This article provides an essay on the economic growth of a country.

Introduction:

The determination of income, output employment and general price level under given conditions of relatively fixed productive capacity; which meant that the analysis was essentially static.

Once we turn our attention and introduce the theory of growth into our analysis, as also the problems of growing economy, we are no longer in the realm of static economy.

In other words, we should discuss not only the problem of growth in the productive capacity of the economy but equally the vital problem of the continuing upward adjustment of aggregate demand necessary to the utilization of an expanded productive capacity. Economic growth implies an increase overtime in the actual output of goods and services as well as an increase in the economy’s capability to produce goods and services. The fluctuations in economic activity that we call business cycles, historically take place around a rising line of trend or growth.

ADVERTISEMENTS:

It is a common economic fact that cycles and growth go together but very few models are concerned with both cycles and growth. The simple multiplier- accelerator model is capableof producing either growth or cycles but not both at the same time. For those values of c and w that generate cycles, we get only cycles that are cyclical in origin. A model of this kind that included a theory of growth would show that these cycles are also affected by growth and that growth, in turn, is affected by the cycles.

A high rate of economic growth has become one of the principal aims of macroeconomic policy. A growing economy produces more commodities in each successive time period. Growth enables a country to provide rising average standard of living for its people. One way growth occurs is that when available but unused productive capacity in the form of unemployed labour and capital is restored to work by an increase in the amount of commodities being purchased. Growth also occurs when there is an increase in the productive capacity of an economy and the demand in such that the additional capacity is used to produce more goods.

As long as economics has been in existence, it has displayed interest in economic growth—that is to say in the increase of the real national income per head over a long period. Mercantilists wanted the development of trade and industry so that the state could be rich and strong and considered restrictions on imports as the best method of doing this. Adam Smith believed accumulation of capital, technological progress, and the increasing division of labour would gradually cause the production per head to grow.

Ricardo had a much gloomier view of this: an increasing population would lead to low wages, to a shortage of land, and thus, to high rents ; profits would suffer from this and growth would, as a result, stagnate. In Marx’s theory, too, growth means decline; at least under capitalism—the collapse of the capitalist system. J. Schumpeter is the man who pushed forward the entrepreneur, who by ‘new combinations’ keeps growth on the go.

ADVERTISEMENTS:

But the neo-classical theory of the 20th century begins to display a certain interest in Stationary State: an economic movement which keeps on turning in the same circle and in which all quantities are at rest. There are no savings, no investments. Economic life seems to have entered its final stage. Each successive time period results in higher and higher money wage levels and smaller profits available for capital formation. No more capital accumulates and production does not rise and the economy is stuck up in a stationary state.

In 1930s old pessimism returns in a new form: that of stationary and perpetual fear of depression. In Keynesian world economic stagnation growth was once more relegated to the background. The conquering of unemployment and deflation was too urgent an aim to allow an intensive study of economic growth of income over longer periods.

Keynes suggests in the General Theory that it is possible for an economy to become so well equipped with capital assets that the MEC of any potential new capital asset would be zero. Then there would be no investment purchasing at any positive rate of interest. Alvin Hansen and others further expanded the ‘stagnation thesis.’

After the war renewed interest was aroused in the study of economic growth, which since then has assumed unprecedented proportions for several reasons. Growth means more and more goods and services would be available to meet the needs of an economy. Growth and rate of growth are important because of the competition between different political and economic systems—many countries apparently are keen to emulate the system that is most successful in producing ever-increasing amounts of goods. To this must be added the challenge of the communist countries—which have had higher growth rates. Further, there is increased realization of the fact that rapid economic growth of poor economies is a necessity for a better international social order and peace.

ADVERTISEMENTS:

The process of growth is concerned with the means by which a nation expands its productive capacity. Quantity and quality of labour force, natural resources, real capital and technology are the fundamental determinants of economic growth process. They define in a basic sense the potential for production of any economy.

Besides, there are variables of more basic character that lie behind the fundamental determinants—the vast array of factors, economic and non-economic, that in some sense account for changes in the supply of labour, technology and stock of capital. Again, there are variables that constitute the socio-economic structure of a society, within which the fundamental determinants must function.

Growth analysis, as the study of long-run aggregate capacity to produce is essentially concerned, first, with long-run production functions—relationships between inputs and outputs—and, second with the conditions of the supply of inputs in the long-run. In the long-run, the aggregate relationship between inputs and outputs is dominated by technological change, and by changes in the composition of output.

The pure theory of growth under highly simplifying assumptions, focussing on certain ratios among capital accumulation, labour supply, output, and other aggregate variables, has been explored by a number of economists. In growth economics analysis is carried out in dynamic terms because it has to deal with the changes in the fundamental variables, population, capital, income, technology, etc. Thus, the rate of growth of output depends on the rate of growth of capital and the capital coefficient. Increase in output per head depends upon two rates—the rate of increase in aggregate output and in population.

