Contract costing is defined as that form of specific order costing wherein work is carried out in accordance with the customer’s special requirement and each order is of long duration.

Contract costing is generally applied by contractors who undertake constructional work and engineering work like roads, dams, buildings, canals, railway lines, bridges, sewerage system of a city or town, hospital, schools, or colleges buildings or private buildings, ship building etc.

Contract costing is also known as Terminal Costing because the work is terminated once it is completed and contract A/c is closed. Most of the expenses on the contract are generally of the direct nature and for the specific contract. Overheads related to central office or store are apportioned among the various contracts on some suitable basis like, wages, or material or period basis etc.

Contents

- Introduction to Contract Costing

- Meaning of Contract Costing

- Definitions of Contract Costing

- Nature of Contract Costing

- Features of Contract Costing

- Characteristics of Contract Costing

- Objectives of Contract Costing

- Industries Where Contract Costing Can be Suitably Applied

- Procedure for Costing of Contract

- Types of Contract

- Elements of Contract Costing

- Profit and Loss on Incomplete Contracts

- Procedure for Recording and Computing Various Elements of Costs

- Work in Progress

- Retention Money

- Credit Items

- Preparation of Contract Account

- Differences between Contract Costing and Job Costing

Contract Costing: Introduction, Meaning, Nature, Features, Elements, Retention Money, Credit Items, Preparation of Contract Account, Differences and Examples

Contract Costing – Introduction

Contract costing is a type of job costing in which a contract constitutes a unit of cost. The principles of job costing are applicable to contract costing and embrace the same basic principles of cost ascertainment. It is akin to factory job costing, but varies only in size; and the contract continues for a longer time.

ADVERTISEMENTS:

A contractor undertakes a small number of big contracts at a time. For example, builders, civil engineering firms, constructional and mechanical engineering firms etc. adopt this method of costing, also known as terminal costing.

Contract costing is less detailed and simpler than job costing. In brief, the points are:

1. Contract take a longer time for completion.

ADVERTISEMENTS:

2. The work is executed at customer’s site.

3. Generally a portion of the contract is given to a sub-contractor, when it is of a special character- for example, floor polishing, colouring etc.

4. Since the contracts take a number of years to complete, the problem of taking the profits arises.

5. Since each contract is distinct from others, all expenses of a particular contract are directly debited to it.

ADVERTISEMENTS:

There arise little problems of under-absorption or over-absorption. However, indirect expenses, common expenses of central office, salary for supervisory staff etc., engaged on two or more contracts, are apportioned to all contracts as a percentage of materials or labour.

Contract Costing – Meaning (With Examples)

Contract costing is defined as that form of specific order costing wherein work is carried out in accordance with customer’s special requirement and each order is of long duration. Contract costing is generally applied by contractors who undertake constructional work and engineering work like roads, dams, buildings, canals, railway lines, bridges, sewerage system of a city or town, hospital, schools, or colleges buildings or private buildings, ship building etc.

Contract for Delhi Metro is a recent example. Konkan Railway is another example of contract costing. In contract costing there are two parties involved – Contractor (who undertakes the job to be completed) and contractee (owner or the person for whom job is completed). In contract costing the cost unit is the contract itself. Contracts are completed at the work site generally by the contractor.

As for example a bridge is to be constructed on the river at the given site itself. A separate account for each contract is opened in the books of the contractor and each contract carried out by the contractor is given separate identity number like contract No. 101,102,103,104 and so on to know the profit or loss made on each contract. Each contract to be completed may take long period depending on the size and nature of the work.

Contract costing is also known as Terminal Costing because the work is terminated once it is completed and contract A/c is closed. Most of the expenses on the contract are generally of the direct nature and for the specific contract. Overheads related to central office or store are apportioned among the various contracts on some suitable basis like, wages, or material or period basis etc.

Contract Costing – Definitions

Contract is a special type of Job Costing where the unit of cost is a single contract. This method is also termed as – ‘Terminal Costing’ as when the work is terminated the cost-sheet has to be completed. It is a variant of Job Costing. In this method it is desired to find out the cost of carrying out a complete contract for a customer involving numerous jobs and batches of jobs.

The costs are ascertained and analysed with respect to the contract accepted for execution. This method of costing is adopted by those concerns undertaking definite contracts e.g., builders, contractors and civil engineers who undertake long-term projects like construction of roads, bridges, houses, large estates, irrigation schemes etc.

It is also adopted by the concerns where the unit of output is heterogeneous e.g., ship building companies, turbines and boilers manufacturing company, motion pictures etc. Contract Costing is that form of specific order costing under which each contract is treated as a separate cost unit and costs are accumulated and ascertained separately for that contract.

The term ‘contract costing’ and ‘contract cost’ has been defined by different experts and professional institutions in the manner stated below:

ADVERTISEMENTS:

The Terminology of I.C.M.A. defines Contract Costing as – “that form of specific order costing which applies where work is undertaken to customer’s special requirements and each order is of long duration”.

