Let us make in-depth study of the accelerator theory of investment in an economy.

Explanation to the Theory:

The Keynesian concept of multiplier states that as the investment increases, income increases by a multiple amount.

On the other hand, there is a concept of accelerator which was not taken into account by Keynes which has become popular after Keynes, especially in the discussions of theories of trade cycles and economic growth.

The acceleration principle describes the effect quite opposite to that of multiplier. According to this, when income or consumption increases, investment will increase by a multiple amount. When income and therefore consumption of the people increases, the greater amount of the commodities will have to be produced.

ADVERTISEMENTS:

This will require more capital to produce them if the already given stock of capital is fully used. Since in this case, investment is induced by changes in income or consumption, this is known as induced investment. The accelerator is the numerical value of the relation between the increase in investment resulting from an increase in income.

The net induced investment will be positive if national income increases and induced investment may fall to zero if the national income or output remains constant. To produce a given amount of output, it requires a certain amount of capital. If Yt output is required to be produced and v is capital-output ratio, the required amount of capital to produce Yt output will be given by the following equation:

Kt = vYt …(i)

where K, stands for the stock of capital,

ADVERTISEMENTS:

Yt for the level of output or income, and

v for capital-output ratio.

This capital-output ratio v is equal to K/Y and in the theory of accelerator this capital-output ratio is assumed to be constant. Therefore, under the assumption of constant capital-output ratio, changes in output are made possible by changes in the stock of capital. Thus, when income is Yt then required stock of capital Kt = vYt. When output or income is equal to Yt-1, then required stock of capital will be Kt-1 = vYt-1.

It is clear from above that when income increases from Yt-1 in period t – 1 to Yt in period, t, then the stock of capital will increase Kt-1 from to Kt. As seen above, Kt-1 is equal to vYt-1 and Kt is equal to vYt.

ADVERTISEMENTS:

Hence, the increase in the stock of capital in period t is given by the following equation:

Kt-Kt-1 = vYt – vYt-1

Kt-Kt-1 = v (Yt – Yt-1) …(ii)

Since increase in the stock of capital in a year (Kt – Kt-1) represents investment in that year, the above equation (ii) can be written as below:

I1 = V (yt – yt-1) …(iii)

Equation (iii) reveals that as a result of increase in income in any year t from a previous year t- 1, increase in investment will be v times more than the increase in income. Hence, it is v, i.e., capital-output ratio, which represents the magnitude of the accelerator. If the capital-output ratio is equal to 3, then as a result of a certain increase in income, investment will increase three times more, i.e., accelerator here will be equal to 3.

It thus follows that investment is a function of change in income. If income or output increases over time, that is, when Yt is greater than Ft-1 then investment will be positive. If income declines, that is, Yt is less than Yt-1 then disinvestment will take place. And if the income remains constant, that is, Yt = Yt-1 the investment will be equal to zero.

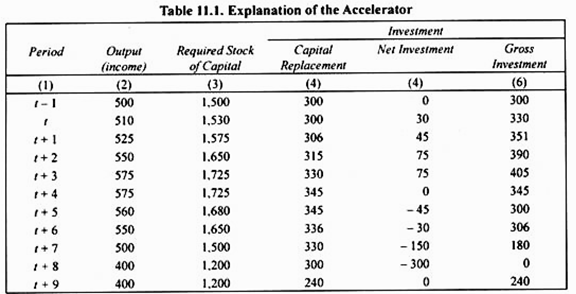

An arithmetical example will make clear the working of the accelerator. This has been represented in the accompanying table.

We have made the following assumptions in making this table:

ADVERTISEMENTS:

(i) Capital-output ratio remains constant and is equal to 3.

(ii) The depreciation that takes place in the stock of capital is equal to one-fifth of the stock existing in the previous year. Therefore, one-fifth of the stock of capital is to be replaced every year.

In the Table 11.1, it is supposed that in period t-1 and several periods before it, output or income is equal to Rs. 500. Given that the capital-output ratio is equal to 3, then to produce ? 500 worth of output, Rs. 1,500 worth of capital will be required. [K = vY; 1500 = 3(500)] which is written in column (3).

