A budget is a plan of action for a future period. Managerial actions that follow their decisions with regard to the aspects of business are based on a budget. The budget pertaining to any of the activities of business is always forward- looking. It is prepared prior to a defined period of time.

The CIMA Official Terminology defines a budget as “A quantitative statement, for a defined period time, which may include planned revenues, expenses, assets, liabilities and cash flows.” A budget is thus, a plan quantified in monetary terms. It is prepared for a defined period of time.

The Chartered Institute of Management Accountants (CIMA), London defines budget as:”A plan expressed in money. It is prepared and approved prior to the budget period and may show income, expenditure and the capital employed. May be drawn up showing incremental effects on former budgeted and actual figures, or be compiled by zero-based budgeting”

Thus a budget is a quantitative and/or monetary interpretation of the policies and aims of a business for a predetermined period and indicates how aims and objects are to be achieved.

ADVERTISEMENTS:

Contents

- What is Budget? (With Meaning)

- Definitions of Budget and Budgeting

- Definitions of Budgetary Control

- Objectives of Budget

- Objectives of Budgeting

- Objectives of Budgetary Control

- Features of a Budget

- Characteristics of Budget

- Characteristics or Ingredients of Budgetary Control

- Elements for the Success of a Budget Plan in an Organization

- Types of Budget

- Requirements of a Sound Budgeting System

- Prerequisites for the Successful Operation of a Budgetary Control System

- Essentials of an Effective Budgetary Control System

- Steps Involved in Budgeting Process

- Steps to be Considered Necessary for a Comprehensive Budgetary Control Programme

- Cash Budget

- Departmental Operating Statement and Budget Report in Graphic Form

- Budget Manual

- Responsibility Accounting

- Performance Budgeting

- Programme Budgeting

- Rolling Budget

- Zero Based Budgeting

- Ratios

- Difference between Forecast and Budget

- Difference between Budgetary Control and Standard Costing

- Advantages of Budgeting

- Advantages of Budgetary Control

- Limitations of Budgeting

- Disadvantages of Budgetary Control

Budget: Meaning, What is, Objectives, Types, Features, Elements, Requirements, Steps, Cash Budget, Budget Manual, Difference, Advantages, Disadvantages and More…

What is Budget? (With Meaning and Essentials)

A budget is a plan of action for a future period. Managerial actions that follow their own decisions with regard to the aspects of business are based on a budget. The budget pertaining to any of the activities of business is always forward- looking. It is prepared prior to a defined period of time.

The CIMA Official Terminology defines a budget as “A quantitative statement, for a defined period time, which may include planned revenues, expenses, assets, liabilities and cash flows.” A budget is thus, a plan quantified in monetary terms. It is prepared for a defined period of time.

The Chartered Institute of Management Accountants (CIMA), London defines budget as:

ADVERTISEMENTS:

“A plan expressed in money. It is prepared and approved prior to the budget period and may show income, expenditure and the capital employed. May be drawn up showing incremental effects on former budgeted and actual figures, or be compiled by zero-based budgeting”

Thus a budget is a quantitative and/or monetary interpretation of the policies and aims of a business for a predetermined period and indicates how aims and objects are to be achieved.

The budget should not be confused with forecasts.A forecast is a mere prediction, which can be made by anybody. Moreover, a forecast need not always be expressed in rupees or quantities. Forecast may be in respect of anything. As against this a budget is a plan of action prepared by an authorised person and may be expressed in terms of rupees and/or quantities.

A budget is a detailed plan of operations for some specific future period. It is an estimate prepared in advance of the period to which it applies, it acts as a business barometer as it is a complete programme of activities of the business for the period covered.

ADVERTISEMENTS:

A budget is defined as a “comprehensive and coordinated plan of action, expressed in monetary terms, for the operations and utilisation of resources of an organisation for some specified period in the future.”

Thus, the essentials of a budget are:

(a) It is prepared in advance and is based on a future plan of actions;

(b) It relates to a future period and is based on objective to be attained;

(c) It is a statement expressed in monetary and/or physical units prepared for the implementation of policy formulated by the management.

Definitions of Budget and Budgeting

‘No risk no gain’ is the slogan of business. The higher the risk, the higher is the profit. In order to maintain the profitability and solvency of any business, a plan has to be formulated in relation to future financial requirements. This plan is known as Budget. Thus Budgeting is related to various methods of planning and preparation of budget plans.

The main definitions of budget and budgeting are as under:

W.J. Batty – “Budgeting is a kind of future accounting in which the problems of the future are met on paper before the transactions actually occur.”

George R. Terry – “A budget is an estimate of future needs arranged according to an orderly basis covering some or all of the activities of an enterprise for a definite period of time.”

ADVERTISEMENTS:

Institute of Cost and Work Accountants England – “Budget is a financial and quantitative statement prepared prior to a defined period of time of the policy to be pursued during that period for the purpose of attaining a given objective.”

G.A. Welsch – A business budget is a plan covering all phases of operation for a definite period in the future.

Bartizol – “A budget is a forecast, in detail of results of an officially recognised programme of operation based on the highest reasonable expectations operating efficiency.”

Prof. Savders – “The essence of a budget is a defined plan of operations for some specific future period, followed by a system of records, which will serve as a check upon the plan.”

ADVERTISEMENTS:

Shilling Law – “Budgeting is the preparation of comprehensive operating and financial plans for a specific interval of time.”

Kohler in ‘A Dictionary for Accountants’ defines budget as any financial plan serving as an estimate of and a control over future operations, any estimate of future costs and any systematic plan for utilisation of manpower, material or other resources.

The Chartered Institute of Management Accountants, London defines a budget as “a financial and/or quantitative statement, prepared prior to a defined period of time, of the policy to be pursued during that period for the purpose of attaining a given objective.”

Budget – Definitions of Budgetary Control

The definitions of budgetary control are as follows:

ADVERTISEMENTS:

W.W. Bigg – “The term budgetary control is applied to a system of management accounting control by which all operations and output are forecast ahead, as far as possible and the actual results are compared with the budget estimates.”

Niles – “Budgetary control is an important tool of management. It is in fact a tool of planning which reaches through coordination into control and ties the three aspects firmly together.”

J. Batty – “Budgetary control is a system which uses budget as a means of planning and controlling all aspects of producing and selling commodities or services.”

Wales – “Budgetary control involves the use of budgets and budgetary reports throughout the period to coordinate, evaluate and control day to day operations and in accordance with the goods specified by budgets.”

Top 8 Objectives of Budget

The objectives of budget are as follows:

1. To get more economic use of capital.

ADVERTISEMENTS:

2. To prevent waste and reduce expenses.

3. To facilitate various departments to operate efficiently and economically.

4. To coordinate the activities of various departments.

5. To plan and control the income & expenditure of the firm.

6. To fix the responsibilities in different departments.

7. To ensure the availability of working capital.

ADVERTISEMENTS:

8. To ensure the matching of sales with production.

Budget – Objectives of Budgeting – Planning, Directing, Coordinating and Controlling

Broadly speaking, the objectives of budgeting can be put as under:

Objective # 1. Planning:

Individual and group actions can be guided only when predetermined targets are there on screen. Targets serve as motivating factor for each and every individual in the organisation. If a goal is there in front of a person, he naturally tries to achieve that goal rigorously, vigorously and sincerely.