The Terminology of C.I.M.A. defines Contract Cost as – “the aggregated costs relative to a single contract designated a cost unit”.

Contract Costing – Nature Explained

Contract costing is the form of specific order costing, generally applicable where work is undertaken to customer’s special requirements and each order is of long duration, such as building construction, ship building, structural for bridge, civil construction, etc. The work is usually done outside the factory.

(i) Higher Proportion of Direct Cost:

ADVERTISEMENTS:

There may many costs which are normally classified as indirect costs. These can be traced specifically with a contract because of the self-contained nature of most site operations. Thus, they can be charged directly, e.g., telephone installed at site, site power usage, site vehicles, transportation, wage bill (of site labour), supervisory staff salary, cost of the plant (exclusively purchased for a particular contract).

(ii) Low Indirect Costs:

The main item of indirect cost in most contracts is a charge for head office expenses. Other indirect costs include wage of workers which cannot be identified with a particular contract, or salary of supervisory staff looking after two or more contracts.

(iii) Difficulties of Cost Control:

ADVERTISEMENTS:

Scale and size of the contract create major problems of cost control. These problems are frequent and concerned with material usage and losses, pilferage, labour supervision and utilization, damage to and loss of plant and tools.

Surplus Materials:

All materials purchased for a contract are charged directly to the contract. At the end of the contract, the contract account is credited with the cost of materials not used, and if they were transferred directly to another contract, the new contract account is debited. If they were not needed immediately, the material is to be stored and the cost debited to a stock account.

Contract Costing – Important Features

Following are the important features of contract costing:

i) The work is carried out away from contractor’s premises i.e., at the contractee’s work site.

ii) A contract is usually a big job of long-duration and may continue over more than one accounting period.

ADVERTISEMENTS:

iii) As the contracts are of large size, a contractor usually carries out a small number of contracts in the course of a year.

iv) Contract work involves too much of risk and uncertainty.

v) A contract undertaken is treated as a cost unit.

vi) A separate account is prepared for each contract to ascertain profit or loss on each contract.

vii) Apportionment of profit on contract to different accounting periods is very difficult.

viii) In case the contract is undertaken of long-duration, a percentage of notional profit depending upon the progress of physical work may be accounted for in each year.

ADVERTISEMENTS:

ix) Most of the materials are specially purchased for each contract.

x) Expenses chargeable to contracts are direct in nature, e.g., electricity, telephone charges, insurance etc.

xi) Allocation and apportionment of overhead costs is a simple task.

xii) Specialists sub-contractors may be employed for say, electrical fittings, welding works, glass work, plumbing work etc.

xiii) Plant and equipment may be purchased or hired for the duration of the contract.

xiv) Nearly all labour will be direct.

ADVERTISEMENTS:

xv) The payment is received depending on the stage of completion of work.

xvi) A contract usually includes clause for ‘penalty’ for delayed completion.

xvii) A contract usually includes ‘Escalation Clause’ under which the contractor is compensated for increase in costs on account of inflation.

xviii) A percentage of the value of work done is deducted from the progress payment as ‘Retention Money’.

xix) Most of the items of cost are directly chargeable to individual contracts. Administrative overheads and other common costs are apportioned to several contracts on a suitable basis.

xx) Payments are made on a running account basis depending upon the progress of work as indicated by the certificate of contractor’s architect/ surveyor.

ADVERTISEMENTS:

xxi) A certain amount of profit is taken at the end of the year on incomplete contracts.

Contract Costing – 8 Distinctive Characteristics

The distinctive characteristics of the contract costing may be as follows:

(i) Contract work is performed on the basis of agreement between the contractor and contractee. This agreement should be very clear about contract price, period of completion, payment of money, quality of work, inspection, and various other terms.

(ii) Contract generally takes more than one year (long period) for completion.

(iii) For cost calculation and profits single contract (each contract) is the cost unit.

(iv) Working place is contract site and not the factory generally.

(v) For completing the contract some parts of the work or job may be assigned to specialist known as sub-contractor like electricity fitting or sewerage line etc. of a building.

(vi) Hire charges paid for the plant machinery or equipments specially used on the contract are charged to that contract for which they are used.

(vii) Payments are received by the contractor from contractee on the basis of work certified by the surveyor or engineer or architect from time to time as per the agreement.

(viii) If the contractor fails to complete the work in time then penalties may be imposed by contractee for delay.

4 Main Objectives of Contract Costing

The main objectives of contract costing are:

1. Comparison of actual cost with estimated cost.

2. Detailed analysis of cost to provide a basis for cost-plus pricing.

3. Calculation of profit which may reasonably be taken each year on a long-term contract.

4. Guidance to management on the utilisation of resources.

Contract Industries Where Contract Costing Can be Suitably Applied

Contract Costing can suitably be applied in –

1. Readymade Garments

2. Pharmaceutical Industries

3. Manufacturing Industries.

4. Industries engaged in the construction of building, roads, ships, dams, boiler house, bridges or other construction work.