The Keynesian concepts of multiplier and accelerator form the corner stone’s of modern economic growth of income over longer periods. Keynes suggests in the General Theory that it is possible for an economy to become so well equipped with capital assets that the MEC of any potential new capital affect economic growth models.

A brief review of the well known Harrod Domar Model would bring out clearly the extent to which Keynesian Economics has helped in the modern analysis of growth problems. Over time it is possible that an economy’s capacity to produce will change owing to changes that might occur in either the size or the productivity of its labour force.’ Economists have long attempted to determine how much an economy will grow, whether it will stop growing, and what it will be like when and if growth ceases.

They concede, however, that there is an absolute limit to the amount of commodities which an economy’s workers can produce at a given point in time. The limit is set by the existing quality of the economy’s labour and its willingness to work, the quantity and quality of capital in the economy which is available for the workers to use and the level of technology. Needless, however, to add, that just because there is the possibility of growth, it does not necessarily follow that it inevitably occurs. For many reasons, various economies, at different times, apparently have not grown.

Modern growth theory has developed along two distinct directions. One set of theories is concerned primarily with the problems of growth in the economically underdeveloped countries and seeks to develop a comprehensive theory that will account for all the important variables, economic and non- economic, that enter into the process of economic growth. These theories dig deep into the underlying social and cultural structure of a society to identify and explain the forces that are in some sense determinants of the fundamental factors.

In such economies, a growth theory, while taking into consideration strictly economic variables like labour, stock of capital, quantity of natural resources, must also take into account the need for socio-economic set up. W.W. Rostow tries to analyze the process of growth in terms of a series of five stages through which all developing nations sooner or later pass, irrespective of their socio-economic systems. His aim is to develop a broad enough theory which covers and explains the process of growth and development in diverse societies like USA, erstwhile USSR, Japan, Germany, Modern India and Communist China.

ADVERTISEMENTS:

The other group of growth theories concentrates on the problems of growth in developed economies. Because they have been developed within the framework of Keynes income output and employment analysis—these are also called ‘Post-Keynesian’. It assumes that one or more of the variables that determine productive capacity is undergoing change at the steady rate over time. These theories study the effect of a continuous change of this kind on the economy’s productive capacity and try to explain how the level of aggregate demand may be adjusted over time to the resulting changes in productive capacity.

Steady Growth:

Basically, steady rate of growth is one in which the rate of growth of output capacity is matched by a corresponding increase in effective demand. A steady growth would imply the study of the trend of national income in the long period. It means the study of the development of income in the long period without instability and fluctuations. Steady and stable growth is possible only It’ the technological and organizational improvements that are required are brought about without any friction.

There will be steady growth if the rate of investment is such that the additional income generated is just enough to take care of the increased productive capacity resulting from increased investment. An excess of productive capacity over income generated will bring about fall in prices and profits; while an excess of income over productive capacity will have the opposite effect.

Thus, in a growing capitalist economy, a stable rate of growth can be maintained only by steadily increasing investment. What is, therefore, required is a theory which in explaining the occurrence of cyclical fluctuations in income and employment, explains growth as well. A satisfactory theory of business fluctuations should explain not only the occurrence of cycles, but also their occurrence as part of the pattern of economic growth.

ADVERTISEMENTS:

Kaldor points out that earlier model of trade cycle were static in the sense that they treated the fluctuations as movements around a stationary equilibrium. A proper theory of economic development according to him should be capable of deriving both trend and fluctuations as the resultant of the same set of influences. Hence, the need of a type of analysis “which places long-run tendencies in the centre and works the problem of business cycles into that theme.”

Basic Principles of Long-Run Growth Theory:

The theory of income determination presented so far is a short-run theory. It neglected the capacity increasing effect of investment. A long-run growth theory highlights the dual aspect of investment. On the one hand, it generates income (through multiplier), which is an essential study in the short period; on the other hand, it creates additional productive capacity, which is an essential study in the long-run. Thus, the chief problem in the study of long-run growth is first not only to keep in mind the dual effect of investment but also to ascertain the conditions, under which the additional productive capacity created could be absorbed.

In the short-run study of growth one may concentrate on the income-generating effect of investment; however, when we consider longer periods of time we cannot overlook the dual effects of investment, i.e., its effects of income and productive capacity. This, in turn, gives rise to a number of problems for a theory of long-run growth which don’t arise in a short-run theory of income determination.

Assuming initially a full employment equilibrium level of income, the maintenance of this equilibrium year after year requires that the volume of spending generated by investment must be sufficient to absorb the increased output made possible by investment. Just as we need demand so that the goods produced can be sold, we need demand so that the production capacity can be fully utilized.

