The term public includes all economic units, i.e., households, firms and institutions except the producers of money, that is, the Government and the banking system.

The Government includes Central and the State Government. The banking system includes Reserve Bank of India and all banks that accept demand deposit.

This means, public includes all local authorities, non-financial institutions and non-departmental public sector undertakings and foreign and Central Banks who hold part of Indian money in India in form of deposits from RBI.

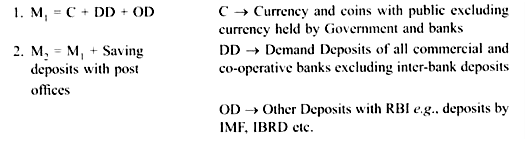

There are four alternative measures of money supply used in India:

ADVERTISEMENTS:

Narrow Definition of Money:

Broad Definition of Money:

3. M3 = M1 + Net Time deposits of bank.

ADVERTISEMENTS:

4. M4 = M2 + total deposits with post office (excluding national saving certificate).

These 4 definitions are given in descending order of liquidity.

M1 → most liquid measure

M4 → least liquid measure of money supply

ADVERTISEMENTS:

All economic theories are based on (M1) but for policy prescriptions (M3) is better measure than (M1). This is because in M3 measure the problem of dividing

Saving deposits into time and demand deposits does not arise. Therefore, (M3), is a better measure than M1.

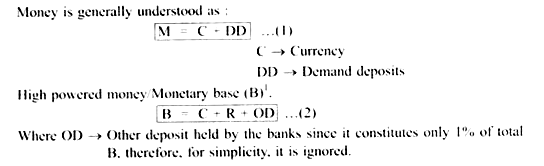

Measures of Money Supply/H-Theory of Money Supply/High Powered Money Supply/Determinants of Money Supply:

Difference between (1) and (2) is of the second component, i.e., in (1) we have DD and in (2) we have R. To produce demand deposits banks have to maintain reserves. Therefore, H is called the base money. This difference is of crucial importance for the theory of money supply.

According to monetary economists the single most important factor that determines money supply is (H). Therefore, it is called as (H) theory of money supply or money multiplier theory.

Money supply is a function of three exogenous variables:

1. Monetary base B: (B = C + R) → It is directly controlled by the bank. It is also known as high powered money.

2. Reserve Deposit Ratio: rr → It is the fraction of deposits that banks hold in reserve. It is determined by the business policies banks and the laws regulating banks.

ADVERTISEMENTS:

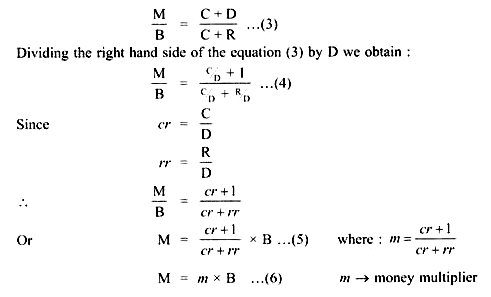

... rr = R/D

3. Currency-Deposit Ratio, cr → It is the amount of currency held by people as a fraction of their holdings of demand deposits (D), Currency (C) and DD are the functions of level of income and interest rate. Therefore, C and DD are assumed to be highly correlated, i.e., C will be proportional to DD.

... cr = C/D

Money supply: M = C+D …(1)

ADVERTISEMENTS:

Money Base: B = C+R …(2)

Dividing Equation (1) by (2) we obtain:

Equation (6) shows that determinants of money supply are (a) those that effect B, (b) those that effect M

ADVERTISEMENTS:

since, the monetary base has a multiplied effect on the money supply. Therefore, the monetary base is also called high-powered money.

Conclusion:

The money supply, therefore, depends on three exogenous variables:

1. B

2. rr

3. cr

ADVERTISEMENTS:

Changes in these variables cause the money supply to change:

(i) Money supply is directly proportional to the monetary base (B), an increase in B

increases the money supply by the same percentage.

(ii) Money supply is inversely related with rr and cr.

Lower the rr, greater will be the loans given by the bank and thus greater will be the credit creation. Thus, a decrease in rr raises the money multiplier and the money supply.

(iii) Lower the cr, more is the credit creation

ADVERTISEMENTS:

Reason:

Less currency will be held by public and more currency will be held by banks. Therefore, more money banks will be able to create. Thus, a decrease in the cr raises the money multiplier and the money supply.