Even under recessionary conditions, as are prevailing today worldwide, meticulous planning helps a lot as managerial expectations are known to everybody through the medium of budgets.

During the process of planning, management also is enlightened about the strengths and weaknesses of the business in depth and thus can chalk out plans to thwart the threats faced by it and exploit fully the opportunities available. Thus, decision-making is also assisted by budgeting.

ADVERTISEMENTS:

Objective # 2. Directing and Coordinating:

Different operations are to be directed and co-ordinated as per the plans laid down. One of the important objectives of budgeting is to direct and coordinate the business activities systematically and smoothly so that the goals are attained. For the purpose, responsibility centres may be established.

Objective # 3. Controlling:

Unless and until, actual performance are not compared with the budgets and control is exercised for off-budget performances, the basic purpose of budgeting stands defeated.

Proper reporting to management is essential and reversely down the line instructions are passed how to struggle with the deficiencies and shortcomings.

Unplanned expenditures are also controlled in the process. Feedback is provided to employees from time to time so that corrective steps are taken promptly so as to meet the targets.

Budget – Objectives of Budgetary Control

Budgetary control could be described as ‘forward costing’ establishment of budgets and then their application with a view to ensure control over the activities of a concern. The basic purpose is to improve the efficiency and profitability of the concern.

ADVERTISEMENTS:

The objectives of budgetary control may be stated thus:

1. To provide a detailed plan of action for a business over a period of time;

2. To coordinate the different units and activities of the organisation with a view to utilise resources judiciously;

3. To motivate organisational members to perform well;

4. To exercise control on cost through comparison of actual results with budgeted ones and initiating rectificational steps promptly.

Top 5 Features of a Budget

The following features of a budget:

1. It is goal oriented. It is aimed at achieving the objectives of an enterprise.

2. It is future oriented. It is prepared and approved prior to a defined period of time.

3. It is an expression of policies and plans in monetary and physical terms.

4. It helps in estimating income and expenditure for the budget period.

5. It also estimates the capital to be employed for achieving the predetermined goals.

5 Main Characteristics of Budget

The main characteristics of budget are:

1. It is a plan expressed in monetary terms or quantity or both.

2. It is related to a definite future period.

3. It is prepared prior to a defined period.

4. It is approved by the management for implementation.

5. It indicates the business policy which has to be followed so as to achieve a given objective.

Budget – Characteristics or Ingredients of Budgetary Control

Following are the main characteristics or ingredients of budgetary control:

1. Preparation of budgets either in physical terms or monetary terms or both in terms of various activities in pursuance of objectives set by the management.

2. Comparison of actual performance with the budgeted figures.

3. Analysis of budget variances to know the reasons.

4. Revision of budgets in the light of changed circumstances.

5. Institution of correct & remedial actions.

Essential Elements for the Success of a Budget Plan in an Organization

The success of the budget plan in an organization depends on the following essential elements:

Element # (a) Accurate Forecasting of Business Activities:

Forecasting is an integral part of the budgeting process. It is not only the starting point, but is also critical to the development of an accurate budget.

Element # (b) Coordinating Business Activities:

Budgeting needs to coordinate all the individual budgets into an integrated plan, as each budget has certain implications for other budgets. There must be coordination between sales, production, purchasing, and personnel budgets.

Element # (c) Communicating the Budgets:

The success of a comprehensive budgeting programme depends on communication of individual budgets to the different units in the organization. The basic point is that the preparation of the budget is of no value unless it is known to the person for whom it is meant.

Managers are not responsible for budget unless the budget is communicated clearly, concisely, and in an authoritative manner to them.

Element # (d) Acceptance and Cooperation:

Successful budgeting also requires that budgets should be accepted by the people who must execute them. Budgeting should have the active cooperation of the entire organization from top to bottom.

Element # (e) Reasonable Flexibility:

The budgeting programme should contain reasonable flexibility if the situation so demands. However, it should be noted that too much flexibility and too much tightness are both undesirable. Too much flexibility will weaken the cost control and the budget will become inoperative.

Similarly, too much rigidity, not permitting reasonable deviations, will create problems and restrictions in the implementation of the budget. If conditions have changed making the estimates and budgets inaccurate, the budgets should be revised.

Element # (f) Providing a Framework for Evaluation:

Budgeting provides a basis to evaluate the performance of different departments. A comprehensive budget, properly developed, will initially contain organizational goals and expectations, and subsequently can be used as an effective evaluation technique.

Types of Budget

The budgets can be classified as–

(i) fixed and flexible budgets, and

(ii) short term and long term budgets.

1. Production Budget:

It is a forecast of total production of a business organisation during a definite period. It is prepared keeping in view the sales budgets, production capacity, probable changes in stock and loss in production. Production budget is prepared by the production manager.

2. Material Budget:

It is a forecast of quantity, quality and cost of material used in production. While preparing this budget, value of material (to be purchased), availability of finance should be given due consideration, quantity of material is an important function of material budget. Loss of materials and other types of losses should be given due consideration.

3. Factory Overhead Budget:

It is a forecast of indirect expenses to be incurred in relation to production for budget period. Both fixed and variable expenses are included in it. Separate budgets can be prepared for fixed and variable expenses.

If production is done in various departments, separate budgets can be prepared for different departments and one master budget can also be prepared.

4. Selling and Distribution Overhead Budget:

It is a forecast of expenses, to be incurred on selling and distributing the finished product. This budget is based on the sales budget. This budget should be prepared only after analysis of selling and distribution overheads of past years. Market research should be given due consideration.

5. Cash Budget:

It is a forecast of cash required for successful and smooth operation of activities. This budget is prepared by giving due consideration to receipts and payments. Cash budget can be prepared for short term as well as for long term basis.

It is to be divided into two parts—one part of probable receipts and the second part of probable payments. Cash budgets are prepared keeping in mind all the financial resources. It is prepared by the chief accountant.

6. Capital Expenditure Budget:

It is a forecast of expenditure to be incurred in purchase and expansion of fixed assets. It is prepared keeping in mind the probable increase in demand of products, finances available in long term production capacity. This budget is prepared for the long term.

7. Plant Budget:

It is prepared in factories, where maximum work is performed by machines. It is a forecast of availability of plant for proposed production. This budget is prepared by the production manager, with the help of the production budget.

8. Administration Overhead Budget:

It is a forecast of expenses to be incurred on administrative works for budget period. For this purpose, expenses incurred in past years should be analysed. Administrative expenses can be divided into various departments such as legal, accounts, research, planning, public relation etc.

9. Labour Budget:

It is a forecast of the number of labour hours to be worked by labour in production. Amount paid to workers and other perquisites are recorded in this budget. Time and motion study is kept into mind, while preparing this budget. On the basis of this budget, recruitment department makes arrangements for recruitment of labour.

