Let us make in-depth study of the importance, concept, measurement, measures, determinants, factors determining, relation with budget deficit and effect of open economy of money supply.

Importance of Money Supply:

Growth of money supply is an important factor not only for acceleration of the process of economic development but also for the achievement of price stability in the economy.

There must be controlled expansion of money supply if the objective of development with stability is to be achieved. A healthy growth of an economy requires that there should be neither inflation nor deflation. Inflation is the greatest headache of a developing economy.

A mild inflation arising out of the creation of money by deficit financing may stimulate investment by raising profit expectations and extracting forced savings. But a runaway inflation is highly detrimental to economic growth. The developing economies have to face the problem of inadequacy of resources in initial stages of development and it can make up this deficiency by deficit financing. But it has to be kept strictly within safe limits.

ADVERTISEMENTS:

Thus, increase in money supply affects vitally the rate of economic growth. In fact, it is now regarded as a legitimate instrument of economic growth. Kept within proper limits it can accelerate economic growth but exceeding of the limits will retard it. Thus, management of money supply is essential in the interest of steady economic growth.

Concept of Money Supply and Its Measurement:

By money supply we mean the total stock of monetary media of exchange available to a society for use in connection with the economic activity of the country.

According to the standard concept of money supply, it is composed of the following two elements:

1. Currency with the public,

ADVERTISEMENTS:

2. Demand deposits with the public.

Before explaining these two components of money supply two things must be noted with regard to the money supply in the economy. First, the money supply refers to the total sum of money available to the public in the economy at a point of time. That is, money supply is a stock concept in sharp contrast to the national income which is a flow representing the value of goods and services produced per unit of time, usually taken as a year.

Secondly, money supply always refers to the amount of money held by the public. In the term public are included households, firms and institutions other than banks and the government. The rationale behind considering money supply as held by the public is to separate the producers of money from those who use money to fulfill their various types of demand for money.

Since the Government and the banks produce or create money for the use by the public, the money (cash reserves) held by them are not used for transaction and speculative purposes and are excluded from the standard measures of money supply. This separation of producers of money from the users of money is important from the viewpoint of both monetary theory and policy.

ADVERTISEMENTS:

Let us explain the two components of money supply at some length:

Currency with the Public:

In order to arrive at the total currency with the public in India we add the following items:

1. Currency notes in circulation issued by the Reserve Bank of India.

2. The number of rupee notes and coins in circulation.

3. Small coins in circulation.

It is worth noting that cash reserves with the banks has to be deducted from the value of the above three items of currency in order to arrive at the total currency with the public. This is because cash reserves with the banks must remain with them and cannot therefore be used for making payments for goods or by any commercial bank’s transactions.

It may further be noted that these days paper currency issued by Reserve Bank of India (RBI) are not fully backed by the reserves of gold and silver, nor it is considered necessary to do so. Full backing of paper currency by reserves of gold prevailed in the past when gold standard or silver standard type of monetary system existed.

According to the modern economic thinking the magnitude of currency issued should be determined by the monetary needs of the economy and not by the available reserves of gold and silver. In other developed countries, since 1957 Reserve Bank of India follows Minimum Reserve System of issuing currency.

Under this system, minimum reserves of Rs. 200 crores of gold and other approved securities (such as dollars, pound sterling, etc.) have to be kept and against this any amount of currency can be issued depending on the monetary requirements of the economy.

ADVERTISEMENTS:

RBI is not bound to convert notes into equal value of gold or silver. In the present times currency is inconvertible. The word written on the note, say 100 rupee notes and signed by the governor of RBI that ‘I promise to pay the bearer a sum of 100 rupees’ is only a legacy of the past and does not imply its convertibility into gold or silver.

Another important thing to note is that paper currency or coins are fiat money, which means that currency notes and metallic coins serve as money on the bases of the fiat (i.e. order) of the Government. In other words, on the authority of the Government no one can refuse to accept them in payment for the transaction made. That is why they are called legal tender.

Demand Deposits with the Public:

The other important component of money supply are demand deposits of the public with the banks. These demand deposits held by the public are also called bank money or deposit money. Deposits with the banks are broadly divided into two types: demand deposits and time deposits. Demand deposits in the banks are those deposits which can be withdrawn by drawing cheques on them.

Through cheques these deposits can be transferred to others for making payments from whom goods and services have been purchased. Thus, cheques make these demand deposits as a medium of exchange and therefore make them to serve as money. It may be noted that demand deposits are fiduciary money proper.

ADVERTISEMENTS:

Fiduciary money is one which functions as money on the basis of trust of the persons who make payment rather than on the basis of the authority of Government. Thus, despite the fact that demand deposits and cheques through which they are operated are not legal tender, they function as money on the basis of the trust commanded by those who draw cheques on them. They are money as they are generally acceptable as medium of payment.

Bank deposits are created when people deposit currency with them. But far more important is that banks themselves create deposits when they give advances to businessmen and others. On the basis of small cash reserves of currency, they are able to create a much larger amount of demand deposits through a system called fractional reserve system which will be explained later in detail.

In the developed countries such as USA and Great Britain deposit money accounted for over 80 per cent of the total money supply, currency being a relatively small part of it. This is because banking system has greatly developed there and also people have developed banking habits.

On the other hand, in the developing countries banking has not developed sufficiently and also people have not acquired banking habits and they prefer to make transactions in currency. However in India after 50 years of independence and economic development the proportion of bank deposits in the money supply has risen to about 50 per cent.

