Several arguments are advanced to justify a policy of protection.

Haberler has classified these arguments into two groups: 1. Economic Arguments 2. Non-Economic Arguments.

These arguments are analysed below:

1. Economic Arguments:

The principal economic arguments in support of a protectionist commercial policy are as follows:

ADVERTISEMENTS:

(i) Infant Industry Argument:

The most effective, accepted and sustained argument in support of protection is that a newly established industry is incapable of facing intense competition from the low-cost foreign industries in its earlier stage of development. Such an industry has to be protected from foreign competition by the state at least until it matures enough to face world competition.

The argument was initiated by the writers like Alexander Hamilton, Friedrich List, J.S. Mill and Bastable and continues to muster support even in the more recent times. This argument is based upon the implied assumption that the given country has a latent comparative advantage in the industry or group of industries to be protected. Only thing is that this industry or group of industries is to be given protected environment to grow upto an optimum size and become capable of achieving a high level of efficiency and consequent minimum costs.

The argument is that the given industry has potential comparative advantage but it cannot initially reap the internal economies of scale in the face of stiff foreign competition. Given protection through import duties, subsidies and provision of infrastructural and other facilities, it will be able to expand and take advantage of economies of scale and the benefits of learning by doing. The protection granted to a group of infant industries will generate external economies through the development of power, transport, communications, research etc.

ADVERTISEMENTS:

These industries have linkage with several other industries and, therefore, can create a strong spin off for the whole economy. The protective duties accruing to the government can be utilised for the creation of economic and social overheads. This argument has much significance for industrial development of late-coming LDC’s. It is precisely because of the growth possibilities of new or infant industries that protection has become an important feature of policy-making in LDC’s.

A highly important aspect of this argument is that protection to the infant industry should only be for a short duration. As soon as they gather strength and overcome their initial cost-disadvantage, the protection should be withdrawn and these industries must be exposed to foreign competition.

J.S. Mill laid down a test, called as Mill’s Test which specified that protection to infant industries should be only temporary. It should be continued only for such time till the industry overcomes its historical handicap and corrects the transient cost distortion. After that the industry must dispense with protection and withstand the foreign competition. In this regard, Bastable suggested a more rigorous test termed as Bastable Test.

This test specified that the industry seeking protection should not only eventually withstand foreign competition, it should also show that, in the event of granting protection to it, the ultimate saving in costs would be more than sufficient to compensate the community for the high cost of protection. If an industry can satisfy Mill-Bastable Test, the country must grant protection and allow it to grow and stand on its own feet.

ADVERTISEMENTS:

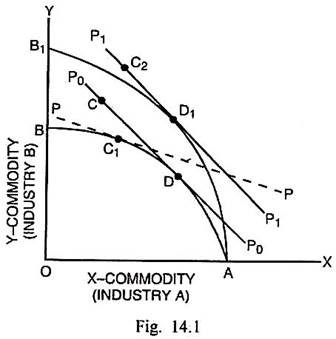

The infant industry argument can be analysed through Fig. 14.1. In Fig. 14.1., commodity X of industry A is measured along the horizontal scale and commodity Y of industry B is measured along the vertical scale. BA is the production possibility curve. Given the international exchange ratio line P0P0 under the conditions of free trade, production takes place at D and consumption at C.

If protection is granted to the infant industry B and tariff is imposed on commodity Y, the terms of trade line becomes PP. The line PP is tangent to the production possibility curve at C1. The country consumes and produces Y commodity at the point C1. Since under protection, people consume less quantities of both commodities, protection lowers the welfare of the community.

However, increased production in the protected industry assures internal economies and improvement in skills and efficiency so that the productive capacity of the economy expands and country will experience a shift in its production possibility curve to B1A. If now protection is withdrawn and free trade is resumed, the international price ratio line is P1P1 (parallel to P0P0). The tangency of P1P1 with B1A shows that production occurs at D1. The consumption, however, takes place at C2. It represents a higher level of social welfare. It is, therefore, clear that by nurturing the infant industry for some time, the country has become able to achieve higher levels of production as well as welfare.

Limitations:

The infant industry argument suffers from certain limitations and it has been objected by the economists on various grounds.

Firstly, to begin with every industry is an infant industry. It is, therefore, necessary to make a choice whether one or the other infant industry deserves protection. There should be more rigorous test than Mill-Bastable Test for making this choice.

Secondly, while granting protection to infant industries, it is stated that it is to be withdrawn after a short period when industry would become able to face foreign competition. Such a criterion about the withdrawal of protection is completely vague.

