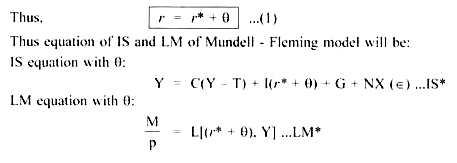

Interest rate in small open economy is not only determined by the world interest rate but also by the risk factor and expectation of a change in the ER.

Assume:

1. Domestic interest rate (r) is determined by:

(a) World interest rate (r*), and,

ADVERTISEMENTS:

(b) risk premium (θ)

2. Risk premium (θ) is determined by:

(a) Risk

(b) expected change in RER

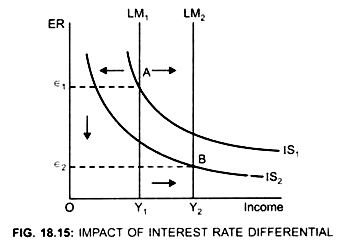

Initially the economy is in equilibrium at point A where

IS1 = LM1

ER → є1

Income level → Y1

ADVERTISEMENTS:

Assume:

Risk premium (θ) rises

... r = r* + θ

Rise in θ will lead to rise in the domestic interest rate

When domestic interest rate (r) rises it will have 2 effects:

1. Because of rise in premium, domestic interest rate rises. Therefore investment will decrease. As a result, IS curve will shift to the left from IS1 to IS2 (Fig. 18.15) on the other hand,

2. LM curve will shift to the right from LM1 to LM2

Reason:

demand for money for speculative purpose (L2) is inversely related to interest rate.

ADVERTISEMENTS:

... r* + θ > r*

... demand for money falls with given money supply:

Money supply > Demand for money

... More money will be left for transaction purpose.

ADVERTISEMENTS:

Along with this, as

r* + 0 > r*

... inflows > outflows

Result →

ADVERTISEMENTS:

Money supply will increase

... LM curve will shift to the right to LM2

Economy will be in equilibrium at point B where IS2 = LM2

Exchange rate → є2

... ER falls from є1 to є2

ADVERTISEMENTS:

... NX rises

income level rises from Y1 to Y2 because magnitude of increase in NX is greater than decrease in investment. Thus even though investment falls, but due to depreciation of ER, NX rises and the income level rises.