Let us make an in-depth study of the Purchasing Power Parity (PPP). After reading this article you will learn about: 1. Subject-Matter of Purchasing Power Parity 2. Link of PPP with RER 3. Implications of PPP 4. Theory and Evidence of PPP.

Subject-Matter of Purchasing Power Parity:

There is a famous hypothesis called the law of one price (LOOP).

It is based on the concept of arbitrage, which is speculation over space.

Arbitrage refers to transferring a commodity from a low priced to a high priced market. As a result of such transfer, prices are equalised in both the markets. When this happens, we say that the LOOP prevails.

ADVERTISEMENTS:

A simple example will make the point clear. Suppose the price of wheat is higher in London than in Manchester. Under free trade (with no government intervention), traders will buy wheat from Manchester, and sell it in London. As a result the price of coffee will rise in Manchester (due to shortage) and fall in London (due to excess supply).

Ultimately, the prices will be equalised in the two markets and arbitrage will stop. Thus, the same price will prevail in two different locations within a country’s domestic territory.

If we apply LOOP in the international market place, we find purchasing power parity. It states that in the presence of international arbitrage, a pound will have the same purchasing power in, the UK and in the USA or another country such as Japan. The reason is easy to find out.

If a person could buy more coffee domestically than abroad, then traders will make gain by buying coffee at home and selling them abroad. Due to the operations of the arbitrageurs, whose objective is profit maximisation, the domestic price of coffee will rise relative of foreign price.

ADVERTISEMENTS:

The converse is also true. If a pound could buy more coffee in USA than in UK, the arbitrageurs would buy coffee abroad and sell it at home. This will cause the domestic price to fall below the foreign price. Thus, the activities of profit-seeking international arbitrageurs will cause the price of coffee to be the same in all countries.

Link of PPP with RER:

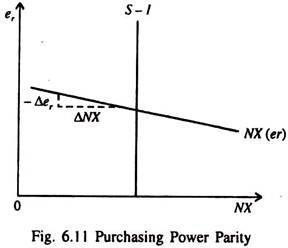

It is possible to suggest an interpretation of PPP in terms of RER. The instantaneous response of the profit-seeking international arbitrageurs implies that net exports are extremely sensitive to small movements in the RER.

A slight drop in the prices of domestic goods relative to foreign goods — or, what comes to the same thing, a marginal fall in RER — induces arbitrageurs to buy goods in the home country (where prices are low) and sell them in foreign countries (where prices are high). The converse is also true.

A slight increase in the relative price of domestic goods induces arbitrageurs to import the same goods. This means that the net export schedule NX(er) is almost horizontal (completely elastic) at the RER that equalises purchasing power among the nations.

ADVERTISEMENTS:

A slight drop in the RER leads to a substantial increase in net exports. This very fact ensures that the equilibrium RER is very close to the level ensuring purchasing power parity. This relation always holds.

Implications of PPP:

There are two implications of PPP:

(i) Since the net exports schedule is flat, changes in saving and investment have no effect on the rate of exchange — nominal or real.

(ii) Since the RER remains fixed, all changes in the NER results from price level changes and not from changes in the quality of exports and imports.

Theory and Evidence of PPP:

The PPP is not very realistic the following two points may be noted in this context:

(i) Non-traded goods:

There are various non-traded goods and services such as haircuts. There is no scope of arbitrage even if prices differ across national borders. A barber from London cannot go to New York every now and then to earn more even if a haircut in New York is more expensive than in London.

(ii) Substitutability:

ADVERTISEMENTS:

Furthermore traded goods are relative prices of Rolls Royce and Ford cars can vary to some extent due to differences in tastes. This means that there is hardly any opportunity for making profits through arbitrage operations.

For these reasons, real exchange rates may and often do vary over time. However, the PPP doctrine provides a very important insight the fluctuations in the RER are very small and do not last for long. The reason is easy to find out the farther the RER deviates from the level predicted by purchasing power parity, the stronger is the incentive for individuals to engage in international arbitrage.