ADVERTISEMENTS:

In other words, our problem is not only to remove unemployment of labour but also unemployment of capital. To remove the unemployment of labour we increase investment, but it increases the supply of capital goods and thereby might cause or tend to cause unemployment of capital. In trying to solve the problem of unemployment of labour we are likely to create the problem of unemployment of capital.

If the marginal propensity to save is given, then the more capital is accumulated, and the higher national income already is, the greater must be the absolute volume of net investment. Therefore, if full employment is to be maintained, the absolute amount of net investment must ever increase. This, in turn, requires continuous growth, in real national income. Thus, it can be seen, that a process of growth, once started, must continue ad infinitum if disturbances are to be avoided. We can speak of steady growth or disturbance free growth, if the increase in the capital stock, brought about by additional investment, can be utilized in conformity with the intentions and expectations of firms.

This is the most important condition that must be fulfilled for a steady growth. Therefore, it is clear that if we want to maintain full employment without any disturbances it is essential that the absolute volume of net investment must over expand in a manner that facilitates the process of continuous matching between the expansion of productive potential and the growth in real national income.

Other conditions along with this basic condition for steady growth are:

That the rate of growth of real income (Y) must be equal to the rate of growth of productive capacity (assuming a constant degree of utilization). It is the basic condition for disturbance-free growth. Another condition of the disturbance-free growth is the equality of voluntary savings and investment in each period. Hence, second basic condition is that S = I. Thirdly, income and net investment must grow exponentially if steady growth is to be ensured. In other words, if the desired degree of utilization of the growing capital stock is to be realized, income must grow at an ever- increasing rate.

Fourthly, given the capital-output ratio, a high marginal propensity to save is the fundamental condition for a rapid growth of real income.In the long-run growth model the effect of a high MPS is totally different from that in the short-run theory of income determination, where a high MPS leads to a reduction in income. In the long-run growth model a high MPS is necessary, while in the short-run cyclical growth model, a high MPS has the opposite effect of reducing national income.

ADVERTISEMENTS:

Let us understand that there is no contradiction of any kind about saving in the foregoing statement. While discussing savings, all that is necessary is to make it clear whether one is considering long-run growth or whether one is considering the short-run aspects of fluctuations in income within the framework of a given productive capacity. The theory of long-run growth, neglects those short period fluctuations in income which occur within any given productive capacity, and concentrates on those effects on income which stem from the capacity increasing effects of investment.

The effects of additional savings appear in one way when we consider only long-run development and assume that run. Thus, the theory of long-run growth explains the trend of national income, while the short-run theory of income determination explains the fluctuations of income around the trend.

The central problem of the theory of long-run growth is to understand the above conditions for disturbance—free or steady growth in the sense enumerated above. The latest development of the theory aims at combining both approaches in an analysis which takes account of both aspects simultaneously.

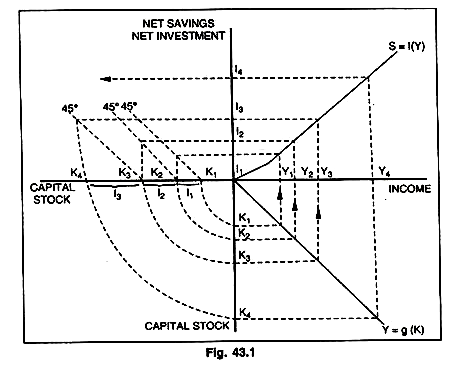

G. Borifibach has given a simple diagrammatic representation of the process of growth discussed here:

In the Fig. 43.1 given above the saving function S = f(Y) is drawn in quadrant I. Given the MPS, we can read off immediately what level of net investment is required if a given level of income is to be reached. In quardrant IV the straight line through the origin represents the relationship between the capital stock, given the degree of utilization and potential income. The capital stock K1 K2……. corresponds to the potential income Y1, Y2…… Quadrant II shows the addition to the capital stock, which is equal to prevailing net investment.

The process of growth takes place as follows: Let the capital stock in the first period be K1. If this capital stock is utilized to the degree intended by firms, the real income Y1 can be produced. But this real income Y1 can be absorbed only if net investment is at the level I1, which leads to a rise in the capital stock from K1 to K2. If this enlarged productive capacity is to be utilized to the degree intended by firms, the level of income Y2 must be produced.

The level of income Y2 will be absorbed only if net investment is at the level I2.This in turn leads to an increase in the capital stock, and so on. It can be seen that the absolute increases in K, Y and I become ever larger, and that the process of growth never leads to a stationary state. However, this growth model states nothing about the forces which determine actual or observable growth. It merely elucidates the conditions for disturbance free or steady growth.