Thirdly, even if it is recognised that infant industry can grow through protection, yet it cannot be denied that a large cluster of inefficient firms will start growing around a few efficient units behind the tariff walls. This inefficient chunk of industries will seek the perpetuation of the policy of protection.

ADVERTISEMENTS:

Fourthly, protection may create vested interests and the political pressures are brought upon the government to continue this policy almost indefinitely.

Fifthly, protection leads to emergence of local monopolies or cartels, which corrupt the legislators and government officials for not withdrawing protection.

Sixthly, Haberler has refuted the view that the growth of infant industries will create internal and external economies. He held such a possibility as vague, muddled and doubtful. In this context, he remarked, “… argument for tariff based upon them belong to Curiosa of theory rather than to a practical economic theory.”

Seventhly, there is a common saying—once an infant, always an infant. As protection is granted on the ground of infancy, it becomes difficult to withdraw it even after a long time as it is always argued that industry is still unable to face the rigours of foreign competition and society has to bear the burden of high costs in the form of tariffs on the one hand and excessively inefficient industry on the other.

ADVERTISEMENTS:

Eighthly, the protection to infant industries was supported by the economists, in the last two centuries on the grounds of development of the economies. Even in the recent times, the LDC’s justify it from this very viewpoint.

However, the protection may not bring about greater or rapid development in a capital-deficient country. Protection can only create investment opportunities by disrupting foreign imports but it cannot create savings or capital necessary for growth. The protection of import-substitutes at a relatively higher costs may adversely affect the rates of saving and investment apart from strengthening inflationary pressures in LDC’s. If protection does not bring about an improvement in productive skills, it can have little positive effect upon the growth process.

Despite protection, the industries in the LDC’s may remain unable to face the competition from the industries of advanced countries on account of the expanding technological gap with those countries. The protection to infant industry does not provide any mechanism through which the increasing technological gap between the rich and the poor countries can be bridged up. Thus the high expectation of accelerated development through protection may remain unfulfilled.

(ii) Elimination of Distortion Argument:

ADVERTISEMENTS:

It is sometimes argued that the commodity and factor markets in a country may involve certain distortions. In the commodity market, distortions may be on account of externalities in consumption and production and monopolistic or monopsonistic pricing. In the factor market, the distortions occur because of wage rigidities, wage differentials between sectors (agriculture and industry), immobility of labour between sectors, credit rationing in capital market and disequlibrium in factor markets.

The presence of such distortions prevents the attainment of gains from the competitive free trade. It necessitates the policy of protection to industries not on a temporary basis as presumed in the case of infant industry argument, but on the permanent basis.

In order to analyse the effect of protective measures like tariffs and subsidies in the elimination of distortions in commodity market, it is supposed that the industry B (producing Y-commodity) has comparative advantage but the externalities are responsible for a higher social cost than the private cost in this industry.

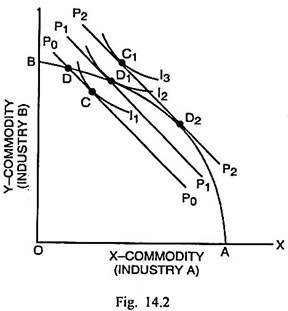

The production possibility curve in Fig. 14.2 is AB related to X- commodity of industry A and Y-commodity of industry B. In the conditions of free trade, the production takes place at D and consumption occurs at C where the international exchange ratio line is tangent to community indifference curve I1.

It is supposed that the social cost of producing larger quantity of Y is very high due to domestic commodity market distortions. To remove this distortion, a tariff is imposed on the import of product Y such that the terms of trade line becomes P1P1. In this case, the production and consumption take place at D1.

Since the consumption equilibrium has shifted to the higher community indifference curve I2, it signifies a gain in welfare. But that is not a definite outcome. It is possible that there is deterioration in the welfare. That is determined by the relative production gains and consumption losses.

ADVERTISEMENTS:

Tariff alone cannot give the optimal solutions, if the distortions are present in the commodity market. The optimum solution is reached where there is a combination of import duties and subsidies. Such a possibility can result in the shift in the international terms of trade line to P2P2 (parallel to the line P0P0).

In this case, production equilibrium is determined at D2 whereas the consumption equilibrium is determined at C1. It lies upon the community indifference curve I3 that is even higher than the community indifference curve I2. Hence the protective measures comprised of tariff and subsidies are better than tariff alone, when there are distortions in the commodity market.

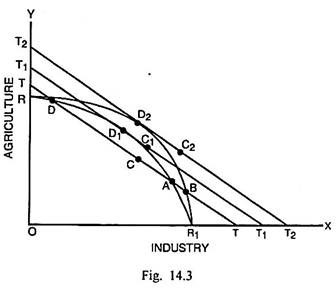

When distortions are present in the factor market, there cannot be optimum allocation of factors and production possibility curve is likely to shift towards the origin. The effects of distortions and their removal through protective measures can be explained through Fig. 14.3.

