In this article we will discuss about:- 1. Definition of Economic Rent 2. The Division of Total (Factor) Incomes 3. Determinants of the Division.

Definition of Economic Rent:

In economics rent refers to producer’s surplus. It is different from contract or commercial rent, which refers to the price paid to hire something, such as a machine or a piece of land. While explaining the concept and source of economic rent, modem economists have drawn a distinction between transfer earnings and economic rent. Transfer earning refers to the minimum supply price of a resource. It is the minimum sum that has to be paid to a source to prevent it from transferring its service to another sector or activity.

In other words, the amount that a factor must earn in its present use to prevent it from moving (i.e., transferring its service) to another use. Sometimes it is called the opportunity cost of resources. An excess of actual return over this amount is treated as surplus income or economic rent. Thus, in modem terminology, transfer income is necessary income and economic rent is surplus income. The composition of the two in total factor income affects the mobility and allocation of factors.

Like rent, profit in economics is also treated as a surplus income. It is a surplus over opportunity cost. Profit, however, accurse to the fourth factor, viz., organisation and entrepreneurship. But rent, according to modem theory, accurse to any factor the supply of which is not elastic.

The Division of Total (Factor) Incomes:

ADVERTISEMENTS:

According to modem theory, the actual earning of a factor has two components, i.e., transfer earning and economic rent. In other words, economic rent is the difference between actual earning and expected (transfer) earning.

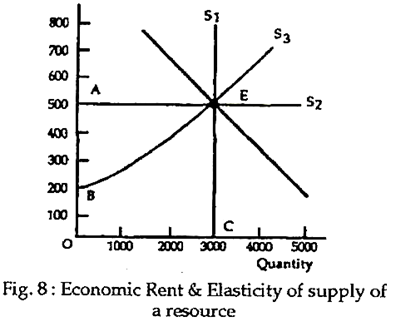

However, the division of total factor income between transfer income and economic rent depends on the shape of the supply curve of the resource., i.e., on the elasticity of supply of the resource. Three possibilities are shown in Fig. 8. Here D is the market demand curve of the resource. The three possible supply curves are S1, S2 and S3. The market price of the resource is Rs. 500 per unit and the quantity hired is 3,000 units. The total payment to the factor is Rs. 500 × 3,000 = Rs. 15 lakhs and is represented by the area OAEC.

Case I. No transfer cost:

ADVERTISEMENTS:

When the supply curve is completely inelastic (S1), transfer cost is zero, because an unchanged quantity is offered at all prices (including zero price as is indicated by point C). So the entire return to the factor is economic rent or surplus. This is so because a fall in the price of the resource would not cause the supply of the resource to fall in its present use. In other words, a decrease in price would not induce any unit of the factor to move to any other sector in search of higher return.

Case II. No economic rent:

When the supply curve is completely elastic-a horizontal straight line like S2 the minimum supply price of the resource is Rs. 500 per unit. This is the minimum sum that has to be paid to prevent the factor from transferring its service somewhere else. In this case a small drop in the price paid to the factor would induce all units of the factor to go somewhere e se. So, the entire return to the factor is transfer (necessary) cost and surplus income (rent) is zero.

Case III. Both transfer cost and economic rent:

ADVERTISEMENTS:

In most normal situation of downward sloping demand curve and upward sloping supply curve the total factor income will have two components: necessary income and surplus income. Such a situation is in the positively sloped supply curve S3. Here, at a price of Rs. 500 the 3,000 the unit or the marginal unit is just receiving its transfer earnings, but the 2,999th unit is earning a surplus income or income well above its transfer cost (as the height of the supply curve shows).

Here, part of the income (shown by the areas below the supply curve OBEC) is transfer income and part of the income (shown by the area above the supply curve, BAE) is economic rent. One can verify that the more inelastic the supply curve the larger will be the economic rent (because the smaller will be transfer cost). This is the more usual situation than the other two.

Rent and price in modern theory:

According to modern theory there is a close relation between rent and price. If for instance, the demand for a factor increases and it becomes scarce, its market price will rise. As a result all units of the factor already employed will earn surplus income. It is because their necessary income or transfer earning has already been covered, or, in other words, the owners of these units were ready to supply their service at a lower price.

