Integral Accounting is a system of recording financial and costing transactions in one self-contained ledger, called the Integrated Ledger. It implies maintenance of only one set of books for both financial and cost accounts.

This system helps to ascertain marginal cost, variances, abnormal losses and gains. It also helps to prepare profit & loss account and balance sheet according to the requirements of law. It provides detailed information regarding cost of each product, Job, process or operations. It also helps the management to control the liabilities and assets of the business.

Contents

- Introduction of Integrated Accounting

- Meaning of Integrated Accounts

- Features of Integral Accounts

- Procedure for Integration of Cost and Financial Accounts

- Subsidiary Ledgers

- Principles to be Considered while Designing Integrated Accounting System

- Requirements of Integrated Accounting

- Prerequisites of Integrated Accounts

- Scheme of Making Entries

- Accounting Entries

- Problem Relating to Valuation of Stocks

- Making Third Entries

- Benefits of Integrated Accounting

- Advantages of Integrated Accounting

- Disadvantages of Integrated Accounting

- Limitations of Integrated Accounting

Integrated Accounting: Meaning, Features, Principles, Requirements, Accounting Entries, Making Third Entries, Benefits, Advantages, Limitations, Problems and Examples…

Integrated Accounting – Introduction

Integral Accounting is a system of recording financial and costing transactions in one self-contained ledger, called the Integrated Ledger. It implies maintenance of only one set of books for both financial and cost accounts.

ADVERTISEMENTS:

Since both financial as well as cost accounts use the data from the same records relating income and expenditure it would be useful to combine both and avoid problems of integration such as – unnecessary clerical effort, wastage of time, duplication of effort etc.

Integrated accounting system refers to a single accounting system, where cost and financial accounts are maintained in the same set of books of accounts based on double entry system. Such system provides fully the information required by cost and financial accountants.

Transactions are classified both functionally and by their nature, e.g., purchases are analysed by nature of material and its end-use. It eliminates the operation of cost ledger control account in financial ledger and general ledger adjustment account in cost ledger. Personal accounts and real accounts are maintained and the nominal accounts follow the principles of cost accounting system.

Purchases account is eliminated and postings are made direct to Stores control, WIP or Overhead account. Similarly payroll account is eliminated and postings are made direct to Wages control account and overheads.

ADVERTISEMENTS:

This system helps to ascertain marginal cost, variances, abnormal losses and gains. It also helps to prepare profit & loss account and balance sheet according to the requirements of law. It provides detailed information regarding cost of each product, Job, process or operations. It also helps the management to control the liabilities and assets of the business.

Meaning of Integrated Accounts

The term “integral accounts” relates to a single accounting system. Only one set of books is kept, one profit figure generated, and information from financial ledger is used both for financial and managerial purposes. Hence there is no need of operating Cost Ledger Control Accounts and of reconciling the cost and financial accounts.

The Chartered Institute of Management Accountants, London, defines it as “a system in which the financial and cost accounts are interlocked to ensure that all relevant expenditure is absorbed into cost accounts”.

An accounting system in which cost and financial accounts are kept in the same set of books is called integrated (or integral) accounting system. This system avoids the need for separate sets of books for costing and financial purposes. The accounts are so designed that full information required for costing as well as for financial accounting purposes is available from the same set of books.

ADVERTISEMENTS:

All transactions are classified functionally as well as by their nature. For example, purchase are analysed by nature of the material and its end-use. Purchase account is eliminated and stores control account, overhead account, work in progress account and all such accounts necessary to meet costing requirements are opened in the same set of books. Payroll is straightway analysed into direct labour and overhead accounts.

Functional classification enables the firm to ascertain the cost (together with necessary analysis) of each product, job, process, operation or any other identifiable activity. It also ensures the ascertainment of marginal costs, variances, abnormal losses and abnormal gains. In fact, all information that the management requires from a system of cost accounting for doing its work properly is made available.

From the financial accounting point of view, integrated accounts give full information to prepare the profit and loss account and the balance sheet and enable a firm to exercise full control over its assets.

