Let us make an in-depth study of the Keynes’s Rejection of the Quantity Theory:- 1. Keynes’ Rejection of the Traditional Quantity Theory 2. Keynes’s Own Version 3. The Reformulated Quantity Theory 4. Merits of Keynes’ Version of the Quantity Theory of Money 5. Assumptions and Limitations.

Keynes’ Rejection of the Traditional Quantity Theory:

The classical quantity theory of money was not acceptable to Keynes.

He found it rather too narrow and unable to explain the general behaviour of prices.

To Keynes, the-causal relationship is neither direct nor proportional. Keynes’ theory of prices, like the rest of his theory, is of a more general nature as compared to the traditional quantity theory of money.

ADVERTISEMENTS:

Keynes denounced the classical theory on the ground that it is based on unrealistic assumptions of full employment and absence of money illusion. According to Keynes, the theory unnecessarily takes money as neutral and is based on a false division of the economy into the real sector (in which the relative values of the commodities are determined) and the monetary sector (in which these relative values are expressed in terms of money).

Keynes’s Own Version:

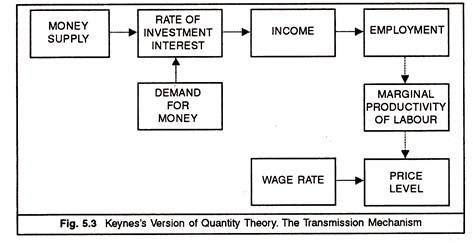

Keynes’ contribution lies in removing the old fallacy that prices are directly determined by the quantity of money. His theory of money and price levels brings forth the truth that prices are determined primarily by the cost of production. Keynes believes that changes in the quantity of money do not affect the price level (value of money) directly but do so indirectly through the rate of interest, the level of investment, income, output and employment.

The initial impact of the changes in the total quantity of money falls on the rate of interest rather than on prices. As the quantity of money is increased (other things remaining the same), the rate of interest is lowered because the quantity of money available to satisfy speculative motive increases.

A lowering of the rate of interest (marginal efficiency of capital remaining the same) will raise investment, which in turn, will result in an increase of income, output, employment and prices. The prices rise on account of various factors like the rise in labour costs, bottlenecks in production etc. Thus, in Keynes’ view the level of prices is influenced indirectly as a result of the effects of changes in the quantity of money on the rate of interest and hence on investment.

ADVERTISEMENTS:

It is on account of this reason that Keynes’ analysis is, at times, spoken of as the contra quantity ‘theory of causation’ because it takes rise in prices as a cause of the increase in the quantity of money demanded instead of taking the increase in the quantity of money as a cause of the rise in prices.

The process that follows is like this: An Increase in the quantity of money…. results in the fall in the rate of interest……. which encourages investment…… which in turn, raises income, output and employment…. it results in raising the cost of production…. this results in raising prices: The traditional theory ignored the influence of the quantity of money on the rate of interest, and thereby on costs and output.

It had a direct mechanism as it goes directly from increase in the quantity of money to increase in the level of prices. Keynes substituted in its place the indirect mechanism which explained the rise in the price level as part of the process in which investment, income and employment changes.

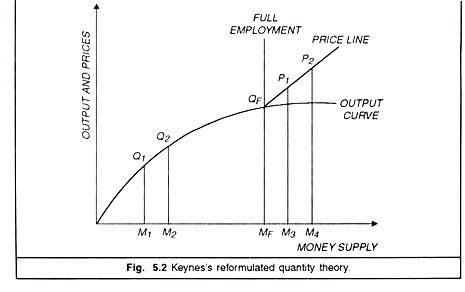

The figure 5.2 shows that when money supply is raised from M1 to M2, output and prices increase in the same proportion: Mf shows the money supply consistent with full employment, aggregate output is the maximum here. Beyond the full employment limit, if money supply is increased from M3 to M4 prices rise proportionately with money while output remains the same.

The Reformulated Quantity Theory:

It should be clear that Keynes reformulated the Quantity Theory. The pith and substance of the theory of money as reformulated by him is: As long as there are human and material unemployed resources in the economy, a rise in the price level will help expansion of income, output and employment.

However when the level of full employment has been attained and the supply of the factors of production becomes inelastic, true inflation sets in. Steps have to be taken to curb it and to keep it within bounds. This reformulated version brings forth the fact that ah increase in money becomes a matter of concern only after full employment. Thus, it points out the desirability of resorting to deficit financing in order to fight deflation.

Let us now understand Keynes theory of money and prices in terms of effective demand with the help of Figure 5.2. Changes in aggregate demand will affect prices according to the effect of such changes on cost and output. It may be noted that effective demand will not change in exact proportion to the variations in the quantity of money nor will prices change in exact proportion to changes in effective demand; increased effective demand will manifest itself partly in increased employment and partly in increased prices.

In the beginning, starting from a period of depression, employment is likely to rise faster than prices; later as full employment is approached, prices are likely to rise faster than employment. However, the proposition that “so long as there is unemployment, income will change in the same proportion as the quantity of money; and when there is full employment, price will change in the same proportion as the quantity of money” is mere approximation to the truth. It is a general sort of statement subject to so many qualifications as prices do rise during the transition period (till the level of full employment is reached).

A rise in prices during the period may occur on account of the following reasons:

(1) Increased bargaining power of the workers

(2) Operation of the law of diminishing returns and

(3) Bottlenecks in production.

Merits of Keynes’ Version of the Quantity Theory of Money:

1. It Analyses the Causal Process:

Keynes’ great merit lies in removing the old notion that prices arc directly determined by the quantity of money. He brings to the fore the true and real causal process which exists between the quantity of money and prices. The relationship that exists is indirect and is brought through changes in the rate of interest. The schematic diagram given below shows in six steps the causal process of the increase in the general price level when the money supply is increased.