Four Measures of Money Supply:

ADVERTISEMENTS:

Several definitions of money supply have been given and therefore various measures of money supply based on them have been estimated. First, different components of money supply have been distinguished on the basis of the different functions that money performs. For example, demand deposits, credit card and currency are used by the people primarily as a medium of exchange for buying goods and services and making other transactions.

Obviously, they are money because they are used as a medium of exchange and are generally referred to as M1. Another measure of money supply is M 3 which includes both M1 and time deposits held by the public in the banks. Time deposits are money that people hold as store of value.

The main reason why money supply is classified into various measures on the basis of its functions is that effective predictions can be made about the likely effects on the economy of changes in the different components of money supply. For example, if M1 is increasing firstly it can be reasonably expected that people are planning to make a large number of transactions.

On the other hand, if time-deposits component of money supply measure M3 which serves as a store of value is increasing rapidly, it can be validly concluded that people are planning to save more and accordingly consume less.

Therefore, it is believed that for monetary analysis and policy formulation, a single measure of money supply is not only inadequate but may be misleading too. Hence various measures of money supply are prepared to meet the needs of monetary analysis and policy formulation.

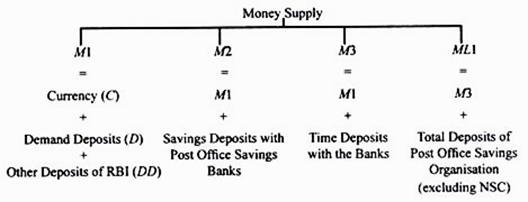

Recently in India as well as in some developed countries, four concepts of money supply have been distinguished. The definition of money supply given above represents a narrow measure of money supply and is generally described as M1.

ADVERTISEMENTS:

From April 1977, the Reserve Bank of India has adopted four concepts of money supply in its analysis of the quantum of and variations in money supply. These four concepts of measures of money supply are explained below.

Money Supply M1 or Narrow Money:

This is the narrow measure of money supply and is composed of the following items:

Ml = C + DD + OD

Where, C = Currency with the public

DD = Demand deposits with the public in the commercial and cooperative banks.

OD = Other deposits held by the public with Reserve Bank of India.

ADVERTISEMENTS:

The money supply is the most liquid measure of money supply as the money included in it can be easily used as a medium of exchange, that is, as a means of making payments for transactions.

Currency with the public (C) in the above measure of money supply consists of the following:

(i) Notes in circulation.

(ii) Circulation of rupee coins as well as small coins

(iii) Cash reserves on hand with all banks.

Note that in measuring demand deposits with the public in the banks (i.e., DD), inter-bank deposits, that is, deposits held by a bank in other banks, are excluded from this measure.

ADVERTISEMENTS:

In the other deposits with Reserve Bank of India (i.e., OD) deposits held by the Central and State Governments and a few others such as RBI Employees Pension and Provident Funds are excluded.

However, these other deposits of Reserve Bank of India include the following items:

(i) Deposits of Institutions such as UTI, IDBI, IFCI, NABARD etc.

(ii) Demand deposits of foreign Central Banks and Foreign Governments.

(iii) Demand deposits of IMF and World Bank.

It may be noted that other deposits of Reserve Bank of India constitute a very small proportion (less than one per cent).

Money Supply M2:

ADVERTISEMENTS:

M2 is a broader concept of money supply in India than M1. In addition to the three items of M1, the concept of money supply M2 includes savings deposits with the post office savings banks. Thus,

M2 = M1 + Savings deposits with the post office savings banks.

The reason why money supply M2 has been distinguished from M1 is that saving deposits with post office savings banks are not as liquid as demand deposits with commercial and cooperative banks as they are not chequable accounts. However, saving deposits with post offices are more liquid than time deposits with the banks.

Money Supply M3 or Broad Money:

M3 is a broad concept of money supply. In addition to the items of money supply included in measure M1, in money supply M3 time deposits with the banks are also included. Thus

M3= M1+ Time Deposits with the banks.

It is generally thought that time deposits serve as store of value and represent savings of the people and are not liquid as they cannot be withdrawn through drawing cheque on them. However, since loans from the banks can be easily obtained against these time deposits, they can be used if found necessary for transaction purposes in this way. Further, they can be withdrawn at any time by forgoing some interest earned on them.

It may be noted that recently M3 has become a popular measure of money supply. The working group on monetary reforms under the chairmanship of late Prof. Sukhamoy Chakravarty recommended its use for monetary planning of the economy and setting target of the growth of money supply in terms of M3.

Therefore, recently RBI in its analysis of growth of money supply and its effects on the economy has shifted to the use of M3 measure of money supply. In the terminology of money supply employed by the Reserve Bank of India till April 1977, this M3 was called Aggregate Monetary Resources (AMR).

Money Supply M4:

The measure M4 of money supply includes not only all the items of M3 described above but also the total deposits with the post office savings organisation. However, this excludes contributions made by the public to the national saving certificates. Thus,

M4 = M3 + Total Deposits with Post Office Savings Organisation.

