Here is a compilation of term papers on ‘Inflation’ for class 9, 10, 11 and 12. Find paragraphs, long and short term papers on ‘Inflation’ especially written for commerce students.

Term Paper on Inflation

Term Paper Contents:

- Term Paper on the Meaning of Inflation

- Term Paper on the Kinds of Inflation

- Term Paper on the Nature, Features and Characteristic of Inflation

- Term Paper on the Causes of Inflation

- Term Paper on the Effects of Inflation

- Term Paper on the Control of Inflation

Term Paper # 1. Meaning of Inflation:

A rise in price level or fall in the value of money is often the result of the excessive amount of money, or excessive issue of paper currency and this is commonly referred to as inflation.

ADVERTISEMENTS:

The various economists have defined inflation as follows:

“Inflation is a general and continuing increase in prices. This does not imply that all prices are increasing, some prices may even be falling, and the general trend must be upward. The rise in prices must also be continuing; once and for all price increases are excluded.” – Michael R. Edgmand

“We define inflation as rising prices, not as high prices. In some sense, then inflation is a disequilibrium state.” – Gardner Ackley

“By inflation we mean a time of generally rising prices for goods and factors production- rising prices for bread, cars, haircuts, rising wages, rents etc.” – Paul A. Samuelson

ADVERTISEMENTS:

“Inflation is a state in which the value of money is falling or prices are rising.” – Crowther

“The obvious definition of inflation is that inflation is a rising price level” – Edward Shaoiro

“Inflation is a self-perpetuating and irreversible upward movement of prices caused by excess of demand over capacity to supply.” – Emile James

“Inflation consists of a process of rising prices.” – A.C.L. Day

ADVERTISEMENTS:

The well-known English economist John Maynard Keynes has clearly distinguished between two types of rise in the price level in a country:

(a) Rise in prices followed by increase in production and employment; and

(b) Rise in prices not followed by such an increase in output and employment.

If a country is working with a large number of men unemployed, and a large number of factories, workshop etc. not fully utilised, any expansion of money and consequent increase in demand for goods and services will result in the rise in the price level and also rise in the production of goods and services.

This type of increase in production and in employment will continue so long as there are unemployed men and materials i.e., till the stage of full employment. Keynes states that the rise in the price level upto the stage of full employment is a good thing for the country since there is an increase in output and also in employment. Reynes uses the term reflation for such a rise in the price level.

The rise in the price level after the state of full employment is bad for the country since there is no corresponding increase in production and employment. Inflation is used to refer to such a rise in the price level after the economy has attained full employment in development countries like, India there may be heavy unemployment and under-employment and economic resources may not be fully employed.

In such economies, rise in the price level may not lead to increase in production and employment because of certain constraints in production as, for example, shortage of technical and managerial skill, shortage of power, transport etc. (known as bottle-necks). Hence, India can experience inflationary rise in prices even though it has not reached a stage of full employment.

Term Paper # 2. Kinds of Inflation:

(i) Demand Pull Inflation:

This represents a situation where the basic factor at work is the increase in demand for resources either from the government or the entrepreneurs or the households. The result is that the pressure of demand is such that it cannot be met by the currently available supply of output. If, for example, in a situation of full employment, the government expenditure or private investment goes up this is bound to generate an inflationary pressure in the economy.

(ii) Cost Push Inflation:

In certain cases, prices may be pushed up by rise in wages or rise in profit margins. Often higher commodity taxes imposed by the government will raise the cost of production and therefore, raise the prices of goods and services. Thus, rise in wages, profit margins, and taxation all these are responsible for cost-push inflation.

(iii) Open or Suppressed Inflation:

ADVERTISEMENTS:

A country might experience open or suppressed inflation. Open inflation refers to a situation where prices rise without any interruption. It is a situation where government does not make any attempt to stop rising prices. Suppressed inflation, on the other hand, is the one where government actively intervenes to check rising prices through price-ceiling, rationing or otherwise. Private holdings of cash and bank balances increase during the suppressed inflation. Prices will not rise in the controlled sector.

(iv) Money Inflation and Price Inflation:

Money inflation occurs in the initial stage. There is an expansion in the money supply during the initial stage leading to a sharp rise in the price level. Price inflation is the next stage when the rapid rise in demand leads to an enormous increase in the money supply. During this stage, the money supply fails to keep pace with the rate of increase of price level. Prices rise rapidly and the money supply lags behind in this stage of inflation.

(v) Wage Induced and Deficit Induced Inflation:

Inflation may also occur on account of the increase in money wages. Money wages have a tendency to increase whenever prices rise. Strong trade union may force employers to increase wages. This results in increased cost of production without any increase in output. This lead to further rise in price. Such type of price rise is called the wage induced inflation.