In Fig. 14.3., given the distortions in the factor market, the production possibility curve is RAR1. If the international terms of trade line, under the conditions of free trade is TT, the production takes place at D and consumption at C. If protection in the form of tariff is extended to industrial goods, the terms of trade line is T1T1.

ADVERTISEMENTS:

Production now takes place at D1 and consumption at C1. Since consumption point C1 is better than C, protection is advantageous for the country. But it is not always true. A tariff can never bring the true domestic marginal rate of transformation in production to coincide with the international terms of trade.

The social welfare, subsequent to the imposition of tariff, may get actually deteriorated. In such an event, subsidy on production can prove to be better than free trade. But even that policy is unlikely to lead to the optimal solution. A combination of subsidy to labour in the industrial sector and a tax on the use of labour in agriculture will make the country produce at D2 and consume at C2. Only though such a set of protective measures can a country reach its undistorted production possibility curve.

(iii) Key Industries Argument:

The key industries are such industries, which are of basic character. They open up the possibility of developing several other industries. The key industries include agriculture and such industries as iron and steel, heavy engineering, chemicals, heavy electricals, cement, machine tools, petroleum etc. In case of these key industries or socially important industries, countries protect the domestic production even if the goods can be obtained at a lower cost from the foreign markets. In the LDC’s this argument carries much weight with the development planners.

It is believed that such industries must be developed at any cost as they can open the gates for industrialisation. The developing countries, through protection to basic or key industries, can hope to achieve industrial self-sufficiency in particular and economic self- sufficiency in general.

(iv) Diversification of Industries Argument:

ADVERTISEMENTS:

An important argument in support of protective tariff is one of diversification of industries or achievement of a proper balance among different groups of industries. The specialisation of countries in a narrow range of exports exposes them to recurrent economic fluctuations, apart from making them excessively dependent upon the others. The unbalanced growth leads to much instability of the economy.

Some factors of protection, employed in the exports industries are recklessly exploited, while others are either not utilized at all or grossly underutilised. Since dependence on foreign countries is risky and dangerous politically and economically, all countries feel the necessity of having a balanced and self-sufficient economy through diversification in industrial production secured by enforcing protective tariff on certain categories of foreign products.

Although the LDC’s give much importance to this argument, yet this argument is criticised on several grounds. Firstly, no country of the world including the U.S.A. and other highly advanced countries have natural and other productive inputs large enough to develop all the industries and achieve economic self-sufficiency.

Secondly, the grant of protection for the achievement of diversification in production cuts at the root of the principle of comparative cost advantage and prevents the international specialisation.

Thirdly, diversification and consequent economic self-sufficiency leads to international isolation. It is not only impossible in the modern conditions but is also self-defeating, as it will saddle a country with inefficient industries and high cost and price structures.

Fourthly, the industrial diversification and self-sufficiency leading to isolation of a country result in serious destabilisation of the economy on account of absence of foreign trade and non-availability of international finance for development.

ADVERTISEMENTS:

Fifthly, the historical experience also shows that the self- sufficiency is very difficult to be achieved. After years of economic isolation, the communist countries like Russia and China had to return to international trade and market-oriented system.

(v) External Economies Argument:

Sometimes it is argued that the imposition of tariff can facilitate the development of a large number of industries. The industrial expansion brings in external economies that provide a strong impetus to overall growth of a whole economic system. The external economies may be technological and monetary or pecuniary.

The technological economies signify the impact of the use of specific techniques and factor inputs upon the output of the other firms, when the different firms are linked with one another horizontally or vertically. The pecuniary external economies arise when the profits of one firm are affected by the actions of other producers.

In this connection Scitovsky remarked, “….with the expansion in the capacity of an industry as a result of investment, prices of its products would fall and prices of the factors used by it could rise. The lower prices of products will benefit consumers and rising factor prices would increase the level of income of their suppliers. These are the pecuniary external benefits of economies which may result by appropriate tariff or commercial policy in the case of LDC’s.

The benefits of external economies can be obtained through protective commercial policy only if the expansion of industries is planned in an integrated manner. In such a situation alone, the profitability in each one of them can be a reliable index of their social desirability.

(vi) Sunset Industries Argument:

A more recent argument that has emerged from the European countries is that some of their labour-intensive industries including textiles, clothing, footwear and steel have been losing competitiveness to the countries like Japan, South Korea, Taiwan, Malaysia and India since 1970’s. The argument is that sun is setting on some mature industries of Europe. They can re-equip themselves and regain their competitiveness only if temporary protection is granted.