5. Industries undertaking engineering projects, civil engineering works, mechanical engineering firm.

6. Public works contractors involved in railway line contracts.

Generally, two parties are involved in a contract viz., the contractor – the person who undertakes the contract, and the contractee – the person who assigns the contract.

Under Contract Costing, a separate number is allotted for each contract and all related costs are accumulated for each contract. That means, a separate set of accounts are kept and maintained for each individual contract undertaken by the company.

Basic Procedure for Costing of Contracts

The basic procedure for costing of contracts is as follows:

1. Contract Account:

Each contract is given a distinguishing number and a separate account is opened for each contract.

2. Direct Costs:

Most of the costs of a contract can be allocated direct to contract. All such direct costs are debited to the contract account.

Direct costs for contracts include:

i. Materials,

ii. Labour and supervision,

iii. Direct expenses,

iv. Depreciation of plant and machinery,

v. Subcontract costs.

3. Indirect Costs:

Contract account is also debited with overheads which tend to be small in relation to direct costs. Such costs are often absorbed on some arbitrary basis as a percentage on prime cost, materials, wages etc. Overheads are normally restricted to head office and storage costs.

4. Transfer of Materials or Plant:

When materials, plant or other items are transferred from the contract, the contract account is credited by that amount.

5. Contract Price:

The contract account is also credited with the contract price. However, when contract is not complete at the end of the financial year, the contract account is credited with the value of work-in-progress as on that date.

6. Profit or Loss on Contract:

The balance of contract account represents profit or loss which is transferred to Profit and Loss Account. However, when contract is not completed within the financial year, only a part of the profit arrived at is taken into account and remaining profit is kept as reserve to meet any contingent loss on the incomplete portion of the contract.

Top 2 Types of Contract: Fixed Price and Cost-Plus Contract

There are two types of contract:

(i) Fixed price contract and

(ii) Cost-plus contract

Type # (i) Fixed-Price Contract:

In this type of contract, price is usually fixed and agreed upon in advance. Generally, tenders are invited giving details of the contract to fix up the contract price. As per agreement between the parties, any additional work may be charged separately. There may be a provision in the agreement to allow the contractor to pass to the contractee additional costs incurred due to price rise of materials or wages awards, etc.

Type # (ii) Cost-Plus Contract:

Cost-plus contract is a contract in which price is not agreed upon in advance for one reason or other. This type of contract is entered into when it is impossible to calculate future price or cost with reasonable accuracy because of lack of past records and experience or because of peculiar circumstances, for example, drilling of oil well.

The contract price is ascertained later by adding a fixed percentage of profit to the total cost of the contract. Different items of expenditure to be considered for ascertaining cost of the contract are agreed upon in advance.

Advantages of Cost-Plus Contract:

For the Contractor:

(1) The contractor is assured of a fixed profit margin.

(2) There is no chance of incurring any loss on the contract.

(3) The contractor is not affected by any fluctuations in the market prices of different elements of cost.

(4) Submission of tenders becomes simple.

For the Contractee:

(1) The contractee feels satisfied because the price is based on actual cost.

(2) In an uncertain situation, the contractee is completely protected.

Disadvantages of Cost-Plus Contract:

For the Contractor:

(1) It discourages contractor to take measures for cost reduction because the profit is based on cost. Lower cost will lead to lower profit.

(2) Disputes may arise between the parties.

For the Contractee:

(1) Generally profit is based on cost. It encourages wasteful expenditure since the higher the cost, the larger will be the profit.

(2) The amount to be paid by the contractee is uncertain because it cannot be determined until the work is completed. It may create certain problems in cash management.

Contract Costing – Top 9 Elements

Element # 1. Material:

(i) Specially purchased for contract –

If materials are specially purchased and used by a specific contract, the contract account will be debited by the value of materials and supplier’s cash account will be credited. If any part of material is left at the end of year, it will be shown in credit side of contract account and asset side of the balance sheet.

(ii) Materials issued from stores –

When a common material is used by many contracts that material will be kept in the stores. If material is issued from the store, relevant contract account will be debited and store control account will be credited by the value of material.

Generally, left out material at the end of period will be returned to the store. In such a case, contract account will be credited while store control account will be debited (assuming integral system of accounting is used).

(iii) Sale of surplus material –

It is common to sell any surplus material at contract site. The sale proceeds from such material will be credited to the respective contract account. Any profit or loss arising on such sale will be transferred to costing P & L A/C.

(iv) Transfer of material from one contract to other –

It is a common practice to transfer raw material or plant and equipment from one contract to another in case of need, emergency or completion of either of the contract. In such a situation, material is transferred along with “Material transfer Note”. The receiving contract account will be debited and sending contract account will be credited.