Deficit-induced inflation, on the other hand, occurs when the governments resort to deficit financing. Sometimes the government is not in a position to meet its expenditure by taxation i.e., its expenditure is more than income. The government then resorts to deficit financing. To finance deficit, government may increase the money supply by printing new currency notes. This results in rising prices. Wherever prices increase due to deficit financing, we call it deficit induced inflation.

(vi) Creeping, Walking, Running and Galloping Inflation:

ADVERTISEMENTS:

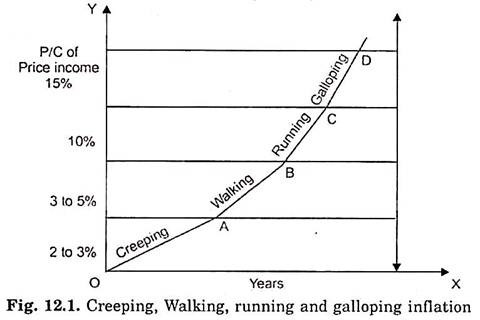

This classification is made on the basis of the extent to which prices rise. Creeping inflation is the mildest type of inflation. Prices rise very slowly. They increase by about 2 to 3% p.a. Such type of inflation is not at all dangerous to the economy. In fact, some economist Price income suggest that such type of inflation has 15% to be encouraged to make the economy dynamic.

But if the prices start rising 10% gradually at the rate of 3 to 5 per cent p.a., the situation is called the walking 3 to 5% inflation. If proper control is not exercised over this type of inflation, it 2 to 3% may turn into what is known as 0 Years running inflation. During running inflation, the rate of increase in the price level gets further accelerated. The price level under this type of inflation rises approximately by 10 per cent every year.

In case government fails to curb running inflation in time, it may easily develop into a galloping or hyperinflation. Hyperinflation is the most reverse type of inflation. Prices rise rapidly and perhaps there is no limit to which prices may rise. This type of inflation was experienced by India during the Janta Dal government regime (1989-91). At the time the rate of inflation was 17% approximately. The above classification of inflation into creeping, walking, running and galloping inflation can be better explained with the help of Fig. 12.1.

(vii) Comprehensive and Sporadic Inflation:

ADVERTISEMENTS:

Inflation is also classified into comprehensive and sporadic inflation on the basis of coverage and scope. Comprehensive inflation is an economy-wide inflation. It occurs when the entire economy experiences inflationary pressures. Prices of all commodities rise in the economy. Price rise is not confined to any particular sector. It extends to every sector in the economy. It is normal inflationary phenomenon and refers to the rising prices of the general price level.

Sporadic inflation on the other hand is sectorial in nature. It refers to a situation wherein inflation is experienced by certain sector of the economy. It may occur on account of restricted supply of certain commodities due to certain specific reason like crop failure resulting in the price rise of food-grains or formation of a successful monopoly in the manufacturing sector causing price rise only in the manufacturing sector. Sporadic inflation is thus confined to only certain sectors in the economy.

Term Paper # 3. Nature, Features and Characteristic of Inflation:

Characteristics and features of inflation are as follows:

1. Inflation is an economic phenomenon. It is the result of economic forces.

2. Inflation is also a monetary phenomenon. Excess supply of money may cause inflation.

3. Cyclical movement is not inflation.

ADVERTISEMENTS:

4. The hall mark of inflation is excess demand in relation to everything.

5. Inflation is a dynamic process which can be observed only over a long period of time.

6. It is always associated with an uninterrupted rise in prices.

7. Price rise is persistent and irreversible immediately. It is different from temporary price rise.

8. Pure inflation is a past full employment phenomenon.

Term Paper # 4. Causes of Inflation:

Inflation in an economy arises on account of number of factors. These factors relate mainly either to the demand or to the supply side. By demand we mean the demand of money income for goods and services and by supply we imply the available output for which the money income can be spent. Expectations also play an important role in causing inflationary pressures in the country.

ADVERTISEMENTS:

Therefore, the factors that cause inflation may be divided into three groups:

(i) Demand Factors:

Increase in demand may be due to:

(а) Increase in disposable incomes.

(b) Increase in community’s aggregate spending on consumption and investment goods.

(c) Excessive speculation and tendency to hoarding and profiteering on the part of producers and traders.

(d) Increase in salaries, wages or dearness allowance.

ADVERTISEMENTS:

(e) Increase in foreign demand and hence exports.

(f) Increase in population.

(g) Increase in money supply.

These causes may operate singly or in combination with one another. Generally, the most important cause of inflation is excessive public expenditure financed by deficit financing during war or on the implementation of plans for economic development. The newly created money increases government demand for goods and services and also the purchasing power of the people through increase in disposable income.

