In this article we will discuss about:- 1. Introduction to Harrod-Domar Growth Model 2. Domar’s Growth Model 3. Harrod’s Growth Model 4. Relevance of Harrod-Domar Growth Model for Developing Countries.

Introduction to Harrod-Domar Growth Model:

Keynes in his General Theory was concerned with the determination of income and employment in the short run. He explained that since in the short-run situation of developed capitalist economies aggregate demand was deficient in relation to the aggregate supply of output, the equilibrium will be established at less than full-employment level.

Since the propensity to consume (and therefore saving propensity) is given and remains constant in the short run, if the amount of investment as determined by expected rate of profit and the market rate of interest is not equal to the amount of saving at the full-employment level of income, the economy will be in equilibrium at less than full capacity level (i.e., less than employment level) of output. He did not go into the question of the long-run growth of the economy.

In fact, he overlooked the effect of investment in a given period on the increase in productive capacity. However, investment has a dual effect. Firstly, investment increases aggregate demand and income of the people through the multiplier process, and secondly, it raises the productive capacity of the economy through the addition it makes to the stock of capital. Indeed, investment by very definition means the addition to the stock of capital. While Keynes took into account the demand effect of investment, he ignored the capacity effect of investment.

ADVERTISEMENTS:

Harrod and Domar extended the Keynesian analysis of income and employment to long-run setting and therefore considered both the income and capacity effects of investment. Harrod and Domar models of economic growth explained at what rate investment should increase so that steady growth is possible in an advanced capitalist economy. In the growth models of Harrod and Domar, the rate of capital accumulation plays a crucial role in the determination of economic growth.

The problem of present-day mature economies lies in averting both secular stagnation and secular inflation. These were the pioneer works of Harrod and Domar that set the ball rolling in regard to this issue, i.e., the maintenance of steady growth in advanced industrialised countries. The Harrod and Domar models seek to determine that unique rate at which investment and income must grow so that full-employment level is maintained over a long period of time, i.e., equilibrium growth is achieved.

Harrod and Domar developed their models of steady growth quite separately, though Harrod published his theory earlier than Domar. Although their models of steady growth differ in details, yet the underlying basic idea is the same. Both of them assigned to capital accumulation a crucial role in the development process. But they emphasised the double role of the investment process, viz., generating income (increasing demand) and adding to the productive capacity of the economy. The classical economists confined their attention to the capacity or supply side only, whereas the earlier Keynesian economists studied the problem of demand only whereas Harrod and Domar consider both sides.

They start with full-employment equilibrium level of income. According to them, to maintain full employment equilibrium, demand (total spending) generated by investment must be sufficient to be the additional output caused by this investment. To ensure steady growth with full employment the absolute amount of net investment must keep increasing and there must also be continuous growth of real national income.

ADVERTISEMENTS:

Because if demand and income did not increase while annual investment went on occurring, the additions made to the capital stock would remain unutilised and also employment could not be provided to the growing labour force which would result in unemployment of these two major resources. Obviously, such a situation is not conducive to steady economic growth.

Domar’s Growth Model:

Let us first consider the supply side, that is, the capacity effect of investment. Increase in national output or national income of an economy during a period depends upon the increase in the stock of capital (which is represented by ∆K) during a period and the output-capital ratio or the productivity of capital. Assuming that both national income and the capital stock are measured in money, output- capital ratio can be written as ∆Y/ ∆K, where ∆Y stands for the increase in the national income and ∆K for the increase in the stock of capital.

Thus if Rs 4 worth of capital goods is required to produce one rupee worth of real output, marginal output-capital ratio is equal to 1/4 or 0.25. Thus, the absolute increase in national income during a period (∆Y) can be obtained from increment in stock of capital ∆K multiplied by the output produced by a unit of capital [i.e, ∆Y/∆K].In symbolic terms we may express this as follows –

∆Y=∆K. (∆Y/∆K)…………(1)

ADVERTISEMENTS:

Now, change in capital stock (∆K) is nothing else but investment. Therefore, following Domar in place of ∆K we can write I. The marginal output-capital ratio ∆Y/∆K which is assumed to be constant as well as equal to average output-capital ratio by Domar and Harrod, can be denoted by σ. Thus, as Domar puts it, growth in capacity-output can be written as under –

∆Y=I σ … (2)

It may be noted that output-capital ratio (σ) is reciprocal of capital-output ratio i.e. (∆K/∆Y or K/Y). Let us give an example. If Rs 500 crore is invested in a year and capital-output ratio is 4 (i.e. output- capital ratio will be 1/4), then growth in output in a year will be.

