In this article we will discuss about:- 1. Definitions of Capital Formation 2. Process of Capital Formation 3. Factors 4. Rate 5. Reasons for Slow Growth Rate 6. Suggestions.

Definitions of Capital Formation:

The capital formation actually signifies a very important aspect of economic development. This means making and increasing of more capital goods, such as machines, tools, factories, buildings, raw materials, fuels, etc., which are to be further used in producing more goods.

It should, however, be very clearly understood that capital formation does not mean increase in money capital, but it actually refers to increase in physical capital, i.e., machinery, factories, transport equipment, bridges, power projects, dams, irrigation systems, etc. To sum up, capital formation implies the creation of real assets.

“Formation of capital implies that society uses its present production not only for the satisfaction of its consumption but also uses a part of it on capital goods that is making machines, transport facilities or other production equipment.”-NURKSE

ADVERTISEMENTS:

“In circumstances of restrained economic growth and industrialization, capital formation should be understood to be limited to machinery, instruments and inventories which are directly capable of being used in work.”-PROF. KUZNETS

“The amount a country adds to its capital during a period, is known as the capital formation during that period.”-BENHAM

Capital formation does not only refer to the development of physical goods but also to the development of human capital. Like education, health, developing skills, etc.

Capital formation consists of both tangible goods like plants, tools and machinery and intangible goods like high standards of education, health, scientific progress and research.

Process of Capital Formation:

ADVERTISEMENTS:

The process of capital formation occurs in three stages, which we shall discuss in detail. But one fundamental aspect must be borne in mind that for the accumulation of capital goods (capital formation), part of current consumption must be sacrificed.

By deferring a part of current consumption, savings are created which are invested for increasing capital goods. Thus, for capital formation, both savings and investments are necessary. An example will explain by this point.

Suppose a person earns Rs. 5,000 per month and he spends the entire amount and saves nothing for future. On the other hand, if he saves Rs. 2,000 per month out of his earnings of Rs. 5000, he can accumulate a handsome amount for future investments. This accumulated money can be invested by him either for procuring equipment and machinery or he may purchase shares and government bonds.

By means of these savings and investments, he provides benefit to the society, as the society will have a larger volume of stocks of capital and also greater production of goods and services that simultaneously provides benefit to himself, also as he is able to earn more income. On the contrary, if he goes on increasing his savings (in the form of money capital), but does not invest it for purchase of capital goods, his act will not be covered under capital formation.

ADVERTISEMENTS:

The three stages of capital formation are:

(i) Creation of Savings,

(ii) Effective Mobilization of Savings, and

(iii) Investment of Savings.

I. Creation of Savings:

It is the savings which are transformed into capital.

The savings are created by individuals, who defer their present consumption by curtailing their expenditures on consumer goods, but the saving by individuals depends more or less upon:

(i) Ability (or power) to save,

ADVERTISEMENTS:

(ii) Willingness (or desire) to save, and

(iii) Opportunity to save.

(i) Ability (or Power) to Save:

It directly depends upon the income of individuals and the taxation policy of the government. Higher income of people enables them to save more as compared to lower income. Countries like U.S. A. and some western countries have high per capita income, so the people over there have higher savings, whereas undeveloped or underdeveloped countries have low per capita income and so the people have a lower saving power.

ADVERTISEMENTS:

Besides the level of income, the taxation policies of the government also affect the ability to save. When the rates of income tax and sales tax are high, the major portion of the earnings of people goes to the government exchequer and very little remains with people to save and invest. Thus, the power to save increases, when the taxation rates are normal and reasonable.

Standard of living of the people also affects directly the ability to save. Higher standard of living implies higher income and thus higher rate of savings. Whereas lower standard of living results from lower income and therefore lower ability to save. Finally import reduces the ability to save, export increases national income and therefore raises the ability to save.

(ii) Willingness (or Desire) to save:

Even though people may have a higher ability (or power) to save, the important condition is that they must have willingness or desire to save. But the desire to save depends on many personal, family and national considerations like family affection, desire to start a business, old age considerations and unforeseen emergencies. Apart from the above, the higher rates of interest also motivate the people to save. Reduction in income tax induces people to save more, while an increase in income tax adversely affects the willingness to save.