Let us summaries the four concepts of money supply as used by Reserve Bank of India in the following tabular form:

Determinants of Money Supply:

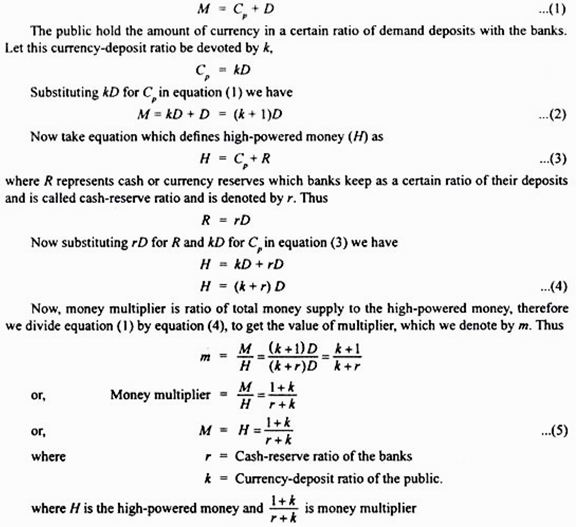

In order to explain the determinants of money supply in an economy we shall use M, concept of money supply which is the most fundamental concept of money supply. We shall denote it simply by M rather than M1. This concept of money supply is composed of currency held by the public (Cp) and demand deposits with the banks (D). Thus

M = Cp + D …(1)

Where, M = Total money supply with the public

Cp = Currency with the public

D = Demand deposits held by the public

The two important determinants of money supply as described in equation (1) are (a) the amounts of high-powered money which is also called Reserve Money by the Reserve Bank of India and (b) the size of money multiplier.

We explain below the role of these two factors in the determination of money supply in the economy:

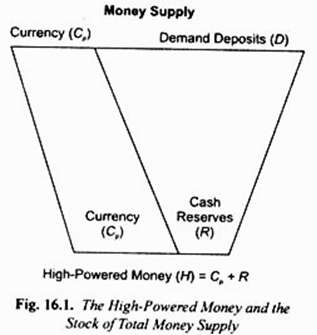

1. High-Powered Money (H):

The high-powered money which we denote by H consists of the currency (notes and coins) issued by the Government and the Reserve Bank of India. A part of the currency issued is held by the public, which we designate as Cp and a part is held by the banks as reserves which we designate as R.

A part of these currency reserves of the banks is held by them in their own cash vaults and a part is deposited in the Reserve Bank of India in the Reserve Accounts which banks hold with RBI. Accordingly, the high-powered money can be obtained as sum of currency held by the public and the part held by the banks as reserves. Thus

H = Cp+ R …(2)

Where, H = the amount of high-powered money

Cp = Currency held by the public

R = Cash Reserves of currency with the banks.

It is worth noting that Reserve Bank of India and Government are producers of the high-powered money and the commercial banks do not have any role in producing this high-powered money (H). However, commercial banks are producers of demand deposits which are also used as money like currency.

But for producing demand deposits or credit, banks have to keep with themselves cash reserves of currency which have been denoted by R in equation (2) above. Since these cash reserves with the banks serve as a basis for the multiple creation of demand deposits which constitute an important part of total money supply in the economy, it provides high-powered-ness to the currency issued by Reserve Bank and Government.

A glance at equations (1) and (2) above will reveal that the difference in the two equations, one describing the total money supply and the other high-powered money, is that whereas in the former, demand deposits (D) are added to the currency held by the public, in the latter it is cash reserves (R) of the banks that are added to the currency held by the public.

In fact, it is against these cash reserves (R) that banks are able to create a multiple expansion of credit or demand deposits due to which there is large expansion in money supply in the economy. The theory of determination of money supply is based on the supply of and demand for high- powered money.

Some economists therefore call it ‘The H Theory of Money Supply’. However, it is more popularly called ‘Money-multiplier Theory of Money Supply’ because it explains the determination of money supply as a certain multiple of the high- powered money. How the high-powered money (H) is related to the total money supply is graphically depicted in Fig. 16.1.

The base of this figure shows the supply of high-powered money (H), while the top of the figure shows the total stock of money supply. It will be seen that the total stock of money supply (that is, the top) is determined by a multiple of the high-powered money (H). It will be further seen that whereas currency held by the public (Cp) uses the same amount of high-powered money, that is, there is one-to-one relationship between currency held by the public and the money supply.

In sharp contrast to this, bank deposits (D) are a multiple of the cash reserves (R) of the banks which are part of the supply of high-powered money. That is, one rupee of high- powered money kept as bank reserves gives rise to much more amount of demand deposits. Thus, the relationship between money supply and the high-powered money is determined by the money multiplier.

The money multiplier which we denote by m is the ratio of total money supply (M) to the stock of high-powered money, that is, m = M/H . The size of money multiplier depends on the preference of the public to hold currency relative to deposits, (that is, ratio of currency to deposits which we denote by K) and banks’ desired cash reserves ratio to deposits which we call r. We explain below the precise multiplier relationship between high-powered money and the total stock of money supply.

It follows from above that if there is increase in currency held by the public which is a part of the high-powered money with demand deposits remaining unchanged, there will be a direct increase in the money supply in the economy because this constitutes a part of the money supply.

If instead currency reserves held by the banks increase, this will not change the money supply immediately but will set in motion a process of multiple creation of demand deposits of the public in the banks. Although banks use these currency reserves held by the public which constitutes a part of the high- powered money to give more loans to the businessmen and thus create demand deposits, they do not affect either the amount of currency or the composition of high-powered money. The amount of high-powered money is fixed by RBI by its past actions. Thus, changes in high-powered money are the result of decisions of Reserve Bank of India or the Government which owns and controls it.

2. Money Multiplier:

Money multiplier is the degree to which money supply is expanded as a result of the increase in high-powered money. Thus

m = M/H

Rearranging we have, M = H.m …(3)

Thus money supply is determined by the size of money multiplier (m) and the amount of high- powered money (H). If we know the value of money multiplier we can predict how much money will change when there is a change in the amount of high-powered money.

