direct investment, where the foreign firms or multinational corporations (MNCs) retain managerial control over its investment, foreign capital is often accompanied by foreign skilled personnel to operate the production units.

5. Stimulating domestic demand:

In case of India, Brazil and other large developing countries, imports of new manufactured goods have stimulated domestic demand in the initial stages when efficient domestic production of these goods were not economically feasible.

Contact with the rest of the world has acted as a powerful factor in creating demand for manufactured goods in the initial stages of industrialisation and stimulating domestic production of import-substitute items at a later stage of industrialisation and economic development.

6. Promoting competition:

International trade often acts as an anti-monopoly weapon by foreign domestic producers to achieve greater efficiency so as to be able to introduced foreign competition and survive in the long run. This is no doubt very important for keeping the cost and price of intermediate and semi-finished products used as the main or subsidiary inputs in the domestic production of various commodities low.

Trade as a Hindrance to Growth:

International trade is not an unmixed blessing for developing countries. It can also act as an obstacle (hindrance) to growth in more ways than one. Firstly, developing countries suffer from deteriorating terms of trade. Secondly, the gains from trade are not equally shared by all sections of society.

Producers of import-substitute manufactured goods gain at the expense of primary producers. As a result there is more inequality in the distribution of income. These and other issues discussed in the context of trade problems of developing countries. Moreover, many developing countries of today lack the institutions conducive to rapid growth.

In spite of all these most economists continue to believe that trade is the most promising engine of growth for the developing countries, and they argue that the doctrine of comparative advantage applies with particular force to those countries, which should attempt to make the best possible use of their scarce human factor (skills) and limited physical capital.

While making an overall assessment of the effects of trade on growth Peter B. Kenen writes: “Many developing countries did not welcome private foreign capital because it had colonial overtones. Nor were they willing to serve forever as suppliers of raw materials. They feared the instability of raw materials prices and wanted to draw back from export dependence. Above all, they identified economic development with industrialisation and sought to build modern factories to symbolise their independence and assert their maturity. Invoking the infant industry argument, countries in Asia and Latin America engaged in systematic import substitution. They protected their import- competing industries, penalised their export industries and tended to neglect agricultural development.”

Protectionism in Developed Countries:

The future success of international trade in serving as an engine of growth for developing economies depends only in part on the developing economies’ willingness to eliminate trade barriers and integrate their economies into the world economy. It also depends on the willingness of the developed countries to open their economies to trade with the developing countries.

The truth is that the developed economies are very ‘protectionist’ against industries in which developing economies are most likely to enjoy a comparative advantage. Given the importance of international trade for economic growth, the protectionism by the developing economies may be a major cause of the lack of convergence in per capita output in the world.

Conclusion:

In summary is becoming increasingly difficult to treat international trade, international investment and immigration as separate phenomena. Trade often requires supporting investments in distribution and marketing facilities.

Improved transportation and communications permit multinational corporations to increasingly establish and spread production centres in accordance with every country’s comparative advantage, and thus many foreign investments directly increase imports and exports. And people frequently accompany trade and investment flows.

All of these components of globalisation are also closely related to economic growth. After all, globalisation is just an international extension of the increased specialisation, exchange and interdependence that characterise the process of economic growth.