∆Y= 500 x 1/4

= 125 crore

Demand or Income Effect of Investment:

Now, according to Domar, growth in capacity-output will be realised only if aggregate demand or income of the people increases by a sufficient amount. The increase in aggregate demand or income is explained by the Keynesian theory of multiplier. Domar has based his analysis of demand or income effect of investment on the Keynesian theory of multiplier and income determination.

According to this, increase in income (or aggregate demand) is given by the increase in investment (∆I) and the size of multiplier, i.e., 1/s where s is the marginal propensity to save (assumed by Domar to be equal to the average propensity to save). Thus, according to income effect of investment –

∆Y=(1/s). ∆I…………..(3)

ADVERTISEMENTS:

Note that 1/s represents the size of investment multiplier.

The growth in income (∆Y) must be large enough to generate demand equal to capacity growth in output as explained above.

Domar’s Growth Equation in Terms of Rates of Growth:

It is greatly helpful to express the above growth equation in terms of rates of growth of income and capital. That is, growth in income and capital should be expressed as ratios of total income. For doing so we divide both sides of equation (1) above by Y and obtain-

ADVERTISEMENTS:

∆Y/Y = (∆K/Y).( ∆Y/K) …(4)

It represents the rate of growth of income and is therefore written as simply GY. Besides, ∆K stands for increment in capital during a given time period and is nothing else but investment. Therefore, for ∆K in the equation (4) we can write I which represents investment. With these changes, we get the following equation–

Gy=1/Y. (ΔY/ΔK)

If it is further assumed that output-capital ratio remains constant, then the marginal output-capital ratio (∆Y/∆K) will be equal to average output-capital ratio(Y/K). With this assumption and also expressing output-capital ratio by σ we can write the above equation as follows–

ADVERTISEMENTS:

Gy=1/Y. σ …(5)

Where, Gy= Growth rate of output or income

I/Y = Rate of investment as ratio of national income

σ = Output-capital ratio

From the growth equation (5) above, it is clear that, given the output-capital ratio, rate of growth of output depends upon the rate of investment; the greater the rate of investment, the greater the rate of growth of output or income. To maintain full-employment equilibrium as the economy grows at a steady rate, rate of savings (S) must remain equal to rate of investment (I). Therefore, in equation (5) we can write S/Y for I/Y. By doing so and rewriting equation (5) we have

Gy=S/Y. σ

ADVERTISEMENTS:

Since S/Y represents ratio of savings to national income, we can write it as s. With rewriting the above equation we have

Gy = s.σ …(6)

The above equation (6) represents the productive capacity effect of investment and saving and therefore represents the supply-side of the growth problem.

The Condition for Equilibrium Growth:

To achieve and maintain equilibrium or balanced growth, aggregate demand (i.e., aggregate expenditure) must increase at the rate which is large enough to absorb the increase in capacity-output.

We have explained above (equation (3) that aggregate demand or income increases at the rate 1/s. ∆I where s is propensity to save and ∆I is the absolute increase in investment. On the other hand, as shown by equation (2) above, the increase in capacity output occurs at the rate of Iσ where I is the absolute rate of investment and σ is the output-capital ratio. Thus, steady equilibrium growth rate will be achieved only if rate of growth of aggregate expenditure (demand or income) equals the rate of growth in capacity output.

ADVERTISEMENTS:

Thus, it follows that to maintain full-employment equilibrium growth of output the following condition must hold:

As seen above in equation (6), rate of growth of income (∆Y/Y or Gy) is also equal to sσ, it follows that for equilibrium growth Gy = ∆Y/Y=∆I/I= sσ

If the above condition is not fulfilled, the economy would not move along the equilibrium growth path.

Thus, the essential condition for maintaining a continuous equilibrium state of full employment is that investment and real income must both grow at a constant annual rate. This rate should be equal to the propensity to save (s) multiplied by output-capital ratio (σ) i.e., sσ.