Change in the high-powered money is decided and controlled by Reserve Bank of India, the money multiplier determines the extent to which decision by RBI regarding the change in high-powered money will bring about change in the total money supply in the economy.

Size of Money Multiplier:

Now, an important question is what determines the size of money multiplier. It is the cash or currency reserve ratio r of the banks (which determines deposit multiplier) and currency-deposit ratio of the public (which we denote by k) which together determines size of money multiplier. We derive below the expression for the size of multiplier.

From equation (1) above, we know that total money supply (M) consists of currency with the public (Cp) and demand deposits with the banks. Thus

From above it follows that money supply in the economy is determined by the following:

1. H, that is, the amount of high-powered money, which is also called reserve money

2. r, that is, cash reserve ratio of banks (i. e., ratio of currency reserves to deposits of the banks)

This cash reserve ratio of banks determines the magnitude of deposit multiplier.

3. k, that is, currency-deposit ratio of the public.

From the equation (4) expressing the determinants of money supply, it follows that money supply will increase:

1. When the supply of high-powered money (i.e., reserve money) H increases;

2. When the currency-deposit ratio (k)’ of the public decreases; and

3. When the cash or currency reserves-deposit ratio of the banks (r) falls.

Cash Reserve Ratio of the Banks and the Deposit Multiplier:

Because of fractional reserve system, with a small increase in cash reserves with the banks, they are able to create a multiple increase in total demand deposits which are an important part of money supply. The ratio of change in total deposits to a change in reserves is called the deposit multiplier which depends on cash reserve ratio.

The value of deposit multiplier is the reciprocal of cash reserve ratio, (dm = 1/r) where dm stands for deposit multiplier. If cash reserve ratio is 10 per cent of deposits, then dm = 1/0.10 = 10. Thus deposit multiplier of 10 shows that for every Rs. 100 increase in cash reserves with the banks, there will be expansion in demand deposits of the banks by Rs. 1000 assuming that no leakage of cash to the public occurs during the process of deposit expansion by the banks.

Currency-Deposit Ratio of the Public and Money Multiplier:

However, in the real world, with the increase in reserves of the banks, demand deposits and money supply do not increase to the full extent of deposit multiplier. This is for two reasons. First, the public does not hold all its money balances in the form of demand deposits with the banks.

When as a result of increase in cash reserves, banks start increasing demand deposits, the people may also like to have some more currency with them as money balances. This means during the process of creation of demand deposits by banks, some currency is leaked out from the banks to the people.

This drainage of currency to the people in the real world reduces the magnitude of expansion of demand deposit and therefore the size of money multiplier. Suppose the cash reserve ratio is 10 per cent and cash or currency of Rs. 100 is deposited in bank A. The bank A will lend out Rs. 90 and therefore create demand deposits of Rs. 90 and so the process will continue as the borrowers use these deposits for payment through cheques to others who deposit them in another bank B.

However, if borrower of bank A withdraws Rs. 10 in cash from the bank and issues cheques of the remaining borrowed amount of Rs. 80, then bank B will have only Rs. 80 as new deposits instead of Rs. 90 which it would have if cash of Rs. 10 was not withdrawn by the borrower. With these new deposits of Rs. 80, bank B will create demand deposits of Rs. 72, that is, it will lend out Rs. 72 and keep Rs. 8 as reserves with it (80x 10/100 = 8).

The drainage of currency may occur during all the subsequent stages of deposit expansion in the banking system. The greater the leakage of currency, the lower will be the money multiplier. We thus see that the currency-deposit ratio, which we denote by k, is an important determinant of the actual value of money multiplier.

It is important to note that deposit multiplier works both ways, positively when cash reserves with banks increase, and negatively when the cash reserves with the banks decline. That is, when there is a decrease in currency reserves with the banks, there will be multiple contraction in demand deposits with the banks.

Excess Reserves:

In the explanation of the expansion of demand deposits or deposit multiplier we have assumed that banks do not keep currency reserves in excess of the required cash reserve ratio. The ratio r in the deposit multiplier is the required cash reserve ratio fixed by Reserve Bank of India.

However, banks may like to keep with themselves some excess reserves, the amount of which depends on the extent of liquidity (i.e. availability of cash with them) and profitability of making investment and rate of interest on loans advanced to business firms. Therefore, the desired reserve ratio is greater than the statutory minimum required reserve ratio. Obviously, the holding of excess reserves by the banks also reduces the value of deposit multiplier.

Conclusion:

Theory of determination of money supply explains how a given supply of high-powered money (which is also called monetary base or reserve money) leads to multiple expansion in money supply through the working of money multiplier. We have seen above how a small increase in reserves of currency with the banks leads to a multiple expansion in demand deposits by the banks through the process of deposit multiplier and thus causes growth of money supply in the economy.

Deposit multiplier measures how much increase in demand deposits (or money supply) occurs as a result of a given increase in cash or currency, reserves with the banks depending on the required cash reserve ratio (r) if there are no cash drainage from the banking system. But in the real world drainage of currency does take place which reduces the extent of expansion of money supply following the increase in cash reserves with the banks.

Therefore, the deposit multiplier exaggerates the actual increase in money supply from a given increase in cash reserves with the banks. In contrast, money multiplier takes into account these leakages of currency from the banking system and therefore measures actual increase in money supply when the cash reserves with the banks increase.

The money multiplier can be defined as increase in money supply for every rupee increase in cash reserves (or high-powered money), drainage of currency having been taken into account. Therefore, money multiplier is less than the deposit multiplier.