The fears were expressed that without protection there would be large-scale displacement of labour and capital from these industries. In view of this argument, tariffs were imposed upon the import of textiles, clothing, footwear etc. in a number of European countries. The sunset industries argument to tackle unemployment in those countries is guided mainly by political consideration. In addition, once these industries are given protection, the removal of it will be extremely difficult.

(vii) Employment Argument:

A major argument is support of protective tariff since long has been employment argument. It is certainly tempting for a country suffering from excess capacity or structural unemployment to rely upon protection to create additional jobs in the import-competing industries. As tariff is imposed, there is a reduction in imports. Consequently, import-competing industries find opportunities to enlarge their sales in the home market. That assures generation of additional employment directly in such industries.

The induced increase in employment may take place later in those industries, which depend upon the import-competing industries as well as the import- substitution industries. Keynes offered this type of logic to justify British tariff during 1930’s. Although he did not advocate it as a general case for protection, yet he recognized moderate tariff as the only way of stimulating recovery without substantially reducing foreign competition.

In this connection, a counter-argument is sometimes given. The restriction of imports from abroad causes a reduction in exports of the trading partners and consequent decline in their income. A fall in foreign incomes will have repercussion on the exports of the home country by way of drop in exports. Such a development will result in the reduction in employment in the export industries of the tariff-imposing countries. Thus there may be no net increase in employment.

If the home country resorts to protective tariff in times of recession or contraction, the trading partners may be provoked to impose retaliatory tariff. The adoption of these beggar-my-neighbour policies by several countries is likely to reduce the volume of international trade and aggravate recession and unemployment. In this context, Keynes remarked, “If a reduction of imports causes almost at once a more or less equal reduction in exports—obviously a tariff…. would be completely futile for the purpose of augmenting employment.”

In case the exports of the tariff-imposing country remain unaffected, there may be stimulation of employment, according to Keynes, in two situations. First, if the tariff-imposing country is, at the same time, also a lending country, its exports will remain intact, and the increase in employment in the import- competing industries will not be off-set by reduction in employment in the export industries.

Secondly, if the tariff-imposing country follows a policy of subsidising its exports, it is possible that the exports of the tariff-imposing country remain the same but it can reduce its imports and expand the production of import-competing goods and enlarge the volume of employment. The arguments given by Keynes have been, however, refuted by the critics.

According to them, the lending operations by the tariff-imposing countries may cause diversion of capital resources from the domestic investment to foreign countries. The diversion of invisible funds may have adverse effect on the volume of domestic employment. As regards subsidies, the other countries may also grant subsidies to their exports and continue to supply their products in the tariff- imposing country. In this situation, the effect of tariff stands nullified and the employment is not likely to increase.

There can be some circumstances in which the imposition of tariff can bring about expansion in employment in the short period. Firstly, if a country has a monopoly position in respect of exportable goods, the quantity of exports may remain unchanged, while tariff restricts imports and enlarges employment.

Secondly, even if exports decline, the saving of purchasing power consequent upon reduction in import, through tariff, may get switched to exportable goods. The domestic consumption of these products in a large measure can still stimulate employment. Hence, it may be conceded that tariffs can have favourable effect on domestic employment at least in the short period.

Haberler also admitted that tariff, in specific conditions, could be capable of removing frictional, technological, cyclical and even structural unemployment in the short run. In his words, “… leaving aside a few exceptional cases, a favourable result can be expected only in the short run, so that tariffs can be advocated on this ground only from a short run, and indeed, short-sighted standpoint.”

Ellsworth and Leith have not supported tariffs for inducing the expansion of employment. According to them, “Tariffs once imposed are very difficult to be removed. It amounts to a permanent reallocation of resources for what is essentially a short run cyclical problem (unemployment)”. This beggar-my-neighbour policy is bound to provoke retaliation and to have serious adverse repercussion effects.

It is, therefore, not practical to rely upon protection to expand employment. The monetary and fiscal policies can prove to be more effective in the realisation of the goal of maximization of employment.

(viii) Anti-Dumping Argument:

The imposition of tariff has a strong justification when the foreign producers have been resorting to dumping. This practice means sales in a foreign market at a price lower than that received in the home market, after allowing transport and other charges involved in transfer.

Since dumping results in the flooding of a given market with low priced foreign products, the import-competing firms are likely to be hit very hard. The protective tariff can be enforced to prohibit dumping by the foreign producers. Although the members of GATT agreed to curb such practices in 1967, yet this practice still continues.

