In this article we will discuss about:- 1. Meaning and Explanation of Inflationary Gap 2. Elimination of Inflationary Gap 3. Inflationary Gap and Inflation Rate 4. Significance 5. Limitations 6. Inflationary and Deflationary Gaps 7. Examples.

Meaning and Explanation of Inflationary Gap:

Keynes, in his pamphlet entitled How to pay for the War, 1940 explained inflation in terms of inflationary gap According to him, inflationary gap exists when, at full employment income level, aggregate demand exceeds aggregate supply. This means that due to increase in investment and government expenditure, the money income increases, but production does not increase because of the limitations of productive capacity.

As a result, an inflationary gap comes to exist, causing the prices to rise. The prices continue to rise so long as the inflationary gap exists. Prof. Kurihara defined inflationary gap “as an excess of anticipated expenditure over available output at base prices.”

An inflationary gap arises when a government chooses to finance even its normal expenditure through monetary expansion in a time of full employment. It can also occur during a strong private investment boom (such as might result from massive innovations, opening of new territory, etc.) if the monetary authorities are willing to accommodate increased demand for money. However, the important cases of inflationary gap are those associated with the government expenditure on war or war preparations.

ADVERTISEMENTS:

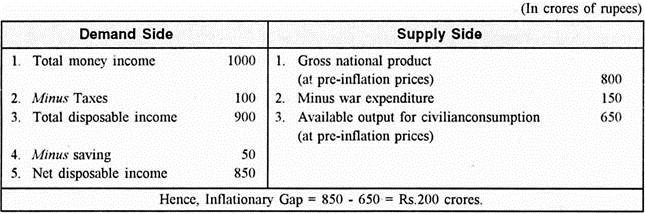

To illustrate the concept of inflationary gap, let us take the example of a wartime economy. On the supply side, suppose the value of gross national product is Rs. 800 crores at pre- inflation prices. If, out of this, the government takes away output worth Rs. 150 crores for war purposes, an output worth Rs 650 crores is left of civilian consumption. Thus, Rs. 650 crores is the value of available supply of goods for civilian consumption.

Now take the demand side. Suppose that the money income paid to the various factors of production is Rs. 1000 crores. If, out of this money income, the government takes away Rs.100 crores by way of taxes, the total disposable income left with the people will be Rs. 900 crores. Again, if the community keeps Rs. 50 crores as saving, then the net disposable income will be Rs. 850 crores.

This is the actual money income with the community for spending purposes. But, the total supply of goods available is worth Rs. 650 crores. Thus, there arises an inflationary gap worth Rs. 200 crores (i.e., Rs. 850 minus 650 crores).

The above process has been summarised below:

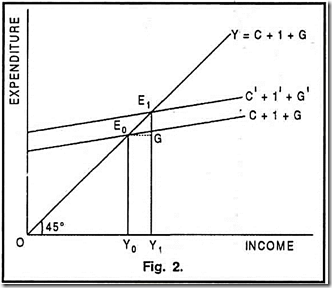

Figure 2 gives the graphic representation of the concept of inflationary gap, 45° line or Y = C + I + G is the equilibrium line which shows the equality of total income and total expenditure. C + I + G curve represents total expenditure comprising private consumption (C), private investment (I) and government expenditure (G). The initial equilibrium of the economy is at point E0 which represents full employment income OY0.

When expenditure increases from C + I + G to C’ + I’ + G’, the new equilibrium will be at point E1, representing higher money income OY1. The available output (i.e. real income) is (E0 Y0) (or OY0) which is less than the money income (E1 Y1 or OY1) by the vertical distance E1G. Thus, in this case, E1G is the inflationary gap. It shows the difference between anticipated expenditure, E1 Y1 and the available goods and services E0 Y0.

Elimination of Inflationary Gap:

Both natural forces and deliberate measures can close the inflationary gap created by excess expenditures, but the latter arc considered more reliable and certain than the former.

ADVERTISEMENTS:

The inflationary gap causes the prices to rise, but the price rise does nothing directly to eliminate the gap. However, there are a number of indirect effects of the price rise which tend to reduce the gap.

1. Keynes’ Effect:

When money supply is constant or rises in small proportions than prices, rate of interest will rise, tending to reduce the investment expenditure.

2. Wealth Effect:

Higher prices may reduce consumption expenditure by reducing real wealth held in the form of government money and government debt.

3. Balance-of-Trade Effect:

Higher prices will lead to encourage imports and reduce exports.

(i) If tax collections rise faster than prices, this will shift the consumption downward by reducing the real disposable income.

ADVERTISEMENTS:

(ii) Transfer payments fixed in money terms become less significant in real terms, thus reducing consumption expenditure.

(iii) Real government purchase will also be reduced if budgets are fixed in money terms.

5. Price Expectation Effect:

If the current rise in prices is expected to be temporary and to be followed by later reduction in prices, consumer buying of durables and investment in plant and equipment may be delayed and inventories reduced, thus narrowing the inflationary gap.

ADVERTISEMENTS:

6. Redistribution Effect:

If money wage rates are fixed (or wage- adjustment gap exists), higher prices will go entirely to profits. Assuming the marginal propensity to consume of the profit earners less than that of the wage earners, a redistribution of income towards profits will tend to reduce aggregate demand and to narrow the inflationary gap.

7. Money Illusion Effect:

If some spenders suffer from money illusion and at least a part of their expenditure is fixed in money terms, inflation will reduce the real value of such expenditure and close the inflationary gap.

ADVERTISEMENTS:

Rather than waiting for the natural forces to close the inflationary gap, fiscal policy can be used to reduce government expenditure and to increase taxes, thus to reduce the total expenditure in the economy.