ADVERTISEMENTS:

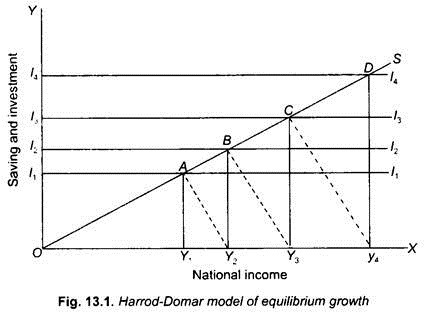

We can explain the model in geometrical terms with the help of Fig. 13.1 given above. Here real income is measured along the horizontal axis, while saving and investment (in real terms) are measured along the vertical axis. The saving function is represented by the line OS starting from the origin. Its slope is given by the marginal propensity to save (S) which is assumed to remain constant for a considerable period of time. The initial investment demand is represented by curve I1I1. This intersects the saving function OS at the point A so that the corresponding equilibrium level of income is Y1. We assume that it corresponds to the full-employment level of national income.

Now, the new capital so created (represented by OI1) will lead to the increase in productive capacity as determined by output-capital ratio. Given the output-capital ratio, investment OI1 leads to Y1 Y2 increase in output or income. As a result, national income will increase to Y2. The ratio between the increase in income (∆Y or Y1Y2) and the increase in investment (OI1) is given by the ‘output-capital’ ratio σ. But the new equilibrium level of income Y2 will be realised or maintained only if the investment demand function shifts upward to I2I2 and intersects the saving function OS at the point B, which is vertically above Y2.

However, as soon as the new capital equipment represented by the higher level OI2 starts producing goods, capacity output or income will rise to Y3 (indicating an increase by an amount σ times OI2, over the previous level of income (Y2). But the new level of income Y3 will be maintained only if investment increases so much that the new investment demand curve I3I3 intersects the saving function OS at C. In this way, the process will continue so long as the investment increases by the appropriate amount in each period. The income would successively go on rising by an amount σ times the previous period’s investment. And the investment in each period would rise by σ times the output-capital ratio. Thus, income would continue to grow at the steady rate of sσ.

It is evident from the basic equation ∆ I/I = sσ that greater the saving rate(s), the greater will be the growth of investment needed to maintain the steady growth with full employment. Similarly, greater the value of (i.e., the output-capital ratio), the greater should be the increase in income to avoid emergence of excess capacity. But greater income is possible only through greater investment. Hence, if income is to grow at a steady rate, investment must also grow at the annual steady rate given by sσ.

If, ∆ I/I < sσ, that is, if sufficient growth in investment does not take place, steady growth with full employment cannot be achieved. On the other hand, if today’s investment is sufficient to achieve equilibrium growth with full employment, investment will have to be much more in the next period for generating sufficient increase in demand so as to utilise fully the expanded production capacity and to avoid the underutilisation of capital stock which will result in a fall in investment, and cause depression. In other words, “the economy must, so to speak, run faster and faster to stay in the same place, otherwise it will slip downwards.”

Harrod’s Growth Model:

Here we will explain the essential features of Harrod’s growth model separately. In his essay “Towards a Dynamic Economics”, Harrod put forward a theory which can be considered as truly dynamic. Explanation of secular trends is his main theme. He seeks to explain the secular causes of unemployment and inflation and the factors which determine the equilibrium and the actual rate of capital accumulation.

ADVERTISEMENTS:

The classical economists considered economic development as a race between technological progress and capital accumulation on the one hand, and growing population and diminishing returns from land on the other. Harrod drops diminishing returns, regards technological progress and population growth as independent factors.

In Harrod’s analysis of economic growth there are three basic elements:

(a) Population growth,

(b) Output per head as determined by level of technique or inventions and

(c) Capital accumulation.

Inventions may be neutral, i.e., leave the capital coefficient unchanged, or capital-saving, i.e., reducing the capital coefficient, or ‘labour-saving’ which will increase the capital-output ratio. It may be noted that capital-output ratio is the reciprocal of output- capital ratio (σ), the concept used by Domar. It is important to mention that Harrod uses the concept of incremental capital-output ratio, which is the reciprocal of marginal output-capital ratio (σ) of Domar’s model.

