Let us learn about the Concept of Rent by Modern Economists.

Modern economists have generalized the concept of rent, though it was David Ricardo who first propounded the theory of rent and applied it to land only. Modern economists argue that supply of all inputs is more or less inelastic. So rent is enjoyed by all the inputs including land.

An alternative definition of rent has been given by modern economists. Economic rent is defined as the difference between actual earnings and transfer earnings or minimum supply price of any input. Actual earnings are the earnings what an input actually earns after rendering services for a given period of time.

Transfer earnings are the payments that must be paid to keep an input in its present use. Transfer earning or the minimum supply price is the price that must be paid to an input in order to retain its job. Thus, economic rent is a payment to any input over and above what is required to keep the input in its current employment. In other words, economic rent is any payment in excess of transfer earnings or minimum supply price or opportunity cost.

ADVERTISEMENTS:

Transfer earnings are regarded as opportunity cost of keeping an input in its present use, or it is regarded as the input’s supply price in its present occupation. Whenever an input does not have an alternative use, its opportunity cost becomes zero. Thus the entire earnings of that input become rent.

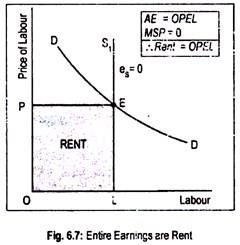

The volume of economic rent depends on the elasticity of supply of any input. Let us assume that the supply of labour is perfectly inelastic as drawn in Fig. 6.7. In the short run, the supply of labour may be completely inelastic. Here LS1 is the supply curve whose coefficient of elasticity of supply is zero. This means that, whatever the price, its supply is always OL.

Even if the input is not rewarded its supply would be fixed at OL. That is why the supply curve of this input is completely inelastic (eS = 0). Actual earning (or AE) of an input are determined by the intersection of the demand curve for an input and the supply curve of that input. Thus, the actual earning of the input becomes equal to OPEL. Since opportunity cost or the minimum supply price (or MSP) is zero, the entire earnings of the input are economic rent (i.e., OPEL).

ADVERTISEMENTS:

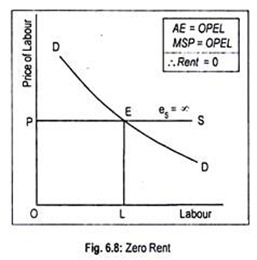

In Fig. 6.8, we have drawn a perfectly elastic supply curve of labour, PS. This means that, at a given price OP, any amount of labour will be supplied. Thus the minimum supply price of that input is OP. Actual earning is determined by the intersection of the DD curve and the PS curve at point E. Actual earning now equals OPEL. Since actual earning and opportunity cost are the same, labour does not enjoy any amount of economic rent.

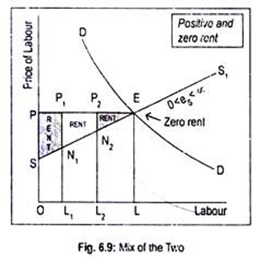

In case of an upward rising supply curve of an input, part of its earnings become rent. In Fig. 6.9, we have drawn a positively sloped supply curve of labour, SS1. Its slope indicates that, as price of labour increases, its supply increases. Demand curve DD intersects the supply curve SS1 at point E.

Actual earnings are, therefore, OPEM. Now these actual earnings can be split into two parts: opportunity cost and the economic rent. Suppose OL1-th unit of labour is supplied whose opportunity cost is the area under the supply curve, i.e., L1N1.Its actual earnings are L1P1 (= OP). Thus, the OL1-th unit of labour earns rent to the tune of P1N1 or SN1P1P area. Similarly, OL2-th unit of labour enjoys rent of P2N2 amount since actual earnings (L2P2) exceed opportunity cost (P2N2).

ADVERTISEMENTS:

For the OL-th unit of labour—since actual earnings and opportunity cost are equal—no economic rent accrues. In other words, OL-th unit of labour does not receive any surplus or economic rent. As OL-th unit of labour does not get rent, it may be called the ‘marginal labour’—a notion similar to Ricardo’s ‘marginal land’.

Likewise, OL1-th and OL2-th units of labour may be called ‘intra-marginal’ one for which rent is positive. But, for OL units of labour, opportunity cost or minimum supply price equals OSEL area, while actual earnings are OPEL. Thus OL units of labour get rent to the extent of PSE.

It can be concluded that the volume of economic rent depends on the elasticity of supply of any input. Greater the elasticity of supply lower is the economic rent, and lower the elasticity of supply, greater is the economic rent.

Finally, modern economists challenged Ricardo’s contention—rent is price- determined but not price-determining. This view of Ricardo is correct only when the supply of land is viewed from the society’s angle. In this situation, opportunity cost is zero since land has no alternative use. In such a situation, rent is price-determined. But from a firm’s or industry’s point of view, opportunity cost is positive. So, rent will then determine price and not the other way, round as Ricardo argued.