(ix) Balance of Payments Argument:

When a country is faced with the balance of payments deficits and the payments due to import goods and services are an excess of receipts from abroad, the protective tariff may assist in removing the balance of payments deficits. Tariff can restrict imports from abroad and allow the growth of import- substitution industries within the home country. This measure may become unavoidable, if the deficit country does not possess sufficient reserves of gold or foreign exchange to adjust the payments deficit.

The neutralisation of payments deficit through protective tariffs is considered more expedient than even devaluation for certain reasons. Firstly, the devaluation is likely to have more widespread effects than tariffs, which are applicable to a specific commodity or group of commodities. Secondly, devaluation is not likely to make desired impact on imports, if the demand for imports in the home country is less elastic so that rise in import price causes little reduction in payments for imports.

Tariff as a means for balance of payments adjustment is criticised on certain grounds. Firstly, the imposition of import duties and consequent reduction in the supply of imports may create inflationary situation in the home country. That may aggravate the balance of payments deficits.

Secondly, tariffs cut the exports of trading partners and lower their income and employment. It amounts to a beggar-my-neighbour policy whereby the home country seeks to have gain at the cost of the foreign country.

Thirdly, tariffs may have little effect on the flow of foreign products especially when the foreign country enjoys the monopoly position or the foreign products are far superior than the home produced import substitutes. In such a situation, no improvement in balance of payments deficit can be expected through imposition of tariff.

Fourthly, the tariffs are likely to result in retaliatory measures by the foreign countries.

Fifthly, if in the face of tariffs, the foreign countries start providing subsidies to their exportable products, the effect of tariffs will get neutralised and balance of payments situation will not get improved.

Sixthly, tariffs can, at the most, suppress the payments disequilibrium in the short period; they cannot provide a permanent remedy to the problem of balance of payments deficit.

(x) Terms of Trade Argument:

A country can bring about an improvement in its terms of trade through the imposition of protective tariff. As tariff is imposed and imports are restricted, the rate at which the exports of country are exchanged, gets improved.

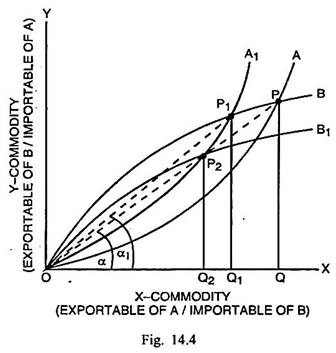

The extent, by which the terms of trade of a country can get improved, depends upon the relative elasticities of demand and supply at home and abroad. A country, which has a relatively less elastic demand for the foreign product, is in a better position to improve its terms of trade. This can be shown through Fig. 14.4.

In Fig. 14.4, OA is the offer curve of country A and OB is the offer curve of country B. The trade takes place at P where county A imports PQ quantity of Y and exports OQ quantity of X. The terms of trade for country A at P = (QM/QX) = (PQ/OQ) = Slope of Line OP = Tan α.

As country A imposes protective tariff on the import of Y commodity, its offer curve shifts to OA1. Now exchange takes place at P1. At this point, the terms of trade for country A = (QM/QX) = (P1Q1/OQ1) = Slope of Line OP1 = Tan α1. Since Tan α1 < Tan α, there is an improvement in the terms of trade for country A through the policy of protection.

The terms of trade argument is, however, criticized on certain grounds. Firstly, the imposition of tariff may improve the terms of trade but it may cause a reduction in the volume of trade. Fig. 14.4 shows that the quantities of the two commodities exchanged at P1 are less than the quantities exchanged at P.

Secondly, if the foreign country B imposes equivalent retaliatory tariff on the product of country A, there may not be any improvement in the terms of trade for country A. In Fig. 14.4, when country B imposes retaliatory tariff, the offer curve of country B shifts to OB1, the exchange takes place at P2. The terms of trade for country A at P2 = (QM/QX) = (P2Q2/OQ2) = Slope of Line OP2 = Tan α2.

Since the terms of trade at P and P2 are measured by constant tan α, there is no improvement in terms of trade. There is, however, further curtailment of the volume of trade. Thirdly, a regime of protective tariffs enforced for the sake of terms of trade results in misallocation of resources, reduction in volume of trade and loss in consumers’ satisfaction or welfare and can cause grievous injury to the economies of all the protectionist countries.

(xi) Foreign Capital Inflow Argument:

If a country imposes high tariffs, the foreign business firms may like to set up their branches in the tariff- imposing countries and start producing their products within these countries. Thus there can be a large flow of direct investments. In this way, they can avoid tariff restrictions and have easy access to the markets of the tariff-imposing countries. The flow of foreign capital through tariffs has taken place in some of the European countries from the U.S.A.