ADVERTISEMENTS:

(iii) Opportunity to Save:

The opportunity to save refers to the conditions of peace and security in the country and a favourable political philosophy of the government to motivate people to save. When there is peace and security in the region or country, then the trade, business, banking system, etc., will function normally and people in general will be inclined to save more. Besides, certain measures and schemes introduced by the government and state agencies like P.F. (provident fund) have also helped in inculcating the habits of savings even amongst people of lower incomes.

II. Effective Mobilization of Savings:

It is not only enough to have more savings. The capital formation cannot occur, unless the savings of the people are actually utilized (i.e. invested) for producing capital goods. But for achieving this goal, the savings of various households and individuals need to be effectively mobilized and made available to businessmen and entrepreneurs for investments.

The institutions like banks, insurance companies, improvement trusts, finance corporations, etc., play a very important role in bringing die individual savers and investors together, actually, all these financial institutions constitute a kind of capital market in the country and ensure that the savings of the society are mobilized and transferred to entrepreneurs who require them.

ADVERTISEMENTS:

The savings of the people must be properly invested for the purpose of producing capital goods by a good number of honest and venturesome entrepreneurs in different productive systems, such as agriculture, industry, trade, public works, transport, communication and improved technical know-how.

The entrepreneurs will however get motivated only when:

(i) The rate of interest on money capital is not very high, and

(ii) There are good chances of profit.

The rate of interest is determined and decided as per the policies and directions of the Central Bank of a country (Reserve Bank of India) and the Government. The chances of reasonable and good profit from any venture depends upon factors like marginal efficiency of money, the nature of the product, the size of market existing and expected for that commodity. As such the total quantum of investment varies according to the expected changes in profits.

Factors Affecting Capital Formation:

The following are the factors affecting the formation of capital in a country:

ADVERTISEMENTS:

1. Volume of Saving:

The accumulation of capital directly depends upon saving. Saving means the difference between income and consumption. The difference can be utilized for capital formation. According to MARSHALL- “Larger the volume of savings, larger the size of capital, smaller the volume of saving, smaller is the size of capital.” The amount saved as money is mobilized and then converted to capital assets.

2. Ability to Save:

It directly depends upon the income of the individuals and the taxation policy of the government. Higher income and low taxation leads to higher rate of capital formation.

3. Willingness to Save:

It depends upon many personal, family and national considerations like family affection, desire to start a business, old age consideration and unforeseen emergencies.

ADVERTISEMENTS:

4. Profit of Public Sector Enterprises:

A public sector enterprise is a very important form of business organization. Since these are owned by the government rather than by individuals, all the profits of these enterprise can be used for capital formation by the government.

5. Market Conditions:

The prosperity encourages and enhances the saving but depression reduces the saving of people. Capital formation is highly affected by market conditions of boom and depression.

6. Facilities of Investment:

When the people are provided with more facilities to mobilize the savings, the people save more and invest more. The commercial banks, mutual funds, etc., encourage the people to save more. More saving leads to more capital formation.

ADVERTISEMENTS:

7. Modifying Income Tax Policies:

The government may provide a boost to capital formation by extending assistance to potential investors in various ways. For instance, by conducting techno-economic surveys of various lines of production, giving tax benefits to newly set up production unit, or by granting income tax benefits to people who wish to save (e.g., exempting from income tax that part of income which is saved).

These steps are particularly useful when investment is constrained, not by the policy of saving, but by the unwillingness of the producers to invest the savings that are available in the economy.

8. Monetary Policy:

The economic policies pursued by the government also constitute an important factor affecting capital formation in the country. While these policies, by themselves, do not act as sources of capital formation, they act as factors affecting the sources.

9. Commodity Taxation:

Commodity taxation can also be used to raise the rate of savings. If items of consumption, i.e., especially items of luxury consumption are subjected to high rates of sales taxes, this will raise the prices of the consumption goods (because the sales taxes are added to the prices of the goods). This will reduce consumption in the country. Naturally, savings will increase if income remains unchanged.

10. Deficit Budget:

There are other fiscal measures also, that can be adopted for the purpose of increasing capital formation in the country. The government often comes forward to build large public sector projects. These increase capital formation by creating social overhead capital. The costs of building these projects are often covered by budget deficits.