It is worth noting that rapid growth in money supply in India has been due to the increase in high-powered money H, or what is also called Reserve Money (Lastly Reserve Bank of India, the money multiplier remaining almost constant.

The money supply in a country can be changed by Reserve Bank of India by undertaking open market operations, changing minimum required currency reserve-deposit ratio, and by varying the bank rate. The main source of growth in money supply in India is creation of credit by RBI for Government for financing its budget deficit and thus creating high-powered money.

Further, though the required currency reserve-deposit ratio of banks can be easily varied by RBI, the actual currency reserve-deposit ratio cannot be so easily varied as reserves maintained by banks not only depend on minimum required cash reserve ratio but also on their willingness to hold excess reserves.

Lastly, an important noteworthy point is that though money multiplier does not show much variation in the long run, it can change significantly in the short run causing large variations in money supply. This unpredictable variation in money multiplier in the short run affecting money supply in the economy prevents the Central Bank of a country from controlling exactly and precisely the money supply in the economy.

Factors Determining Money Supply: RBPS Analysis:

In its analysis of factors determining money supply in India and sources of variation in it, Reserve Bank of India does not follow any explicit theory of money supply such as money multiplier theory explained above. It provides only purely accounting or ex-post analysis of variations in money supply and the factors or sources causing these variations.

Although Reserve Bank provides figures of the high-powered money in its analysis, it virtually clubs high-powered money with the ordinary money to calculate the total money supply in the country and therefore does not give due importance to the high-powered money as an important factor causing variation in money supply in the economy.

Further, Reserve Bank also does not lay emphasis on the two behavioural ratios, namely, desired currency-deposit ratio (k) of the public and desired cash reserve ratio (r) of the banks, as determinants of money supply, though it provides ex-post or realised figures of these ratios. We explain below Reserve Bank’s analysis of sources of variation in money supply.

Reserve Bank of India classifies factors determining money supply into the following categories:

(a) Government borrowing from the banking system;

(b) Borrowing of the private or commercial sector from the banking system;

(c) Changes in net foreign assets held by the Reserve Bank of India caused by changes in balance of payments position; and

(d) Government’s currency liabilities to the public.

(a) Bank Credit to the Government:

When the Government expenditure exceeds government revenue and there is deficit in government’s budget, then it resorts to borrowing from the Reserve Bank of India which creates new currency notes for the purpose. This creation of new currency for financing the deficit of the Central Government Budget is known as monetization of deficit.

It was previously called deficit financing. Monetization of deficit is an important source of change in money supply in the economy. It may be noted here that since 1995, a good part of budget deficit is financed through open market operations by RBI by selling Government securities to the banks.

This is done to neutralize the monetary impact of large accumulation of net foreign exchange assets with RBI caused by capital inflows on a large scale. Therefore, there has been a decline in RBI’s credit to the Government in the last about 10 years.

The Government also borrows from the ordinary commercial banks. When banks lend money to the Government, they create credit. For instance, for purchase of food grains by the Food Corporation of India, the banks give a large amount of loan to the Government. The creation of deposits by the banks when they create credit for the Government leads to the increase in money supply in the economy.

(b) Bank Credit to the Commercial or Private Sector:

The private sector also borrows from the banking system when its own resources are less than its total expenditure. This also adds to the money supply with the public because when banks lend, they create credit. This also affects the money supply in the same manner as the Government borrowing from the banking system.

There is, however, an important difference. Whereas Government can borrow more or less compulsorily from Reserve Bank of India, the private sector cannot do so from the commercial banks.

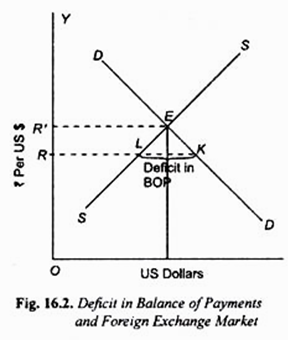

(c) Changes in Net Foreign Exchange Assets:

Changes in the foreign exchange assets held by the Reserve Bank can also bring about a change in the money supply. The change in the net foreign assets may be caused by balance of payment situation. Suppose the balance of payments is adverse or unfavourable and therefore available foreign exchange is less than the country needs to pay for its imports, both visible and invisible.

In order to meet this adverse balance of trade the country will have to dispose of some of its foreign exchange assets. If there is a net adverse balance of payments, rupees would flow into the Reserve Bank which pays out foreign exchange. This would have the effect of reducing the Reserve Money (i.e. the high-powered money) in India and the contraction of the money supply with the public. Opposite result would follow when there is a net surplus in the balance of payments of a country.

It follows from above that a deficit in the balance of payments on current account decreases the supply of rupee currency (that is, high-powered or reserve money) in the economy and thereby causes contraction in money supply with the public. On the contrary, a surplus in the balance of payments will increase the foreign exchange assets and thereby will lead to the expansion in reserve money and money supply in the economy.

It may also be noted that apart from balance of payments on current account foreign exchange reserves or assets may also come through either foreign aid or deposits in Indian banks by NRI or foreign direct investment made by foreign companies in India. For example, in recent years there has been a large-scale inflow of foreign exchange through investment made by foreign companies and NRI deposits in India.

As a result, our foreign exchange reserves have substantially gone up, which have resulted in the issue and expansion of rupee currency in circulation. In August 2004 foreign exchange reserves has risen to US $ 119 billion. But RBI has neutralized its monetary impact by mopping up liquidity of the banks through open market operations by selling them Government securities. This is called sterilization of inflows of foreign exchange.