(v) Material given by contractee –

If contractee promises to provide any material towards contract, there is no need to charge the amount of material to contract account. However a separate record will be kept by contractor so that remaining material at the end or completion of contract can be handed over to the contractee again.

Element # 2. Labour:

Labour is divided into two parts:

(i) Direct Labour –

Normally every worker working at contract site is treated as direct labour and the cost of direct labour is charged to the debit side of contract account. Thus, direct labour mean those labour and supervisory staff which are specially engaged in completion of a single contract. It may also include other staff like guard, supervisor, junior engineer etc.

(ii) Indirect Labour –

Those labourers who are providing their services to more than one contract at a time on hourly or daily basis are called indirect labour. It may include supervisory staff like junior engineer, managers who are engaged for more than one contract. Indirect labour cost will be apportioned over to the contracts concerned on some reasonable basis.

In case a company has undertaken number of contracts at a time, a separate wage sheet should be maintained for each contract for determination of wage cost spent on each contract.

Element # 3. Plant & Machinery:

There are two methods to charge depreciation on plant & machine in contract costing:

(i) If Plant is Purchased Specially for Contract:

In this case, contract account will be debited with the cost of plant & machinery including installations costs if any. The contract account will be credited with the revalued (depreciated value) amount at the end of the period. The net effect of this exercise will result in automatic charge of depreciation amount to the contract account.

This method can also be used where P & M is used for longer time period say 3-4 years for a specific contract. If any plant & machinery is sold at the completion of the contract, the realized value from the sale will be credited to the contract account. Any profit/loss on the sale of P & M will be transferred to costing profit and loss account.

(ii) Plant & Machine Used for Contract or Contracts:

In case plant & machinery is used for more than one contract then depreciation will be charged to the contract account for the duration for which it is used. For instance, if a bulldozer is used for 3 months and 10 days for contract A, the depreciation for 3 month & 10 days will be charged to contract “A” account. So, this method is used where a contract requires services of plant for a short period or where plant is used for more than one contract.

Element # 4. Indirect Expenses:

These expenses are also called overhead costs. Indirect expenses include common office expenses and common supervisory staff engaged when number of contracts are being undertaken by the company. There expenses will be apportioned to the contracts on some equitable basis.

Sometimes, these expenses are spread to the concerned contracts according to the ratio of total cost incurred on the contracts excluding indirect expenses. For instance, total of materials and labour cost for three contracts A, B, C. are 10000, 30000 and 50000 respectively. The Indirect cost (which is common to these 3 contracts) may be apportioned to contract A, B and C in the ratio of 1:3:5. (i.e., ratio of labour and material cost)

Element # 5. Escalation Clause:

Escalation clause in the contract agreement safeguard the interests of both contractor and contractee. Escalation clause provides that during the execution of contract, if price of raw material and labour (which is beyond the control of contractor) goes beyond a specified limit over the current market price at the time of signing agreement, the contract price will be adjusted accordingly. The method to adjust the price will be explained in the escalation clause.

Element # 6. Sub-Contracts:

Sometimes the specialized work related to the contract may be entrusted to another contractor by the main contractor. This is called sub-contracting. The works that may be given on sub-contract include steel work, electricity, flooring, decoration etc. The cost of sub contract is direct cost to the main contract and will be charged to the debit side of main contract.

Element # 7. Cost plus Contracts:

In cost plus contracts, the contractee agrees to pay a certain amount over and above the cost of contract by way of percentage of overhead cost and profit.Cost plus contract system is employed where it is difficult to quote the price of contract by contractor because of absence of past information.

If contractor is not able to estimate the cost to be incurred or exact amount of work to be done, then cost plus contract method is the best option. It ensure a fair amount of profit to the contractor at the completion of the contract. These types of contracts are generally entered by Govt., with the contractor.

The type and amount of the work to be done may be changed at any time by the contractee. But the biggest drawback of this system is that contractor has no incentive to control the costs. Thus it may result in wastages and higher cost of contracts.

Element # 8. Extra Work to be Done:

It is possible that certain works may not be mentioned or remembered at the time of entering into contract agreement. Therefore, contractee may alter or may get some addition work to be done at the completion or ever during contracts.

The contractor will charge for this additional work done.

There are two possibilities in this case:

(i) Substantial work –

It may be treated as separate work and separate account should be maintained for this substantial extra work done. The cost plus method may be used to calculate the amount of work done.

(ii) Minor works –

If extra work to be done is not substantial one, the cost of such work may be charged to the main contract account. The amount to be received in respect of this minor work should be credited to the contract account.

Element # 9. Work Certified and Uncertified and Payments (WIP):

In contract costing, contractee usually hires a surveyor, engineer or architects who will issue a certificate stating the value of work done and approved by him.