10. Production Cost Budget:

It is a forecast of cost of that production, which has been ascertained in production budget. Material, labour and other direct expenses are included in production cost. Probable increase or decrease in prices of raw materials, increase or decrease in labour cost are kept into mind, at the time of preparation of this budget.

11. Sales Budget:

It is an estimate of total sales to be made during a definite period. Sales budget is prepared in quantity as well as in Rupees. It should be prepared with great caution.

The following points are considered before preparing this budget:

(i) General Trend of Sales

On the basis of general trends of sales, it will be easier to forecast the changes in sales.

(ii) Information to Dealers

Dealers can give information about probable sales, competition, habits of customers etc. This information is helpful to sales managers in the preparation of sales budgets. Salesman’s information also carries a weight in it.

(iii) Change in Policies

Sales manager should keep in mind the probable changes in the policies of business organisation. When an organisation brings any new product, it may change the advertising policy distribution ratio accordingly.

(iv) Plant Capacity

It should be kept in mind the plant capacity, while preparing the sales budget. Plant should be utilised in accordance to its capacity.

(v) Material and Labour

While preparing sales budget, availability of material and labour should be kept in mind. The sale budget should be adjusted accordingly.

(vi) Market Analysis

Probable demand of market, possibilities of competition and changes in prices should be ascertained in preparing the budget.

(vii) General Conditions of Business

Information about the general condition of business may be obtained from national and international statistics, government policies etc.

(viii) Special Circumstances

Special circumstances of external environment can affect sales of the organisation. This is to be kept into mind before preparing the budget.

(ix) Financial Aspect

With every increase in sales volume, extra capital may be required for new machines and for which availability of financial resources are to be studied.

(x) Other Factors

While preparing sales budget, other factors such as competition in the market, policy of government towards industry should be taken into consideration.

Budget – Requirements of a Sound Budgeting System

The following are the requirements of a sound budgeting system:

(1) Support of top management

The top management’s active participation in the budget process is absolutely essential for its successful implementation. It should take interest not only in setting the budgets but also to investigate the reasons for any deviation of actuals from budgeted figures.

It should motivate the personnel, reward for achievements and take punitive action where necessary.

(2) Reasonable goals

The organisational goal should be quantified and clearly defined. These goals must be within the framework of the organisation’s strategic and long range plans. The responsible executives should agree that the budget goals are reasonable and attainable.

(3) Participation by responsible executives

The persons responsible for execution of budgets should participate in the process of setting the budget figures.

(4) Clearly defined organisation

Well-defined lines of authority and responsibility should be established throughout the organisation. All departmental executives should be aware of their authority and responsibility.

(5) Continuous budget education

Continuous budget education in respect of objectives, potentials and techniques of budgeting through written manuals, meetings, etc., and creation of a cost awareness atmosphere will lead to effective implementation of budgets.

(6) Efficient accounting system

During the preparation of budgets reliable historical data are collected from the accounting department. These data form the basis of many estimates. Responsibility accounting is absolutely essential for successful budgetary control.

(7) Constant vigilance

Periodic reports should be prepared promptly, comparing budgets and actual results, and forwarded to the managers responsible for it for proper remedial action.

(8) Flexibility

The budget should cover all phases of the organisation and have a degree of flexibility, so that it can be revised with changing circumstances.

(9) Maximisation of profit

The functional goals should not conflict with overall organisational goals. The budget should motivate personnel at all levels to achieve budgeted levels of efficiency and activity and thereby earn maximum profit.

(10) Cost

The cost of introducing a budget system should not exceed the benefits derived from it.

(11) Integration with standard costing system

Budget programme should be completely integrated with standard costing system, both in budget preparation and variance analysis, where standard costing system is also used.

Budget – Prerequisites for the Successful Operation of a Budgetary Control System

The following are the prerequisites for the successful operation of a budgetary control system:

(1) Establishment of Budget Centres:

CIMA has defined a budget centre as – “a section of an organisation for which separate budgets can be prepared and control exercised”.

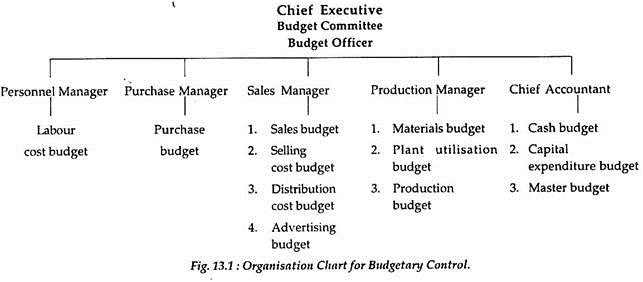

An organisation is divided into several segments, which are clearly defined for the purpose of budgetary control according to responsibilities of departmental heads. These segments are technically referred to as budget centres. Budget prepared for a ‘budget centre’ is called a ‘departmental budget’.

These budgets are prepared with the help of departmental heads, e.g., purchase budget is prepared with the help of purchase manager, labour cost budget is prepared with the help of personnel manager, and so on.

(2) Preparation of an Organization Chart:

A well-defined organisation chart, showing clearly the lines of authority and responsibility of each member of management and his position in relation to other members – both upwards and downwards — is absolutely essential for a successful budget system.

The design of an organisation chart will depend on the nature and size of the company and the extent of the control desired.

A specimen organisation chart is shown in Fig. 13.1:

(3) Establishment of Adequate Accounting Records:

The accounting system should be able to record and analyse the information required. The budget procedures must use the same classification of expenses and revenues as the accounting department for comparison purposes.

A Chart of Accounts or Accounts Code corresponding to the budget centres should be maintained for establishment of budgets and control through it.

(4) Establishment of Budget Committee:

In small concerns, a budget officer or the chief accountant prepares the budget and coordinates all the work involved. In large concerns, a budget committee is formed consisting of chief executive, budget officer and heads of functional departments or budget centres, e.g., sales manager, production manager, purchase manager, chief accountant, standards and quality control manager etc.

Usually, the chief executive is the head of this committee, so that decisions of this committee become binding on others. The budget officer, often called budget director or controller, should be directly responsible to the chief executive and acts as a secretary of the budget committee.

The main functions of the budget committee are:

(a) To assist all departmental managers in making budget by providing them information about past performances;

(b) To inform all departments regarding requirements, dates of submission of the budgets, etc.;

(c) To circulate broad outline of the policies framed by the top management in relation to the budget system;

(d) To receive the budgets from various departments and scrutinise them;

(e) To discuss problems with departmental heads and suggest revision of functional budgets, where necessary;

(f) To settle disputes between departments on budget matters and approve revised functional budgets;

(g) To prepare a master budget after the approval of the functional budgets;

(h) To compare actual performance with budgets, analyse variances and recommend corrective action, where necessary;

(i) To inform departmental heads regarding changes in budget policies and procedure and the revisions made in their budgets by the committee.