Further, to deal with the problem of excess liquidity of the Indian banks caused by the rise in foreign exchange reserves, and with a view to check rise in inflation rate Reserve Bank of India has in April 2004 entered into an agreement with the Central Government to sterilize the monetary impact of these reserves.

With this agreement, Market Stabilisation Scheme (MSS) has been started. Under this scheme the Central Government has issued Market Stabilisation Bonds. These bonds were sold by RBI to commercial banks to mop up excess liquidity of Rs. 60,000 crore in 2004-05. But these Rs. 60,000 crore were kept apart in special deposits with RBI and were not meant to be used by the Government.

It should be noted that if the foreign exchange reserves are used to import goods in short supply, it will help in lowering inflation rate for two reasons. First, this will reduce rupee currency in circulation which will cause reduction in money supply in the economy.

Contraction in money supply will help in controlling inflation through reducing aggregate demand. Secondly, the imports of goods will increase aggregate supply of goods in the economy which will tend to lower prices.

(d) Government’s Currency Liabilities to the Public:

Changes in money supply in the economy are also brought about by Government’s currency liabilities to the public. Coins and one-rupee notes represent Government’s currency liabilities to the public. On 31st March 2004-05, there were outstanding balances of Government currency liabilities of Rs. 7291 crores as compared to Rs. 7071 crores on March 31, 2003. If Government’s currency liabilities increase, the money supply also increases.

Budget Deficit and Money Supply:

A budget deficit is also an important source of expansion of money supply in the economy. There are two possible links between budget deficit and growth in money supply. First, when following an expansionary fiscal policy the government raises its expenditure without financed by extra taxation and thereby causing a budget deficit, it will tend to raise interest rate. This happens when budget deficit is financed through borrowing from the market.

As a result, demand for money or loanable funds increases which, given the supply of money, causes interest rate to rise. Rise in interest rate tends to reduce or crowd out private investment. If the Central Bank is following the policy of a fixed interest rate target, when the government resorts to borrowing to finance the budget deficit, then to prevent the rise in interest rate the Central Bank will take steps to increase the money supply in the economy.

The second link between budget deficit and expansion in money supply is direct. This occurs when the Central Bank itself purchases government securities when the government resorts to borrowing. The Central Bank is said to monetize budget deficit when it purchases government securities as it prints new notes for the purpose and gives it to the government for meeting public expenditure.

In some countries such as the US, Federal Reserve (which is the Central Bank of the USA) enjoys a good deal of independence from the Treasury (i.e., the Government) and voluntarily decides when and how much to purchase government securities to finance its budget deficit.

Central Bank‘s Dilemma:

The Central Bank of a country faces a dilemma in deciding whether or not to monetize budget deficit. If the Central Bank does not monetize budget deficit to meet its increased expenditure, the government will borrow from the market and in the absence of any accommodating monetary policy this will tend to raise interest rate and thereby reduce or crowd out private investment.

Referring to the policy of Federal Reserve of the United States, Dornbusch, Fischer and Startz write, “There is accordingly a temptation for the Federal Reserve to prevent crowding out by buying government securities thereby increasing the money supply and hence allows an expansion in income without a rise in interest rates”. But the policy of monetization of budget deficit by the Central Bank involves a risk. If the economy is working near-full employment level, that is, at near-full production capacity, monetisation of budget deficit will cause inflation in the economy.

However, if the economy is in the grip of a severe depression, the risk of causing inflation through monetisation of budget deficit and consequent growth in money supply is not much there. It follows from above that in any particular case the Central Bank, if it enjoys freedom from the Government, has to judge whether it should adopt accommodatory monetary policy to achieve its goal of interest-targeting or allow fiscal expansion through monetisation of budget deficit accompanied by the tight monetary policy to check inflation. It is the latter course of action that was adopted by Reserve Bank of India before 1995 when government’s fiscal deficit was high and a good part of it was monetised by it.

Money Supply and the Open Economy:

The transactions of an open economy also affect the growth of money supply in it. In the open economy there is free flow of goods and services through trade with foreign countries. Besides, in the open economy there are flows of capital between countries. The impact of transactions of an open economy on the money supply can be better understood from national income identity of an open economy.

National income of the open economy is written as:

Y = C + I + G + NX …(1)

or, NX = Y – (C + I + G) …(2)

where NX stands for net exports or trade balance. In the trade balance if we also include exports and imports of services (i.e., invisibles), then NX can be taken as current account balance.

The current account balance (NX) can be either positive or negative. If in equation (2) above aggregate expenditure (C + I + G) exceeds national output (Y), current account balance or NX will be negative, that is, imports will be greater than exports.

In other words, there will be deficit in current account of the balance of payments. On the other hand, if aggregate expenditure is less than national income [ (C + I + G) < Y], there will be surplus in the current account balance of payments. This implies that our exports will be greater than imports.

Now, if in a year there is deficit in current account, that is, NX is negative, it means our demand for foreign exchange, say, the US dollars, for imports of goods and services will exceed the supply of foreign exchange. This situation is depicted in Fig. 16.2 where the curve DD represents demand curve for foreign exchange (US $) and SS is the supply curve of foreign exchange (US $) at exchange rate (Rs. per US dollar) and OR and LK represent deficit in current account.

If the economy is under flexible exchange rate regime and the Central Bank of the country does not intervene at all, the exchange rate will change to OR’ and as a result deficit in current account balance will be eliminated and equilibrium restored at the new exchange rate. If there is such a situation, there is no impact on the money supply.