While arriving at the behaviour of income as a response to entrepreneurial decisions regarding investment, Harrod makes two assumptions:

(i) Saving in any period of time is a constant proportion s of the income received during that period, and

(ii) The investment is proportional to the rate of increase of income.

The second assumption is in fact the acceleration principle which states that the increase in output or income that occurs induces an increase in the stock of capital.

Harrod begins his analysis of growth by marrying together acceleration principle and the theory of investment multiplier. As in Domar’s model, Harrod explains that growth rate (Gy or ∆Y/Y) depends on the rate of capital formation (or investment) and capital-output ratio which he defines as “the value of the capital goods required for the production of a unit increment of output”. He put forward three growth equations. He takes saving as a fixed proportion of national output or income. Presenting a more elaborative analysis of growth than Domar, Harrod advanced three growth equations. Harrod writes his first growth equation as follows –

Gy=s/ν….(1)

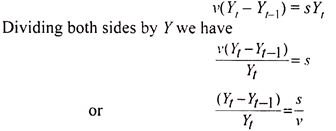

Where, Gy is the rate of growth in a period (∆Y/Y), s is the rate of saving (i.e. proportion of saving to national income (s/y) and ν is the capital-output ratio. It is important to note that capital-output ratio ν in Harrod’s growth equation (1) above is the one that is actually obtained from the extra capital accumulation (∆K) and increase in production of goods and services in a year (∆Y). Harrod derives this growth equation as–

Following the Keynesian framework, Harrod takes that actual saving must be equal to actual investment. Further, since Harrod takes saving (S) as a constant proportion of national income (T) in a period, we have–

S = sYt

Where, s is propensity to save.

Investment (I or ∆K) in a period t depends on the rate of increase in production (or income), that is, ∆Y (or Yt– Yt-1) and the actual capital-output ratio (ν). Thus we have

∆K or I= ν (Yt –Yt-1)

Since in a period actual saving must be equal to actual investment, we have

Since (Yt -Yt-1)/Yt represents actual growth of output or income, we can denote it by Gy. Thus

Gy = s/ ν

Gv is the growth of output or income which actually occurs in a period. The above growth equation is in fact a truism as it is always true by definition depending as it is on the accounting identity that actual investment equals actual savings of a period.

Warranted Rate of Growth:

Harrod proposes a second growth equation which he calls a fundamental growth equation to describe the equilibrium growth at a steady rate. The warranted rate of growth is taken to be that rate of growth which if it occurs will keep the entrepreneurs satisfied that they have produced neither more nor less than the right amount. Being satisfied with the achievement of this growth rate, the entrepreneurs will maintain or perpetuate the same rate of growth. Warranted rate of growth is thus equilibrium rate of growth in the sense that producers, if they achieve it, will be induced to maintain it.

The condition for warranted rate of growth is stated as under:

Gw = s/ νr ………(2)

Harrod denotes capital-output ratio by the letter C, but following the modern practice we are using ν for it.

Gw = “Warranted rate of growth”, which is that rate of income growth of output or income. (∆Y/Y), which will keep entrepreneurs satisfied with the amount of investment they have actually made, i.e., it is in fact the full-capacity rate of growth.

νr = required incremental capital-output ratio to sustain the warranted rate of growth and is determined by the state of technology and the nature of goods constituting the increment in output.

s = average propensity to save.

The sort of entrepreneurial behaviour envisaged by Harrod means that to maintain full employment, the desired (ex-ante) saving out of the full-employment income must be offset by an equal amount of desired investment. But to induce this much investment, income must be growing.

In both the above equations (1) and (2) above s is the same because Harrod assumes that the saving intentions are always realised so that ex-ante savings are always equal to ex-post savings.

Thus, Harrod is able to show that for dynamic equilibrium Gw = s/ νr.

It is important to note that νr in growth equation (2) is different from ν of the growth equation (1), As noted above, ν in Harrod’s growth equation (1) shows the increment in the amount of new capital installed during a period divided by the increase in output actually obtained from it during that period. It shows what has been actually produced with the addition to the capital stock in a period and not whether producers are satisfied with the increase in output actually realised. For example, if there are boom conditions in the economy and as a result the increase in capital installed during the period is fully utilised, actual capital-output ratio (ν) will be lower. On the other hand, if there is a demand recession in the economy, the good amount of extra capital installed will not be utilised for production and consequently incremental capital-output ratio (ν) will be higher.