(j) To prepare a budget manual and co-ordinate all budget work.

(5) Preparation of Budget Manual:

According to CIMA, a budget manual is, “a document which sets out the responsibilities of the persons engaged in the routine of and the forms and records required for budgetary control”.

It contains the guidelines for preparation and implementation of various budgets which are summarised below:

(a) Definition and clarification of different terms used in budgets.

(b) Definition of functional and organisational objectives.

(c) Responsibility and authority of different functional heads, budget committee, and budget director. It lays down what is to be done, how it is to be done, when it is to be done, and, by whom.

(d) Procedures and forms to be used in the budget preparation.

(e) Budget calendar, specifying the dates on which different functional budgets and reports are to be submitted to the budget committee for review and approval.

(f) Method of accounting, account code, budget centre code, etc.

(g) Operational and follow-up procedures, type of budget to be adopted etc.

A budget manual helps to standardise methods and procedures, eliminates overlapping of functions and develops improved techniques for forecasting sales and costs. It should be well-written, indexed and divided into distinct sections in loose-leaf for easy distribution to all departmental heads.

(6) Determination of Budget Period:

According to CIMA, budget period is “the period for which a budget is prepared and used, which may then be subdivided into control periods.”

Usually, a budget is prepared for one accounting year sub-divided into 4 quarters or 12 months. A rolling or continuous budget is a 12 months’ budget prepared 2 or more times in a year.

These budgets are more accurate but are not used for high clerical costs. In seasonal industries, a shorter budget period, say, one seasonal cycle, or 6 months, or a quarter, will be found more useful. In industries involving huge capital investment and long production cycles, e.g., power plant or ship building, budget period will be more than one accounting year.

Short-term budgets will be much more detailed and are costly to prepare and operate, whereas long-term budgets are affected by unforeseen conditions and are unsuitable for controlling a business. For better control, budget is broken down into figures for a shorter period.

Thus, if the sales budget covers the next 5 years, production and cost budgets may cover one year only. Yearly budgets are divided into months so that actual results can be compared with the budgeted figures and corrective actions can be taken where necessary.

(7) Determination of the Key Factor:

It refers to that factor which, at a particular time, will limit the activities of an undertaking and forms the basis for the preparation of various functional budgets. It is also called the “Limiting” or “Governing” or “Principal Budget factor”. It is defined as “the factor the extent of whose influence must first be assessed in order to ensure that functional budgets are capable of fulfillment”.

Generally, sales are taken as the principal budget factor but other factors of production — e.g., materials, labour, machines, capital, etc., — may also become the principal budget factor.

The various key factors which affect budgeting are:

(i) Sales:

(a) Market potentialities and customer demand.

(b) Shortage of experienced salesmen.

(c) Insufficient advertising due to shortage of fund.

(ii) Materials:

(a) Availability in the market.

(b) Restrictions imposed by quota, licences, etc.

(iii) Labour:

(a) General shortage of labour.

(b) Shortage of highly skilled labour for automatic machines.

(iv) Plant:

(a) Limited plant capacity due to non-availability of machines.

(b) Limited capacity due to shortage of fund.

(c) Bottlenecks in certain key processes.

(v) Management:

(a) Shortage of experienced executives.

(b) Inadequate research facilities.

(c) Shortage of capital.

The principal budget factor is the starting point for the preparation of functional budgets. For example, when sales potential is limited, sales become the key factor. Hence, sales budget should be prepared first and the production and other budgets will follow it. Sometimes more than one factor may limit the activity level.

In such a situation the main factor is called the principal budget factor and other factors are called the limiting or governing factors. Here the relative impact of such factors is considered for the preparation of budget or graphs, linear programming, operations research, etc., may be used.

For example, the preparation of the production budget follows the preparation of sales budget. But situations may force the revision of sales budget in the light of existing production capacity. Here sales are the key factor and production capacity is the limiting factor.

A factor does not remain a principal budget factor for all times. A principal budget factor today may not be the budget factor tomorrow; or, a key factor in the short run may not be a key factor in the long run.

The management may overcome the limitations imposed by key factors by working overtime or shifts, installing or luring new plant and machinery, introducing new methods, changing product-mix, providing incentive schemes, etc.

Budget – Essentials of an Effective Budgetary Control System

The essentials of an effective budgetary control system are:

1. Well-defined Objectives

The goals of any system to be laid down must be clear, specific and well-defined. Budgets can be prepared and implemented effectively only when the objectives are pinpointed and crystal clear.

2. Achievable Goods

The goals set must be capable of being attained. They should be realistic and not illusory. Past, present and future— all must be considered while establishing targets which are reasonably attainable.

3. Optimisation of Profit

The ultimate goal of any system designed and put into operation by the management must aim at optimisation of profit and not its maximisation. The wealth has to be maximised.

4. Support of all Concerned

Right from top to bottom, everyone must be quite supportive and forthcoming to the system in order to attain the budgetary targets. Top management must encourage all in the organisation to be budget-friendly so that co-operation automatically flows in.

5. Conjunction with Standard Costing

Budgetary control should be applied, as far as possible, in conjunction with a system of standard costing. The two systems put together yield better results.

6. Participative Management

Coordination amongst different levels of management is necessary. It is essential that in preparation and execution both, all concerned participate. Best human engineering is needed for most effective budgeting. Recognition of people is a must.

7. Budget Education

Those who are affected and are to be held responsible for off-performance must be properly educated about the targets and consequences of failure to achieve them together with the advantages which shall accrue to all for favourable performance.

8. Timely Reporting

The actual performances and deviations of budgets from them must be regularly reported to the higher authorities so that necessary follow-up action may be taken in time. Moreover, the information system must provide data in a usable form to assist in making sound managerial decisions.

9. Sound Organisational Structure

The organisational structure should be such as to suit the budgetary control system. A restructuring of the organisational system may be required in order to have adaptability to the newly enforced budgetary control system.

Organisation consists of an intelligent grouping of tasks, a coordination of the work of groups, the establishment of definitive lines of authority and responsibility in the execution of the tasks and a procedure for enforcement of the responsibility so assigned.

10. Cost-benefit Analysis

No system can be successful if its costs exceed the benefits. Hence effectiveness of the budgetary control system demands that its costs must be contained within the parameters of its benefits.

11. Aspect of Human Relations

Budget is a device to control costs through people; hence human relations aspects are of paramount importance in dealing with the subject. No management tool can be used to maximise effectiveness without motivation and co-operation.

Thus, for successful budgeting and an effective budgetary control system, the above ingredients have to be carefully looked into beforehand. Actually, these are prerequisites for installation of a successful budgetary control system.

In nutshell, success lies in a positive attitude by all—the initiative is to be taken by the top management which inculcates a feeling amongst all and sundry that budget is a challenge, a goal, an objective that can be attained and even surpassed.

Budget – 5 Steps Involved in Budgeting Process

Budgeting process involves the following steps:

(i) To forecast sales indicating what quantity and quality of goods should be made available.

