Role of World Bank in India!

The World Bank was established in 1946 as a twin institution with the IMF (International Monetary Fund) as a result of the Bretton Woods Conference.

It assists reconstruction and development of the needy countries through long and medium term loans. It pays special attention to the development of under-developed countries.

It not only grants loans out of its own funds, but it also assists private foreign investment by guaranteeing or participating in loans and investments made by private investors and coordinates the lending activities of the rich countries at a governmental level. It has thus helped in raising productivity and the living standards in developing countries.

ADVERTISEMENTS:

The World Bank advances loans to the developing countries subject to the following conditions:

(a) The overall economy of the borrowing country is soundly operated

(b) If the overall economic plans would reinforce the basic soundness of economy, and

(c) The projects which the bank is asked to finance have been carefully prepared and are economically and financially justified.

ADVERTISEMENTS:

In order to obtain IBRD loans it is necessary for a developing country to keep a constantly critical eye on the soundless of its budget structure, on healthy relationship between wages and prices, on the effective utilisation of its available productive resources, on the flow of goods within its borders and the volume and character of its imports and exports; and on all the diverse aspects of national life which reflect the health of its economy.

The Bank charter provides that its loans must be for productive purposes and meant to finance foreign exchange requirements of specific projects. Before a loan is granted the merits of the projects to be financed are carefully studied and it is ensured that only the most urgent and useful projects are taken up first. Also, before making or guaranteeing any loan, the Bank must satisfy itself that the borrowing country cannot obtain the loans from private sources at reasonable terms.

The Bank makes prudent assessment of the projects to make sure that the loans will be repaid. The broad aim is to help strengthening the economy of the borrowing country and stimulate production activity in general rather than help the production of particular goods. It does not engage in equity financing.

The World Bank has become a part of a broadening stream of financial and technical assistance to the less developed countries. Although now other sources and institutions have also joined in the task which the Bank pioneered with such imagination and purposiveness, it has not detracted from the importance of the part which the Bank is playing in mobilizing international assistance to developing countries.

ADVERTISEMENTS:

However, there is a definite limit to the amounts that the Bank can lend. Its entire subscribed capital is not really available for lending. Additional funds are raised by issuing bonds and here also there is a limit to the total amount that the Bank can raise by issuing bonds. The capacity of the developing countries to absorb capital for really productive purposes also imposes a limit.

The Bank has repeatedly made it clear that the main burden of international finance must fall on private investors or on loans at nominal interest or outright grants by rich countries. It cannot be expected to meet capital requirements of the developing countries in their entirety.

There is thus need for other sources or organisations to undertake this all important task. The Bank can render a useful service by providing technical assistance in preparing development plans and by supplying relevant information to the other lenders. Above all, it can serve as a negotiation forum and provide mediation.

The World Bank has given a large financial assistance to India for economic development. Special mention may be made of the assistance World Bank has given to India in the development of infrastructure such as electric power, transport, communication, irrigation projects, steel industry. For a long period, India was the signal largest borrower from the World Bank. At present India is the third largest borrower of funds from the World Bank. Till June, 1999 India got, 172 loans amounting to 26 billion US dollars from World Bank.

The Role of IBRD (World Bank):

Countries with a per capita income of less than $ 5,225 that are not IDA-only borrowers are eligible to borrow from IBRD. Countries with higher per capita incomes may borrow under special circumstances or as part of a graduation strategy. It is important to note, however, that the amount that countries can borrow from IBRD depends on their creditworthiness.

Thus, countries may be eligible to borrow but may not have access to IBRD resources because of poor creditworthiness. In addition, IBRD loans outstanding to any individual borrower, irrespective of its creditworthiness, may not exceed $ 13.5 billion.

Seventy-five per cent of poor people who live on less than $1 per day live in countries that received IBRD lending. IBRD borrowers are typically middle-income countries that enjoy some access to private capital markets. Some countries are eligible for IDA lending due to their low per capita incomes, but they are also creditworthy for some IBRD borrowing.

These countries are known as blend borrowers. Even excluding IBRD loans to the blend countries, a full 25 percent of those who live on less than $1 a day live in countries that are IBRD borrowers. IBRD provides important support for poverty reduction by facilitating access to capital in larger volumes on good terms, with longer maturities, and in a more sustainable manner than the market provides.

IBRD is a AAA-rated financial institution—with some unusual characteristics. Its shareholders are sovereign governments. Its member borrowers have a voice in setting its policies. IBRD loans (and IDA credits) are typically accompanied by non-lending services to ensure more effective use of funds. Also, unlike commercial banks, IBRD is driven by development impact rather than profit maximization.

ADVERTISEMENTS:

In the fiscal year 2002 IBRD raised $ 23 billion at medium to long-term maturities in international capital markets. The funding volume in year 2002 was above the $ 17 billion raised in the fiscal year 2001. Borrowings, along with shareholder equity, fund IBRD’s loans and investments. Its financial strength is based on the support it receives from its shareholders and on its financial policies and practices, which are designed to maintain a high credit standing in the international markets.