But what determines the size of the required incremental capital-output ratio (νr) which keeps entrepreneurs to perpetuate the growth rate. The size of the νr is determined by technological conditions and the nature of goods comprising the increment of output. This warranted rate of growth will be achieved if sufficient increase in income takes place during the growth process.

The proportion of investment to income being fixed, an increase in income would mean that in the next period both income and investment must be higher. In such a situation the producers would like to perpetuate the rate of growth which they have already realised. Under such circumstances the producers invest in the hope that they will be able to sell what they have planned to produce. In other words, the producers will desire to invest an amount required by Gwνr which will be equal in magnitude to s, i.e., the given proportional saving rate.

Condition for Equilibrium Growth Rate in Harrod’s Model:

Now, what is the condition for equilibrium growth rate? In Harrod’s model, if incremental capital-output ratio (νr) actually realised happens to be equal to required capital-output ratio (νr), warranted by technological and other conditions, then the actual rate of growth, GY is equal to the equilibrium warranted rate of growth (Gw), the rate which the circumstances of the economy warrants, the economy will be growing at the equilibrium rate (Gy = Gw). It may be noted that actual rate of growth will be equal to the warranted rate of growth when investment is increasing at the rate high enough to generate adequate demand to ensure capacity growth rate (Gw).

Harrod lays down equilibrium condition for steady growth by saying that the actual rate of growth must be equal to the warranted rate of growth, i.e., the rate of increase in output or income should be just so much as to keep the entrepreneurs satisfied with the actual investment they have made. Thus for equilibrium growth rate Gy = Gw.

Thus, so long νr = ν, the producers would like to perpetuate a growth rate that is equal to the actual or realised rate. In other words, Gy (the actual growth rate) will be the same as that which the producers want to perpetuate, i.e., Gw. But we have seen above that Gw stands for the rate of growth which when realised leaves the entrepreneurs in a state of mind that they shall be prepared to undertake a similar advance in the future.

Furthermore, if the income increases at this rate it will continue to increase at this rate. This is how a steady growth rate is assured. Income will have to grow faster and faster, if the entrepreneurs are to be convinced that the higher investment was desirable. In this way, both income and investment will go on increasing from one period to the next. There is thus a cumulative equilibrium growth of income and investment.

Graphic Illustration of Harrod’s Model:

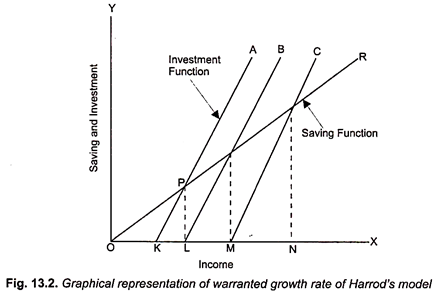

We can geometrically illustrate Harrod’s model with the help of Fig. 13.2 given below. Here income is measured along the horizontal axis, while saving and investment are measured along the vertical axis. The line OR is drawn with a slope s (of the fundamental equation Gw = S/νr) where s represents the saving function. The line KA represents the Harrodian investment function I = νr ∆Y (i.e., νr=I/∆Y). For the sake of convenience we may write this function as It = νr (Yt– Yt-1). This means that the investment will be zero if the current income (Yt) is the same as the previous income (Yt-1). As such the investment function line KA cuts the income-axis at K which corresponds to the previous period’s income (Yt-1). Further, the slope of the investment function KA is equal to νr and this is greater than 45° on the assumption that νr> 1.

From Fig. 13.2 given above, it can be seen that the saving-investment equilibrium in the current period is attained when the level of income is OL. And this level of income in the current period is more than the previous period’s income level by an amount KL. Thus, the warranted rate of growth Gw =∆Y/Y=Y1-Yt-1/ Yt is given by KL/OL.

In the succeeding period (t+ 1), OL becomes the previous period’s income and the investment function shifts to LB. So if νr remains unchanged, LB will be parallel to KA. The new saving-investment equilibrium will be established where LB intersects OR. And this occurs at the income level of OM.