The total work done till date by contractor is divided into two:

(i) Work certified –

This is the part of work (WIP) which is approved by surveyor or engineer. This work is valued at the contract price, thus it includes an element of profit too. The contractor has the right to ask for payment against this work certified.

(ii) Work uncertified –

The work which is not approved by contractee’s engineer for payment purpose is called work uncertified. The work is unapproved because it has not reached at a stipulated stage as agreed upon or as per norms of the industry. This work is valued at cost only.

The Value of both work certified and work uncertified will be shown on credit side of contract A/c and asset side of the balance sheet. The total value of work certified and uncertified (i.e., WIP) will be reduced by the amount paid by contractee and any reserve created for the profit.

Payments:

The contractee will pay on the basis of work certified by his surveyor. It is common practice that a fixed percentage of work certified is paid by the contractee to the contractor. For instance if work certified is Rs. 100,000 and contractee pays 70% , the amount to be paid will be Rs. 70000 (70% of work certified). The remaining amount Rs. 30,000 which is not paid is called retention money.

Cash ratio – It is the percentage of work certified which is paid by contractee to the contractor. As in above example, 70% is the cash ratio.

Retention ratio – The amount which is not paid (30%) as in above example in respect of work certified is called retention money. The retention money works as a security towards any defective or substandard work done by the contractee. Treatment of work in progress in contract costing.

The value of work in progress (i.e., work certified and work uncertified) can be dealt with in two ways in cost accounting:

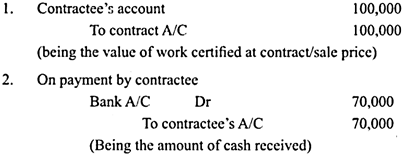

I. The value of work certified is debited to the contractee’s personal account and credited to the contract account. On receipt of money form the contractee, the amount is credited to the contractee’s account and debited to the cash account.

Thus, following journal entries are required:

Amount of cash received (cash ratio) will always be less than the value of work certified. The contractee’s account will be shown on the asset side of the balance sheet as shown below:

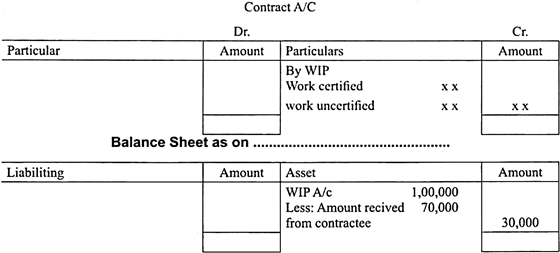

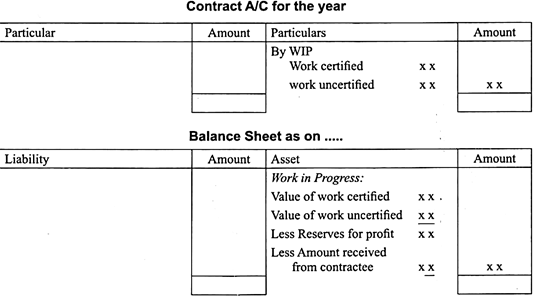

Presentation of WIP in Contract A/C and Balance Sheet:

It should be remembered here that next year, the journal entry for work in progress should not include amount included in WIP in current year.

II. In second method, a memorandum record of work certified is maintained. The value of work certified and uncertified will be debited to the memorandum work certified and uncertified in progress account and credited to the contract account. The cash received from the contractee will be credited to his personal account.

The work in Progress account is shown on asset side of balance sheet after deducting from it, amount received from contratee and reserves created for profit. Next year, the WIP account will be shown on debit side of contract account and the process will continue till completion of contracts. In contract completion year, contractee’s personal account is debited and contract account is credited.

Presentation of WIP in Contract A/C & Balance Sheet:

Reserve for profit is that part of profit on incomplete contracts which is not transferred to the costing profit & loss account.

Profit and Loss on Incomplete Contracts (With Ground Rules and Formulas)

Profit on the Incomplete Contract:

If a contract has been started and finished in the same financial period, there is no problem. But large contracts extend over two, three or more years. It would not be advisable to wait for the profit calculation for all these years till the contract is fully completed. Such procedure will mean absence of profits till the contract is in progress and abnormal profits in the year it reaches completion.

Such a fluctuation is not desirable from view viewpoint of payment of dividends to shareholders and payment of income-tax. In practice, therefore, profit is calculated and credited from year to year on some conservative basis.

Some of the ground rules which have been accepted in this regard are as follows:

1. Profit is calculated only in respect of work certified by the contractee’s architect or surveyor. No profit is calculated in respect of work uncertified which is valued at cost.

2. If the value of work certified is less than 1/4th of contract price, no profit should be transferred to profit and loss account.

3. If the value of work certified is 1/4th or more but less than 1/2 of the contract price, then generally, 1/3rd of the profit is transferred to profit and loss account.

