The following points highlight the Economic Policies under Floating Exchange Rates. The Policies are: 1. Expansionary Fiscal Policy 2. Monetary Policy 3. The Monetary Transmission Mechanism 4. Trade Policy.

Economic Policy # 1. Expansionary Fiscal Policy:

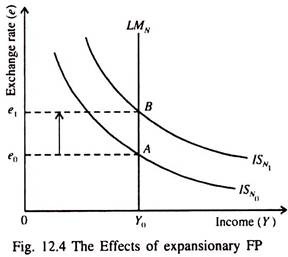

If the government of a small open economy now adopts an expansionary fiscal policy in the shape of an increase in G or a cut in T, the ISN curve will shift to the right as shown in Fig. 12.4.

This will lead to an appreciation of the exchange rate, income remaining constant at the original equilibrium level. In a closed economy, an increase in Y increases the demand for money.

As a result, r rises. This is not possible in an open economy due to perfect capital mobility.

ADVERTISEMENTS:

If r goes above r*, there will be a net inflow of capital. This will increase the demand for domestic currency. The domestic currency will appreciate. Domestic goods will be expensive compared to foreign goods. This will reduce net exports and neutralise the effect of expansionary fiscal policy on Y.

Economic Policy # 2. Monetary Policy:

If the central bank increases M, the LMN curve shifts to the right from LMN to LMN as shown in Fig. 12.5. As a result, exchange rate falls but Y rises.

The Monetary Transmission Mechanism:

ADVERTISEMENTS:

In an open economy, an increase in M does not lead to a fall in r, because r is fixed by r*. Thus, if r falls due to an increase in M, there will be outflow of capital — since domestic investors seek to get higher return abroad.

This very fact prevents r from going below r*. Moreover, the capital outflow increases the supply of domestic currency in the foreign exchange market. As a result, there is depreciation of exchange rate (i.e., automatic fall in the external value of the home country’s currency).

This makes domestic goods cheaper compared to foreign goods. So exports rise, imports fall and net exports increase. Thus, in a small open economy, monetary policy influences income by causing exchange rate movements (since r cannot move up or down).

Economic Policy # 3. Trade Policy:

ADVERTISEMENTS:

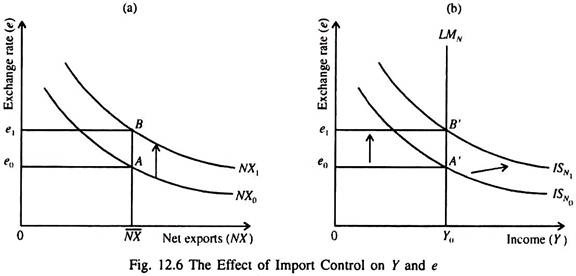

Suppose a small open economy under floating exchange rate reduces imports by imposing a quota. This virtually amounts to an increase in net exports. (After all, one pound saved is one pound earned). As a result, the net export curve shifts to the right from NX0 to NX1, as shown in Fig. 12.6 (a). This increases desired expenditure and shifts the ISN curve to the right in Fig. 12.6 (b).

As a result, the exchange rate appreciates (the domestic currency becomes more valuable than a foreign currency); it moves up from e0 to e1. But income remains constant. Thus, in an open economy, trade restriction cannot increase income (although, in a closed economy, a fall in imports raises Y since imports are a leakage from the circular flow of income). It may be noted that an import restriction does not affect Y, C, G or I.

So, it does not affect NX since:

NX(e) = Y – C(Y – T) – I(r*) – G.

The favourable effect of an increase in NX is offset by an appreciation of the currency in the foreign exchange rate market. Thus, if the pound appreciates, Britain’s export will fall and imports will rise. This will offset the initial increase in NX caused by a fall in Britain’s imports due to the imposition of an import quota.