However, if the Central Bank wants to maintain the exchange rate at OR, then current account deficit equal to LK has to be met. If there are no capital inflows, then to maintain the exchange rate at OR, the Central Bank of the country has to supply foreign exchange equal to LK out of the reserves held by it.

But when the Central Bank (RBI in case of India) pays out foreign exchange from its reserves, it will receive money (i.e., rupees in India) from importers of goods and services in return for foreign exchange paid to them to meet the deficit. Thus some money (say Indian rupees) will flow into the Central Bank and thus withdrawn from circulation.

As a result of Central Bank intervention to meet the current account deficit and to maintain the exchange rate money supply in the economy decreases. It is important to note that the Central Bank of the country cannot go on supplying foreign exchange reserves, year after year, for a long time because foreign exchange assets with the Central Bank are available in limited amount.

The above analysis of contraction in money supply as a result of use of foreign exchange reserves to meet the current account deficit is based on two assumptions. First, it is assumed that there are no capital flows to meet the deficit in current account balance. Second, it is assumed the exchange rate is not allowed to change as a result of in balance between demand and supply of foreign exchange due to current account deficit.

Capital Inflows:

However, if there are sufficient net capital inflows accruing from the capital account of the balance of payments, then deficit in current account (i.e., negative NX) can be met by these capital inflows. In this case there will be no impact of deficit in current account balance of payments on money supply in the economy.

Now take the opposite case of surplus in current account balance (i.e., when NX is positive). This implies that the supply of foreign exchange exceeds demand for it. In the absence of capital out-flows this excess supply of foreign exchange will have to by purchased by the Central Bank if exchange rate is to be maintained.

The Central Bank (RBI) will print new notes to pay for the purchase of foreign exchange. This will lead to the increase in money supply in the economy. However, if exchange rate is allowed to change, as is the case under flexible exchange rate system, the exchange rate will adjust to bring supply and demand for foreign exchange in equilibrium.

Overall Balance of Payments and Capital Inflows:

When in an open economy with flexible exchange rate regime there is deficit in overall balance of payments (i.e., on both current and capital accounts), it means that capital inflows are insufficient to bridge the gap in the balance of payments, then, in case of India, this has to be met with use of foreign exchange reserves by the Reserve Bank of India.

When Reserve Bank of India pays foreign exchange (e.g. US $) to finance the deficit in overall balance of payments, it gets rupees in return. Thus rupee currency flows into the RBI. As a result, money supply (rupee currency) in the economy will decline.

However, under flexible rate system, if RBI does not intervene, the deficit in overall balance of payments will cause rupee to depreciate.

Now suppose there is surplus in overall balance of payment as capital inflows exceed the deficit in current account. The large capital inflows can occur due to heavy foreign direct investment (FDI) and portfolio investment by foreign institutional investors (FII) as it happened in some years in India, especially in 2006-07, 2007-08 and 2010-11.

In the absence of intervention by RBI under the flexible exchange rate system, these large capital inflows will cause appreciation of Indian Rupee. In fact, though RBI has been intervening in foreign exchange market from time to time, its intervention has been only limited. As a result, between Oct. 2006 and Oct 2007, rupee appreciated by 15 per cent.

By making our exports relatively expensive the appreciation of rupee adversely affects our exports and therefore growth in GNP and employment. Besides, appreciation of rupee makes imports relatively cheaper and leads to large imports of goods and materials and thereby harms our domestic manufacturing industries.

To prevent the high appreciation of the Indian Rupee RBI purchases US dollars from the foreign exchange market from time to time. When RBI purchases dollars from the foreign exchange market, it pays rupees to the sellers of foreign exchange. To do so more rupee currency is printed by RBI to pay for US dollars purchased by it.

In this way more rupee currency (i.e., high-powered money) comes into existence in the economy. Thus intervention by RBI to prevent appreciation of rupee results in increase in money supply in the economy.

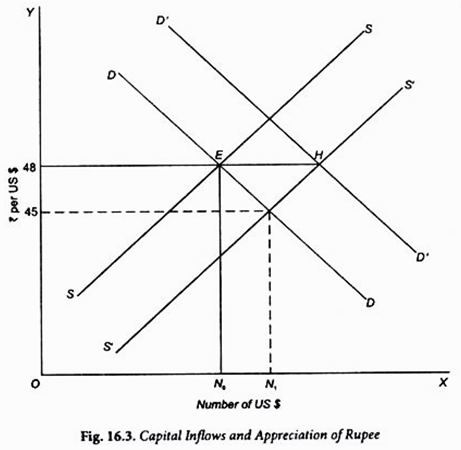

The effect of large capital inflows and its effect on appreciation of currency and money supply in the Indian economy is illustrated in Fig. 16.3 where exchange rate of rupee for US dollars (Rs. per US $) is measured on the Y-axis and number of US dollars are measured on the X-axis.

Initially the equilibrium between demand for and supply of dollars in the Indian foreign exchange market determines equilibrium exchange rate equal to Rs. 48 per US $. As a result of large capital inflows supply curve of US dollars shifts to the right to S’S’. With this, at the existing exchange rate of Rs. 48 per US dollar, EH is the increase in capital inflows.

Now, under a variable exchange rate regime as it exists today, if exchange rate is allowed to adjust freely, rupee will rise to Rs. 45 per US dollar. If Reserve Bank wants to manage it and tries to maintain it at Rs. 48 per US dollar, it will have to buy US dollars equal to EH from the market.

By buying US dollars equal to EH, RBI will cause the demand curve for US dollars to shift to the right to the new position D’D’ and the new equilibrium is established at point H which corresponds to Rs. 48 per US dollar.