The rest of the profit is carried forward on the contract account as a reserve against future contingencies. If the cash received from the contractee is less than the value of the work certified, the profit is reduced by this proportion.

The formula is:

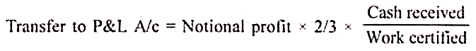

4. If the work on the contract has advanced to 50% or more of the contract price but is less than 90 per cent of the contract price, then 2/3rd of the profit is transferred to profit and loss account. Again, if the cash received from the contractee is less than the value of the work certified, the credit for the profit is proportionately reduced.

Here, the formula is:

5. When a contract has reached an advanced stage, the contractor may be in a position to estimate future costs with some degree of accuracy. The costs, including contingencies plus actual expenditure to date, will reveal the estimated total cost of the contract. By deducting this figure from the contract price, the estimated net profit on the contract will be disclosed.

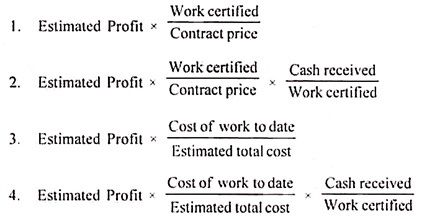

Profit is transferred to profit and loss account based on any of the following formulae:

However, in most cases formula (1) is preferred. The above rules give only an approximate figure of profit. The true profit figure can be ascertained only when the contract is finally complete. The working rule is that the contractor should be generous in showing the expenditures and little conservative in taking credit for the revenues.

Loss on the Incomplete Contract:

If a loss is incurred, the prudence concept should be applied, i.e. the entire amount of loss should be transferred to Profit and Loss Account in the period in which it is incurred.

Procedure for Recording and Computing Various Elements of Costs

Under Contract Costing, a separate account called Contract Account is opened and maintained for each contract. All the costs incurred for a contract are recorded in the separate account kept for the contract. Because, each contract is reckoned as a Cost Unit. It may be noted at this stage that a contract may also be regarded as a Cost Centre.

Further, it may also be considered as a Profit Centre as it is possible to ascertain the contract-wise profit or loss. Because, the very purpose of keeping separate account for each contract is to ascertain the costs and profit or loss.

With this background, the procedure for recording and computing various elements of costs is enumerated below:

1. Cost of Materials:

Materials used for the completion of any contract may include any one or more of the following categories of materials:

i. Materials purchased exclusively for the contract,

ii. Materials issued by the Stores Department of the contractor-company,

iii. Materials transferred from other contracts, and

iv. Materials supplied by the contractee.

In the case of the materials purchased exclusively for a specific contract, the total purchase price (including carriage charges and other related expenses, if any) is debited to the contract concerned. In the case of materials issued from Stores Department of the contractor-company, the total value of the materials issued is debited to the Contract Account.

It may be remembered here that the value of materials issued depends upon the quantity of materials issued and the issue price. The issue price depends upon the pricing method such as FIFO, LIFO, etc.

In the case of materials transferred from other contracts, the amount at which the materials were received from other contracts is debited to the Contract Account (i.e., the Account of the contract which received the transfers). And in the case of materials supplied by the contractee himself, no entry is required in the Contract Account.

i. Excess material at the site of the contract after the completion of the work is returned to the Stores Department. Therefore, the value of the materials returned to the Stores Department is credited to the Contract Account.

ii. In the same way, value of any materials transferred from the contract to other contracts is credited to the Contract Account (i.e., the Account of the contract from which materials are transferred).

iii. Sometimes, materials not required for the contract or unused materials at the contract site are sold to other parties. In this case, the amount realised from the sale is credited to the Contract Account and any profit or loss on the sale (i.e., the difference between the cost and selling price) is transferred to the Costing Profit and Loss Account.

iv. Further, cost of any theft or destruction on account of fire which represents the abnormal loss is transferred to the Costing Profit and Loss Account by crediting the Contract Account. This is to ensure that the cost of the contract is not affected by any abnormal loss or profit.

v. Any materials lying at site at the end of the accounting period is carried forward as a charge against the next period by crediting the Contract Account.

2. Wages:

Wages and remuneration of the workers and employees engaged on a particular work irrespective of the nature of their work is allocated directly to the work by debiting it to the Contract Account. When the workers are to move from one contract work or site to another, detailed time sheets should be maintained recording therein the details of time worked by different workers for different contract works.

Based on the time spent by the workers for different contract works, wages are distributed among the contracts. The share of each contract is debited to the concerned Contract Account.

3. Other Direct Expenses:

Other expenses (other than Direct Material Cost and Direct Labour Cost) which are incurred exclusively for a specific contract such as architects and consultants fees, cost of design, cost of special tools, jigs, etc., hire charges of plants, if any, etc., are charged directly to the contract concerned by debiting the Contract Account.

