In this article we will discuss about collusive oligopoly and how is price determined in this oligopoly.

When there is product differentiation, i.e., differentiated oligopoly, two or few sellers may recognise that their prices are closely interrelated. Since each firm is a price-searcher, each will guess and learn from experience that as and when it cuts its price, its rivals tend to match or even exceed such a price cut. The consequence: a continuous price war, which will come to a halt as soon as few sellers feel that they are on the same boat.

In the past oligopolists used to form cartels or trusts. Of late, this strategy has become ineffective due to the enactment of anti-trust laws everywhere. In reality the oligopolists hesitate to charge too high a price because that may tempt new rivals to enter the industry. They would, of course, charge a price higher than the purely competitive one but with necessary moderation lest new firms should be attracted into the industry.

The most typical form of collusion where firms join hands to gain the advantages of monopoly is a cartel. A cartel is a formal agreement among firms regarding pricing and/or market sharing.

ADVERTISEMENTS:

Firms often get together and set prices so as to maximize total industry profits. This collusive oligopoly resembles monopoly and extracts the maximum amount of profits from customers.

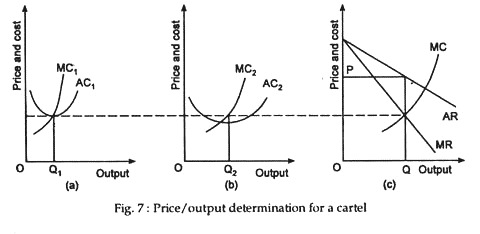

If a cartel has absolute control over its members as is true of the OPEC, it can operate as a monopoly. To illustrate, consider Fig. 7 below.

The marginal cost curves of each firm are summed horizontally to derive an industry marginal cost curve. The profit-maximizing output and equilibrium price (P0) are determined simultaneously by equating the cartel’s total marginal cost with the industry marginal revenue curve. Now each individual firm can easily find its output by equating its marginal cost to the pre-determined industry profit-maximizing marginal cost level.

ADVERTISEMENTS:

How profits are shared among firms?

Profits are allocated on basis of:

(1) Individual outputs,

(2) Historical market shares,

ADVERTISEMENTS:

(3) Production capacity of firms and

(4) Bargaining power of individual firms.

However, cartel arrangements do not last for long due to:

(1) Changing products,

(2) Entry of new firms into the industry and

(3) Disagreement among the members.

But subversion of the cartel by an individual firm is highly elastic provided it can lower its prices without other cartel members learning of this action and retaliating.