In this article we will discuss about:- 1. Assumptions of Classical Theory of Interest 2. Supply and Demand for Capital 3. Determination of Rate of Interest 4. Features of Classical Theory 5. Criticisms.

The economists like Ricardo, J. S. Mill, Marshall and Pigou developed the, classical theory of interest which is also known as the capital theory of interest or the saving-investment theory of interest or the real theory of interest. According to this theory, interest is a real phenomenon and the rate of interest is determined exclusively by the real factors, i.e., the supply of and demand for capital under perfect competition. The supply of capital is governed by thrift (i.e. saving) or time preference and the demand for capital is influenced by the productivity of capital.

Assumptions of Classical Theory of Interest:

The classical theory of interest is based upon the following assumptions:

(i) Perfect competition exists in the factor market.

ADVERTISEMENTS:

This assumption has the following implications:

(a) The equilibrium rate of interest is determined by the competitive forces of demand and supply in the capital market.

(b) Interest rate is flexible, i.e., it freely moves to whatever level the demand and supply forces dictate.

(ii) The theory assumes full employment of resources.

ADVERTISEMENTS:

This assumption has the following implications:

(a) Saving involves sacrifice of abstaining from or postponing of consumption and interest is the reward for abstinence or waiting: it is only when all resources are fully employed, higher rate of interest is paid to induce people to save or abstain from consumption or postpone consumption

(b) Income level is assumed to be constant; it is at the full employment level that income and output do not change and become constant.

(c) The assumptions of full employment and given level of income lead to the further assumption that the demand and supply schedules of capital are independent and do not influence each other; it is only when income changes as a result of a change in investment, that saving changes in consequence.

ADVERTISEMENTS:

(iii) Economic agents act rationally, i.e., they are motivated by self-interest and want to maximise economic benefit.

(iv) The price level is assumed to be constant. If it changes then the economic agents do not suffer money illusion, i.e., savers and investors react to changes in the real interest rates and not the changes in the money interest rates.

(v) Money is neutral and serves only as a medium of exchange and not as a store of value.

Supply and Demand for Capital:

Supply of Capital:

The supply of capital depends upon savings which, in turn, depend upon a number of psychological, economic and institutional factors broadly classified as – (a) the will to save, (b) the power to save, and (c) the facilities to save. Saving means curtailment of consumption or postponement of the present consumption. Thus, saving involves a sacrifice, abstinence or waiting. The rate of interest is considered to be the reward for abstinence or waiting.

It is an inducement for the act of saving or foregoing the present consumption. In deciding between the present consumption (which involves no saving) and the future consumption (which requires saving), the individual has to take into consideration the opportunity cost of each alternative and the opportunity cost is measured by the rate of interest.

For example, if the current rate of interest is 5% then by consuming Re. 1 of income now, the individual is foregoing the consumption of Rs. 1.05 one year later. Thus, the higher the current rate of interest, the greater the opportunity cost of present consumption as compared to the future consumption, and, as a result, greater the inducement to save out of the present income.

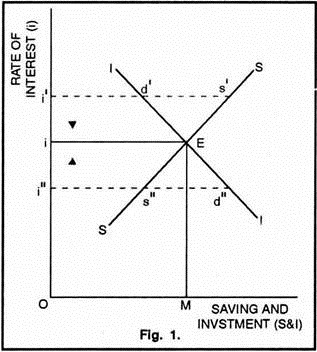

Hence, saving is interest elastic and there is a positive relationship between the rate of interest and saving. The supply curve of capital or the saving schedule (SS curve in Figure 1) slopes upward to the right which indicates that higher the rate of interest, larger will be the savings and greater will be the supply of capital and vice versa.

Demand for Capital:

ADVERTISEMENTS:

Capital is demanded by the investors because it is productive and brings profits to them. The demand for capital or investment demand depends, on the one hand, on the productivity of capital, i.e., returns on investment, and on the other hand, on the rate of interest, i. e., the cost of investment. Productivity of capital is subject to the law of diminishing returns.