Similarly in the case of India, the foreign firms entered into collaboration agreements with Indian firms for the same reason. This benefit can be derived only if the tariff-imposing country has a large domestic market. LDC’s can utilize this opportunity for accelerating their growth, provided they can make the foreign capitalists to invest capital in the capital goods sectors rather than luxury or semi-luxury consumer goods sectors.

(xii) Strategic Industries Argument:

This argument emphasises that the modern high- technology industries in the fields of information technology, defence, telecommunications, computers etc. require protection. These industries are highly capital-intensive. They involve huge expenditure on Research and Development (R & D). The support of government to high-tech industries is expected to enable such industries to gain comparative advantage in these crucial industries.

The degree of risk in these industries is very high. They can result in large external economies. They can open up substantial growth prospects for the countries. In view of strategic importance of these modern industries, they should be protected from foreign competition.

In this connection, a crucial question is which industries should be accorded the status of strategic industries and be accorded protection. The supporters of strategic trade policies suggest some criteria in this regard.

These criteria are:

(i) They should have high value-added per worker.

(ii) They pay high wages to workers.

(iii) They make use of high technology.

The strategic trade policies promoted the growth of steel industry in Japan in the 1950’s. In the United States, the government extended protection to agriculture and defence industries on the ground of strategic trade. In European countries like France and Britain, the support on this basis was extended by the governments in the development of supersonic aircraft in 1970’s and development of Airbus aircraft in the 1980’s.

The policy of protecting such industries has, however, certain shortcomings. First, it is quite difficult to specify the appropriate criteria to select the industries having large external economies. Second, for the protection and development of the strategic high-tech industries, the laying down of appropriate policies also poses much problem.

Third, as many developed and developing countries take resort to protective measures, their policies will have neutralising effect and gain from protection may be very little. Fourth, the adoption of import restrictions against high-tech industries of foreign countries is likely to provoke retaliatory measure from them.

(xiii) Revenue Argument:

The policy of protective tariff is supported also on the ground that the government can obtain substantial revenues from this source. It has been a major source of revenues for the governments in the LDC’s like India. It is claimed that tariffs kill two birds with one stone. They yield revenue along with providing protection against foreign competition. There is, however, a counter-argument that these two objectives of tariffs are not consistent with each other. Generally, tariffs that yield more revenues, afford less protection and vice-versa.

In this regard, it must be pointed out that the revenue is not fundamental consideration for the imposition of tariff. The prime goal is that of protection, additional revenue is just a by-product. Therefore, it may be stated that tariff can provide protection plus some amount of revenues. Another relevant fact in this regard is the incidence of import duties, which may be wholly or partially borne by the domestic consumers. The revenue yield from tariffs must be evaluated keeping in consideration the burden that it imposes upon the people of the home country.

(xiv) Expansion of Home Market Argument:

If the tariffs are imposed upon the foreign products, the flow of foreign products gets restricted and the domestic producers have the opportunity of enlarging their production. They will try to dispose of their production in the home country by reducing prices and advertising. Since there is expansion of employment in new industries, the workers have larger purchasing power.

This also contributes in increasing the size of market. In this regard some objections are raised. Firstly, tariffs may enlarge the home market but that may be at the expense of foreign markets. The restrictions on the imports of foreign products will attract similar restrictions upon the exports of the home country by the foreign governments. Consequently, the exports are likely to decline.

Secondly, in the protected home market, the producers will charge high prices and sell products of inferior quality. This is not likely to bring about any sizeable expansion in the home market.

(xv) Factor Redistribution Argument:

In the over-populated less developed countries like India, the supply of labour in agriculture is so excessive that the marginal product of labour is zero. The writers like Lewis, Nurkse, Ranis and Fei and Jorgenson advocated the diversion of surplus manpower from agriculture to industries for achieving a higher rate of growth.

In this context, Lewis, Myrdal and Manoilesco suggested that imposition of tariffs on the imports of industrial goods can restrict import and provide opportunities for the home industries to expand and absorb the surplus labour diverted from agriculture.

Such a diversion of labour will cause an increase in the marginal productivity of labour and thus tariffs can contribute in growth-oriented redistribution of factors. In this connection, it must be remembered that mere imposition of tariff is unlikely to result in any large- scale diversion of manpower from agricultural to non-agricultural sectors. There are several formidable economic, sociological and technical constraints upon such a redistribution of productive factors in the LDC’s.

(xvi) Bargaining or Retaliation Argument:

If a country finds that neighbouring countries or its trade partners have armed themselves with tariff weapons and their protective commercial policies are causing harm to its exports, it has to resort to the imposition of tariffs against the exports of other countries by way of retaliation or as a means of bargaining from equal or better position. By the threat or actual resort to tariff, it can persuade other countries to dismantle the tariff walls and permit liberal and easy flow of products.