(ii) Supply Factors:

No corresponding increase in the output of goods and services may be due to:

(а) Increase in exports for earning the required foreign exchange.

ADVERTISEMENTS:

(b) Draught, famine or any other natural calamity adversely affecting agricultural production.

(c) Deficiency of capital equipment.

(d) Scarcity of other complementary factors of production e.g., skilled labour or technicians, essential raw materials or lack of dynamic entrepreneur.

(e) Speculative hoarding by the producers, traders and middlemen in anticipation of a further rise in prices.

(f) Prolonged industrial unrest resulting in reduction of industrial production.

(iii) Role of Expectation:

Inflation cannot be explained only in terms of excessive spending relative to available output. Expectations play an important role in the speed of inflation. Expectations regarding future movement of prices and wages result in the inflationary pressure in the economy. When prices are expected to increase, consumers will purchase more goods.

This will lead to an increase in the price level. Similarly, a rise in the expected income induces people to spend more. Expected wage increases also bring about inflation in the country. Expectations thus play a vital role in causing inflation in an economy.

Term Paper # 5. Effects of Inflation:

Inflation indicates the rise in the price level and a fall in the value of money.

The effects of inflation can be broadly classified under following three categories:

(i) Political Effects of Inflation:

Inflation also leads to political upheavals. Political indiscipline grows and corrupt practices become common. Hitler became dictator of Germany only because of hyper-inflation during 1920s. Political revolutions are the outcome of inflationary rise in prices. Political and economic speculations are encouraged by inflation. Political stability is disturbed by inflation.

(ii) Economic Effects of Inflation:

Economic effects of inflation can be studied under following two heads:

(a) Effects on Distribution of Income:

Inflation redistributes income because prices of all factors do not rise in the same proportion. The effect of inflation on the incomes of different classes of earners is not uniform.

Following classes of people are affected by it:

1. Working Class:

Wages do not rise as fast as the prices rise during inflation. Naturally, workers tend to lose during the period of rising prices. The trade unions try to bargain with their employers for higher wages. Still the rise in wages is not corresponding to a rise in the prices. So, the workers are adversely affected during inflation. Salaried people have a more harsh effect of inflation than the wage-earners as they are not organised like the salaried people.

2. Consumers:

Inflation reduces the consumption of people. Rising price reduces private consumption by reducing the purchasing power in the hands of the people. The resources left unused can be secured by the government by printing new currency notes or raising the public debt. Thus, inflation can transfer the resources from the public to the government.

The reduced consumption of the public or increased savings is termed as the phenomenon of forced savings. Forced savings have been made use of by many countries for their economic development. However, consumers have to lead a low standard of living in the initial stages of development.

The effects of inflation have been nicely concluded by Kenneth K. Kurihara in the following manner:

“Inflation redistributed wealth and income in such a way as to hurt consumers, creditors, small investors and low and fixed income group, and benefits businessmen, debtors and farmers.”

3. Renteir Class:

People whose incomes are fixed (the rentier class) viz., pensioners, annuity holders, people living on past savings, etc., suffer the most during inflation. Inflation causes the real income of these people to fall due to rising prices. Falling real income reduces their standard of living. Inflation is thus harmful to the rentier class.

4. Debtors and Creditors:

Debtors as a group are benefitted during inflation whereas the creditors are put to loss. The debts are always fixed in terms of money in the modern economy. When a person borrows money before rise in the price level and repays later when prices have risen, he pays back the same amount of money but definitely having less purchasing power. Creditors are at a loss during inflation as they receive money having less purchasing power.

5. Farmers:

Farmers are benefitted during inflation because of two factors:

(a) The price of farm products increase; and

(b) Increase in the cost of production lags behind the rise in the prices.

Farmers who produce food-grains and other highly inflation-sensitive products are benefitted the most. Farmers in debts repayment repay their old debts along with the rate of interest as they get profits due to rising prices. They are further benefitted as debtors as they pay back lower purchasing power to the creditors. Inflation thus provides double advantages to the farmers.

6. Business Community:

The manufacturers, merchants and entrepreneurs stand to gain during inflation. The value of stocks held by the merchants increases during inflation. Business community sells commodities at better prices and earns high profits. Entrepreneurs earn huge profits as the rise in the price will be more than the rise in the cost of production. Producers try to increase the price in the cost of production instead of reducing their margin of profits. Inflation has favourable effect on the business community.

7. Investors:

Inflation is favourable to those who invest in equities, but is rather harsh to those who invest in fixed interest yielding bonds. Equity dividends increase during inflation due to increased corporate earnings and investors in equities are benefitted. Fixed interest yielding bonds bring the same income but less purchasing power.