Additional units of capital are less productive than the earlier units; with the investment of more and more capital, the marginal productivity of capital declines. The producer will continue his investment of capital as long as the productivity of capital is more than the rate of interest and will stop further investment when the productivity of capital equals the rate of interest. This shows that at higher rates of interest, the producers demand less capital and at lower rates of interest, they demand more capital.

Thus, the demand for capital is inversely related to the rate of interest. The demand curve for capital or the investment schedule (II curve in Figure I) slopes downward to the right which indicates that higher the rate of interest, smaller the demand for capital.

Determination of Rate of Interest:

ADVERTISEMENTS:

Assuming the income level to be given, the rate of interest is determined by the intersection of the demand curve and the supply curve of capital.

The determination of equilibrium rate of interest of the following three conditions:

(i) The supply of capital or saving is an increasing function of the rate of interest:

S = f (i); dS/di > 0

ADVERTISEMENTS:

(ii) The demand for capital or investment is a decreasing function of the rate of interest:

I = f(i); dl/di < 0

(iii) The supply of capital equals the demand for capital:

S = I

Where, S = saving, I = investment,

and i = rate of interest.

ADVERTISEMENTS:

In Figure 1, the II curve (demand curve for capital) intersects the SS curve (supply curve of capital) at point E. The equilibrium rate of interest is Oi and OM is the quantity of capital demanded and supplied at this rate. In other words, at the equilibrium rate of interest, i.e., Oi, saving = investment = OM.

Any deviation from the equilibrium rate of interest (Oi) will be unstable. If, at any time, the rate of interest rises to Oi the supply of capital exceeds the demand for capital (i s’ > id’). As a result of this excess of capital supply, the rate of interest will fall to its equilibrium level (Oi). Similarly, if the rate of interest falls to Oi”, the demand for capital exceeds the supply of capital (i” d” > i” s”). As a result of this excess of capital demand, the rate of interest rises to its equilibrium level (Oi).

Features of Classical Theory:

The distinguishing features of the classical theory of interest are given below:

1. Capital Theory of Interest:

In the classical theory, interest is defined as reward for the use of capital and the rate of interest is determined by the demand and supply of capital. The supply of capital is a positive and the demand for capital is a negative function of the rate of interest.

2. Real Theory:

ADVERTISEMENTS:

The classical theory is concerned with the real rate of interest which is determined purely by the real factors of saving and investment. The concept of real rate of interest can be defined as the money or market rate of interest less the anticipated rate of inflation. If it is assumed (as the classical theory does) that the price level is constant and everyone anticipates that it will remain constant, then the real and money rates of interest are equal.

3. Flow Theory:

The theory is stated in flow terms. Total saving and total investment have been considered as flows per unit of time. In other words, the supply of saving is regarded as a flow of funds into the capital market and the demand for investment as a flow of funds off the capital market. The equilibrium of the capital market requires the equilibrium between the flows of saving and investment.

4. Equilibrating Mechanism:

According to the classical theory, the rate of interest is the equilibrating force between saving and investment. Whenever there is disequilibrium between saving and investment, the equilibrium is restored through changes in the rate of interest. If at any time, saving exceeds investment (i’ s’ > i’ d’ at Oi’ rate of interest in Figure I), the rate of interest falls and brings equality between saving and investment. On the other hand, if investment exceeds saving (i” d” > i” s” at Oi” rate of interest), the rate of interest rises and brings equality between saving and investment.

5. Positive Rate of Interest:

ADVERTISEMENTS:

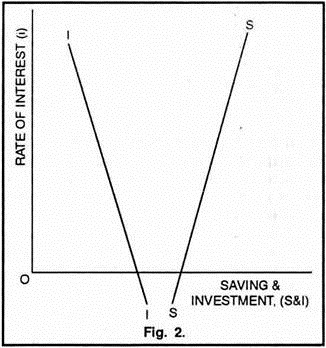

An important feature of the classical theory of interest is that it assumes a positive real rate of interest. The theory implicitly requires that the demand and supply curves of capital intersect at a positive real rate of interest. If, for example, the two curves do not intersect at a positive rate of interest (as shown in Figure 2), then, at zero rate of interest, there will be excess supply of capital (Os > Od). This is a situation of general glut which implies that equilibrium is inconsistent with fill employment.