As such the warranted rate of growth in the period (t+ 1) would be LM/OM. In the same way, the investment function of the period (t + 2) will be given by the line MC, generating an equilibrium level of income ON and the corresponding warranted rate of growth of MN/ON .

Now, it may be observed that due to the properties of similar triangles KL/OL, LM/OM, MN/ON are equal to each other. This implies that so long as the values of s and νr remain unchanged, the warranted rate of growth takes place at an unchanged proportionate rate. However, with the passage of time, the investment function goes on shifting successively to the right and the income would go on increasing at the warranted rate if the saving-investment equilibrium continues to be maintained in the successive periods.

Natural Rate of Growth:

Expansion, however, cannot go on indefinitely. The availability of labour and natural resources would put the limit. In other words, it is not necessary that the warranted rate of growth Gw (which in the equilibrium state is also equal to the actual rate of growth Gy) is the maximum attainable rate of growth. With this view in mind, Harrod introduces yet another rate of growth called the ‘natural rate of growth’, Gn which is the maximum rate of growth allowed by the increases of macro variables like population growth, technological improvements, and growth in natural resources.

In fact, Gn is the highest attainable growth rate which would bring about the fullest possible employment of the resources existing in the economy. This may be considered as the ceiling rate of growth. Joan Robiuson calls it the maximum feasible rate of growth. If I stands for growth rate of population (or labour force) and t for technological progress (i.e. rate of increase of productivity), then natural rate of growth can be written as–

Gn = l + t

Hence, for the equilibrium growth rate at full employment of all existing resources, the following condition must be satisfied–

Gn = Gw = Gy

Any deviation from this path would bring about instability in the economy.

The Golden Age:

The equality of three growth rates (Gv = Gw = Gn) ensures that economy is in moving or dynamic equilibrium. This is also called balanced growth equilibrium. Joan Robinson describes the equality of these three growth rates as a golden age as its represents a very satisfactory and happy situation. This is a happy situation because the equality of these three growth rates (Gy = Gw = Gn), will ensure steady equilibrium growth rate along with full unemployment of labour and without creating excess productive capacity. However, Joan Robinson has emphasised that the gold age, namely, the equality of three growth rates “represents a mythical state of affairs not likely to obtain in any actual economy.

This is because the four key variables, namely, propensity to save (s), required capital-output ratio (νr) of the warranted rate of growth, the rate of growth of population (I) and rate of technological change (t) are determined quite independently of each other. While the warranted rate of growth (Gw) is determined by the value of s and νr, the natural rate of growth is determined by rate of population growth (I) and the rate of technological progress (t). The golden age or balanced growth equilibrium of Gy = Gw = Gn will occur only when the four variables, s, ν, I and t have appropriate values. But this seems to be very unlikely to occur. It is only by chance that these four variables will have right or appropriate values to guarantee the golden age equilibrium.

Relevance of Harrod-Domar Growth Model for Developing Countries:

Harrod and Domar models are closely similar to each other. Both the economists have sought to utilise the Keynesian framework, which was originally designed to tackle the short-term problems of a static economy to the dynamic problems associated with long-term sustained growth.

Starting with an economy at full employment level, these economists have sought to provide answer to the following questions:

(a) How can a steady rate of growth be maintained at full employment level without inflation or deflation?

(b) Under what circumstances the rate of increase of income would be such as to save the economy from being entrapped in secular stagnation or secular inflation?

However, there are some limitations of applying Harrod-Domar models to the conditions of developing countries. First, to assume away the role of government is to disown the realities completely. In fact, due to the vast structural changes to be effected government in these economies must step in a big way to initiate and accelerate economic development as an efficient manager of the whole economy, lest we may slide down the slope.

Besides, the assumption of an initial full- employment level of income is not valid for the developing countries; disguised unemployment pervades these underdeveloped economies, especially in the labour-surplus economies. It is a case of structural disequilibrium arising basically from the imbalance between labour and capital. Even if we make allowance for the entire savings to be invested, the growth of capital stock fails to match with the growth of labour force.

Being based on fixed capital-output and capital-labour ratio, the Harrod and Domar models have only limited applicability to the developing world. Their peculiar problems demand a different solution from the one suggested by these models. To absorb the surplus labour force, there is a need to bring down both the capital-output and capital-labour ratios through reducing capital intensity. The Harrod-Domar models by assuming a constant capital coefficients rule out such a possibility.