But for buying US dollars equal to EH, RBI will have to print new rupee currency to pay for US dollars. Thus more high-power money (i.e., rupee currency) would come into circulation in the Indian economy. Thus RBI did not intervene sufficiently to prevent the appreciation of rupee between Oct. 2006 and Oct. 2007.

This is because such intervention leads to the increase in money supply that is likely to cause inflation in the Indian economy. Therefore, RBI intervened only to a small degree and let the rupee appreciate to some extent.

On the other hand, in 2011 the RBI faced the opposite problem when after August 2011, there was net large capital outflow from India due to uncertainty caused by European debt crisis and economic slowdown in the US. The FIIs started selling Indian equity and bonds and converting rupee into US dollars.

This led to the increase in demand for dollars resulting in appreciation of US dollar and depreciation of Indian rupee. The value of rupee which was around Rs. 44 to a US dollar in the first week of September 2011 depreciated to around Rs. 53 in the second week of December 2011. This depreciation of rupee will make our imports costlier which will tend to raise inflation if not matched by fall in international commodity prices.

To prevent sharp depreciation of rupee the RBI intervened in the foreign exchange market by selling dollars in the market. Again its intervention was only limited. In fact, the RBI has no fixed target for maintaining exchange rate of rupee at any level and instead its policy is to allow exchange rate of rupee to fluctuate within a band. In fact, RBI faces a dilemma which we discuss below.

RBI Dilemma: External Balance and Internal Balance:

RBI faces a dilemma because if it does not intervene in the face of large capital inflows rupee will appreciate much which will adversely affect our exports and therefore growth of GNP and employment in our economy. On the other hand, if it intervenes and purchases enough US dollars from the market to prevent any appreciation of rupee, it will cause large increase in money supply that would cause higher rate of inflation.

A major objective of RBI is to control inflation. Therefore, RBI has to strike a balance between the two alternatives. It has been intervening in the foreign exchange market to prevent large appreciation of rupee. But it cannot buy inflows of foreign exchange indiscriminately as it leads to higher inflation.

RBI has also resorted to sterilization of increase in money supply by selling government securities to the banks and thereby getting back the money issued by it. But there is limit to this sterilization operation as it has not unlimited amount of government securities to sell them to the banks. Hence the dilemma faced by it. We explain the sterilization operations by RBI later.

It follows from above that the two objectives of external balance and internal balance clash with each other. External balance occurs when balance of payments is in equilibrium or close to it.

When external balance does not exist the Central Bank will either go on losing foreign exchange reserves which it cannot do so for long or it will be gaining foreign exchange reserves which also poses a problem as it leads to increase in money supply and causes inflationary pressures in the economy.

On the other hand, internal balance exists when the economy is in equilibrium at full employment or full productive capacity level without any inflationary pressures. Thus, to ensure internal balance requires that money supply should not be allowed to increase much. Since the two require different types of policy measure by the Central Bank, they clash with each other. Hence, the dilemma faced by the Central Bank.

Sterilization by the Central Bank:

Sterilization provides a way out of the problem of clash between the goals of external balance and internal balance. Sterilization refers to the action by the Central Bank of a country to offset or cancel the impact of its foreign exchange market intervention on the money supply through open market operations.

The sterilization measures can be used both to offset the reduction in money supply when in case of current account deficit the Central Bank of the country sells foreign exchange in the market and also when the Central Bank offsets the effect of increase in money supply when it buys foreign exchange from the market in case of surplus in balance of payments or when large capital inflows are coming into the economy.

Let us first explain sterilization operation by the Central Bank in case of deficit in current account of the balance of payments. The deficit in current account balance requires the Central Bank to sell foreign exchange from its reserves to prevent the depreciation of domestic currency (that is, to maintain the exchange rate constant).

The sale of foreign exchange in foreign exchange market by the Central Bank causes money supply in the economy to decrease that has deflationary effect on the economy. To avoid this adverse effect, the Central Bank buys government securities (i. e., bonds) through open market operations.

When it does so the Central Bank prints domestic currency to pay for the bonds it purchases. In this way money supply in the economy increases which offsets the decrease in money supply brought about by the Central Bank when it sells foreign exchange to prevent the depreciation of the domestic currency.

Thus, provided it has enough foreign exchange assets, with sterilization operations by the Central Bank persistent deficit in balance of payments is possible because it insulates the money supply changes in the domestic economy from the Central Bank intervention in the foreign exchange market.

Sterilization Operations in Case of Surplus in Balance of Payments or Large Capital Inflows:

Now, we take up the opposite case when there is surplus in balance of payments or when large capital inflows are taking place. This situation requires that Central Bank intervenes in the foreign exchange market and buys foreign exchange inflows from the market to maintain the foreign exchange rate or to prevent the appreciation of domestic currency.

In the two years (2006-08) due to large net capital inflows in the Indian economy there was quite a large appreciation of the Indian rupee against US dollar that produced undesirable effects. Therefore, Reserve Bank intervened in the foreign exchange market by buying US dollars to prevent too much appreciation of the Indian rupee.

The purchase of foreign exchange (US dollars) from the foreign exchange market by the Reserve Bank led to the increase in money supply in the Indian economy that caused inflationary pressures. To sterilize the effect of this increase in money supply RBI undertook open market operations by selling government securities to the banks which paid rupees to it.

In this way some rupee currency had been withdrawn from the economy. In this way inflationary pressures created by the original increase in money supply through intervention in foreign exchange market have been offset.