The below mentioned article provides notes on Commodity Futures Market.

In recent years, importance of commodity futures market is increasing throughout the world. Keeping in conformity with its need, commodity futures market is now being developed in India in right perspective. The commodity futures market normally facilitates the price discovery process and provides a platform for price risk management in commodities in an effective manner.

The market comprises 21 commodity futures exchanges, which include five national and 16 (commodity specific) regional commodity exchanges. During the year 2010, one commodity exchange, namely, Ahmadabad Commodity Exchange (ACE) was upgraded to a national exchange and rechristened as ACE Derivatives and Commodity Exchange limited, Ahmadabad.

At present, agricultural commodities, bullion, energy, and base metal products accounts for a large share of the commodities traded in the commodities futures market. Futures trading in zinc and lead, mini contracts were introduced for trading during the year 2010. The total value of trade in commodity futures market has increased considerably during the period 2008 to 2010.

ADVERTISEMENTS:

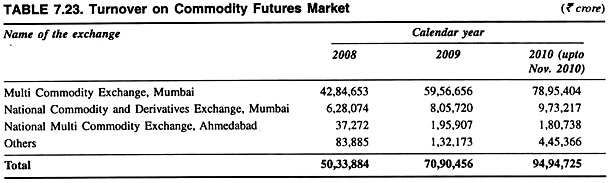

Table 7.23 shows those changes experienced in turnover on commodity futures markets.

Table 7.23 shows that the total value of turnover on commodity futures markets increased from Rs 50, 33,884 crore in the Calendar year 2008 to Rs 70,90,456 crore in 2009 and then to Rs 94,94,725 crore during 2010 (up to November).

The growth in this turnover could be attributed to larger participation in the market; increase in global commodity prices the advent of new commodity exchanges and the restoration of trade in some of the suspended agricultural commodities. The value of trade in commodity futures market in different commodity groups shows considerable changes in recent years.

ADVERTISEMENTS:

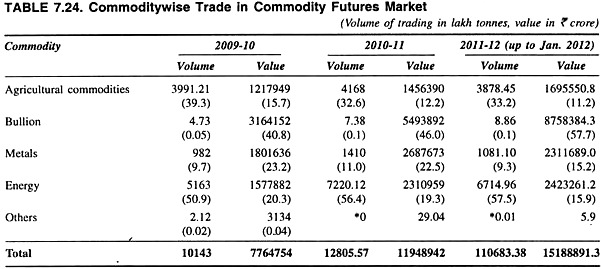

Table 7.24 shows such changes in detail.

It is observed that in 2010-11, in value terms bullion accounted for the maximum share of traded value (46.0 per cent) among the commodity groups followed by metals (21.5 per cent), energy (19.3 per cent) and agricultural commodities (12.2 per cent). However, in quantity terms, trade in energy accounted for 56.4 per cent followed by agricultural commodities (32.6 per cent), metals (11.0 per cent) and bullion (0.1 per cent).

Again during the year 2011-12 (up to January 2012), in value terms bullion accounted for the maximum share of traded value among the commodity groups (57.7 per cent) followed by energy (15.9 per cent), metals (15.2 per cent), and agricultural commodities (11.2 per cent).

ADVERTISEMENTS:

However, in quantity terms, trade in energy accounted for 57.5 per cent followed by agricultural commodities (33.2 per cent), metals (9.3 per cent), and bullion (0.1 per cent).

The Forward Markets Commission (FMC), which is the regulator for commodity futures trading under the provisions of Forward Contracts (Regulation) Act 1952, continued its efforts to strengthen and broad base the market since 2010 onwards.

Initially, the efforts were mainly directed at enlarging the participation of physical market stakeholders, especially farmers, as hedgers in the commodity futures market by increasing the level of awareness of physical market participants and policy markers about the economic role of this market.

The FMC also ensures the dissemination of spot and futures prices of agriculture commodities at Agricultural Produce Market Committees (APMCs) through the implementation of the Price Dissemination Project, in coordination with AGMARKNET and the national commodity exchanges.

The FMC has also taken many initiatives and conducted awareness programmes during the year 2011.

Which include media campaign under the Jago Grahak Jago Programme about the Dos and Don’ts of trading in the commodity futures market; Police training programmes in the states of Madhya Pradesh, Chhattisgarh, Tamil Nadu and Delhi related to dabba trading or illegal trading; a massive awareness and capacity-building programmes for various shareholder groups with primary focus on farmers.

In order to work as regulatory body, the FMC also took the following important steps in order to develop the commodity futures market:

(i) The commission amended the guidelines for grant of recognition to new commodity exchanges under the Forward Contracts (Regulation) Act 1952 by specifying the equity that can be held by a single stock exchange or commodity exchange and the cumulative equity shareholding of all stocks and commodity exchanges.

(ii) The equity structure of the nationwide multi-commodity exchanges was specified after five years of operation, in view of which, no individual or persons acting in concert can hold more than 15 per cent of the paid up equity capital of the exchange. The original promoter/investors can also not hold more than 26 per cent of the paid up equity capital of the exchanges.

ADVERTISEMENTS:

The amended clause also restricts the shareholding of stock exchange(s) and commodity exchange(s) in the National Commodity Exchange.

(iii) To protect the interests of customers, guidelines on market access through authorized persons for all national commodity exchanges were amended whereby the system of sub-brokers was discontinued and the members of the national commodity exchanges were required to provide access to their clients only through authorized person(s) appointed as per the Commission’s guidelines.

(iv) Guidelines were issued specifying the conditions which are required to be fulfilled by the members of the commodity exchanges willing to set up wholly owned subsidiaries and joint ventures in the overseas markets.

Thus on the regulatory front, the FMC undertook certain important measures for developing the commodity futures market which include ensuring more effective inspection of members of the exchanges on regular basis and also in a comprehensive manner by covering all important aspects of regulatory regime; bringing out a guidance manual for improving and it practices prescribing penalty structure for client code modification and for the execution of trade; and also granting exemptions for short hedge for soya bean/oil futures, issuing directives for segregation of client accounts.

ADVERTISEMENTS:

Thus the commodity futures market has been facilitating the price discovery process and providing a platform for price risk management in commodities. Currently (in 2014-15) 113 commodities are notified for futures trading of which 43 are actively traded in 4 national and 6 commodity specific exchanges.

Among all these commodities, agricultural commodities, bullion, energy and base metal products account for a large share of the commodities traded in the commodity futures market.

Accordingly, the share of agricultural commodities in the total turnover was 18.37 per cent in 2014-15, with food items contributing 50.01 per cent of it. The remaining 81.63 per cent turnover was contributed by bullion metals and energy contracts. Besides, a committee set up by the Ministry of Finance, which submitted its report in April 2014, has observed that hedging efficiency of the commodity futures markets in low.

In order to ensure that forward markets in commodities are well regulated and the Indian Commodity futures market is compliant with international regulatory requirements, the regulatory framework for the commodity future market needs, to be strengthened in the country at the earliest.