Secondly, the usefulness of models based on the concept of capital-output ratio is of little operational significance in developing economies. Depending on the nature and degree of various shortages, bottlenecks and market imperfections, the productivity of invested capital is amenable to considerable fluctuations. It is indeed very difficult to have an accurate and valid estimate of a concept like capital-output ratio under such fluid conditions.

Commenting in this regard, Prof. Hirschman remarks that the predictive and operational significance of a model based on the concept of capital- output ratio is far less for an underdeveloped economy than for advanced economies. Models such as these, therefore, cannot explain the mechanism through which economic growth can get under way and could be carried forward in the present-day developing economies.

Thirdly, the Harrod-Domar growth variables are aggregative in nature and, therefore, fail to show the sectorial interrelationship. Besides, the processes of development of the developing economies are, as is being increasingly acknowledged, fundamentally linked with structural and institutional changes. Their highly aggregative nature, comments Prof S. Chakravarty, ‘prevents them from being used as a tool in detailed quantitative policy making and conceals many structural aspects of the problem of a steady rate of growth.’

Fourthly and very importantly, these models can at best offer counter-cyclical and counter-stag- nation policy formulation. They are in no way any guide to industrialisation programming for growth which is the dire necessity of developing countries. For instance, in Harrod’s model, the deviations between the actual, warranted and natural rates of growth indicate that the advanced economies are subject to cyclical fluctuations and secular stagnation.

Harrod is of the view that chronic deflation is a far greater possibility in advanced countries on account of the fact that these countries save more than the investment can absorb. Domar has also presented a similar reasoning. He similarly maintains that the likelihood of effective demand falling short of productive capacity is more pronounced. Of course, even in developing countries, the problems of growth of effective demand falling short of growth in capacity output cannot be denied but the developing countries face more severe problems of low rate of savings and low productivity of investment.

Further, Harrod excludes autonomous investment as an explicit variable in his formulation of ‘warranted’ saving-investment equality. But the exclusion of autonomous investment as an important factor in determining growth in developing countries by Harrod in his growth model renders his concept of ‘warranted’ growth rate analytically inadequate for the purpose of developing countries.

The apparent reason for this exclusion is to be partly found in Harrod’s desire to make place for the acceleration principle in his growth model. He also ignored the role of public investment to which Keynes assigned a crucial role. But, autonomous investments, whether public or private, are of pivotal importance to the developing countries. Besides, Harrod-Domar growth models assume that propensity to save and the capital-output ratio are constant. But actually they are likely to change over the long-run. Further, if the proportion of factors can be changed as labour may be substituted for capital, then adjustment within the economy can be easily made and steady growth made possible without any rigid conditions.

In spite of the fact that these models are of limited applicability to the developing countries and fail to highlight the crucial issues involved in the development process of these economies they nevertheless are useful in fixing the overall targets of income, investment and savings and in checking the consistency of such targets. Prof. Kurihara states that “Harrod and Domar have made the essential nature of the growth mechanism operationally significant, for they stress saving ratio and the capital-output ratio (or its reciprocal) as measurable strategic variables to investigate and possibly to manipulate for a desired rate of growth. Because of the universal character of these strategic variables, the growth mechanism discussed by Harrod and Domar is applicable to all economic systems, albeit with the modification”.

An indirect use of these models has actually been made in some countries. For instance, in the First Five Year Plan of India, the rate of saving was planned to be raised through keeping the marginal rate of saving above the average rate of saving. And the current rate of capital formation and therefore growth of the economy was sought to be maximised through raising the marginal rate of saving. Thus, these models served to guide the planners in determining the growth rate of the Indian economy. Commenting on these models, Prof. S. Chakravarty remarks that “The great service that these models perform is to indicate very roughly the dimensions of the problem involved in raising the per capita income level in an underdeveloped country”.

