In this article we will discuss about:- 1. Benefits of Speculation 2. Evils of Speculation 3. Control.

Speculation refers to the act of buying or selling of commodities or securities with a view to earning profits from future changes in their prices. If the speculator expects a future rise in prices, he buys at present in order to sell when the prices will rise, which will enable him to make profits. If, on the other hand, he expects a future fall in prices, he will sell at present in order to buy in future when the prices fall. He buys and sells when there is a chance of a speculative profit.

He is not just a gambler, but a specialist in risk-taking. This kind of speculation is called legitimate speculation which is to be distinguished from illegitimate speculation or gambling. Illegitimate speculators have no expert knowledge of the market conditions and want to get rich overnight by unfair practices.

In modern society, speculation is carried on mainly in shares and securities at a place known as Stock Exchange (e.g., Calcutta or Mumbai Stock Exchange) and in the staple commodities like jute, cotton, oilseeds, etc., at a place known as Produce Exchange.

Speculation is traditionally a term of ill repute. It points to a greedy fellow concerning a commodity, then reselling it at a large profit. But speculation can actually serve a very useful purpose.

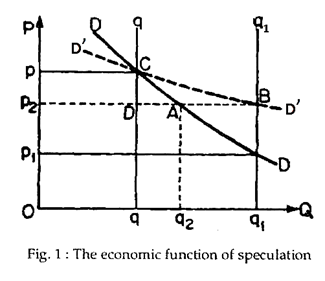

Take the case of a staple agricultural crop. In Fig. 1 q is the normal annual crop of (say) paddy. DD’ is the demand of users of the product. Thus, p is the normal equilibrium price. But, suppose, due to good harvest there is a bumper crop of q1 this year. If the entire amount is now sold to users, price would now fall to a low level (op1). This is about half the normal level.

Speculators, however, are willing to buy at anything below the normal price (op) for later sale. By adding their demand (q2q1 or AB) to users’ (consumers’) demand we get the total demand curve D’D’. So, price will be p2 (which is considerably closer to the normal price), sales to users oq2 and addition to speculators’ holdings q1 – q2. This occurs only in case of storable commodities and through some people who are neither suppliers nor consumers, but pure traders or speculators.

In the opposite case of poor crops (oq), prices may go up and up. In this case, with present price above the expected future price the speculators will be selling rather than buying. This will hold down the rise of prices and also increase the supplies available for immediate use.

Benefits of Speculation:

ADVERTISEMENTS:

Speculation serves two major purposes:

1. It reduces the fluctuation of price around its normal level:

So, to the extent that speculators can forecast the future with accuracy, their activities will be beneficial to society. As R. G. Lipsey puts it, “Speculation has a tendency to iron out fluctuations of prices over time, if the speculators take a correct view of the average round over which price fluctuations will occur”.

2. It evens out the rate of consumption by diverting supplies from bumper years to poor years:

ADVERTISEMENTS:

Says L.H. Leftwich, “Speculation plays an important role in smoothing out the consumption of the good over time. The actions of speculators modify the price rise that would have taken place over the very short-run period and bring about a more even flow of the product to consumers over time”.

So, speculators are not only equalising the supply coming to the market in each period but stabilising prices in the process. Thus, demand-supply balance as also price stability are achieved. In fact, they help to “even out the consumption of crop between harvest times and to carry over the proper amounts of food and fibre between seasons”.

3. Speculators perform another important function:

By shouldering all the risks they enable others to avoid risk. This is known as “hedging” and this is possible if a speculative market exists.

4. Moreover, the existence of speculators in a market means that it is always possible to buy or sell. Speculation, therefore, makes securities more liquid.

Evils of Speculation:

All said speculation has certain adverse effects also.

They are discussed below:

1. Speculators often raise or lower price artificially. They often try and are able to push prices down by their own activities just before they make purchases, and raise prices just before they sell.

2. Secondly, they may cause wide fluctuations in share prices. Share prices reflect the relative profitability of different companies and high returns on investment attract new capital. So, undesirable speculation may cause resources (capital) to be diverted from productive to unproductive enterprises. So, capital flows into those trades whose shares speculators are prepared to buy, and out of those trades whose shares speculators are attempting to sell.

ADVERTISEMENTS:

3. In times of scarcity speculators may corner the commodities from the market and reap monopoly profits. This is a feature typical of the Indian commodity market.

4. Finally, when capital cannot be raised men cannot find employment. And, the ease with which capital can be raised depends not only on the prospective return on an investment but on the mood of speculators.

Control of Speculation:

Speculation is often beneficial to society. But undesirable speculation needs to be controlled.

The following steps may be taken to control speculation:

ADVERTISEMENTS:

1. Much speculation takes place on bank credit. So, if bank advances are restricted for hoarding and speculative purposes as is done in India through selective credit control measures, the volume of speculation can be kept in check.

2. In the security market, it may be suggested that once securities have been transferred to a new owner he should not be permitted to dispose of them until a certain minimum period has elapsed.

3. Control of investment, exists in some advanced countries, may also prevent any serious diversion of real resources to wasteful uses.

4. Speculation may also be controlled through legal enactments. In India, the Forward Contracts Regulation Act has been passed to regulate forward contracts other than those on share markets and prohibits options in commodities and bullion. In the USA, the Securities and Exchange Commission was set up to control the volume of trading in shares.

ADVERTISEMENTS:

Conclusion:

However, control of speculation is difficult because it is not always possible to distinguish between speculative dealings and genuine investment. The conclusion is that, there is need for caution lest any undue restriction on speculation should hamper productive investment.