This argument is attacked on various grounds. Firstly, the retaliatory tariff by different countries will result in the shrinkage of international trade.

Secondly, the retaliatory tariff can seriously imperil the economic and political relations of the countries and undermine the hopes of greater international economic co-operation.

Thirdly, the retaliatory tariff may not assure better bargaining particularly when the reciprocal demand for the products of home country by the foreign countries is rather weak.

Fourthly, the vested interests in a country may be so powerful that they may not permit the reduction in tariffs. As a consequence, tariffs or threat of tariff cannot serve as an effective weapon in bargaining.

(xvii) Keeping Money at Home Argument:

It is sometimes argued that the surplus import of foreign products involves not payments to the foreigners, which brings about an expansion in income in the other countries, while there is a leakage from circular flow of income of the home country. If imports are restricted through tariffs and goods are instead manufactured in the home country, both commodities and money remain at home. This argument is fallacious because of certain reasons.

Firstly, the imports are to be paid by exports. If a country makes imports from abroad, it has also the opportunity to export its products. If it is able to expand its exports over and above its imports, there can be a flow of money or income from foreign countries to the home country.

Secondly, generally such commodities are imported as are available at lower prices in the foreign countries than in the home country. The imports at lower prices relieve the domestic shortages and increase the real standard of consumption. Thus, gain in welfare due to imports cannot-set the outflow of currency. Thirdly, if a country follows this argument that will completely eliminate the international trade.

(xviii) Pauper Labour Argument:

One of the arguments advanced especially in advanced countries to support protection is based upon the ground of safeguarding the interests of labour. There are generally wide differences in the wage rates in different countries. For instance, the wage rates in the U.S.A. are twice as high as those in Britain and three times that of Italy and about 15 times than that in India.

In view of such wage differences, it is argued that the products of high-wage countries cannot compete with the products turned out by the low-wage countries through what is termed as the use of ‘pauper’ labour. Therefore, in order to shelter the living standards of workers from the competition of pauper labour, the protective tariffs should be clamped upon the products of low-wage countries.

Haberler criticised this argument as misleading. According to him, this argument implies that tariffs should be imposed just because a foreign country has been producing a commodity at a lower cost. It may result in the negation of the principle of international trade itself.

Taussig and Haberler point out that the pauper-labour argument rests upon the assumption that unrestricted trade will lead to equalisation of wages the world over. Such a possibility does not exist in actual reality on account of serious impediment upon the mobility of factors. Jacob Viner defended the pauper labour argument.

According to him, the international trade will reduce the relative share of scarce factor in the real national income despite the international immobility of factors. The neo-classical economists, on the other hand, maintain that possibility of decline in wages in the high-wage country may exist in the short run. But the long run effect of free international trade upon labour incomes is likely to be beneficial both in the advanced and low-wage countries.

Haberler and J. Viner also came round the view that increased productivity due to international division of labour and technological developments would assure steady gains in labour income. The distribution of income, as suggested by various empirical studies has not gone against labour in the advanced countries over a long period.

Stopler and Samuelson have lent support to the pauper labour argument. According to them, the free trade will allow the labour-intensive imports to enter into a labour-scarce country. It will result in a reduction in the scarcity of labour and consequent fall in wages relative to the return on capital. In their words, “… international trade necessarily lowers the real wage of the scarce factor expressed in terms of any good.”

If protection is granted against the import of cheap labour product, the tariff-imposing country can keep the price of labour high and keep the distribution of income in favour of labour. However, in this connection, it is counter-argued that a country can enjoy the benefit of free trade and at the same time keep the income distribution in favour of labour through the use of appropriate monetary and fiscal policies.

J. Bhagwati has pointed out that the protection will not necessarily raise the real wages of the protected factor. According to him, “….protection (prohibitive or otherwise) will raise, reduce or leave unchanged the real wage of the factor intensively employed in the production of a good accordingly as protection raises, lowers or leaves unchanged the internal relative price of that good.”

Ellsworth has repudiated the pauper labour argument on the two grounds. Firstly, labour is not the only factor of production. It is combined with capital and natural resources to produce goods. The labour-scarce countries tend to produce goods through capital-intensive methods and the products embodying much capital can be produced by them at low cost.

It is fallacious to suppose that the high wage countries are at a disadvantage in all lines of production. The experience shows that the United States has been exporting foodgrains to different parts of the world despite the fact that it is a labour-scarce country.