Top 3 Features of Integral Accounts

The typical features of integral accounts are as follows:

(i) Control accounts for stores, work-in-progress and finished goods are maintained in the general ledger itself.

(ii) Wages and overhead accounts are maintained in the usual manner. At the end of the period an analysis is made of these accounts and transfers are made to work-in-progress, service departments and production departments, etc.

(iii) Accruals and prepaid expenses are brought into account for each cost period, instead of at the time of making the final accounts.

Procedure for Integration of Cost and Financial Accounts (With Illustrations)

In order to integrate the Cost and Financial Accounts, the following procedure is followed:

1. Integration of Cost and Financial Accounts can be achieved by introducing and operating the essential Accounts of Cost Accounts in the financial books of accounts. That means, in addition to the accounts such as Share Capital, Assets, Creditors, Debtors, Bank, etc., the financial books will have the Nominal Accounts which facilitate proper ascertainment of costs.

ADVERTISEMENTS:

2. All accounts, except the General Ledger Adjustment Account, that are maintained in cost ledger (as under Non-integrated Accounting System) are also continued to be maintained under Integrated Accounting System. That means, under Integrated Accounting System, General Ledger Adjustment Account is eliminated.

Further, the following accounts are also usually maintained:

i. Share Capital Account

ii. Fixed Assets Account

ADVERTISEMENTS:

iii. Debtors Control Account

iv. Creditors Control Account

v. Accrual and Prepayment Accounts

vi. Depreciation Account

ADVERTISEMENTS:

vii. Discounts Account

viii. Bank Account

ix. Profit and Loss Account, and

x. Cost Control Account.

Cost Control Account acts as a central control account.

3. For the purpose of passing journal entries, it is necessary to observe each and every transaction, entries under Cost Accounting and under Financial Accounting, and then to decide about how an integration of these in one set of books can be made.

ADVERTISEMENTS:

A few illustrations analysed below help to understand the integration:

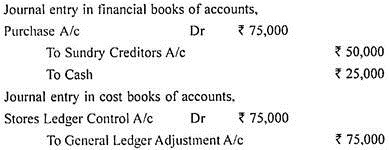

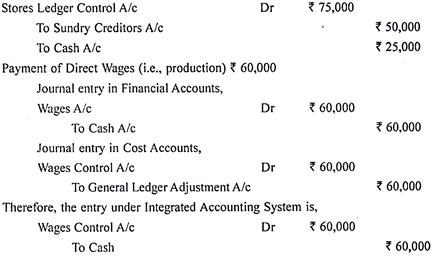

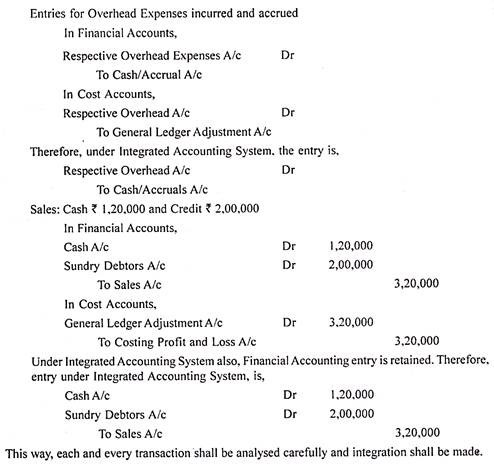

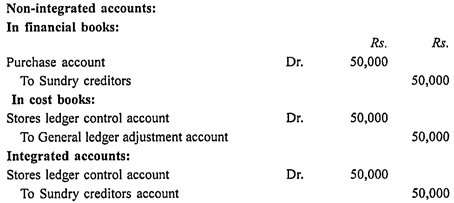

Material Purchased – Cash Basis Rs.25,000, Credit Rs.50,000:

An analysis of the journal entry in the cost books reveals that it does not make any difference between cash purchase and credit purchase. As there is only one set of accounts, under Integrated Accounting System, there is no need for the Control Account viz., General Ledger Adjustment Account.

