In this article we will discuss about price fixation by law and its implication.

Maximum Price Fixation by Law (Price Ceiling):

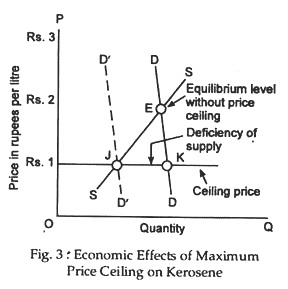

The government sometimes sets by law either a maximum price of a commodity or a minimum price of a resource. Consider, say, the market for kerosene. The situation is illustrated in Fig. 3. The original equilibrium in this market occurs at a price of Re.1 a litre. Now suppose, because of war or emergency a drastic cut in supply occurs.

So, that supply curve shifts to the left and the open market price rises to Rs. 2 per litre. Since consumers have to suffer a lot due to this high price, the government might choose to control the price by passing a law and thus fix a maximum price of kerosene at the old level of Re. 1 per litre. The ceiling price line CJK in Fig. 3 shows the legal price ceiling.

At this price consumers are desirous of buying more than what producers are willing and able to supply. Thus, there is excess demand at this price (measured by the horizontal distance JK). Thus there is shortage of kerosene in the market at this legal maximum price—a game of musical chair in which somebody loses his seat as soon as the music stops playing.

Of course, some people will be ready to pay more for kerosene because of the limited quantity of the item that is available. Thus, there will be black-marketing or illegal trading because nobody can officially pay more than Re. 1 per litre. Thus, we have worst of both the worlds—higher price and smaller quantity. In the absence of price ceiling the equilibrium quantity will be high as indicated by point E in Fig. 3.

Rationing:

The only solution to the problem lies in some kind of non- price allocation or rationing. The government will have to allocate kerosene among consumers just to ensure that everybody gets at least a minimum quantity of this essential commodity.

ADVERTISEMENTS:

As Paul Samuelson puts it, “If for political or other reasons market price is not to be permitted to rise high enough to bring quantity demanded down to the level of quantity supplied, ultimately some kind of non-price rationing develops. Governments, generally, turn to formal allocation or coupon rationing during the period of extreme shortage.”

As an alternative to direct allocation by the government ration coupons may be issued. The government must issue enough coupon to lower the demand curve to d’D’ in Fig. 3 where supply and new demand balance at the ceiling price.

Minimum Floors and Maximum Ceilings:

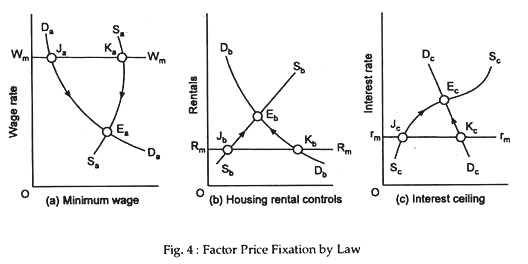

In times of emergency or political instability or general shortage the government introduces price and wage controls. Liberal economists like Milton Friedman feels that such price controls are likely to have some undesirable consequences. For example, as Fig. 4(a) shows, if a minimum wage is fixed above the equilibrium level, there will be a problem of involuntary idleness of labour or the problem of unemployment.

ADVERTISEMENTS:

For example, if the minimum wage is fixed at FA which is higher than equilibrium level, some workers will remain unemployed. Now trade unions will allocate the jobs among the job seekers. Lowering the minimum wage raises employment as shown by the arrows.

Fig. 4(b) analyses the economic implications of rental ceiling. If the rent is fixed by the government there will be a large group of people who cannot find accommodation in big cities like Calcutta or Mumbai. These people have to bribe landlords or put enormous security deposits for rental accommodation. Thus, non-price allocation or rationing occurs. Another consequence of this is that, if the maximum rent is fixed below the equilibrium level construction of new buildings and repair and maintenance of old ones will suffer.

Finally, we can refer to interest rate ceiling. If the maximum rate of interest is fixed below the equilibrium level, there will be a problem of excess demand-for loans. So, those who are interested in obtaining loans from the banks or non-banking financial institutions may pay more than the market rate of interest. This point is indicated by the arrow in Fig. 4(c).

Conclusion:

Thus, the conclusion is that, if the maximum price of a commodity or resource is fixed below the equilibrium level there will be the problem of black-marketing. Thus, price control cannot succeed without administered rationing. On the other hand, if the maximum price is fixed above the equilibrium level, there will a problem of excess supply but the market will take care of itself, i.e., it will be automatically cleared.