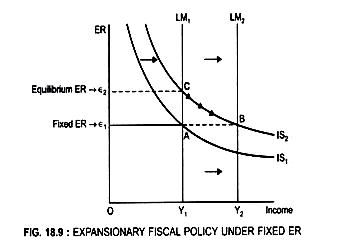

Initially, the economy is in equilibrium at point A.

At point A : IS1 = LM1

Fixed ER → є1

If there is an Expansionary fiscal policy, it will lead to an increase in AD.

ADVERTISEMENTS:

Result:

IS curve will shift to the right from IS1 to IS2 (Fig. 18.9)

At the given ER → є1

Product market is in equilibrium at point B

ADVERTISEMENTS:

But at point B, IS2 ≠ LM1

For both markets to be in equilibrium, ER has to rise from є1 to є2

Equilibrium will be attained at point C as here IS2 = LM1

But a point C: Equilibrium ER (є2) > Fixed ER (є1)

ADVERTISEMENTS:

To maintain Fixed ER, Central Bank will buy $, (that is, the arbitrageur will sell $) to the Central Bank

Result:

Money supply of rupee will increase and LM curve will shift to the right from LM1 to LM2 till equilibrium ER is established at fixed ER (є1)

Due to shift in LM curve, ER falls from є2 to є1 and Fixed ER becomes equal to the Equilibrium ER

However, Income level will increase from Y1 to Y2.

Equilibrium will be at higher income level (Y2)

This is at point B where IS2 = LM2 at higher income level → OY2 but at same ER → є1

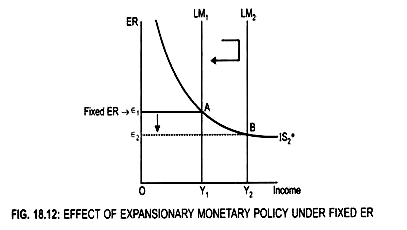

Expansionary Monetary Policy Under Fixed ER With Price Level Fixed:

ADVERTISEMENTS:

If Central Bank buys bonds from the public, money supply will increase.

Result:

LM curve will shift to the right from LM1 to LM2 as a result ER falls from є1 to є2 (Fig 18.12).

ADVERTISEMENTS:

Fixed ER (є1) > Equilibrium ER (є2)

The arbitrageur will sell domestic currency (Rs) to the Central Bank and buy $

Result:

ADVERTISEMENTS:

Money supply will decrease, and thus LM curve will shift back to the left from LM2 to LM1 (to its initial position).

ER will rise to є1 and fixed ER will be maintained.