In other words, government should incur a budget surplus. Monetary policy can also be directed towards decreasing the money supply. The Keynesians, however, doubt efficacy of monetary policy to deal with both inflationary and deflationary situations.

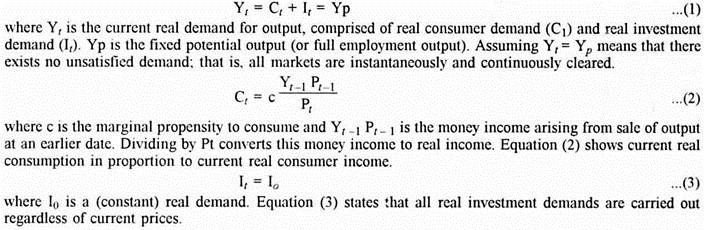

Inflationary Gap and Inflation Rate:

There exists a positive functional relationship between inflationary gap and the rate of inflation (or the rate of prices increase); the larger the gap, the faster the price will rise; the smaller the gap, the more slowly the prices will rise.

This relationship between the inflationary gap and the rate of inflation can be understood with the help of a dynamic model of the process of demand inflation as given below-

ADVERTISEMENTS:

Thus, we conclude- (a) The rate of inflation is a direct function of the size of the inflationary gap, (b) When inflationary gap is zero, the rate of price increase will be one or there is no percentage rise in prices per period.

Significance of Inflationary Gap:

The significance of the concept of inflationary gap is discussed below:

1. Effect on Income and Prices:

The significance of inflationary gap depends on its effect on the national income and prices. When inflationary gap exists at full employment, it increases money income of the people, but output cannot be increased because of full employment. Therefore, inflationary gap directly leads to the rise in prices.

2. Non-Monetary Inflation:

Keynes’ emphasis on the flow of expenditures (C + I + G) as the cause of demand pull inflation leads to the conclusion that a society can have non-monetary inflation. This is quite opposite to the view held by the quantity theorists who believed that inflation is due to the excessive growth of money stock.

ADVERTISEMENTS:

In Keynes’ analysis, the effect of this excessive growth of money supply may be uncertain because it will cause inflationary rise in prices indirectly through its effect first on rate of interest and, in turn, on aggregate spending.

3. Anti-Inflationary Policies:

Inflationary gap guides the monetary and fiscal authorities to adopt appropriate anti- inflationary measures to control inflationary pressures. These measures aim at affecting the propensities to consume, to save, and to invest, which together determine the general price level.

Limitations of Inflationary Gap:

1. Time Lags:

There are time lags between the receipt of income and its expenditure and between the adjustment of wages and prices. But for these time lags, inflation during and after war periods would have been much more serious and disastrous. Larger these lags, milder will be the effect of inflation and vice versa. As Keynes remarked in his How to Pay for the War, “It is these time-lags and other impediments that come to our rescue. Wars do not last forever.”

ADVERTISEMENTS:

2. Current Flows:

Inflationary gap deals with current flows of income, spending, consumption, investment, saving, etc. But, inflation being a dynamic phenomenon, the increase in price and the expectations of price rise do not affect the current output alone. They also affect the output which has been previously produced and is still available in the market.

Inflationary and Deflationary Gaps:

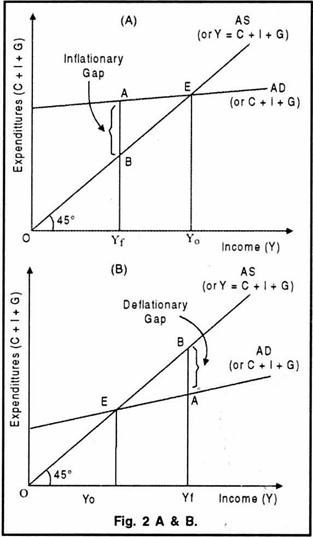

A stable equilibrium level of output (as depicted by Y0 in Figures 2A and 2B) occurs only when aggregate demand (which is represented by the components of consumption expenditure, investment expenditure and government expenditure (AD or C + I + G) and aggregate supply (AS) are equal (as shown by point E in Figures 2A and 2B). Full employment Yf may or may not prevail at equilibrium level of income.

Inflationary Gap:

Inflationary gap occurs when aggregate demand (AD) exceeds aggregate supply (AS) at full employment level of output. In this case, money income rises to a higher equilibrium, but real income (being at full employment output level) remains unchanged. As a result, there is an upward rise in prices because the consumers compete for limited supply of output and bid prices up.

In other words, inflationary gap reflects that at full employment level of output, real income cannot rise, but the prices rise to the extent that AD > AS at full employment. Inflationary gap continues to prevail until either AD contracts to the level consistent with the full employment level or AS is expanded through economic growth.

ADVERTISEMENTS:

In Figure 2A, Yf represents full employment output (i.e., the maximum output the economy can produce in a given short period). The position of AS line (i.e. 45° line which represents Y = C + I + G) is such that at Yf, AD is greater than AS by the amount AB. Thus, AB is the measure of inflationary gap, which is another name for excess demand measured at Yf.

Deflationary Gap:

Deflationary gap prevails when aggregate demand (AD) is less than aggregate supply (AS) at full employment level of output. In this case, income equilibrium occurs while some resources are unemployed. In other, words, deflationary gap depicts unemployment situation attributable to the fact that at full employment level of output, AD < AS.

Thus, deflationary gap is measured as the difference between AD and AS at full employment, Deflationary gap, and the resultant conditions of unemployment and sluggish economic activity, will persist until a higher level of aggregate demand consistent with full employment is achieved.

In Figure 2B, Yf represents full employment output. The position of AS line (i.e., 45° line) is such that at Yf, AD is less than AS by the amount BA. Thus, BA is the measure of deflationary gap, which is the same thing as deficient demand measured at Yf.