Institutional investors safeguard their interest by diversifying their resources in profitable investments, but small and middle class investors lose much. In many countries small investors have experienced heavy losses because of the fall in the purchasing power of money. The fall in the value of money discourages saving and therefore, reduces the volume of funds available for investment in a free market economy.

(b) Effects on Production:

Keynes is of the opinion that a moderate rise in prices i.e., mild or creeping inflation has a favourable effect on production when there are utilised or underemployed resources in existence in an economy. Such a rise in prices creates optimism among the business community as they get more profits with increasing prices. They are induced to invest more and as a result employment, output and income will increase. The limit is set by the full employment level.

Once the full employment stage is reached in the economy, a further rise in the price will not stimulate production, employment and income due to physical limitations. So, till the level of full employment is reached, moderately rising prices are beneficial. The beneficial effects on production are possible only when inflation is moderate. A state of running or galloping inflation creates a lot of uncertainty which is harmful to production.

(iii) Social Effects of Inflation:

Inflation not only creates economic effects but also leads to certain social effects. It brings down the standards of business morality by encouraging a few rich persons. Black-marketing, anti-social activities dominate the society during inflationary rise in prices. Social peace is disturbed.

Frustration exists among poor people. It likely result in a social revolt. Social atmosphere gets totally spoiled as rich men try to exploit the situation and take undue advantage of inflation. Social stability is at stake. Unfair practices and social discontent become order of the day. Patriotic people are penalised.

Term Paper # 6. Control of Inflation:

Inflation is very complex phenomenon. There is no one sovereign remedy to combat it. On the other hand, measures have to be taken on several fronts, monetary and nonmonetary, to fight it. All these measures have one common aim. They aim at reducing aggregate monetary expenditure taking the available output as given.

Broadly speaking, the anti-inflationary measures can be classified as under:

(i) Monetary Measures:

According to some economists, inflation is a monetary phenomenon, i.e., it is caused by the monetary factors. These economists suggest that the control over the supply of money is the best measure to combat inflation.

The anti-inflationary monetary policy refers to the central banking operations of restricting credit. The Reserve Bank of India makes use of its weapons like the bank-rate policy, open market operations, variable reserve ratio and the selective credit controls to restrict credit. The monetary policy can successfully control inflation only when it is caused by the excess supply of money.

(ii) Fiscal Measures:

The two wings of fiscal policy are government revenues and government expenditure. The government’s fiscal policy can contribute to the control of inflation either expenditure, but decreasing government expenditure or combining both the elements. If private spending tends to excessive, the government can moderate the inflationary pressure by reducing its own reduction or postponement of government expenditure in modern times is not an easy task.

There may be projects already under construction and these obviously cannot be postponed. Similarly, other types of expenditure may be necessary to meet the normal requirements of the ‘collective consumption’ of the community-defence, police, justice etc. Then, there may be social expenditures on education, health etc., which are very difficult to cut because of undesirable political effects. Therefore, the major emphasis of fiscal policy in inflation has been a reducing private spending through increased taxation.

An increase in taxes tends to reduce private spending. If the rates of direct taxes on incomes and profits are raised, the private disposable income is reduced and this will tend to reduce private consumption spending. If the rates of commodity taxes are increased or fresh levies are made, the effect on consumption will be more immediate. An increase in the tax rates on a commodity will penalise spending directly by raising the cost of purchases.

Thus in period of inflation, the government should curb its own spending and increase the tax rates to reduce private spending. It is good thing to plan for a budget surplus during inflationary periods.

(iii) Other Measures:

There are also other physical measures to control inflation. For instance, government may try to increase output and thereby control inflation. In countries, like India where inflation is because of the shortage of agricultural commodities, it can be controlled by increasing the output of agricultural commodities.

Even in developed countries, by changing the techniques of production, the level of full employment output can itself be increased and be adjusted to the increased aggregate demand. There may be physical restraints on the increase in output and, therefore, we have to note the problems of technique, availability of factors of production in increasing output.

Inflation may also be due to the speculation activities, business expectations and hoardings. Under such circumstances, the government may try to restrict speculative activities to control inflation. In India, in order to protect the consumers from the evils of speculative activities, the government of India has given greater importance for the distribution of essential commodities through consumers’ co-operatives.

If the rise in the price confined only to some commodities the government may try to control their prices through price controls and rationing of the scare commodities. Rationing and price controls suffer from a severe limitation viz., coercion cannot be extensively made use of in a democratic country.

Lastly, if the inflation is due to the increase in cost (cost-push inflation), it can be controlled by wage freeze. The Government may try to put an end to the wage price spiral by freezing wages. This policy becomes effective if the trade unions do not object to the control over wages. Further, if the government wants to control wages, prices should not be allowed to rise, so that the standard of living of the consumers is not adversely affected.