This article provides views of different economists on saving and investment.

R.G. Hawtrey:

He has formulated the S and I equation in terms of inventory accumulation. According to him Y consists of C + I plus undersigned inventory accumulation.

Saving is that part of national income which is not consumed, hence the difference between S and I is equal to an increase in undersigned inventory accumulation.

The equilibrium condition which brings about equality between S and I is that unintended inventories should neither be increased nor depleted. Hawtrey’s formulation of S and I relationship differs in emphasis only.

ADVERTISEMENTS:

Keynes stresses the total change in effective demand and the equality of 5 and I through total changes in income, while Hawtrey emphasizes that part of the change in effective demand, which reflects the increase or decrease of unsold stocks of goods and inventories of the previous period. However, Hawtrey’s formulations of S and I relationship forms an integral part of his theory of price movements and business fluctuations, in which changes in inventories by wholesale dealers play a strategic role.

D.H. Robertson. The difference between Robertsonian formulation and Keynesian formulation arises from the assumptions relating to earning and spending of income in the given period of time. According to Keynes, current expenditure determines current income, while according to Robertson previous expenditures determine the current income and the current expenditure determine future income.

Keynesian analysis is equilibrium analysis as against the period analysis of Robertson. To Robertson, saving is that part of income received in the immediately preceding period which is not spent on current consumption goods. Investment is defined by him in the same way as by Keynes.

Their relationship may be shown as follows:

Thus, Robertson’s St may be lesser or greater than the Keynesian S depending upon whether the current income is lesser or greater than the income earned in the immediately preceding period. S, would be less than S if yesterday’s income Y t-1 were less than today’s income. Yt and St would be greater than S, if yesterday’s income were greater than today’s income. Hence, the excess of investment over saving in the Robertsonian formulation represents the excess of income earned today over income earned yesterday.

And also savings can exceed investment by the excess of yesterday’s income Yt-1 over today’s income. Hence, Keynes argues, ‘Thus, when Mr. Robertson says that there is an excess of saving over investment, he means literally the same thing, as I mean, when I say that income is falling, and the excess of saving in his sense exactly equal to the decline of income in my sense. If it were true, that current expectation were always determined by yesterday’s realized results, today’s effective demand would be equal to yesterday’s income”.

Dr. F.A. Lutz likes Robertsonian definitions. He says, “In contradiction to Mr. Lerner’s view, it is the contention… that the assumption of a time lag between receipts and expenditure in Robertson’s sense is closer to reality than the assumption of simultaneity between them and is necessary for the analysis of economic events over time.” Robertson’s formulation being dynamic attempts process analysis and is, therefore, more realistic. While Keynes’ attempt is simple but lacks dynamism.

Robertson has no doubt focused attention on some of the weaknesses of the Keynesian formulation. But his own formulation by itself is of little significance for economic analysis. He refers to observed aggregates at different points of time (or over short periods of time) but gives no functional relations between the variables in the system. He did not give importance to the existence of a saving schedule and a consumption schedule, which are so very useful in the analysis of the behaviour of the economic system.

ADVERTISEMENTS:

However, Hansen maintains, “in period analysis, the Robertsonian definitions are useful and indeed necessary in time-rates-of-change analysis the Keynesian definitions are appropriate”. Moreover, since the national income accounts take variables of the same period, Keynesian definitions of saving and investment are more useful than Robertsonian.

New-Wicksellian Formulations:

The Neo-Wicksellian economists like Ohlin, Lundberg, Myrdal have presented the S and I relationship in terms of ex-ante and ex-post quantities. The ex-ante quantities are anticipated or expected or planned, while ex-post quantities are realised. Ex-post S and I are always identically equal to each other, for both are equal to Y – C. A divergence can be there between ex- ante savings and ex-ante investments. There is no reason to believe that planned saving would necessarily be equal to planned investment for the period ahead. But when the planning period is over, the realised saving would necessarily be equal to realised investment.

The Neo-Wicksellian formulation can be easily transformed in terms of schedules and observables. For, ex-ante quantities of savings can be taken to mean the savings schedule, and the ex-ante quantities of investment can be taken to mean the investment schedule, while ex-post S and I can be treated as observed quantities. This formulation would resemble very much the Keynesian formulation of the functional relationship between S and I and the national income.

It is, however, useful to understand the difference between the ex-ante approach and Robertson’s approach. Firstly, ex-ante concepts relate to investment and saving that are planned in a moment of time to be executed over the succeeding period of time, while Robertson is looking at the process of S and I as it takes place during the period. Secondly, ex-ante concepts refer explicitly to expectations while Robertson’s concepts do not.

Thirdly, it might appear as if the magnitude of 5 according to the ex-ante calculations might differ from the magnitude of 5 according to Robertson’s calculations for the reason that the ex-ante saving is conceived of as being determined on the basis of income that people expect to receive in the forthcoming period, while Robertson’s saving is made out of income actually received in the preceding period. But this difference is imaginary.

L.R. Klein:

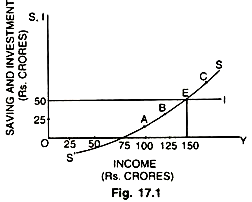

There are savings in the schedule sense as talked about by L.R. Klein. Savings are the function of income. In the schedule sense they show what are the different amounts that are likely to be saved at different levels of income. As income increases, savings out of that income also increase. In the figure 17.1, SS is the saving curve which is rising with a rise in income. On the other hand, the ex-post savings are realised or observed savings. All the points on the S curve in the figure are not saving curve is intersected by the investment curve (and S = I)

SS is the saving curve which rises from left downwards to right upwards indicating that there are no savings as long as the income is below Rs. 75 crore. After this, savings rise with a rise in income. There are many points on the saving curve like A, B, E, C but all these points are not observable or realised, except point E, which is realised or observed because it is here (at E) that the saving curve is intersected by the investment curve (investment curve is assumed to be autonomous for the sake of simplicity only). When the aggregate income is Rs. 150 crore, the saving out of this income is Rs. 50 crores as also the investment, Rs. 50 crore. Therefore, S = I.

It will, however, do no harm to our analysis if we stick to the definitions of saving and investment as given by Keynes, being dependent upon current income and being the difference between current income and current expenditure (i.e., S = Y – C). Keynesian definition is considered better because it is simple and appeals to common sense. It is useful for national income analysis, for, in national income accounts, it is essential that all the variables shall apply to the same period. There is not much difference in the definitions given by different writers, except that Keynesian analysis is equilibrium analysis, while Robertson’s analysis is a period analysis.