Secondly, even if labours were the only factor, a high-wage country could still compete with a low-wage country wherever its relative productivity were higher than its relative wage. Ellsworth, therefore, found little justification in the pauper-labour argument.

In his words, “It is possible to advance it seriously only if one is completely ignorant of both the principles and the facts of international trade. As for the facts, every day, year in and year out, products of high-wage American labour are sold abroad in competition with goods made by low-paid workers. Higher wages are clearly no bar to cost of production, at least in many important lines.”

In the ultimate analysis, it may be stated that the pauper-labour argument has proved to be inconsistent with the actual realities. The labour- scarce countries like the U.S.A. and Britain have maintained high wages inspite of the imports of labour-intensive goods and large-scale immigration of labour from the labour-abundant countries.

(xix) Equalisation of Costs Argument:

The policy of protection is supported sometimes on the ground that it can bring equalisation in the costs of production of foreign and domestic products. If foreign products are cheaper by 20 percent compared with the home-produced goods, the imposition of import tariff of 20 percent can equalise prices and the two countries can compete on equal terms. Taussig considered such a tariff policy as fair. Ellsworth has refuted this argument on certain grounds.

Firstly, if the cost difference is high, the protecting country will have to resort to stiff dose of import duties. That will have serious adverse effect upon the volume of international trade.

Secondly, the restriction on imports from abroad through trade will cause injury to the domestic export industries, as they will find that the foreign markets are shut for them.

Thirdly, the policy of imposing tariffs for the sake of cost equalization is discriminatory. If this principle is applied, the home country will find itself protecting the most inefficient and sick industries with little or no protection to the most efficient industries.

(xx) Conservation of National Resources Argument:

Certain countries specialise in the export of exhaustible raw materials and materials such as coal in Britain, iron ore, manganese and mica in India, gold in South Africa and crude oil in the Middle East countries. The writers like Jevons and Patten argued that the countries exporting exhaustible natural resources like minerals should impose export tariffs for conserving them for a longer period.

They can utilise these resources better by developing the manufacturing industries in the home country and exporting the manufactured products to foreign countries.

(xxi) Economic Recovery:

If a country is passing through recession or contraction, the economic recovery can be possible, it is argued, through the tariff protection. Such a line of reasoning was supported even by Keynes. According to him, for a country, which is neither in equilibrium nor in sight of equilibrium, protection and not free trade is the most rational trade policy. Keynes’ suggestion was refuted both by Robbins and Beveridge. They expressed the fear that restrictions on imports will attract similar restrictions on exports by the others.

However, how exports will be affected, is governed by the reciprocal elasticity of demand for them in foreign countries. In addition, the restriction by foreign countries can have very little effect if the home country has a large internal market. There is presently a strong lobby among the economists that supports tariffs in the event of recession or contraction.

2. Non-Economic Argument:

Certain non-economic arguments are advanced in support of the policy of protection.

These arguments are as follows:

(i) National Defence Argument:

The policy of protection is supported on the basis of the argument that a country must be self-sufficient in the matters of defence production. It is considered risky and dangerous to depend on the foreign countries for the supply of war materials. Even a strong votary of free trade like Adam Smith recognised that “defence is better than opulence”.

In view of the desirability of having independence from other countries in this most vital area, it is felt that the industries producing defence materials must be granted protection irrespective of cost. But the military requirements in modern times are so extensive that a developing country is not likely to achieve self-sufficiency in defence production even if it stretches its available resources to the fullest extent.

Therefore, it is practical for the poor countries to strive for the maximum possible self-sufficiency in defence rather than the unattainable complete independence from the import of defence requirements. Strategy-wise, it is appropriate to procure the latest and more effective defence materials than producing obsolete and less effective materials at home through inefficient sheltered industries. But the security of a nation is of so paramount importance that no economic argument can cut any ice.

(ii) Special Interest Argument:

In a particular country, there may be certain classes of population or occupations, which are very vulnerable to foreign competition. For instance, artisans having special skills cannot produce goods at costs low enough to face competition from machine-made imported products. Their interests should be protected through tariffs for the sake of preserving social ethos and national heritage. Similarly agriculture is a depressed sector in the developing countries.

The farm producers, faced with competition from abroad, have to be protected, otherwise the production process in that sector is likely to get seriously disorganised. In this regard, Haberler remarked, “Agriculture is the well-spring from which the human race is physically and mentally regenerated.”

Therefore, agriculture should be protected from foreign competition at all costs to preserve the special ethos of the nation. Not to speak of the LDC’s like India, even the advanced countries of European Union and the U.S.A. have protected agriculture through sizeable subsidies that resulted in the serious deadlock in the Doha round of negotiations of W.T.O. during the recent years.