Determinants of the Division:

The division of total income between these two components depends largely on the mobility of the factor. This, in its turn, depends on the alternatives open to it.

In a broad sense the mobility of a resource depends on the following two factors:

Types of transfer:

The mobility of a factor largely depends on the view point that we adopt. If we focus on the narrowly defined use of a factor say labour by a firm then it will be highly mobile. A worker in a tea garden of North Bengal can easily move to another tea garden. Thus, within the same industry there are a number of alternatives open to him. Therefore from the viewpoint of the firm the bulk of the wage payment is transfer earning.

If however, we take a broad view of the situation and we consider the use of the factor in a industry, then its mobility will be restricted. It is because the worker, in our example, will find it difficult to find out employment in another industry (say, jute industry) quickly. Thus, from viewpoint of the particular industry (rather than the specific firm within the industry) the bulk of the factor payment is economic rent and a small proportion is transfer earning.

ADVERTISEMENTS:

Finally, from more wider viewpoint of a particular occupation, such as manufacturing, mobility is even less. It is so because a worker from a tea garden can somehow manage to work in a jute mill after a period of training. But, they may never be in a position to operate as a computer mechanic or to fly an aircraft. So, from the general perspective of a particular occupation a small portion of actual earning is transfer earning and the major portion is economic rent.

In the words of R.G. Lipsey:

“As the perspective moves from a narrowly defined use of a factor to a broadly defined use, the mobility of the factor decreases; as mobility decreases, the share of the factor payment that is economic rent increases.”

Time allowed the move. As a general rule factors are more mobile in the long run than in the short run. Thus, a major portion of the actual income of a factor is rent in the short run. It is in this context that Alfred Marshall drew a distinction between economic rent and quasi-rent. Suppose, a business firm installs a specialised machine in its factory. It has only one use. It is expected to yield an annual return of Rs. 5 000. Yet it will be worthwhile to keep the machine in operation.

ADVERTISEMENTS:

Once it has been installed any return from it in the short run above its operating (variable) cost is economic rent. In the short run a firm just seeks to cover variable cost. In this case, the difference P and AFC or TR and TVC measures economic rent or surplus. Thus, if the machine yields an annual income of Rs 1 000 above its operating costs it will remain allocated in its present use. In short in the short run any net income is economic rent.

However, in the long run the firm will seek to cover all costs. Thus what is a surplus income in the short run is very much a necessary income in the long run. Thus, not only variable cost but fixed cost as well will be a part of its transfer earning. This supply means that if the total revenue of the firm is not sufficient to cover its total cost, the machine will not continue to be allocated in its present use in the long run.

Thus in the short run the major part of the income from a man-made asset like a machine is economic rent. But, in the long run the bulk of the earning of a resource is transfer earning. According to Marshall, factor income which is economic rent in the short run and transfer income in the long run is called quasi-rent. Quasi-rent is different from economic rent because it disappears almost completely in the long run (when supply conditions become favourable, i.e., when the supply curve of a resource becomes more and more elastic).

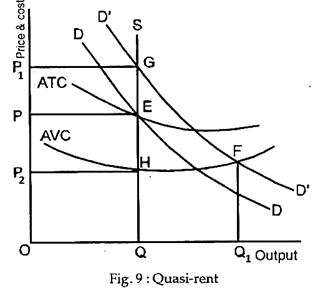

Thus in short, the additional reward to a factor of production which is in short term the fixed supply, over and above variable cost, is called % quasi-rent. In the long run the revenue to the factor of production will be equal to its transfer earning. The concept of quasi-rent is illustrated in Fig. 9.

ADVERTISEMENTS:

Suppose, the short-run demand curve of an resource is DD and the supply curve is QS. The price of the resource is P and quantity is Q. Suppose, now the demand curve shifts to the right to D1D1. In the short run it is not possible to increase the supply of the resource.

Therefore, the price of the service of the resource (say, a machine) rises to P1. Since the machine will be kept operational as long as variable cost is covered, i.e., Q>0, as long as P > AVC, the entire surplus revenue from the machine above the variable cost, i.e., P2GH is surplus or rent.