4. Overhead Expenses:

Besides the Direct Costs, a few items of expenses such as – salary of engineers, surveyors, supervisors, store-keepers, etc., central office expenses, etc., are also incurred commonly for more than one contract. Because, there are contractors who execute more than one contract at a time. Hence, one can find a few items of expenses, which are incurred for the benefit of more than one contract.

Hence, these expenses are called indirect or common costs or overhead expenses and these are apportioned among all the beneficiary contracts on suitable basis. A few bases usually used by the contractors are labour hours, machine hours, labour cost, direct costs, etc. Overhead expenses so apportioned are debited to the concerned Contract Account.

5. Depreciation of Plant and Machinery:

The amount of depreciation on plant and machinery is debited to the Contract Account. To compute the amount of depreciation, any of the following two methods may be followed:

i. When a machine is issued on a contract, the Contract Account is debited with the value of the machine (i.e., original cost or written down value, as the case may be). The Contract Account is credited with the depreciated value of the machine on the completion of the contract (i.e., when the work is completed before the end of the accounting, period) or at the end of the accounting period.

Consequently, the contract stands debited with the amount of depreciation (i.e., the difference between the value of the plant at the time of issue and at the end of the accounting period or on completion of the work).

ii. Alternatively, only the amount of depreciation, computed on the basis of the depreciation method followed by the contractor, may be debited to the Contract Account.

However, when the plant is acquired exclusively for a particular contract, the purchase price including installation costs is debited to Contract Account. When the contract is completed, the Contract Account is credited with the depreciated (i.e., revalued) value or with the sales proceeds, if the plant which is no longer required is sold.

6. Cost of Sub-Contract:

When a contractor undertakes a large contract, he may entrust a specific portion of the main work undertaken by him to another contractor called, sub-contractor. The agreement or contract between the contractor and sub-contractor is called sub-contract.

The payment made by the contractor to the subcontractor forms a direct charge to the contract (i.e., to the main contract) and therefore, debited to the Contract Account. If the contractor supplies any materials, equipment, etc., to the sub-contractor, the cost of such materials, depreciation, etc., should also be debited to the Contract Account.

7. Accrued Expenses:

Accrued expenses are debited, at the end of the accounting period, to the Contract Account and are carried forward for the next accounting period. This way, by considering ail the expenses incurred by the contractor for the contract, cost of the contract is ascertained. On the completion of the work, or as per the terms and conditions agreed to by both the parties, the contractee pays the contract price.

Because, in some cases, the contractee may agree to make part payments from time to time depending upon the degree of work completed as certified by the contractee’s surveyor. By crediting the Contract Account for the contract price and finding out the balance, profit or loss on the contract can be computed.

This procedure is usually followed in the case of small contracts which are normally completed during the same year in which they were undertaken. But in quite a large number of large contracts which require more than one year each for completion, a slightly different procedure is followed to find the profit or loss periodically. Before looking to the computation of profit on incomplete contracts, it is necessary to study two more related aspects viz., certification of work done and the retention money.

Contract Costing – Work-in-Progress

Net expenditure on a contract is known as work-in-progress. The net expenditure is arrived at by adding the various expenses incurred on a contract. For the purpose of finding out the actual expenditure on a contract, it is necessary to add the various items shown on the debit side of the contract, and deduct from the total thus arrived at, materials on hand, returned, sold, lost, stolen, plant on hand, returned, lost, sold stolen, etc.

From the point of view of a contractor, work-in-progress is thus the net expenditure on a contract. It has no relationship with the amount of cash received from contractee. Even if no cash is received, the figure of net expenditure remains the same.

The figure of work-in-progress may also be arrived at by adding work- certified and work uncertified and deducting from the total, profit reserve. Work- in-progress is an asset, shown in the balance sheet by deducting therefrom any advance received from the contractee.

Contract Costing – Retention Money

In most cases, the terms of the contract provide that the amount of work certified by the architect will not be paid in full. This is obviously because of the fact that the contracted has to guard himself against any contingency arising from the non-fulfillment of the terms of the contract by the contractor.

Regardless of the amount of work certified, the contractor is paid a specified percentage of the same and the balance is held or retained by the contracture. The unpaid balance of work certified or the amount held back or retained by the contracted is known as ‘retention money’.

The retention money lying with the contractee will be paid to the contractor after the work is complete. If a separate retention money account is opened, contractee’s personal account will be debited with the actual amount received and the contract will be credited with the sales value of work certified. Retention money will be shown as an asset in the balance sheet at the end of the accounting period.

If a retention money account is not opened, contractee’s personal account will be debited with the full amount of work certified. The actual amount received will be credited to his personal account and the balance shown as an asset in the balance sheet as ‘contractee’.

Credit Items – Work Certified and Work Uncertified

1. Work Certified:

In the case of a large contract which takes a number of years for completion which involved huge costs, a provision is made for the payment of contract price in installments from time to time depending upon the progress of work done. These installments are paid on the basis of the certificate issued by the Architect or Engineer as to the value work done so far.