Hence, by replacing ‘Purchase A/c’ in financial books by ‘Stores Ledger Control A/c’ of cost books, integration can be achieved. The journal entry, under Integrated Accounting System, is, therefore,

4. Valuation of Inventories:

Since there is only one set of accounts under Integrated Accounting System, the question arises as to whether the inventories should be valued (and taken to a single set of accounts) on the basis of Financial Accounting or on the basis of Cost Accounting.

Though any of these two will do as both are based on sound principles, valuation of inventories as per Cost Accounting is preferred for Integrated Accounts as these figures are more reliable. However, for Financial Accounting purposes, some adjustments can be made (i.e., difference between the value as per Cost Accounts and as per Financial Accounts) at the end of the year.

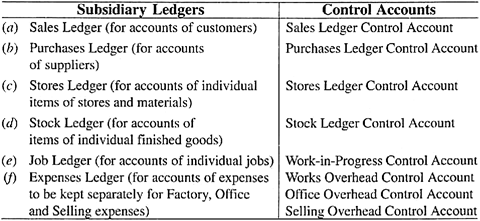

Integrated Accounting – Subsidiary Ledgers

Under the integral accounting all the accounts are maintained in the general or integral ledger. The cost ledger control account is not maintained.

Broadly speaking, the integral accounting consists of a main ledger plus the following subsidiary ledgers:

1. Stores Ledger – It includes accounts relating to each item in stores.

ADVERTISEMENTS:

2. Work-in-Progress or Job Ledger – It has individual job accounts.

3. Stock Ledger – It shows accounts relating to finished products.

4. Overhead Ledger – It contains accounts of factory, office and selling expenses.

5. Creditor’s or Bought Ledger – This ledger shows the Supplies’ Accounts.

6. Debtor’s or Sales Ledger – It has only Customer’s Accounts.

There will be the General Ledger in which the Control Account for each of the above subsidiary ledgers is kept.

ADVERTISEMENTS:

These control accounts are:

i. Stores ledger Control Account.

ii. Work-in-Progress Ledger Control Account.

iii. Finished Stock Ledger Control Account.

iv. Wages Control Account.

v. Production of Works overhead Control Account.

vi. Administrative Overhead Control Account.

vii. Selling and Distribution Overhead Control Account.

viii. Total Creditors or Bought Ledger Control Account.

ix. Total Debtors or Sales Ledger Control Account.

Besides, it also includes accounts not covered by the Subsidiary Ledgers, e.g., Capital Account, reverse and provisions etc.

Principles to be Considered while Designing Integrated Accounting System

The following principles shall be taken into consideration while designing integrated accounting system:

(i) First of all the degree of integration should be determined. In some concerns, integration is done upto the stage of prime cost or factory cost while in others, integration of full records is done,

(ii) The degree of integration will determine the classification of expenditure. The classification of the expenditure shall be made according to functions, for example, office expenses, selling expenses, etc.

(iii) Various Subsidiary Ledgers and Control Accounts to be maintained in the main ledger for carrying out the scheme of integration are as follows –

(iv) Full particulars of items posted to the Control Accounts are supplied to the Cost Office at regular intervals. These details are analysed and tabulated by Cost Office in accordance with the system of costing in use.

(v) The extent of the details to be recorded in the ledger depends upon circumstances but attempts should be made to keep it to the minimum. But full details and complete information regarding each department, process or job are, however given in the tabulations prepared by the Cost Office.

Top 4 Requirements of Integrated Accounting – Degree of Integration, Coordination of Work, Accruals and Prepayments and Coding

Introduction of integral accounting system is conditioned by the following requirements:

Requirement # i. Degree of Integration:

It is necessary, first of all, to determine the degree of integration needed, i.e., whether full or partial. In the case of partial integration, it may be just sufficient to introduce integration up to the stage of prime cost or factory cost. In the case of full integration, however, it is necessary to integrate the whole of the costing and financial accounting records.

Requirement # ii. Coordination of Work:

It is equally necessary to see that the personnel involved in the accounting work, both cost and financial, coordinate their work and co-operate with one another, in the matter of generating accounting information, by processing source documents.