Criticisms of Classical Theory:

The classical theory of interest has been criticized by Keynes on many grounds:

1. Interest not a Reward for Saving:

Keynes has criticized the classical view that interest is the reward for saving or capital on the following grounds:

(a) An individual can get interest by lending money which he has not saved but has inherited from his forefathers.

ADVERTISEMENTS:

(b) If a person hoards his savings in the form of cash, he earns no interest,

(c) Savings depend not only on the rate of interest but also on the level of income, hence interest cannot be a reward for saving,

(d) Keynes regards interest as a monetary phenomenon and defines the rate of interest as a reward for parting with liquidity (or cash balances) rather than a reward for saving.

2. Saving and Investment not Interest Elastic:

The classical theory assumes that saving and investment are interest elastic, i.e., sensitive to changes in the rate of interest. But it is not always so. In reality, investment depends more on marginal efficiency of capital and future expectations than on the rate of interest, particularly during periods of depression.

Similarly, savings are rarely interest elastic. People may save without any rise in the rate of interest, or may save even if the rate of interest falls to zero. In fact, savings are more influenced by the level of income than by the rate of interest.

3. Rate of Interest not Equilibrating Force:

According to the classical economists, the equality between saving and investment is maintained by the interest rate adjustment mechanism. Keynes objected to this view and gave a different mechanism for restoring the equality. According to him, income, and not rate of interest, is the equilibrating force between saving and investment. Whenever saving exceeds investment, income level declines. As a result, saving falls and becomes equal to investment. Similarly, if investment exceeds saving, income level rises, saving increases and becomes equal to investment.

4. Role of Money Ignored:

The classical theory of interest assumes money to be neutral, merely acting as a medium of exchange. It ignores the role of money as a store of value, i.e., it does not take in to consideration the possibility that saving may be hoarded. It also completely ignores the important role the quantity of money, the created money and the bank credit can play in the determination of the rate of interest. All these factors make the classical theory unrealistic and irrelevant in the modern dynamic world.

5. Unrealistic Assumption of Full Employment:

The classical theory is unrealistic because it operates under the special conditions of full employment. Normally, less-than full employment, and not full employment, conditions prevail in the actual world. According to Keynes, when there are unemployed resources in the economy, people need not be paid for abstaining from consumption (i.e., for saving). The problem in such an economy is to put idle resources to use rather than to withdraw already employed resources from their existing employment. Hence, under unemployment conditions, interest cannot be a reward for abstinence or waiting.

6. Discrepancy between Market and Natural Rates:

The classical economists assume that discrepancy between the natural (real) and market (money) rates of interest is merely a chance and cannot exist for a long time. But, according to Wicksell, Keynes and other monetary economists, the market rate of interest normally deviates from the natural rate of interest and this deviation is due to the influence of monetary factors like creation and destruction of bank credit.

7. Narrow View of Supply of Capital:

The classical economists included only saving in the supply of capital. But in reality, the supply of capital comprises of dishoarded money. Moreover, newly created money and bank credit also form important sources of supply of capital.

8. Narrow View of Demand for Capital:

According to the classical theory, the demand for capital comes only from the investors for meeting investment expenditures. It completely ignores the fact that loans are also taken for consumption purposes.

9. Indeterminate Theory:

Keynes criticised the classical theory of investment on the ground that it is indeterminate. According to the classical theory, the rate of interest is determined by the intersection of saving and investment curves. The position of the saving curve depends upon the level of income; saving curve shifts to the right if income increases and vice versa.

Thus, we cannot know the rate of interest unless we already know the income level. But, we cannot know income level without first knowing the volume of investment and the knowledge of the volume of investment requires the prior knowledge of the rate of interest. Thus, the classical theory of interest offers no solution; it cannot tell what the rate of interest will be unless we already know the rate of interest.