Since depreciation of capital occurred in period t-1, it will be one-fifth of the stock of capital existing in the previous period (which is also Rs. 1,500). Therefore, replacement investment in period t-1 will be equal to Rs. 300. Since as compared to the previous period, there is no change in output in period t-1, the net investment in period t-1 will be equal to zero. As a result, the gross investment in period t-1 will be equal to Rs. 300.

ADVERTISEMENTS:

Now suppose that production in the period t rises to Rs. 510 crores as a result of increase in Government expenditure or autonomous investment. To produce output worth Rs. 510 crores, total capital worth Rs. 1530 is required [Kt = vYt 1530 = 3(510)] which is written in column (3). Thus, as a result of increase in output (income) by Rs. 10, net investment has increased by Rs. 30, that is, 1530- 1500 = 30 which means that accelerator is here equal to 3.

In period t the depreciation equation equal to 1/5th of the capital stock of period t-1 will occur, that is, capital depreciation of Rs. 300 (1/5 x 1500 = 300) will occur in period t. Therefore, capital replacement investment in period t will be equal to Rs. 300. Thus, gross investment in period t will be equal to 30 + 300 = 330.

In this way, if output (or income) increases by Rs. 15 in period t + 1, Rs. 25 in period t + 2, and also Rs. 25 in period t + 3, the net investment will increase by three times the increment in output (or income), that is, net investment will increase by Rs. 45 in period t + 1, Rs. 75 in period t + 2 and also Rs. 75 in period t+ 3.

ADVERTISEMENTS:

It will be further observed from Table 11.1 that when output falls in period t + 5 by Rs. 15, the net investment will decline by 3 times of it, that is, equal to Rs. 45. Likewise, from changes in output in different periods we can find out net investment that will take place in any period and with the capital replacement investment we can obtain the gross investment that will occur in any period.

A glance at columns 2, 5 and 6 will show that with a change in output, investment will increase by a multiple of it. This shows that acceleration principle is a powerful destabilizing force working in the economy. If the accelerator is the only force at work, then we shall have too much of instability in the economy—more than is actually found.

In real life, we find that there are limits to instability, both in the upward as well as the downward direction, so that fluctuations in economic activity or what are called business cycles must have a peak as well as a bottom.

Criticism of the Accelerator Theory:

The principle of acceleration has come in for a good deal of criticism in recent years. For example, it has been pointed out by Kaldor that we cannot assume a constant value of the accelerator throughout the trade cycle, that is, it is not true that an increase in output or income by an amount must always give rise to a multiple increase in investment.

This is because, if already, some machines are lying idle, we shall try to use them before rushing in for new equipment. Also, if expectation of entrepreneurs is that the rise in demand brought about by increase in income or output is only a temporary one, they will try to meet it by overworking the existing machinery rather than installing a new plant. Thus, in the theory of accelerator it has been assumed that there is no excess capacity existing in consumer goods industries.

In other words, it has been assumed that no machines are lying idle and no extra shift working is possible. If there had been excess capacity and extra shift working was possible, the supply of goods could be increased with the existing equipment and the accelerator would not come into play.

ADVERTISEMENTS:

Further, in the acceleration principle it has also been assumed that in the capital goods industries, there exists surplus productive capacity. If there is no excess capacity in the machine-making industries, increased demand for machines caused by the requirement for additional output would not lead to increase in the supply of machines.

In the absence of supply of machines, investment cannot increase in the short run. It is thus assumed in the accelerator theory that the machine-making industry is capable of increasing its output for the time being at least. The supply can be increased by reducing stocks of finished machines, by working extra shifts, and so on. But stocks cannot be reduced below zero and working double shifts or adoption of other experiments is found to be expensive. Only when the demand has increased permanently, will the entrepreneurs find it worthwhile to increase investment in machine-making industries.

The size of the accelerator does not remain constant over time. Its value will be affected by the businessmen’s calculation regarding the profitability of installing new plants to make more machines on the basis of their probable working life. It is also assumed that the demand for machines will remain stable in future, although the increase in demand has suddenly cropped up.

However, in spite of the above limitations of acceleration principle, it points out an important force which causes economic fluctuations in the economy. Economists like Samuelson, Hicks and Dusenberry have shown how accelerator combined with multiplier provides an adequate and satisfactory theory of business cycles that occur in free market economies.