The value of work so completed as certified by the Architect of the Contractee is known as “Work Certified”. The amount of work certified is debited to the contractee’s account and credited to the contract account.

In many cases, the terms of the contract provide that the whole amount covered by the certificate shall not be paid to the contractor immediately but a certain percentage there of shall be retained by the contractee until sometime after the completion of the contract.

The sum so retained by the contractee is called ‘Retention Money’ such a provision is intended to place the contractee in a favorable position, in case any faults were to arise in the work already done and the contractor does not rectify the same.

2. Work Uncertified:

Work uncertified refers to the work completed but not certified by the architect. In other words it is the work done since the date of certification. The work uncertified is always valued at cost and debited to the work-in- progress account, the credit being given to contract account.

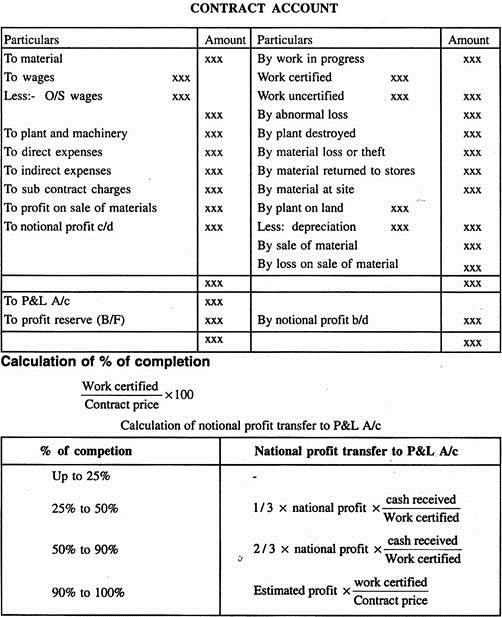

Preparation of Contract Account (With Format)

All the expenses incurred on the contract are debited to the contract account. At the end of the accounting period, the contract account is credited with the amount of work-in-progress, consisting of value of work certified and cost of work uncertified. If any materials are in hand or there is a plant at site, they are also shown on the credit side of the contract account.

The difference of the totals of the two sides represents the notional profit or notional loss. If the credit side is bigger, the difference represents notional profit, if the total debit side exceeds the total credit side, the difference is the notional loss.

Since notional profit is the difference between the value of work certified and the cost of work certified, it may also be arrived at by deducting the cost of work certified from the value of the work certified.

The portion of notional profit to be transferred to the profit and loss account may be determined depending on the stage of completion of the work. The apportionment of the notional profit, i.e., the amount to be transferred to the profit and loss account and the amount to be kept in reserve, may be shown by extending the contract account.

In other words, the amount of notional profit may be carried to the credit side of the contract account and the amount to be transferred to the profit and loss account may be shown on the debit side. The balance of the notional profit is kept in reserve as an element of work in progress.

However, if there is a notional loss, the whole of it is transferred to the profit and loss account. At the beginning of the next accounting year, the amount of work- in-progress representing work certified and uncertified, materials in hand and plant at site etc., are shown on the debit side, and the profit kept in reserve as part of work-in-progress is put on the credit side as the opening balance in the contract account.

In the balance sheet, work-in-progress (less profit in reserve), materials in hand, plant at site etc., are shown on the assets side under the appropriate heads. The cash received from the contractee is also shown as deduction from work-in- progress. Accounting Standard 7 (AS-7) issued by the Institute of Chartered Accountants of India provides that the progress payment received from the contractee may be shown as a liability also in financial statements.

The preparation of the contract account, computation of profit to be taken to the profit and loss account in respect of contracts at difference stages of completion and presentation of work-in-progress and other items in the balance sheet.

A format of the contract account is given below:

Differences between Contract Costing and Job Costing

Although job costing and contract costing belong to the category of specific order costing where work is started after receiving the order of the customer according to the specific instructions of the customers.

The following are the differences between the two:

(i) Contract is of big size while the job is of small size.

(ii) Contract work is done at work site (outside the factory) while the job is generally done in the factory premises.

(iii) Job to be completed takes lesser time (generally less than a year) while contract takes long enough period for completion (more than a year) like Bhakhra Dam, Tihri Dam, SYL Canal, thermal powerhouse etc.

(iv) In contract costing heavy investment and expenses take place in comparison to job costing.

(v) In contract costing major expenses are of direct nature related to that contract only while for job both direct and indirect expenses are equally important.

(vi) Contracts are generally related to construction and engineering works while jobs are related to the production area (as tools, printing, garments, Lathes etc.)

(vii) Contracts are applied for large scale projects while job costing for small scale jobs or works.

(viii) Profits on contract is even to be calculated on the incomplete contracts depending on the work completed while on jobs profits are to be calculated on the completion of jobs.