(ii) To determine management policy regarding range of products, stock levels, channels of distribution, investments etc.

(iii) To prepare a Production Budget in accordance with the forecast and policies and to plan the needs for materials, labour and services along with the costs involved.

(iv) To prepare financial estimates as regards cash requirements for planned operations and investments.

(v) To prepare a ‘Master Budget’ combining and coordinating the individual budgets.

Budget – Steps to be Considered Necessary for a Comprehensive Budgetary Control Programme

The following are the steps to be considered necessary for a comprehensive budgetary control programme –

(1) Laying down organisational goals or objectives,

(2) Formulating the necessary plans to ensure that the desired objectives are achieved,

(3) Translating plans into budgets, i.e., establishment of a budget for each function or activity or segment of the organisation,

(4) Relating the responsibilities of executives to the requirements of a policy,

(5) Recording and reporting actual performance,

(6) Continuous comparison of actual with budgeted results,

(7) Ascertainment of deviations, if any,

(8) Focusing attention on significant deviations,

(9) Investigation into deviations to establish causes,

(10) Presentation of information to management, relating the variations to individual responsibility,

(11) Taking corrective action to prevent recurrence of variations,

(12) Provide a basis for revision of budgets.

Budget – Cash Budget: Purposes, Preparation and Methods

A proper control over cash is very essential in order to run the business smoothly. If cash is not properly managed, this may result into shortage of cash, which may in turn lead to failure of the business. Every business firm, whether small or big needs its own mechanism for managing the cash.

Cash budgeting is one of the mechanisms which are used for managing the cash effectively. Cash budgeting is the process of forecasting the anticipated receipts and anticipated payments of cash to meet the future obligations during the particular period. This period may be daily, weekly, monthly or quarterly etc.

The statement of cash budget is divided into two parts, one showing the estimated cash receipts on account of cash sales, collection from debtors and other receipts and the other showing the estimated payments on account of cash purchases, payments to creditors, payment of other expenses, purchase of assets, etc. It takes into account every transaction which involves the movement of cash.

The main purposes of the cash budget may be outlined as follows:

(i) To indicate the probable cash position as a result of planned operations

(ii) To indicate cash excess or shortages

(iii) To indicate the need for borrowing or the availability of idle cash for investment.

(iv) To make provision for the coordination of cash in relation to-

(a) total working capital;

(b) sales;

(c) investment; and

(d) debt.

(v) To establish a sound basis for credit.

(vi) To establish a sound basis for exercising control over cash and liquidity of the firm.

The cash budget is prepared on the basis of the following information:

(i) The amount of budgeted monthly cash sales and credit sales,

(ii) The number of months within which bills in respect of credit sales are realised,

(iii) Selling and distribution expenses to be incurred during the month,

(iv) The amount of budgeted monthly cash purchases and credit purchases,

(v) Number of months allowed for meeting the bills in respect of credit purchases,

(vi) The amount of salaries and wages to be paid,

(vii) Overhead expenses to be incurred,

(viii) Details of capital expenditure to be incurred and

(ix) Details of administration expenses, payment of dividend, income tax, debenture interest and miscellaneous income. The cash budget usually extends over the same period as the master budget. However, for control purposes, it should be analysed to show monthly or weekly requirements of cash.

There are three methods of preparing the cash budget:

They are:

(i) Adjusted Profit and Loss method, and

(ii) Balance Sheet method.

i. Adjusted Profit and Loss Method:

This method is also called the cash flow statement. It is specially useful to management for long-term forecasting. Under this method, profit is considered to be equivalent to cash. Accordingly, instead of taking into consideration transactions relating to cash receipts and cash payments, only non-cash transactions are considered for preparing the cash budget.

Under this method, profit is adjusted by adding back depreciation, provisions, stock and work-in-progress, capital receipts, decrease in debtors, increase in creditors, etc. Similarly, dividends, capital payments, increase in debtors, increase in stock and decrease in creditors are deducted. The adjusted profit will be the estimated cash available.

For converting profit and loss account into cash forecast, the following information becomes necessary:

(a) Expected opening balance,

(b) Net profit for the period,

(c) Changes in current assets and current liabilities,

(d) Capital receipts and capital expenditure, and

(e) Payment of dividend.

ii. Balance Sheet Method:

Under this method, a budgeted balance sheet is prepared for the budgeted period, showing all assets and liabilities except cash. The two sides of the balance sheet are then balanced. The balance then represents cash at bank or overdraft, depending upon whether the assets total is more than that of the liabilities total or the latter is more than that of the former.

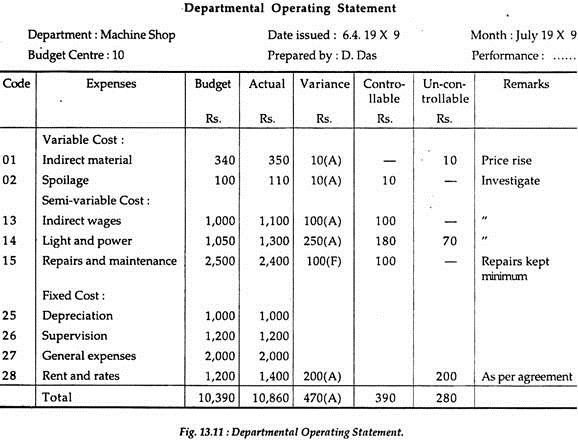

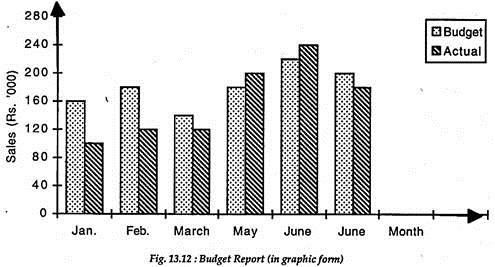

Budget – Departmental Operating Statement and Budget Report in Graphic Form

Establishment of budgets is the first step in budgetary control. For effective budgetary control reports should be prepared at regular intervals showing actual performance alongside the budgeted performance and the reasons for such variances.

Such reports are usually in the forms of Departmental Operating Statement (Fig. 13.11) which shows the operating performance of a departmental manager, during a particular period. These reports contain favourable and adverse variances and are forwarded to heads of departments or budget centres.

Variance is favourable if actual is less than budget and is unfavourable or adverse if actual is more than budget. The heads are required to explain the reasons for these variances so that appropriate corrective action may be taken in time. Usually detailed reports are prepared for the lower level of management.

For higher level of management less detailed reports are prepared with more coverage. The reports should be simple, prompt, and accurate and contain only essential information according to the requirements of the user.

A departmental operating statement and budget report in graphic form are given below:

Budget – Budget Manual: Preparation and Advantages

Budget manual is a document prepared by budget department under the supervision of the Budget Committee. It states the specific procedures to be followed in the development of the budget.

A budget manual also mentions the functions of the budget committee and budget officer and their relationship to other segments of the business in the preparation and administration of a budget.

Generally, a budget manual contains the following:

(i) A statement of the objectives of the business.

