Let us make an in-depth study of the Quantity Theory of Money.

The quantity theory of money, how the quantity of money is related to prices and incomes.

This point may now be explained in detail.

Transactions and the Quantity Equation:

ADVERTISEMENTS:

People hold money mainly for transactions purposes, i.e., to buy goods and services. If people want to exchange more goods and services they need more money. So the more money people need for transactions, the more money they demand and hold. The demand for money is related to the quantity of money because the money market reaches equilibrium when the two are equal.

The Quantity Equation of Exchange:

The link between the volume of transactions and the quantity of money is expressed in the following equation called the quantity equation of exchange:

Money supply x velocity of circulation = price level x volume of transactions

ADVERTISEMENTS:

or, M x V = P x T … (1)

In this equation T, on the right hand side, represents the total number of transactions per period, say, one year. In others words, T denotes the number of times in a year goods or services are exchanged for money. P is the number of rupees exchanged per transaction. In other words, it is the price of an average transaction. The product of the two, i.e., PT, is the number of rupees exchanged per year.

M, on the left hand side of the equation, is the quantity of money and V is called the transactions velocity of money or the rate of money turnover, i.e., the number of times a unit of money circulates in the economy. In other words, velocity tells us the number of times a unit of money such as a rupee coin or a rupee note changes hands in a given period of time.

Basically an Identity:

ADVERTISEMENTS:

The equation of exchange is basically an identity, a truism. If any of the variables in the equation changes, one, two or three others have also to change to maintain the equality. Thus, if M increases and V remains constant, then either P or T has to rise.

From Transactions to Income:

Since it is difficult, in practice, to measure the number of transactions in an economy, economists have replaced T by the total output of the economy Y (which is also a measure of total income). T and Y are not the same, but they are related to each other. If Y increases T also has to rise. The more output is produced, the more goods are bought and sold by the people.

In a broad sense, the rupee value of transactions is proportional to the rupee value of output. Therefore PT can be replaced by PY and we can express the quantity equation as

MV = PY … (2)

where Y = the amount of output produced per year or GDP. Since Y is also the total income earned by the productive factors, V in equation (2) is called the income velocity of money. It indicates the number of times a unit of money is received as income per period (i.e., say, one year).

The Demand Function for Money and the Quantity Equation:

While analysing the effect of money on the economy, economists often express the quantity of money in terms of the quantity of goods and services it can buy. This is known as real money balance and is expressed as M/P, which measures the purchasing power of the quantity of money in circulation (or the stock of money in existence).

A money demand function is expressed as

ADVERTISEMENTS:

(M/P)d = kY … (3)

where k is the fraction or proportion of income people want to hold for the purpose of transactions. Equation (3) states that the quantity of real money balances demanded is proportional to real income. Since money facilitates transactions, people want to enjoy the convenience of money holding. Since people want to buy more goods and services when their incomes rise, the demand for real balances increases when income rises.

Since the equilibrium condition of the money market is that the demand for real balances (M/P)d is equal to its supply (M/P), we have

(M/P) = kY

ADVERTISEMENTS:

or, M(\/k) = PY

or, MV = PY … (4)

where V = 1/k. Equation (4) shows the link between the demand for money and its velocity. When people want to hold a large quantity of money for each rupee of income (k is large), money changes hands slowly (V is small).

The converse is also true: when people want to hold only a small quantity of money (k is small), money changes hands very fast (V is large). So an important prediction of the quantity equation is that the money demand parameter k and the velocity of money V are the two (opposite though) sides of the same coin.

ADVERTISEMENTS:

The Assumption of Constant Velocity:

The quantity equation is just a definition. It defines velocity Vas the ratio of PY (nominal GNP) and M (the nominal quantity of money). If we make the assumption that V remains constant, then the quantity equation is converted into a hypothesis, viz., the quantity theory of money. This theory is very useful for analysing the effects of money on the economy.

However, in reality, velocity changes as soon as the money demand function changes. With the introduction of ATM system, people reduced their average money holdings. This led to a fall in k (the parameter of the money demand equation) and a corresponding increase in velocity.

In spite of this the assumption of constancy of V provides a good approximation in many situations. Assuming that V is constant, we may analyse the effect of the money supply (M) on the economy.

As soon as we make the assumption that V = V̅ (a constant), the quantity equation becomes a theory of determination of nominal GDP. Thus the equation becomes

MV̅ = PY … (5)

ADVERTISEMENTS:

where V̅ means a fixed value of V. In this case, a change in the quantity of money (M) will cause an exact proportionate change in nominal GDP (PY). Thus, if V remains fixed, the quantity of money (M) determines the money value of the economy’s output, its nominal GDP.

Money, Prices and Inflation:

The three building blocks (ingredients) of the quantity theory of money are:

1. The economy’s level of output Y = GDP is determined by the factors of production and the production function.

2. The nominal value of output, PY, is determined by the money supply (if V remains constant).

3. The general price level P is then the ratio of the nominal value of output, PY, to the level of output Y.

ADVERTISEMENTS:

Alternatively stated, the quantity theory of money is based on the propositions that (i) real GDP is determined by the economy’s productive capability, (ii) nominal GDP is determined by M (the quantity of money); and (iii) the GDP deflator is the ratio of nominal GDP to real GDP.

Effect of changes in M on P:

The main prediction of the quantity theory of money is that, if V remains constant, any change in M, effected by the central bank, leads to an exact proportionate change in nominal GDP.

Since real GDP remains constant in the short run when factor supplies remain fixed and technology (which determines the production function) remains unchanged, any change in nominal GDP must represent a change in the general price level (P). Thus, according to the quantity theory of money, the price level (P) is proportional to the money supply (M).