Requirement # iii. Accruals and Prepayments:

It is also necessary to see that a proper procedure is laid down for treatment of accruals, pre-payments, and other adjustments necessary for preparing interim accounts.

Requirement # iv. Coding:

There should be a suitable system of coding to serve the purposes of both financial and cost accounts. Expenditure is recorded in financial accounts according to its nature and not according to the benefit derived.

For instance, all salaries are clubbed together. In costing books, however, it is necessary to-make a functional analysis of the item. For this purpose, it is necessary to devise a coding system so that an item of expenditure may be analysed in both ways.

Prerequisites for Integrated Accounts

The following are the prerequisites of integrated accounts are as follows:

1. A suitable coding system should be developed to serve the purposes of both financial and cost accounts.

2. The management must decide about the extent of integration of the two sets of books. Some concerns prefer to integrate up to the stage of prime cost or factory cost, whereas others prefer to integrate the entire accounting records.

3. There must be an agreed routine regarding treatment of provision for accruals, prepaid expenses, other adjustments required for the preparation of interim accounts.

4. There must be perfect coordination between the staff dealing with the cost information and financial information.

5. Computerisation of integrated accounting is desirable. In computerised environment, the maintenance of two sets of books of accounts is dispensed with.

6. Suitable formats should be introduced for increase of speed in accounting and generation of data for costing and financial purpose.

7. Accounting staff should be properly trained for handling accounting records efficiently.

Integrated Accounting – Various Schemes of Making Entries

Various schemes of making entries in integrated accounting are:

1. All transactions affecting personal accounts need not modify. They are recorded in the usual way as in financial accounts.

2. All incomes not required for costing purpose are also recorded in the usual way as in financial accounts.

3. All non-cost expenses not required for costing purposes are also recorded in the usual way as in financial accounts.

4. All appropriations and writing off of intangible assets are also recorded in the usual way as in financial accounts.

5. All cost transactions are recorded through respective subsidiary ledgers and totals of all transactions are posted to control accounts maintained in the main ledger.

They are:

i. Stores Ledger:

Separate accounts are opened for each material and store. All transactions relating to materials and stores are recorded in these accounts. In the main ledger a total account called stores ledger control account is opened. Total of all purchases are debited to this account.

Total purchase returns and issue of materials and stores are credited to this account. The closing balance represents the value of materials and stores in hand at the end of the period.

ii. Stock Ledger:

Separate accounts are opened for each type of finished goods. All transactions relating to finished goods are recorded in these accounts. In the main ledger a control account called finished stock ledger control account is opened.

The total of all goods finished are debited to this account. All goods sold are credited in this account. The closing balance in this account represents the value of finished goods in hand.

iii. Job Ledger (or) Work-in-Progress Ledger:

Separate accounts are opened for each job undertaken. Expenses incurred for these jobs are debited in respective job accounts. Completed jobs will be credited in work-in-progress ledger and transferred to the debit of finished stock accounts kept in stock ledger.

iv. Expenses Ledger or Overheads Ledger:

This ledger is subdivided into various parts for each class of overheads like, production overheads, office and administration overheads and selling and distribution overheads. All expenses incurred are classified under proper heads and debited in respective overheads accounts. Overheads recovered are credited in these accounts.

In the main ledger separate control accounts like, production overheads control account, office and administration overheads control account and selling and distribution overheads control account are opened. Total of all expenses incurred are debited in the respective control accounts.

Overheads recovered are credited in the respective control accounts. The closing balance in these control accounts represents over- or under-recovery of overheads which will be transferred to profit and loss account.

Cost classification and analysis sheets, notional costs considered for costing purpose only will not form part of accounting records.