(ii) A statement of duties and responsibilities of different personnel involved in the preparation of the budget.

(iii) Time schedule of budget preparation.

(iv) Forms of different schedules.

(v) Procedures for budgetary control.

(vi) Procedures for obtaining approval.

Preparation of Budget Manual:

The budget department at first prepares the budget manual in a rough draft form. This draft manual is circulated to all concerned for comments and suggestions. After considering all the suggestions and comments, a final budget manual is prepared.

Advantages of a Budget Manual:

1. It acts as a guide book of all departments involved in the budgeting process.

2. Less confusion will occur if answers to questions can be obtained from the manual.

3. It will be easier to resolve any difference between two departments when there are written instructions in the budget manual.

4. Reliance on memory is eliminated when a procedure is given in writing.

5. Clear instructions in budget manual will save time of the superiors as juniors will not ask for approval time and again.

6. It will reduce training time of the employees as oral instructions are supplemented with written procedures.

Budget – Responsibility Accounting: Meaning, Requirements and Limitations

Meaning of Responsibility Accounting

Responsibility accounting is a system of accounting which segregates costs and revenues into areas of personal responsibility to assess the performance of the persons to whom adequate authority has been given.

The basic theme of this approach is that managers will be held responsible only for those activities over which they-can exercise a significant amount of control. This approach helps management to plan and control the organisational activities most efficiently.

Here a plan is prepared. Performances are evaluated by comparing actual results with this plan. Deviations from the plan are analysed to fix responsibility. Corrective actions are taken where necessary.

Requirements for Responsibility Accounting:

1. The authority and responsibility of each individual in the organisation should be clearly defined in the organisation structure. A person can discharge his duties efficiently only when he has adequate authority to do so.

2. Responsibility centres should be established within the organisation. A responsibility centre means a unit of an organisation headed by a manager having direct responsibility for its performance.

The following types of responsibility centres can be established for management control purposes:

(i) Cost Centre

According to CIMA, “a cost centre is a production or service, location, function, activity or item of equipment whose costs may be attributed to cost units”.

(ii) Revenue Centre

According to CIMA a revenue centre is, “a centre devoted to raising revenue with no responsibility for production, e.g., a sales centre”. It is often used in non profit making organisation.

(iii) Profit Centre

According to CIMA a profit centre is, “a part of business accountable for costs and revenues”.

(iv) Investment Centre

According to CIMA an investment centre is, “a profit centre whose performance is measured by its return on capital employed”.

(v) Contribution Centre

According to CIMA a contribution Centre is, “a profit centre whose expenditure is reported on a marginal or direct cost basis”.

3. Budgets must be accurate, acceptable and prepared with full participation of managers of different responsibility centres.

4. All levels of management should support the system of responsibility accounting.

Limitations of Responsibility Accounting:

1. It is very difficult to prepare an organisation chart clearly defining the authority and responsibility of each individual. Departments are so intermingled and interdependent that it is impossible to draw distinct responsibility lines. For example, material prices are heavily influenced by the purchase manager but material quantities are heavily influenced by production manager.

2. Individual interest may conflict with organisational interest and hence its implementation may become a problem.

3. Sometimes, it ignores the personal reactions of the people, who are directly involved for its implementation.

4. The system faces passive resistance. It will lose its purpose unless the operating managers enthusiastically support it. It is not a substitute of good management but simply a tool of management.

Budget – Performance Budgeting: Concept and Features

The concept of performance budgeting is used mainly in the Government and public sector undertakings. It projects the Government activities and expenditure thereon for the budget period. It shows budgeted expenses classified by functions, activities and unit cost, if possible.

The main features of performance budgeting are:

(i) Classification into functions, activities or programmes.

(ii) Specifying objectives of each programme.

(iii) Establishing appropriate methods for measurement of work.

(iv) Setting work target for each programme.

Unlike other budgets the objectives of performance budgeting are to provide a closer linkage between planning and action and also to provide a common basis for review, control and reporting.

The basic issues involved in the preparation of these budgets are that of developing work programmes and performance expectations by assigning responsibilities to the executives for the attainment of the goals and objectives of the organisation.

It also establishes well-defined responsibility centres and targets for each such centre in terms of physical units so that actual performance can be compared with it. It forecasts the amount of expenditure needed to meet the physical plan and evaluates the actual with both physical and monetary targets.

Performance budgeting reports are to be submitted at regular intervals to higher authorities showing the physical performance achieved, the expenditure incurred and the variances along with explanations for it.

Here the Government should adopt the accrual system of accounting. Such budgets are similar to the traditional system of budgeting and budgetary control and will be successful if they are drawn up realistically after careful study of feasibility and available resources.

Budget – Programme Budgeting (PB): Distinction, Procedure, Advantages and Disadvantages

PB aims at the proper allocation of resources to meet the objectives of the organisation as a whole. At a first it establishes the overall objectives, and then it identifies the programmes to achieve them.

The costs and benefits of each programme are estimated and allocations to programmes are made on the basis of the cost — benefit evaluation. PB is the counterpart of long term planning in profit organisations.

The objectives of PB may be the building a school, setting a security system, establishing a hospital, defence projects, etc., PB covers the entire period during which expenditure is incurred to finish the programme.

PB was first used in U.S.A. in 1982 in Government concerns. Now it is being applied in private sector and non-profit-organisation e.g., health care, social welfare, education, housing, etc. PB helps the Government to compare alternative programmes and allocate resources to those programmes which will yield the maximum returns of fund invested.

Distinction between Performance Budgeting and Programme Budgeting:

Performance Budgeting:

1. It is retrospective.

2. It is concerned with the process of work.

3. Evaluative in the sense of measuring.

4. It relates to the problems of lower and middle management levels.

5. Oriented to-wards methods to be used to achieve results.

Programme Budgeting:

1. It is prospective.

2. It is concerned with the purpose of work.

3. Connotes planning.

4. It relates to the problems of top management level.

5. Oriented towards the objective.

Procedure for Developing Programme Budgeting:

The four phases of developing PB are:

(a) Programme accounting

It identifies and defines the programmes. Next the expenses are listed for each programme and the total expenditure for a programme which they serve is computed. This is called programme accounting. PB provides output oriented cost information since all expenses are classified by purpose.

(b) Multi-year costing

It is useful when a programme is undertaken on experimental basis for future programme decisions, or, when the initial expenditure on a programme is sufficiently low to deceive the management to accept it in absence of future long term viability.

(c) Description and measurement of activities

In PB objectives, targets, alternatives, output, effectiveness, costs, etc., relating to a programme should be considered before it is approved and undertaken.

(d) Cost-benefits analysis

Such an analysis ranks alternatives for using the funds. Since funds are scarce, it has to be decided which of the projects will be undertaken. It is also very important to select an indicator for measuring performance, benefits and results.

Advantages of Programme Budgeting:

(i) It helps to develop a better decision making process. The decision makers can allocate proper amounts of funds to a purpose as they know how much expenditure has been made for each purpose.