Since the rate of inflation measures the percentage increase in the price level, the quantity theory which is a theory of the general price level is also a theory of the rate of inflation. The quantity equation, when expressed in percentage change form, is

% change in M + % change in V = % change in P + % change in Y.

ADVERTISEMENTS:

In this equation the second term on both the left hand side and the right hand side are assumed to remain constant. So the growth in the money supply (which is under the control of the central bank) determines the rate of inflation. Thus the central bank, which is the central monetary authority, has ultimate control over the price situation or the rate of inflation.

If the central bank keeps the money supply fixed, the price level will remain stable. If the central bank increases M very fast, P will rise quite rapidly, as is observed during hyperinflation (when there is flight from currency).

To sum up, inflation is the rate of increase of the price level. In an economy where GDP does not rise or fall, the quantity theory of money implies that the price level is proportional to the money supply. More money simply raises prices. The central bank can choose whatever rate of inflation it wants just by raising the money supply by that percentage each year.

For price stability the central bank should keep the money supply constant from one year to the next. For 5% inflation it should raise M by 5%.

In a growing economy, rate of inflation will be less than the rate of money growth. If GDP is growing overtime some money growth is needed just to keep the price level from falling from one year to the next.

Theory and Evidence:

ADVERTISEMENTS:

Empirical studies made by Milton Friedman and Anna J. Schwartz show that decades with high money supply growth have led to high inflation and decades with low money growth tend to have low inflation.

Even at the international level we find a close connection between money growth and inflation. According to Paul Samuelson, the quantity theory works based in the long run, not in the short run. It can at best explain certain long-run price level trends, it cannot explain short-run price fluctuations.

Moreover, the quantity theory of money can explain hyperinflation which occurs during war or emergency. It cannot explain normal peace-time inflation.

Revenue from Printing Money:

According to the quantity theory of money equation, growth in the money supply causes inflation. One reason for increasing money supply is to cover a portion of the government’s own expenditure. If the government’s current expenditure cannot be covered through taxes and borrowing (by selling bonds to the public), the government can simply print paper currency.

The revenue earned through the printing of money is called seigniorage. This term may now be explained and its effects on the economy examined.

Seigniorage refers to the amount of real resources brought by the government with newly created money. The objective is to reduce the distortion due to taxation by financing a portion of government spending through new money creation. However, seigniorage also has costs because the faster the money supply growth, the higher will be the inflation rate.

When the central bank prints money to enable the government to finance expenditure, the money supply goes up. The increase in the money supply, in turn, causes inflation and imposes a tax on the community. Such a hidden form of taxation is called inflation tax.

Such a tax is supposed to exist in a situation where a government adopts a policy of promoting inflation in place of an increase in taxation to cover its expenditures. If the government finances its purchases by means of an increase in the money supply when the aggregate supply curve in the economy is inelastic, prices will rise so that all holders of money will find their real purchasing power diminished in a manner similar to an increase in, e.g., income taxes.

As the price level (P) rises, the real value of money (M/P) or the purchasing power of nominal money falls. When the government prints new money for its own use, the existing stock of money in the hands of the public becomes less valuable. Thus inflation is just like a tax on money holding — one of the cruellest forms of all taxes because of its hidden character. Such a tax creates the problem of money illusion.

In truth, in countries experiencing hyperinflation, seigniorage is often the chief source of revenue of the government. But the need to print money to finance expenditure is the primary cause of hyperinflation. So the cure is worse than the disease. And, as Milton Friedman has put it, the neglect of indirect effects is the common source of all fallacies.

The Nominal Interest Rate and the Demand for Money:

The quantity of money demanded also depends on the nominal interest rate, which is the opportunity cost of money holding. It is the cost of holding money as an alternative to holding bonds and earning interest therefrom.

The cost of holding money is r – (-πe) where r is the real return on bonds and -πe is an expected real return on money due to a fall in its value at the same rate as is the rate of inflation.

The quantity of money demanded varies inversely with the price of holding money. Hence the demand for real balances depends both on the level of income and on the nominal interest rate. So the general demand function of money may be expressed as

(M/P)d = L(Y, i) … (6)

where L is money — the most liquid of all assets. Thus the demand for real balances is a function of income (Y) and nominal interest rate (o). However, (M/P)d varies directly with Y. So income elasticity of demand for money is positive. But the lower the nominal rate of interest, the higher the demand for real balances. The interest elasticity of demai.d for money is negative.

Link between Future Money Supply and Current Prices:

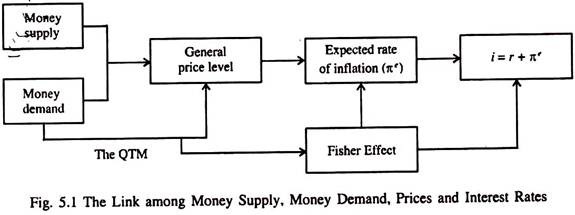

Fig. 5.1 shows multiple links among money, prices and interest rates. While inflation affects the nominal interest rates through the Fisher Effect, the nominal interest rate (being the cost of holding money), in its turn, also affects the demand for money.

So real money demand depends on the expected rate of inflation as equation (7) shows

M/P = L(Y, r + πe) …(7)

where, r + πe = i, through the Fisher Equation (presented later in this chapter). Thus we make the following predictions:

1. The nominal rate of interest (i) depends on expected inflation (πe).

2. The expected inflation (πe), in its turn, depends on the growth in the money supply.

3. There is further effect of money supply on the price level through the demand function for real balances which depends on the nominal interest rate.

4. So, today’s price level depends both on current money supply and money supply expected in the future. To be more explicit, the current price level depends on a weighted average of the current money supply and expected future money supply.