Co-financing:

Co-financing describes funds committed by official bilateral partners, multilateral partners, export credit agencies, or private sources to specific Bank-funded projects. Co-financing enables the World Bank to increase its resources with additional financing to benefit the recipient country. Financing provided by multiple sources in support of individual projects also allows harmonization of policies and procedures, thus reducing the administrative burden on the recipient country and improving effectiveness. In the fiscal year 2002 IBRD and IDA financing of $ 19.5 billion was supplemented by $ 4.7 billion from such sources.

Trust Funds:

ADVERTISEMENTS:

A number of industrial countries, a few of a larger developing countries, the private sector, and non-governmental organizations maintain trust funds with the World Bank that can be used to supplement Bank resources for specific agreed-on initiatives. The trust funds available cover areas that facilitate providing grants for high-priority development needs, including technical assistance and advisory services, debt relief, and post conflict transition. In the fiscal year 2002, trust fund assets grew to $ 5.34 billion.

World Bank’s Strategy: Stronger Focus on Results:

Development experience over the past 50 years has highlighted the importance of focusing on economic and social outcomes. Donors demand that funds provided by their taxpayers achieve results. The citizens of developing countries are impatient to see tangible improvements in their living conditions within a reasonable time frame.

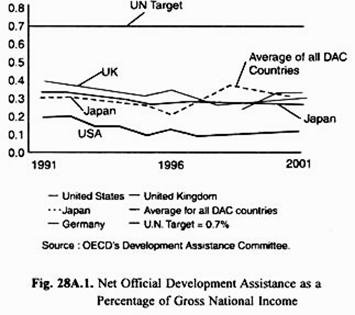

Both expect the World Bank and other development agencies to be able to demonstrate the results of joint efforts. Developing more accurate and timely data on social and economic outcomes and conducting independent evaluations of projects and country programs provide a basis for ensuring accountability and, more importantly, learning from experience. Figure 28A.1 shows official development assistance made by various developed countries to World Bank.

ADVERTISEMENTS:

The Bank has, in the last few years, significantly increased its focus on monitoring the quality of implementation, sustainability, and development outcomes of the programs it finances. Its monitoring and evaluation systems have been strengthened to more comprehensively capture the poverty impact of its policy and investment lending as well as its advisory services. This will enable it to more closely track its progress toward meeting the Millennium Development Goals (MDG).

Financing the Poverty Removal: Efforts by World Bank:

The World Bank is a cooperative institution that mobilizes financing by means of outright contributions from the richer member countries for IDA, and by borrowing from the international capital markets for IBRD. It channels these resources for the benefit of the poor in borrowing countries.

The clients of IDA are the poorest countries, who usually cannot afford to borrow on commercial terms. IDA offers concessional, no-interest loans (or credits) to the poorest countries, repayable in 35 to 40 years after a 10-year grace period. In the fiscal year 2002 IDA provided $ 8.1 billion in financing for 133 projects in 62 low-income countries.

The clients of IBRD, on the other hand, are generally the middle-income countries and, because of the limitation on IDA resources, some of the larger low-income countries that are deemed creditworthy for borrowing from World Bank. IBRD (World Bank) offers loans at near-market terms but with long maturities.

In the fiscal year 2002 IBRD provided loans totaling $ 11.5 billion in support of 96 projects in 40 countries. Poverty reduction is at the core of lending from both IDA and IBRD, through investments that support growth as well as investments in basic public services. In what follows we describe the Bank’s lending instruments and the process of loan approval to reduce poverty in the less developed countries.

The Bank offers an array of customized services through IBRD and IDA – including loans, technical assistance, and advice – to its developing and in-transition member countries. It uses two basic types of lending instruments: investment loans and adjustment loans.

ADVERTISEMENTS:

Investment Loans:

Investment loans provide finance for goods, works, and services in support of economic and social development projects in a broad range of sectors. The nature of the Bank’s investment lending has evolved over time. Originally focused on hardware, engineering services, and bricks and mortar, investment lending has come to focus more on institution building, social development, and the public policy infrastructure needed to facilitate private sector activity as the Bank’s priorities have changed.

Adjustment Loans:

Adjustment loans provide quick-disbursing external financing to support policy and institutional reforms. Adjustment loans were originally designed to provide short-term balance of payments support for macro-economic policy reforms, including reforms in trade policy. Over time they have evolved to focus more on medium-term structural and institutional reforms in the financial sector, social policy and public sector resource management.

Both investment and adjustment loans are used flexibly to suit a range of purposes.

How a Loan is made:

ADVERTISEMENTS:

Lending by the World Bank is developed in several phases. On the basis of economic and sector work, often supported by the Bank, the borrower identifies and prepares the project, and the Bank reviews its viability. During loan negotiations the Bank and borrower agree on the development objective, components, outputs, performance indicators, an implementation plan, and a schedule for disbursing loan funds. Once the Bank approves the loan and it becomes effective, the borrower implements the project or program according to terms agreed on with the Bank.

All loans are governed by the World Bank’s operational policies which aim to ensure that Bank-financed operations are economically, financially, socially, and environmentally sound. Fiduciary policies and procedures govern the use of project-related funds, particularly for the procurement of goods and services. Safeguard policies help to prevent unintended adverse effects on third parties and the environment.

The Bank therefore supervises the implementation of each loan and evaluates its results. Three-fourth of outstanding loans are managed by country directors located away from the Bank’s Washington, D.C., headquarters. Nearly 30 per cent of World Bank’s staff are based in nearly 100 country offices worldwide.