(ii) Better coordination and control by top management over subordinate level are possible.

(iii) Since alternatives are well-defined, PB makes the decision process more effective.

Disadvantage of Programme Budgeting:

Some degree of centralisation may be desirable for strategic areas like defence, security, etc., but excessive centralisation may have adverse effect on decision process.

Budget – Rolling Budget: Definition, Advantages and Disadvantages

Definition of Rolling Budget:

CIMA has defined a rolling budget as – “a budget continuously updated by adding a further period, say a month or quarter and deducting the earliest period”.

Rolling budgets are an attempt to prepare more realistic and certain targets and plans, specially with regard to price levels, by reducing the budget period. For example, a rolling budget is prepared for January to March in more details and April to December in lesser details, due to the uncertainty about the future.

A new budget will be prepared at the end of March, planning April to June in more details and July to March in lesser details. Four rolling budgets should be prepared each 12 months which requires more administrative effort.

The first three months budget is important as it plans working capital, short-term resources (Cash, material, labour, etc.,) and provides a more reliable yardstick for comparison with actual results. A 12 month budget becomes useless when there is rapid inflation. In rolling budget there is scope of revisions in the light of inflationary trends.

Advantages of Rolling Budget:

1. It reduces the degree of uncertainty in budgeting.

2. There is always a budget which extends for some months ahead which is not the case when fixed annual budgets are used.

3. Realistic budgets motivate the managers.

4. Planning and control will be more realistic as these are based on recent plan.

5. It forces managers to review the budget regularly in the light of current events.

Disadvantages of Rolling Budget:

1. This requires more time, effort and money for budget preparation.

2. Revision of budget involves revisions to standard costs and stock valuations. Thus a large administrative effort is needed in the accounts department each time a rolling budget is prepared, to keep the accounting records up-to-date.

3. If the expected changes are not likely to be continuous, updating of budget is not required. Instead, the annual budget may be updated as and when changes are foreseeable, i.e., once or twice, during the year. In such cases rolling budgets are not required.

4. Managers may doubt the value of preparing one budget after another at frequent intervals, even if there are major differences between the figures of two consecutive budgets.

Budget – Zero Based Budgeting: Features, Nature, Process, Advantages and Limitations

In business zero-base budgeting was introduced by Peter Payal of USA in 1969. But in military, it has been in use since 1960. It helps the manager in implementation and formation of various managerial activities. Under this system, every item is checked independently before the preparation of the budget, so that its utility may be ascertained in real life.

Under conventional budget, amendments are made to previous budget, whereas in zero Budget every activity and item is tested and then budget is prepared accordingly for the future.

Features of Zero Based Budgeting:

(1) Each item is analysed from the beginning.

(2) Proposals are prepared and then they are evaluated and afterwards are presented for decision.

(3) For each decision package, a responsible officer is appointed to take care of it.

(4) Resources are allocated for each decision package.

(5) Open and independent communication is made between unit managers and Top level management.

(6) Justification is presented for each’ item of expenditure.

(7) For each programme cost benefit analysis is made.

(8) Each activity is selected for proper decision making.

(9) Relationships are maintained between decision package and targets.

(10) Priorities are identified and decision are taken accordingly.

Nature of Zero Based Budgeting:

Zero-based budgeting is an analytical process, in which relevance of each unit is tested properly. The rank of each unit is defined on the basis of its importance. Every activity is established after its proper revaluation.

(1) Increase in Efficiency

Under it, the various budget are allocated in proper manner, which increases the efficiency in management.

(2) Control on Expenditure

It emphasizes an optimum utilisation of resources and a proper control on unnecessary expenditure. Due to detailed study and analysis of allotted amount control is made on expenditure.

(3) Proper Evaluation

Evaluation of every activity is possible under zero base budgeting system. Proper provision is made in the budget for it.

(4) No Unfair Influence

Under it, old and new proposals are evaluated without any unfair influence. Therefore, resources are allocated properly.

(5) Past Record are not considered

Under this system, past records of expenses are not taken into account and every expenditure is studied in isolation.

(6) Encourages Profitable Issues

Zero base budgeting emphasises on preparation of different alternative plans, which are helpful in the selection of profitable channels.

(7) Proper Coordination

Proper coordination is established between top level management and various managerial decision making units.

Process of Zero-Based Budgeting:

(1) Segmental Objectives

Various departmental objectives are to be defined in accordance with the corporate objectives.

(2) Determination of Scope

Under the activities of zero-base budgeting, scope of organisations is determined.

(3) Cost-Benefit Analysis

It is supposed to be necessary to carryout cost benefit analysis for every decision unit, and on the basis of which alternative activities are assigned in priorities.

(4) Compliance of Operating Expenses

Budget officers should check the compliance of operating expenses; so that difference between sanctioned and allotted expenditure does not arise.

(5) Corporate Objectives

Under-zero base budgeting, corporate objectives are defined. It is determined in advance through detailed study.

(6) Decision Units

Various decision units are identified and made in accordance with the activities of the organisation.

(7) Development of Alternatives

Various alternatives are selected and objectives are attained.

(8) Compliance of Operating Expenses

On the recommendation of top management budget officers try to check the compliances of operating expenses so that the difference between sanctioned and allotted expenditure does not arise.

Advantages of Zero Based Budgeting:

1. It ensures more careful planning and optimum allocation of resources as all activities included in the budget are justified on cost – benefit considerations.

2. It identifies inefficient and unwanted activities and avoids wasteful expenditure. It involves lower and middle level personnel more in the budgetary process.

3. It creates an attitude of questioning each item of budget and discards the attitude of accepting the current position.

4. Cost behaviour patterns are more closely examined.

5. It focuses attention on the future rather than on the past.

6. It has universal application.

7. It acts as a tool of change from which benefit is likely to accrue. It provides better information for decision making.

Additional Advantages of Zero Based Budgeting

Zero based budgeting has the following additional advantages –

(i) Accountability of each manager is defined in advance.

(ii) Managers keep in touch with various techniques and alternatives.

(iii) Weightage can be assigned easily.

Limitations of Zero-Based Budgeting:

(1) Lack of Skill

Due to lack of skills of managers and employees, it is not possible to evaluate the budget properly and it increases the unnecessary expenditure of the organisation.

(2) Resistance of New Ideas

Since the budgeting process is quite different with the conventional process, the managers feel it’s difficult to accept the change process.

(3) Lack of Details

In the absence of actual facts, proper analysis and evaluation of zero base budgeting is difficult.

(4) Unnecessary Paperwork

Detailed analysis of every work is done, which in turn increases the paperwork.

(5) Increase in Costs

Zero based budgeting emphasises on research work and it increases the cost at every level of working.

Budget Ratios: Activity, Capacity, Efficiency and Calender Ratio (With Formulas)

Three important ratios are commonly used by the management to find out whether the deviations of actuals from budgeted results are favourable or otherwise. These ratios are expressed in terms of percentages.

If the ratio is 100% or more, the trend is taken as favourable. The indication is taken as unfavourable if the ratio is less than 100%.