(1) The increase in money supply lowers the rate of interest, if the demand for money remains the same

(2) The lower rate of interest encourages investment which

(3) in turn leads to increase in income (through the multiplier),

(4) Increased output means increased employment,

ADVERTISEMENTS:

(5) Since the marginal productivity of labour falls as employment expands, the costs of production of goods and services rise which

(6) leads to rise in the general price level.

2. It does not Assume Full Employment:

The quantity theory of money like all classical doctrines, is based on the assumption of full employment. As long as the human and material resources were taken to be fully employed, it was easy for the classical thinkers to say that an increase in the quantity of money was associated with or followed by a rise in the price level.

Since money in the classical scheme could not affect employment, it could raise prices only. According to Prof. Dillard, “this leads to the conclusion that all increases in the quantity of money tend to be inflationary, a conclusion quite valid under the assumption that resources are fully employed, but a nonsense conclusion when this special assumption is dropped.” Keynes, on the other hand, does not assume full employment. To him unemployment is the rule and full employment only an exception. He says, “So long as there is unemployment,, employment will charge in the same proportion as the quantity of money.”

3. It Tells us when to Dread Inflation:

ADVERTISEMENTS:

Keynesian approach to the quantity theory of money helps us to look at inflation entirely from a different perspective. It tells us when to dread inflation and when not to dread it. As long as there is unemployment of resources, inflation is not to be feared as it results in an increase in employment and output. But once the level of full employment is attained, true inflation begins and it becomes a real threat.

According to classicals, every increase in money supply results in inflation (as full employment was always presumed). To Keynes, only that increase in money supply results in inflation which takes place beyond the level of full employment. Thus, Keynesian version shows a great advance on the traditional version of the quantity theory of money.

4. It Integrates Monetary Theory with the Theory of Value:

Another great merit of Keynes’ theory of money and prices is that it integrates monetary theory with the theory of value. Keynes gave up the traditional division of the economy into the real sector and the monetary sector and pointed out that there could be no monetary economy in which money was neutral.

The integration of the theory of money with the theory of value on the one hand and with the theory of output on the other, was achieved through the rate of interest: the missing link in the process (rate of interest) was at last discovered.

According to value theory, the price (which is the value expressed in terms of money) is determined by the market forces of demand and supply and the production of a commodity is carried to the extent of the equality of the marginal cost with marginal revenue. Thus, the concepts of marginal cost, marginal revenue, demand and supply, their elasticities (specially in the short period) become important in the theory of value.

When Keynes discusses the theory of prices in general (price level), he emphasises cost of production, elasticity of demand, elasticity of supply and other concepts which are important in the theory of value or commodity price determination. Keynes shows that prices rise on account of the rise in costs of production; costs of production rise because of the inelasticity of short-period supply of output and employment. From a monetary theory of prices, Keynes, thus, shifted to a monetary theory of output. This, in itself, turned out to be an important contribution as it resulted in a successful integration of the quantity theory of money with the theory of value in the realm of macroeconomics.

ADVERTISEMENTS:

Further, Keynes also integrated the theory of output with the theory of money. In fact, the integration of monetary theory with the theory of value is accomplished through the theory of output in which the rate of interest, by influencing the volume of investment, plays a vital role. Changes in the quantity of money, by bringing about changes in the rate of interest affect investment and hence output and employment.

As the volume of output and employment changes, the costs of production vary and prices are also affected. The traditional theory did not pay any heed to the influence that the quantity of money exerts on the rate of interest and through it on income, output, employment and prices. Thus, in addition to integrating the theory of output with the theory of value, Keynes also integrated the theory of output with the monetary theory (theory of money).

5. It Differentiates between the Determination of the General Price Level and Individual Prices:

Keynes’ theory differentiates between the determination of the general price level and individual prices. Individual prices of various commodities are determined by the forces of demand and supply with reference to the nature of competition and the type of market, whereas a large number of considerations enter the determination of the general price level.

To him, analysis of the fluctuations in the general price level is not so simple and straight as has been assumed by the exponents of the traditional quantity theory of money; that is, an increase in the volume of money will not straightway raise the price level. The whole process is highly complicated and roundabout, certainly not so direct and simple as was claimed by the classical economists.

Assumptions and Limitations:

No doubt the reformulated version of the quantity theory of money takes into consideration a large number of factors which were ignored in the classical quantity theory of money. Yet, the new version given by Keynes has its own shortcomings. They mostly stem from its assumptions.

Firstly, it assumes that productive resources arc perfectly elastic in supply before the level of full employment, i.e., there are no shortages of land, labour, and capital. It further presumes perfectly inelastic supply of the factors of production beyond the level of full employment.

ADVERTISEMENTS:

Secondly, it assumes that effective demand increases in proportion to an increase in the quantity of money, failing which output will not expand.

Thirdly, the whole relationship between the quantity of money and the price level is set in motion through the so-called missing link – the rate of interest. But whether or not a change in the rate of interest will cause a corresponding change in the whole chain of investment, employment, income, output, cost of production and prices, will depend upon the two other determinants, namely, the marginal efficiency of capital and the propensity to consume.

Suppose that marginal efficiency of capital is falling or the propensity to consume is decreasing, a fall in the rate of interest may not be able to generate any increase in income, output, employment and hence prices. Thus, unless these elements are assumed to be given or constant, the whole chain of causation may not work at all. Despite these shortcomings, Keynes’ analysis of money and prices is more acceptable as it takes into consideration the phenomenon of employment in the economy and it is superior to the traditional quantity theory.