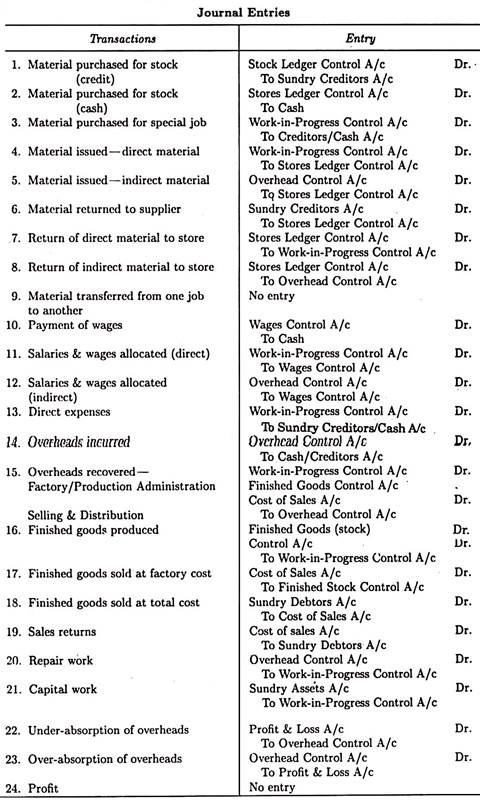

Accounting Entries (With Example)

In the integral system of accounting, since separate books for costing and financial accounts are not maintained, there will be no need for a General ledger adjustment account. However, stores ledger control account, wages control account, production overhead account, work in progress ledger control account, finished goods ledger control account, cost of sales account and overhead adjustment account are maintained.

These are necessary to provide requisite cost accounting information. All other accounts are maintained in the usual way. Thus, integrated accounts will present the same overall picture as is shown by separate cost and financial accounts but will reduce the total number of entries.

Example:

Suppose purchases of Rs. 50,000 of raw materials are made on credit.

This transaction will be recorded in the non-integral and integral system of accounting as under

It will be observed from the above that in the integral accounting system, only essential accounts are debited and credited, viz. stores and creditors. The same procedure is followed for recording wages, overheads, etc.

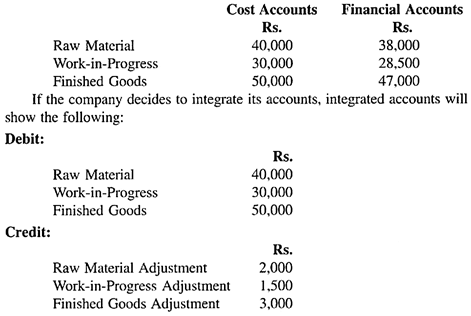

Integrated Accounting – Problem Relating to Valuation of Stocks (With Example)

Under the integrated accounting system, there normally arises the problem of valuation of stock. The values of stocks appearing in cost accounts and financial accounts are generally different from each other. The valuation of stocks per cost accounts is considered to be more reliable and hence included in the integrated accounts.

But in order to serve the purpose of Final Accounts at the end of the year, Stock Adjustment Accounts may be prepared which will record the difference in the valuation of stock as per two sets of books. The treatment can be explained with the help of the following example –

Example:

The stock valuations of Dixcy Creation Ltd., as per cost and financial accounts are shown below –

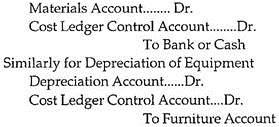

Integrated Accounting – Making Third Entries: Journal Entry Format

An account named “Cost Ledger Control Account” is maintained in the financial records and, whenever, any expenditure relating to costs is incurred Cost Ledger Control Account is debited in addition to the usual account (to be debited). There will be no double entry for the cost ledger control account.

The cost is further analysed into third entry-accounts (which are not part of a double entry system) in respect of materials, factory overhead, administration overhead etc. The total of these accounts are finally transferred to Finished Goods Account, Profit and Loss Account etc., the double entry being in the cost control account.

For instance, when materials are purchased, the entry will be:

Store Ledger Control Account, Wages Control Account and Overhead Control Account with postings are further analysed into different costs— elements of costs. Materials and wages analysed into direct and indirect; indirect cost into Factory overhead, Administration overhead, Selling and Distribution overhead etc.