These ratios are:

i. Activity Ratio

It is a measure of the level of activity attained over a period. It is obtained when the number of standard hours equivalent to the work produced are expressed at a percentage of the budgeted hours.

ii. Capacity Ratio

This ratio indicates whether and to what extent budgeted hours of activity are actually utilised. It is the relationship between the actual number of working hours and the maximum possible number of working hours in a budget period.

iii. Efficiency Ratio

This ratio indicates the degree of efficiency attained in production, it is obtained when the standard hours equivalent to the work produced, are expressed as a percentage of the actual hours spent in producing that work –

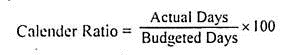

iv. Calender Ratio

Sometimes, Calender Ratio is also calculated. It is calculated on the basis of budgeted working days in a year on a month. It tells about the shortfall or otherwise on account of lesser or more number of effective working days (because of holidays). It is a part of Capacity Ratio.

It can be computed thus:

Budget – Difference between Forecast and Budget

Difference # Forecast:

1. It is a prediction of probable events which are likely to occur as a result of a given set of circumstances during a specified period of time.

2. Forecasting precedes the preparation of budget.

3. A forecast can be made by anybody competent to make judgement.

4. Forecast can be made for purposes other than budgeting, e.g., economic forecast of general business conditions.

5. Forecasts do not connote any sense of control.

6. Forecasts have wider scope.

Difference # Budget:

1. It relates to planned events. Budget is a plan of action proposed to be adhered to during a specified period.

2. A budget is prepared on the basis of forecast made for the budget period.

3. A budget can be set only by seasoned executives of an organisation.

4. Budgets are always prepared with the objects of planning, coordination and control.

5. Budgets lead to a control process, which continues even after the preparation of budget.

6. Budgets have limited scope.

Budget – Difference between Budgetary Control and Standard Costing

Budgetary control is the process of determining various budgeted figures on the basis of past experience for the concerns for the future period and there comparing the budgeted figures with the actual figures for knowing the variances, if any.

It means, first budgets are prepared and then actuals are recorded and by comparing them the variances are found out which will enable the management to take necessary corrective action.

Difference # Budgetary Control:

1. Budgets are estimates on the basis of past experience.

2. Budget is a plan of action for a defined period.

3. Budgetary control is used in all functional areas of an organization (it is more extensive).

4. Budgets are ‘should be’ costs.

5. It is less rigid.

6. It can be operated without standard costing.

7. The projection of budgets is related to the financial accounts.

Difference # Standard Costing:

1. Standards are scientifically planned on technical assessment under a’ set of working conditions.

2. Standard costs are for assessment of operative efficiency.

3. Its use is limited to production costs only. (It is more intensive).

4. Per unit of production.

5. Standards are ‘ought to be’ costs.

6. It is very rigid. It cannot be introduced without budgetary control.

7. The projection of standard costing is related to the cost accounts.

Budget – Advantages of Budgeting

The main advantages of budgeting are:

1. It ascertains the responsibilities of employees.

2. It throws light on capabilities of deficiencies of business and helps in taking measures for improvements.

3. It compels management to maintain adequate statistics.

4. It develops amongst members the habit of giving timely and serious thoughts to all the factors.

5. It increases the profits of organisation as budget expenses are controlled.

6. It initiates thought on basic policies.

7. It compels members to participate in determination of goal.

8. If facilitates maximum utilisation of labour, material, capital and other resources.

9. It develops feelings of coordination amongst various departments of business.

10. It increases the productivity and morale of the employees.

Budget – 13 Main Advantages of Budgetary Control

The main advantages of budgetary control are:

(1) Budgeting compels managers to plan ahead and prepare for contingencies.

(2) It combines the ideas of different levels of management and coordinates all activities of business to centralise control but decentralise responsibility of each manager.

(3) It eliminates wastes and losses and, hence, ensures an increase in productivity of materials, men and machines.

(4) It highlights efficiency and inefficiency and helps management to take prompt remedial action where necessary.

(5) It provides a yardstick against which actual results can be compared.

(6) It plans and controls income and expenditure and thereby maximise profit. It serves as a guide for management decisions.

(7) It ensures adequate working capital and other resources for the efficient operation of the business.

(8) It directs capital expenditure in the most profitable direction.

(9) It helps to get bank credit.

(10) A budget motivates executives to achieve the given targets.

(11) A budgetary control system helps in delegation of authority and assignment of responsibility. It also helps in the introduction of standard costing technique.

(12) Budgeting creates cost-consciousness among the employees.

(13) All functional heads are forced to make plans in harmony with the plans of other departments.

Budget – Limitations of Budgeting

While budgeting performs many functions and has many advantages that are vital to an organization; it has certain limitations which require careful consideration.

(a) Planning, budgeting, or forecasting is not an exact science; it uses approximations and judgement which may not be cent per cent accurate. At best, a budget is an estimate; no one knows precisely what will happen in the future.

(b) The success and utility of budgeting depends on the cooperation and participation of all members of management. All persons should direct their efforts according to the plan. Moreover, the top management should adhere to the budget and provide cooperation.

(c) A budget is only a tool, and it neither eliminates nor takes over the place of management. A budget cannot be substituted for management but should only be used by the management for accomplishing managerial functions. Executives generally feel ‘circled in’ by a budget and its related figures.

They fail to understand that the budget is meant to provide detailed information, goals, and targets which may help them in achieving the company objectives.

(d) It takes time to establish an efficient budgeting process. Also, sometimes too much is expected from a budget and in case expectations are not fulfilled, the blame is put on the budget. An efficient budgeting programme requires that the responsible persons should understand the philosophy, objectives, and essentials of budgeting.

(e) Excessive emphasis on budgeting may result in attempts by lower level of management and employees to buck the system by providing inaccurate estimates of future costs and revenues.

Budget – Disadvantages of Budgetary Control

The disadvantages of budgetary control are:

(1) The budget plan is based on forecasts

Absolute accuracy is not possible in forecasting. Hence the usefulness of the budgetary control system depends upon the extent to which forecasts can be relied upon.

(2) The likelihood of becoming rigid

A budget programme must be dynamic, capable of being adapted to changing business conditions. If the standards set by the budget become rigid, deviations due to changed circumstances beyond the control of management might not be allowed. Budgets which are not revised with the changing circumstances will lose much of their usefulness.

(3) Not a substitute for management

While emphasising the usefulness of budgets, it may be remembered that budgets cannot replace management. In fact it is a tool of management which increases effectiveness of managerial control.

(4) Execution of a budget plan is not automatic

Mere introduction of a budget programme does not mean that their execution is automatic. As budget programmes are related to the executives concerned, their implementation demands a unified effort of all the personnel in the organisation.

(5) Expensive technique

The introduction of a budgetary control system is an expensive affair as it requires specialised staff and involves other expenditure. Hence, it will be difficult for small concerns to adopt it. However, the cost of introduction of a budgetary control system should not be more than the benefits derived from it.