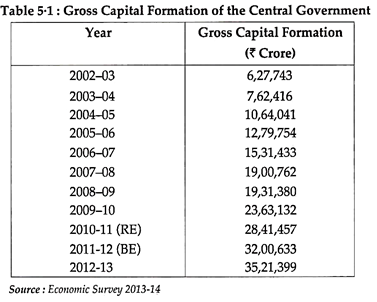

Rate of Capital Formation:

Rate of capital formation is the ratio between gross capital formation and gross domestic product at current prices. It indicates the proportion of GDP that can be utilized for its own growth. It can be measured by dividing gross capital formation by GDP.

Thus:

Reasons for Slow Growth Rate of Capital Formation in India:

The rate of capital formation in India is very low as compared to many advanced countries like U.S.A., Japan, etc.

Some important reasons for lower rate of capital formation are as under:

1. Low Saving Ability:

The people in India have the desire to save and possess all those factors, which motivate the ‘will to save’, like old age considerations, family affection, social and political influence, but they have lower per capita income. Low per capita income leads to low savings which lead to lower rate of capital formation.

2. Habit of Hoarding:

Most of the people have very little capacity to save, and are more in the habit of hoarding their savings in their houses. Such savings are of no use as far as capital formation is concerned, because these hoarding cannot be utilized for any productive purposes.

3. Inflation:

Due to inflationary trend, the prices of commodities go very high and the middle-class people find it very difficult to save any amount. Rather, it is becoming increasingly impossible for them to meet both the ends. Under such conditions of inflation, the majority of middle-class is contributing very little to capital formation.

4. Inadequate Investment Channels:

The banking and financial facilities are inadequate in India. However, after nationalization, large numbers of branches of banks have been opened even in remote areas and villages, but a very wide gap still exists.

The means of transport and communication are not fully developed. These inadequacies adversely affect the mobilization and investment of savings.

5. Taxation Policy:

High level of taxes on property in India, affect the savings and accumulation of capital adversely. The industrialists and businessmen believe that level of taxation should be reduced so that people’s capacity to save is improved; simultaneously improving their capacity to invest.

6. Insecurity:

The condition of law and order in many parts of the country is not normal. There is no adequate security of life and property in some of the regions and this has discouraged the opening of new industries in those areas. The Government’s liberal policy towards the labour has also created a kind of fear amongst the minds of private investors.

Besides the above causes, frequent failures of joint stock companies have made the people reluctant for investments.

7. Lack of Allied Facilities and Infrastructure:

Allied general facilities, which motivate and encourage investment, are also inadequate in India. The facilities of power, engineering industry, technical training, public health systems and measures are not up to the desired level.

This has restricted the expansion and widening of market, reduced the productivity of workers and has increased the cost of production in several sectors of the economy in our country. The private entrepreneurs get discouraged on account of inadequate general facilities.

8. Unequal Distribution of Income and Wealth:

In a country like India there is extreme unequal distribution of income and wealth which keeps the rate of capital formation relatively low. In fact, it restricts real investment in the economy.

Suggestions to Increase the Rate of Capital Formation:

For the economic development and the overall prosperity of the country, the rate of capital formation needs to be accelerated.

Following are some suggestions for achieving this:

1. Tax Result:

The taxation policy should be revised and adequate tax reliefs should be allowed to salaried persons and industrialists.

2. Encourage Savings:

Steps should be taken to intensify and motivate small savings, for which rate of interest on savings should be attractive. Saving schemes like (P.F.) provident fund, compulsory insurance, compulsory deposits, etc., should be encouraged and extended.

3. Facilitate Investment and Production:

Many more avenues of investment and production should be increased by establishing and implementing schemes in agriculture, industry, transport, banking, insurance, trade, etc.

4. Maintenance of Law and Order:

The law and order condition in every part of the country should be improved and security of life and property must be ensured.

5. Equal Distribution of Wealth:

There should be a proper distribution of wealth.

6. Improving and Developing Basic Utilities:

General facilities like means of transportation, communication, power plants, ports, technical training facilities, etc., should be improved and developed in an adequate way.

7. Cheap Capital:

The investors avail credits from various agencies for their growth, but the rates of interest at which credit is available to them is high, thus increasing the cost of capital results in low profit margins for investors. A lower rate of interest will increase the profit and stimulate investments.

8. Identification of Investments:

The productive investments should be encouraged but unproductive investments should not be entertained.

The above suggestions are only general. There may be some specific segments, which may be necessary to be developed according to the region and the requirements thereof, so that capital formation and economic progress are accelerated to a desired rate.