This day-to-day analysis of cost made is known as “making third entries”. There are simply cost analysis recordings or explanatory entry and are not parts of double entry.

Integrated Accounting – Benefits

The following benefits accrue from integral accounting:

1. There is no need to prepare the reconciliation statement. Unnecessary wastage of time and effort could thus be avoided.

2. The system is simple and economical. Clerical cost can be reduced considerable. On comparative terms, integral accounting requires only fewer records and accounts.

3. Quick reports can be prepared without much difficulty.

4. There is no possibility of overlooking an item of expense.

5. It facilitates the introduction of mechanised accounting.

6. It makes the General Ledger self-balancing. This helps in having automatic check on the accuracy of accounts.

7. Various sections in the Accounting Department can be coordinated smoothly.

8. Since cost accounts are posted straight from the books of original entry, cost data can be obtained promptly and regularly.

9. Since there is an automatic check on the correctness of all cost data and accounts, the cost figures are accurate and create confidence of the management.

10. Centralisation of accounting function results in economy.

11. The system simplifies the accounting procedures and widens the outlook of the accountant and his staff who are plated in a better position to appreciate the entire accounting system.

Integrated Accounting Advantages

It has the following advantages:

i. The accounting work is considerably reduced by eliminating the maintenance of unnecessary duplicate records in the cost as well as in financial ledgers

ii. There is no need to reconcile the profit disclosed by the cost accounts with that of financial accounts as only one profit and loss account is prepared. The cost and financial records are in complete agreement.

iii. It tends to simplify the accounting procedures and practices by centralising the accounting system with the object of maintaining greater control over the organisation.

iv. Under this system, heavy cost of keeping two sets of books is reduced.

v. The necessary data in respect of both the sets of accounts, i.e., costing and financial, are easily available in a single ledger.

vi. As the accounts are maintained in an objective form, the process of cost ascertainment and cost control is facilitated.

vii. This system offers the advantages of functional classification of transactions as the transactions are analysed at the very first instance in a functional way rather than under natural headings.

viii. Under this system, the process of preparing interim or final accounts is simplified.

ix. Integrated accounting helps in widening the outlook of the accountant and his staff and in return they appreciate the entire accounting system.

x. Since there is one set of accounts, there is one figure of profit. Hence, the question of reconciliation of costing profit and financial profit does not arise.

xii. Efforts in duplicate recording of entries and to maintain separate sets of books are saved. Thus, there is saving of labour.

xiii. Since financial books are subject to a rigorous accuracy checks, integrated accounts ensures similar checks for cost accounts.

Integrated Accounting – Disadvantages

The system suffers from the following disadvantages:

(i) The system causes delay in providing information. Since the system is expected to serve both the costing and the financial requirements, it gets complicated.

(ii) The need for preparing a reconciliation statement may still be felt since generally, 100% integration is not possible.

(iii) The system does not suit large concerns which require detailed cost and financial information on a continuing basis.

(iv) Integrated accounting system is comparatively more sophisticated and hence its handling requires trained and more efficient persons.

(v) It is also costly.

Integrated Accounting – Limitations

Though the system offer many advantages but it’s not a boon for the business organisations especially large scale organisation where detailed information are required about cost and profit.

The system suffer from following limitations:

(i) Complicated system –

As unified set of accounts are maintained. It is very difficult to find out information without the help of expert professional.

(ii) Coordination problem –

If the system is introduced without proper knowledge of organisational structure, it may lead to coordination problem between departments especially cost accounting and financial accounting department.

(iii) Not suitable for large organisations –

The system is not suitable for large organisations where detailed information are required for every element of cost. Since large organisations deals with huge costs data, it is better to use non-integral system of accounting.

(iv) 100% integration not possible –

Since 100% integration is not possible even in integrated system of accounting, therefore, the need for reconciliation statement may arise.

(v) Superfluous accounting data –

Sometimes financial details included in integrated is superfluous to pure accounting information. Therefore, the basic objective of integrated system is lost. The basic objective of studying cost accounting is to control and reduce cost which is impossible until detailed information about the cost are available.