As noted above, Harrod-Domar model brings out the crucial role for the continuous growth of investment to ensure sustained growth at a steady rate. If investment is not growing sufficiently, the problem of deficient demand will emerge which will bring about recessionary condition even in a developing country. The demand recession will result in rise in capital-output ratio due to the underutilisation of productive capacity. The Indian growth experience clearly brings out this fact. From the mid-sixties to the late seventies the Indian economy witnessed the problem of demand deficiency due to the fall in public investment resulting in lower industrial growth and increase in capital output-ratio. Again during 1997-2003 low industrial growth rate was achieved due to deficiency in demand resulting from stagnation in investment.

Further, Prof. Kurihara contends that though these models are “designed to indicate the conditions of progressive equilibrium for an advanced economy”, yet he says these models are “important not only because they represent a stimulating attempt to dynamise and secularise Keynes’s static short-run saving-investment theory, but also because they are capable of being modified so as to introduce fiscal policy parameters as explicit variables in the economic growth of an under-developed country”. He further writes, these growth models have this positive lesson for developing countries, that state should be allowed to play not only a stabilizing role but also a developmental role, if these economies are to industrialise more effectively and rapidly than the now industrialised economies did in conditions of laissez faire.”

It is evident from above that Harrod-Domar model states the equilibrium conditions for steady economic growth. Despite the fact that Harrod-Domar model was not intended to apply to the developing countries, it has nevertheless been extensively used for the growth problem of developing countries. The important aspect of the model has been that it emphasizes investment for accelerating rate of economic growth in developing countries. There are two issues in this regard.

First, whether it is the level of saving which restricts investment in developing countries as Harrod-Domar formula explicitly implies and, second, as Cairncross has argued; it is the limited opportunities for profits that restrain the level of investment with saving levels adjusting to the scale of investment opportunities that exist. Despite these reservations, attempts have been made to answer such question as what rate of savings (and hence investment) is necessary to achieve a target growth rate given the assumed capital-output ratio.

Introducing Foreign Trade in Harrod-Domar Model:

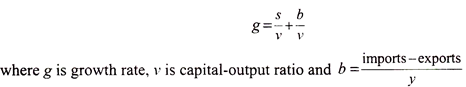

An important extension of the model is the introduction of foreign trade.

This has been done by Bruton who adjusts Harrod-Domar growth formula in the following way–

The implication of Bruton’s formula is that imports can exceed exports (and therefore b in the above formula will be positive). This can take place if the developing country either accepts foreign aid or obtains funds by borrowing (i.e., credit) or permit foreign investment to make up for the shortage of foreign exchange arising as a result of imports exceeding exports.

Thus whatever be the form of capital transfers from the developed countries, they would enable additional investment to take place in the developing countries. Thus, the income-generating effect of additional investment would be the same as would occur from investment financed by domestic saving. Thus, the introduction of ‘foreign sector’ in Harrod-Domar model shows how foreign aid, credit or private foreign investment can promote growth in developing countries.

However, the above particular view of introduction of foreign sector in Harrod-Domar model does not portray the full importance of foreign sector for the growth of developing countries. As a matter of fact, the above adjusted growth formula implies that it will be equal to zero if balance of payments on current account is zero (i.e., imports equal exports) and greater volumes of foreign trade will have no beneficial effect on economic growth of developing countries.

Thus, according to this view, a country need not require much foreign exchange if it is pursuing import-substituting industrialization. Bruton challenged this viewpoint and argued that despite import-substituting industrialization adopted by several developing countries, they need to import raw materials, capital goods and intermediate products which they cannot manufacture within their countries and therefore they either need to expand their exports or get foreign aid, credit or permit foreign investment. It is worthwhile to note that similar argument for export-expansion in India was advanced by Dr. Manmohan Singh, former Prime Minister, in his Ph.D. thesis for Oxford University in the early 1960s.

It was thus argued by him that even if domestic savings were sufficient for making the necessary payments for the domestically produced raw materials and other inputs but to procure foreign raw materials, capital goods and intermediate products a country needs foreign exchange which can be available if a country is able to either expand exports or obtain foreign aid, credit or foreign investment.

This led to ‘two-gap analysis’, domestic saving gap and foreign exchange gap which must be filled up to ensure steady economic growth. Thus it has been argued that domestic savings and transfer of foreign exchange (either through more foreign aid, credit or foreign investment) are not perfect substitutes of each other and that economic growth may be constrained by either saving gap or foreign exchange gap.